2020 REIT Offerings by Sector

Industrial and specialty REITs dominated the offerings, according to S&P Global Market Intelligence.

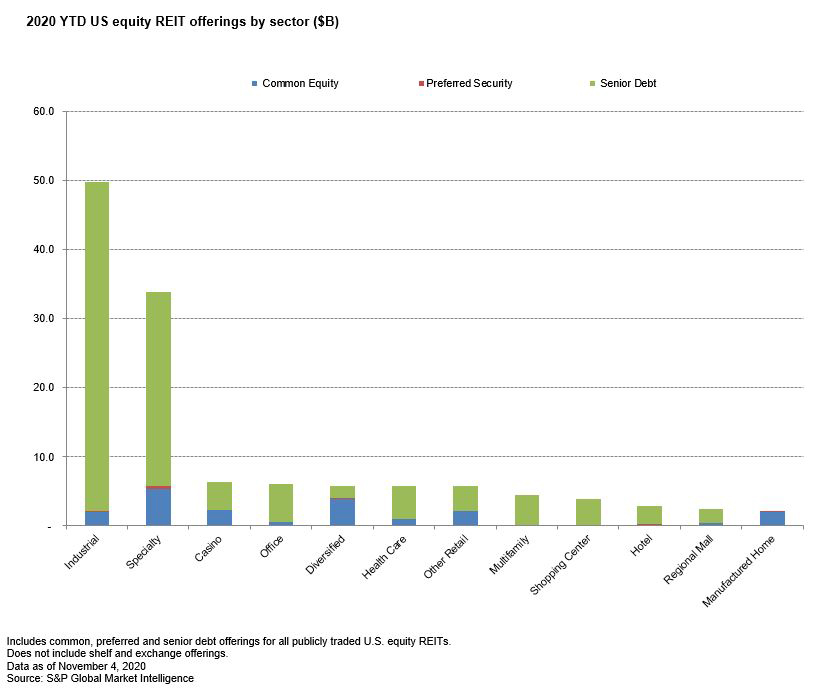

As of Nov. 4, 2020, publicly traded U.S. equity REITs raised approximately $131.19 billion through capital offerings. Senior debt offerings accounted for 83 percent of total capital raised, amounting to $109.21 billion, followed by common and preferred issuances, which totaled $19.95 billion and $2.03 billion, respectively.

Industrial and specialty REITs topped the charts among the REIT property sectors, aggregating $83.68 billion over 132 senior debt, common and preferred stock offerings. Industrial REIT Prologis Inc. raised $46.69 billion through 15 senior debt offerings, while data center REIT Equinix Inc. raised a total of $6.28 billion in two common equity offerings and seven senior debt offerings. Specialty REIT American Tower Corp. ranked third with a total of $6 billion through nine senior debt offerings.

Diana Rose Barrun is an associate in the real estate product operations department of S&P Global Market Intelligence.

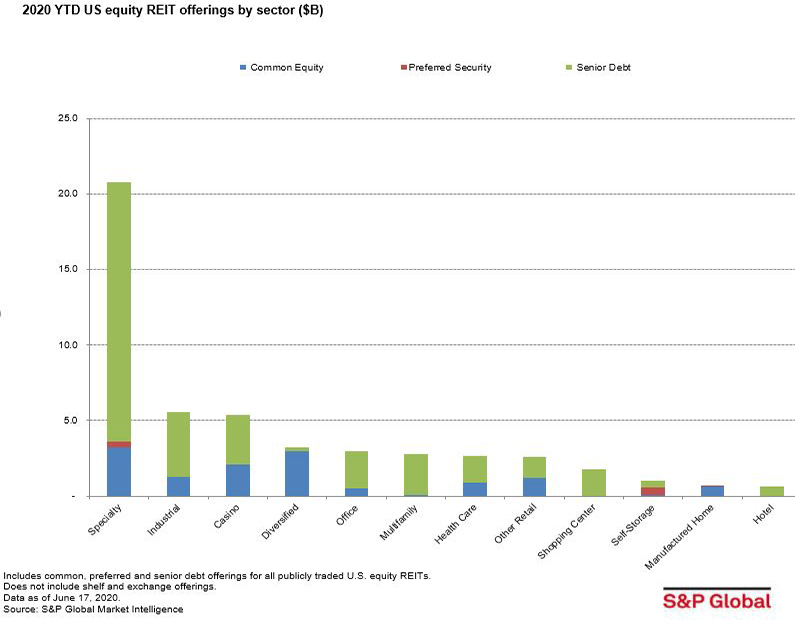

As of June 17, 2020, publicly traded U.S. equity REITs raised approximately $50.07 billion through capital offerings. Senior debt offerings accounted for 73 percent of total capital raised, amounting to $36.31 billion, followed by common and preferred issuances that totaled $12.74 billion and $1.03 billion, respectively.

Last year, REITs had raised $45 billion through July 31.

Specialty and Industrial REITs topped the charts among the REIT property sectors, aggregating $26.28 billion over 65 senior debt, common and preferred stock offerings. Communications REIT Crown Castle International Corp. raised $3.75 billion through five senior debts, while data center REIT Equinix, Inc. raised a total of $2.32 billion in two common equity offerings and one senior debt offering. Communications REIT Uniti Group Inc. ranked third with a $2.25 billion debt offering.

Diana Rose Barrun is an associate in the real estate product operations department of S&P Global Market Intelligence.

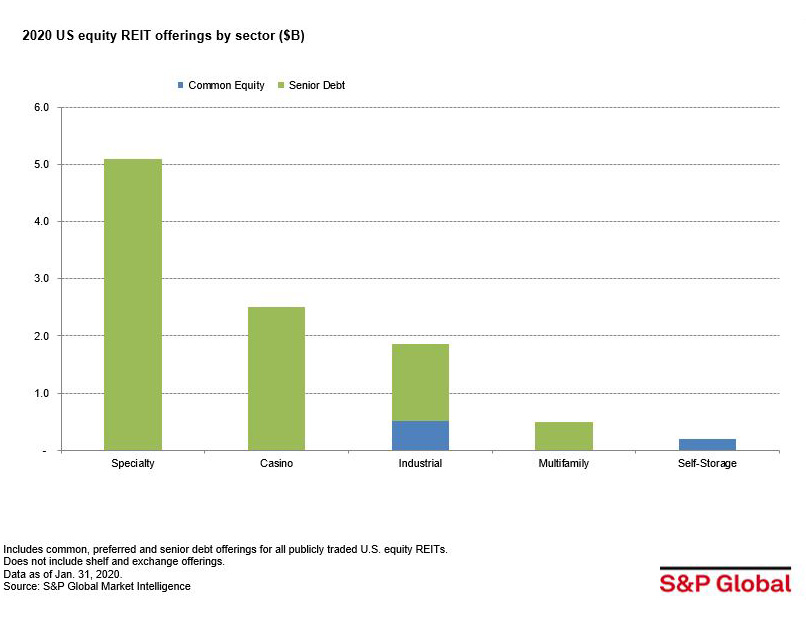

As of Jan. 31, 2020, publicly traded U.S. equity REITs raised approximately $10.59 billion through capital offerings. Senior Debt offerings accounted for 93 percent of total capital raised, amounting to $9.89 billion, followed by common equity, which totaled $0.70 billion.

Specialty and Casino REITs topped the charts among the REIT property sectors, aggregating $7.84 billion over 12 senior debt and common stock offerings. Casino REIT Vici Properties Inc. raised $2.5 billion through three senior debt offerings, while data center REIT Digital Realty Trust raised a total of $1.89 billion in three senior debt offerings. Advertising REIT Lamar Advertising Co. ranked third with a $1 billion debt offering.

Diana Rose Barrun is an associate in the real estate product operations department of S&P Global Market Intelligence.

—Posted on Feb. 19, 2020

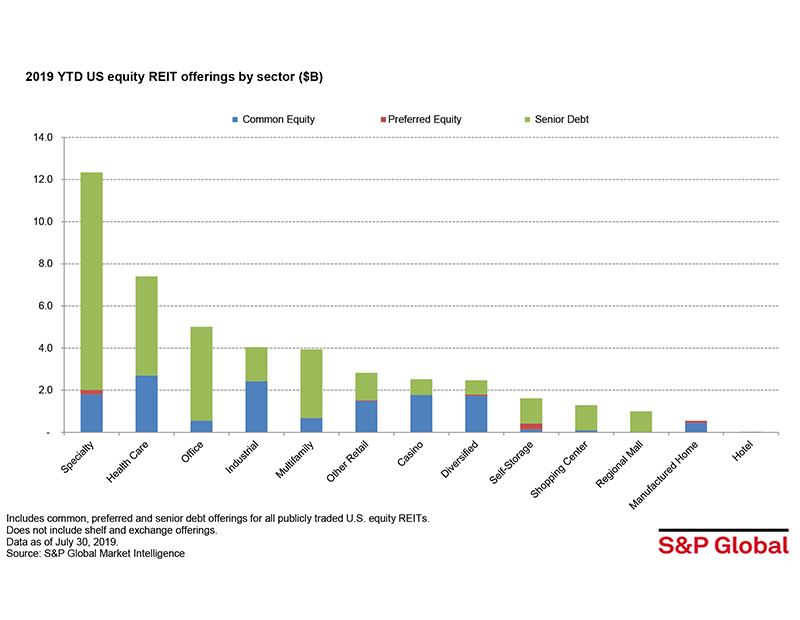

As of July 30, 2019, publicly traded U.S. equity REITs raised approximately $45.07 billion through capital offerings. Senior debt offerings accounted for 68 percent of total capital raised, amounting to $30.47 billion, followed by common equity which totaled $13.85 billion.

As of July 30, 2019, publicly traded U.S. equity REITs raised approximately $45.07 billion through capital offerings. Senior debt offerings accounted for 68 percent of total capital raised, amounting to $30.47 billion, followed by common equity which totaled $13.85 billion.

Specialty and healthcare REITs topped the charts among the REIT property sectors, aggregating $19.74 billion through 29 senior debt and 34 common stock offerings. Specialty REIT American Tower Corp. raised $3.55 billion through four senior debt offering, while specialty REIT Digital Realty Trust, Inc. raised a total of $2.33 billion in four senior debt offerings. Office REIT Alexandria Real Estate Equities Inc. ranked third with an aggregated $2.19 billion capital raised via two common and five senior debt offerings, respectively.

During the first seven months of 2018, REIT capital raisings totaled $20.6 billion.

Aftab Alam is an associate in the real estate client operations department of S&P Global Market Intelligence.

—Posted on Aug. 7, 2019

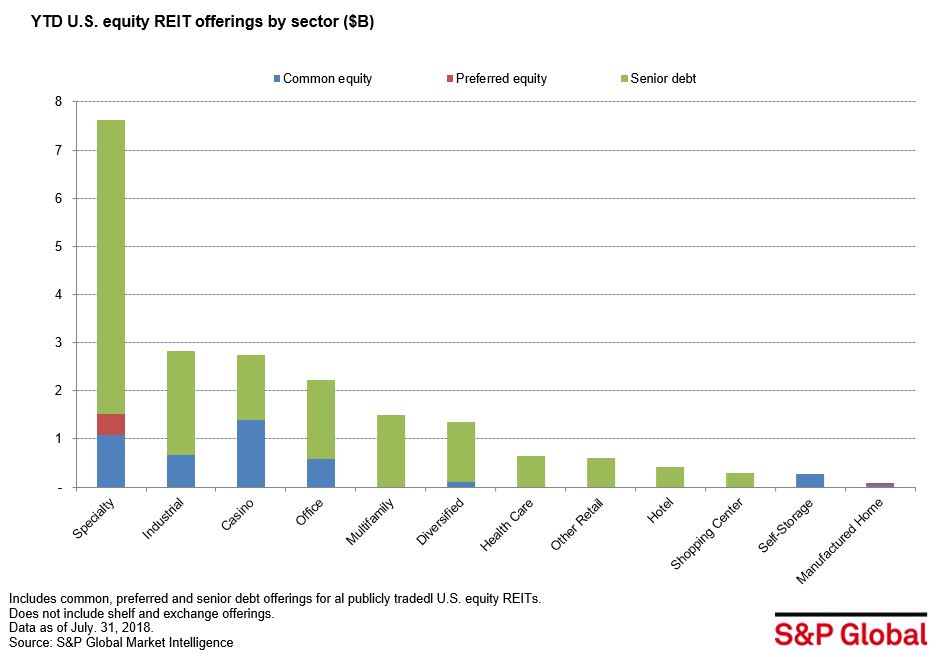

Year-to-date through July 31, publicly traded U.S. equity REITs raised approximately $20.6 billion through capital raising activity. Senior debt offerings comprised $16.0 billion of the total capital raised, followed by $4.1 billion raised through common stock offerings and $477 million through preferred stock offerings.Among the REIT property sectors, the specialty sector raised the greatest amount of capital year-to-date as of July 31, at $7.6 billion, with communications REITs accounting for 50.3% of the total amount raised. The industrial sector raised the second largest amount of capital at $2.83 billion.

Khamile Armhynn Sabas is a senior associate in the real estate client operations department of S&P Global Market Intelligence.

—Posted on Aug. 1, 2018

You must be logged in to post a comment.