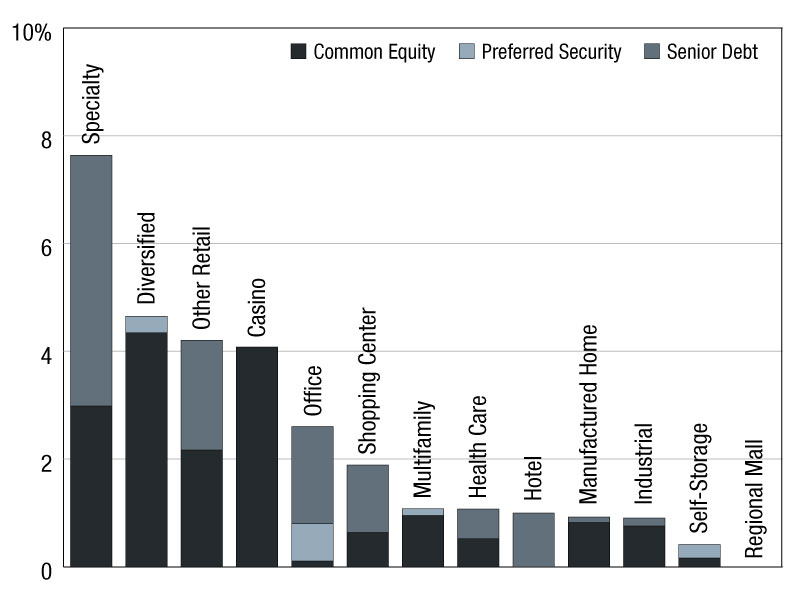

2022 REIT Offerings by Sector

Specialty and diversified topped the charts among the REIT property sectors, according to S&P Global Real Estate.

2022 YTD US equity REIT offerings by sector ($B)

Includes common, preferred and senior debt offerings for all publicly traded U.S. equity REITs. Does not include shelf and exchange offerings. Data as of October 31, 2022 Source: S&P Global Market Intelligence

As of October 31, 2022, publicly traded U.S. equity REITs raised approximately $30.46 billion through capital offerings. Common equity offerings accounted for 58 percent of total capital raised, amounting to $17.55 billion, followed by senior debt and preferred issuances which totaled $11.54 billion and $1.34 billion, respectively.

Specialty and diversified topped the charts among the REIT property sectors. Among specialty sector, American Tower Corporation, raised $2.35 billion through a common equity offering, while diversified REIT Blackstone Real Estate Income Trust, Inc. raised $0.58 billion via common equity offerings.

Iman Niazi is an Associate in the Real Estate Client Operations Department of S&P Global Market Intelligence.

If you are interested to learn more about the products and services available within S&P Global Real Estate data, please visit us here.

—Posted on Nov. 30, 2022

You must be logged in to post a comment.