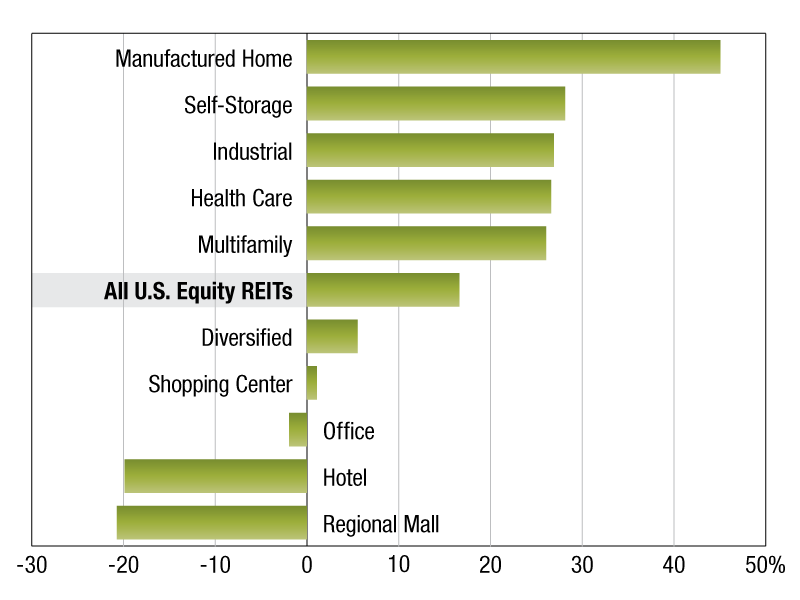

2019 REIT Returns

The Manufactured Homes REIT sector topped the chart with a 45.1 percent total return.

As of September 3, 2019, publicly traded U.S. Equity REITs posted a 16.6 percent one-year total return. The Manufactured Homes REIT sector topped the chart with a 45.1 percent total return, beating the broader U.S. Equity REIT index by 28.5 percentage points. The Self-Storage and iIdustrial REIT sectors followed with 28.2 percent and 26.9 percent one-year total returns, respectively. On the other end of the spectrum, the Regional Mall sector had the lowest one-year total return of -20.7 percent. The Hotel sector had the second lowest among the sectors, with a -19.9 percent one-year total return.

The Multifamily sector index was ranked fifth out of all property sectors, posting a one-year total return of 26.1 percent. Among the multifamily-focused REITs, NexPoint Residential Trust Inc. delivered the highest one-year total return of approximately 51.2 percent. Independence Realty Trust Inc. and Investors Real Estate Trust followed at 44.6 percent and 36.5 percent one-year total returns, respectively. Preferred Apartment Communities Inc. posted a -15.9 percent return for the one year timeframe, and this return is the lowest among the total returns of multifamily index constituents.

Aftab Alam is a senior associate in the real estate client operations department of S&P Global Market Intelligence

—Posted on Sep. 24, 2019

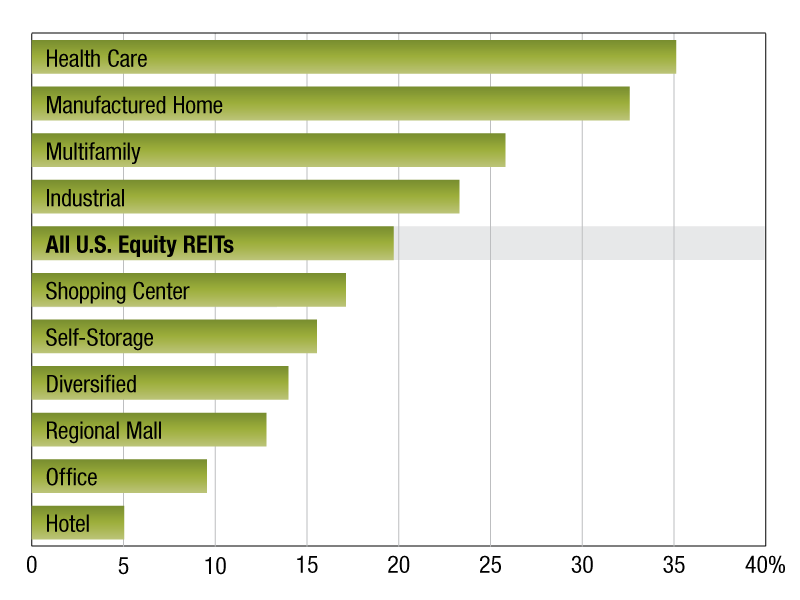

As of March 29, publicly traded U.S. Equity REITs posted a 19.7 percent one-year total return. The Health Care REIT sector topped the chart with a 35.1 percent total return, beating the broader U.S. Equity REIT index by 15.40 percentage points. The Manufactured Homes and Multifamily REIT sectors followed with 32.6 percent and 25.8 percent one-year total returns, respectively.

On the other end of the spectrum, the Hotel sector had the lowest one-year total return of 5.0 percent. The Office sector was second lowest among the sectors, with a 9.6 percent one-year total return.

As of March 29, the Multifamily sector index was ranked third of all property sectors, posting a one-year total return of 25.8 percent. Among the Multifamily-focused REITs, NexPoint Residential Trust Inc. delivered the highest one-year total return of approximately 59.4 percent. Bluerock Residential Growth REIT and UDR Inc. followed at 35.5 percent and 32.0 percent one-year total returns, respectively. Preferred Apartment Communities Inc. posted a 11.5 percent return for the year, lowest among the total returns of multifamily index constituents.

Carter Phillips is an analyst in the real estate client operations department of S&P Global Market Intelligence.

—Posted on Apr. 19, 2019

You must be logged in to post a comment.