2017 Top Mortgage Banks

Favorable Financing By Chris Nebenzahl, Associate Director of Research, Yardi Matrix With interest rates on the rise throughout the second half of 2016, mortgage banks worked hard to provide the best financing for their clients despite volatile times and uncertain futures. In 2017, the real estate industry is poised for another strong year, but the…

Favorable Financing

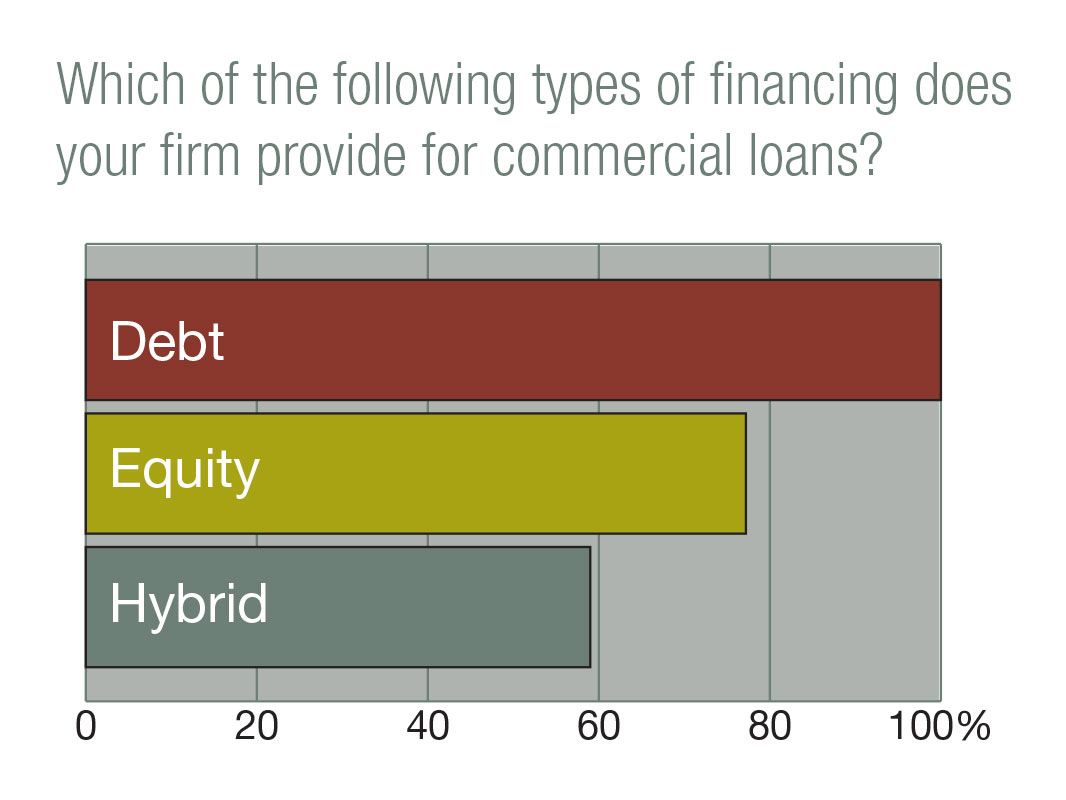

Source: CPE-MHN survey of mortgage banks

By Chris Nebenzahl, Associate Director of Research, Yardi Matrix

With interest rates on the rise throughout the second half of 2016, mortgage banks worked hard to provide the best financing for their clients despite volatile times and uncertain futures. In 2017, the real estate industry is poised for another strong year, but the ability to finance transactions will be one of the hottest topics in the industry. The 2017 CPE-MHN Top Mortgage Banks survey offers key insights into the world of borrowing and lending.

Despite the prospect of rising interest rates, all but one of the firms in our ranking expect originations to increase in 2017. Most firms expect a modest growth of under 25 percent; however, three firms forecast significant origination growth of between 25 and 50 percent. The majority of origination growth remains tied to multifamily, but lending for office, industrial and mixed-use properties is also growing. As demographic and technological shifts change the way consumers shop, the demand for dedicated retail locations has been wavering, while that for industrial and mixed-use properties has increased.

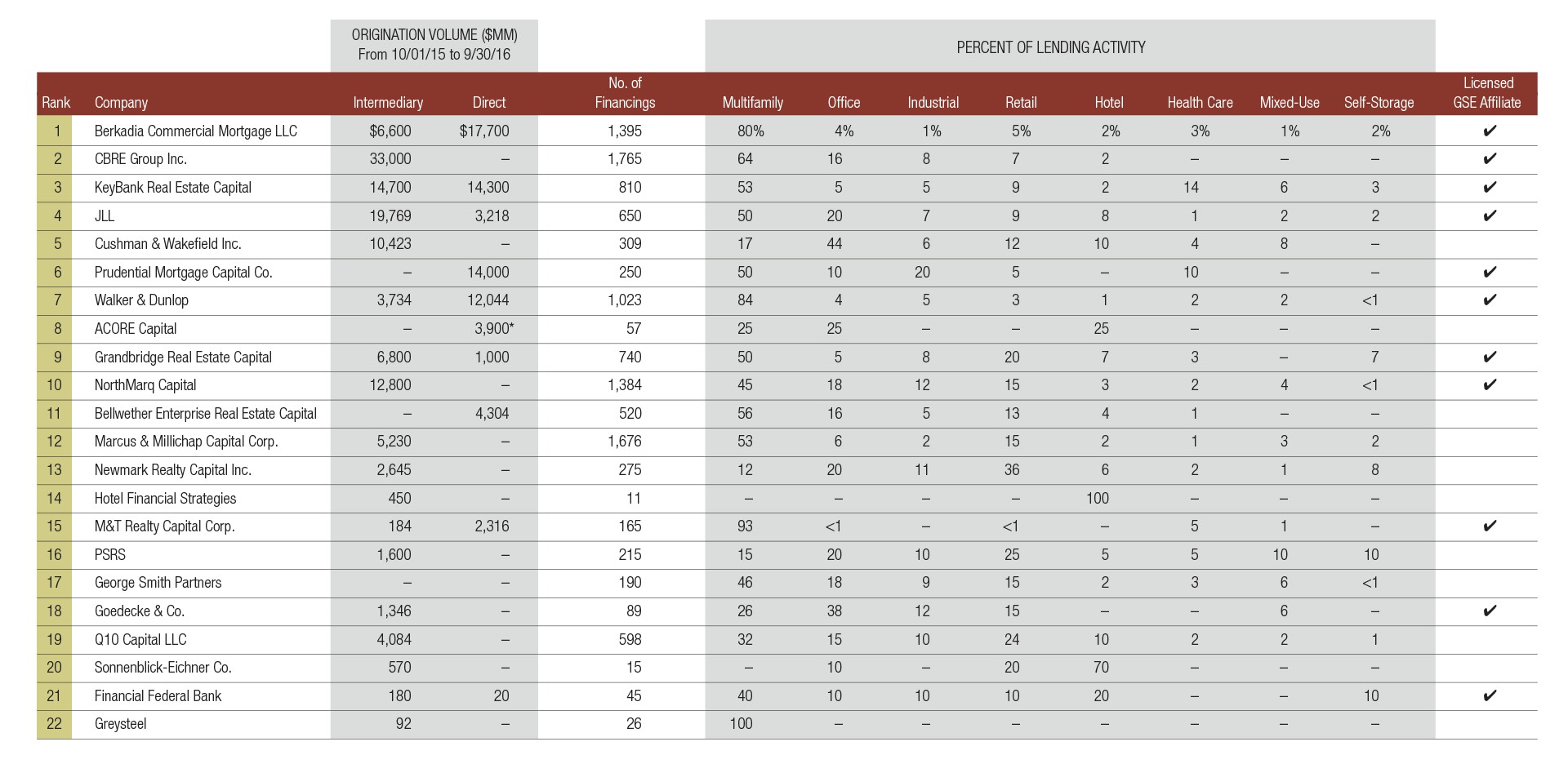

While some of our top mortgage banks offer direct lending to their clients, almost all act as intermediaries between lending sources and their clients. In a rising rate environment, the experience of intermediaries can oftentimes help secure financing at the most competitive levels.

Mortgage banks will keep a close eye on Washington throughout 2017, as plans to deregulate the banking industry and remove some of the restrictions laid out in the Dodd-Frank Act appear to be high on the agenda of the next president and Congress. While legislators will be hesitant to bring the industry back to the pre-recession days of easy money, allowing more access to financing would help developers and investors across the industry.

Of total loan commitments closed (ACORE advises its client, who is the direct lender).

Note: For the percent of lending activity by sector, some firms listed activity in the “Other” category, which is not shown here.

Methodology

The 2017 CPE-MHN Top Mortgage Banks ranking utilized self-reported data for all firms. The ranking is a weighted formula based on a variety of factors, including total transaction volume, coverage offered, growth in transaction volume and loan positioning, among others. The ranking represents what we feel is a logical balance between firm growth and market share, as well as sector diversity or specialization. Ranking factors are not limited to the data that appear on this page.

Originally appearing in the CPE-MHN Guide to 2017.

You must be logged in to post a comment.