2018 CRE Performance: UBS

According to its Real Estate and Private Markets report, the U.S. economy was the world’s strongest during the third quarter with a 3.5 percent growth annually, despite a year-over-year decline from 4.2 percent.

By IvyLee Rosario

The commercial real estate industry is changing rapidly, as shown by UBS’ Real Estate and Private Markets Real Estate Summary 2018, that takes a global overview, as well as an inside look into how the U.S., Europe and APAC regions have performed throughout the year.

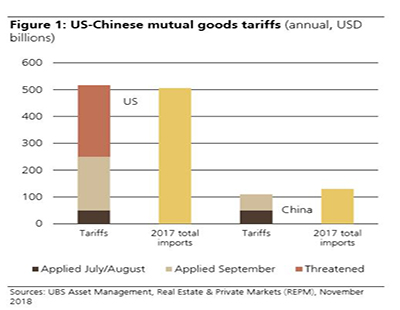

In 2018, there have been several risks within the market, despite an overall positive outlook. The trade war with China continues to escalate and tariffs pose a larger problem down the line, if not resolved. The U.S. is proposing additional tariffs on washing machines, steel, solar panels and aluminium, along with $250 billion of its annual $506 billion of imports from China. On the other end, China is proposing tariffs on $110 billion of its annual $130 billion of imports from the U.S. The 10 percent tariff announced back in September will increase to 25 percent in January 2019, if no agreement is reached. In addition, President Trump also threatened another tariff that will impact $267 billion of goods. Inflation is also a risk, given the tight labor markets and firming wage growth in several countries, which has surpassed 3 percent in the U.S. for the first time since 2009.

According to the report, the economy continues to move in a positive direction, although there was a slow down during quarter three. The U.S. performed the strongest, with growth slowing to 3.5 percent annually from 4.2 percent the previous year. Following that was Europe, which showcased a 0.2 percent growth quarter-on-quarter during quarter three, the slowest change within the last five years and a decline from 0.4 percent in quarter two. In China, growth slowed to 6.5 percent year-over-year.

U.S. property performance

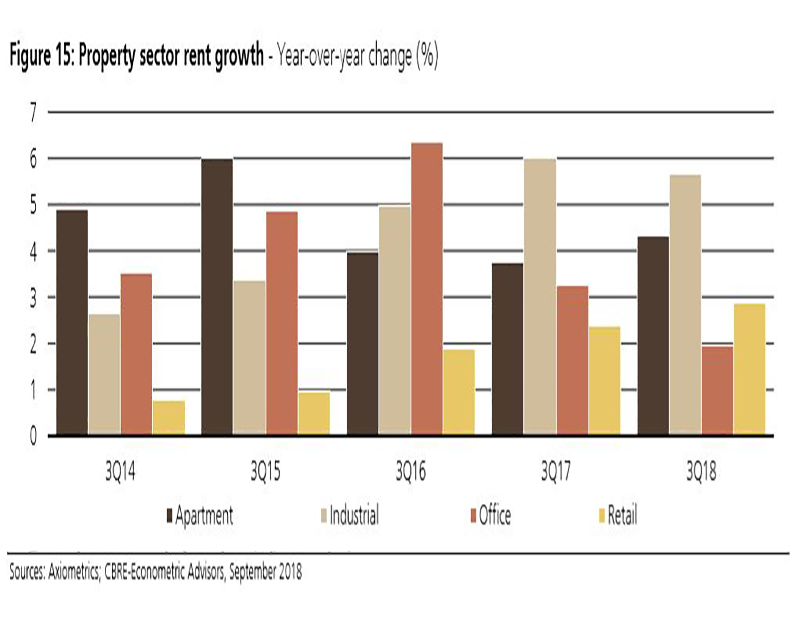

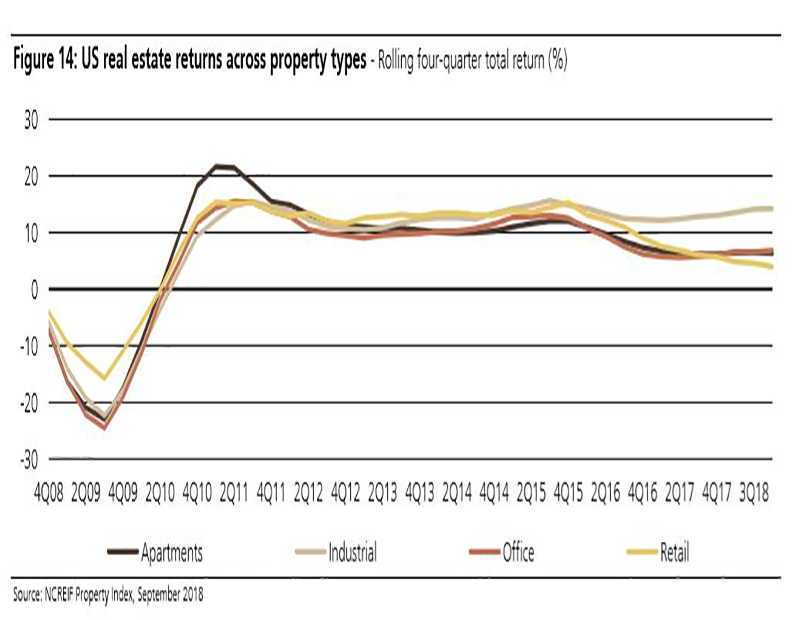

Overall, each property type has performed positively throughout the year, despite some bumps along the way. Across the U.S., the industrial sector has produced the highest returns of all asset classes in 2018, with more than half of its returns coming from capital appreciation. Growth in net rents remains high, although there has been a decline caused by an increase in supply, according to the UBS report. Rents have grown 5.4 percent year-over-year compared to a 7.5 percent growth the previous year. Availability has dropped 30 basis points to 7.1 percent in quarter three, the lowest it has ever been since quarter one of 2001.

When it comes to office and multifamily, appreciation is in line with inflation levels, showing a return that is reflective of the industry’s long-term expectation. In this year’s third quarter, new office building deliveries remained high, especially in technology-related and secondary markets. Office rent growth under-performed inflation at 1.9 percent, with downtown rents growing half the pace as suburban. Average office vacancies dropped by 10 basis points year-over-year, with the gap between downtown office (10.5%) and suburban office (14.1%) remaining wide.

Multifamily vacancy has continued to see a lower performance over the past three quarters, showing a growth of 4.2 percent, which is a decline from its 20-year average of 5.4 percent, according to the report. Homeownership continues to be flat at 64.4 percent, a result of strength within the U.S. labor market and a steady household creation, leading to an increased demand for rental housing.

As for retail, the sector has recently depreciated, producing a positive but below-income return. This is mostly due to the decrease in mall activity. The mall/lifestyle and power center properties are producing higher availability rates of 5.8 and 6.8 percent. Occupancy in neighborhood, community and strip (NCS) retail has dropped 40 basis points year-over-year, but rent growth has increased 2.8 percent year-over-year since 2017. Consumer spending has increased due to an upswing in disposable income and a lower unemployment rate, which is supporting retail sales as a whole throughout the year, concludes the UBS report. Although e-commerce continues to thrive, brick and mortar store sales increased by 4.9 percent during 2018.

Data and charts courtesy of UBS

You must be logged in to post a comment.