2019 REIT Trading Trends

The Manufactured Home sector traded at the greatest median premium to NAV, at 28.4 percent.

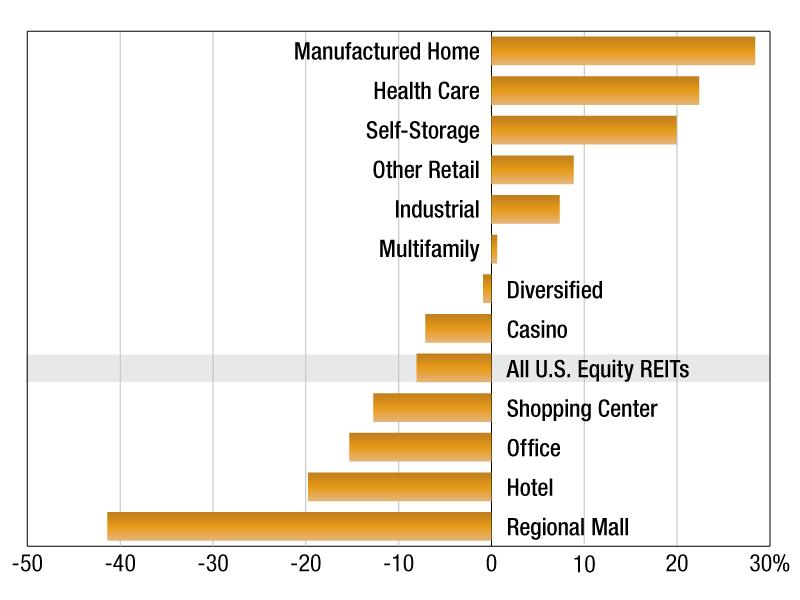

median U.S. equity REIT premium to NAV by sector

As of Aug. 1, 2019, publicly listed U.S. Equity REITs traded at a median discount to consensus net asset value of 8.1 percent. The Manufactured Home sector traded at the greatest median premium to NAV, at 28.4 percent. The Health Care and Self Storage REIT sectors were next in line trading at median premiums to NAV of 22.4 percent and 19.9 percent, respectively. At the other end of the scale, the Regional Mall REIT sector traded at a discount of 41.4 percent, currently the greatest median discount to NAV. The Hotel REIT sector followed with 19.7 percent median discount to NAV.

At the company level, hotel REIT Community Healthcare Trust Inc. traded at the largest premium to NAV, at 92. 5 percent. Right behind were Safehold Inc. and Innovative Industrial Properties Inc., trading at premiums of 72.1 percent and 43.8 percent, respectively. CBL & Associates Properties Inc. traded at the largest discount of all U.S. REITs, at 75 percent. Hotel REIT Ashford Hospitality Trust Inc. and shopping center REIT Cedar Realty Trust Inc. were also at the bottom of the list with large discounts of 58.7 percent and 53.1 percent, respectively.

The U.S. Multifamily REIT sector traded at a median premium to consensus net asset value of 0.6 percent as of Aug. 1, 2019. Within the sector, NexPoint Residential Trust Inc. traded at a premium to NAV of 10.4 percent. Essex Property Trust Inc. and Independence Realty Trust Inc. were next in line at 9.0 percent and 8.7 percent premiums, respectively. Trading at the greatest discount among multifamily REITs was Bluerock Residential Growth REIT Inc. at 14.3 percent. Investors Real Estate Trust and Preferred Apartment Communities Inc. followed, trading at 13.5 percent and 9.3 percent discounts to NAV as of Aug. 1, 2019.

Aftab Alam is an associate in the real estate client operations department of S&P Global Market Intelligence.

—Posted on Aug. 22, 2019

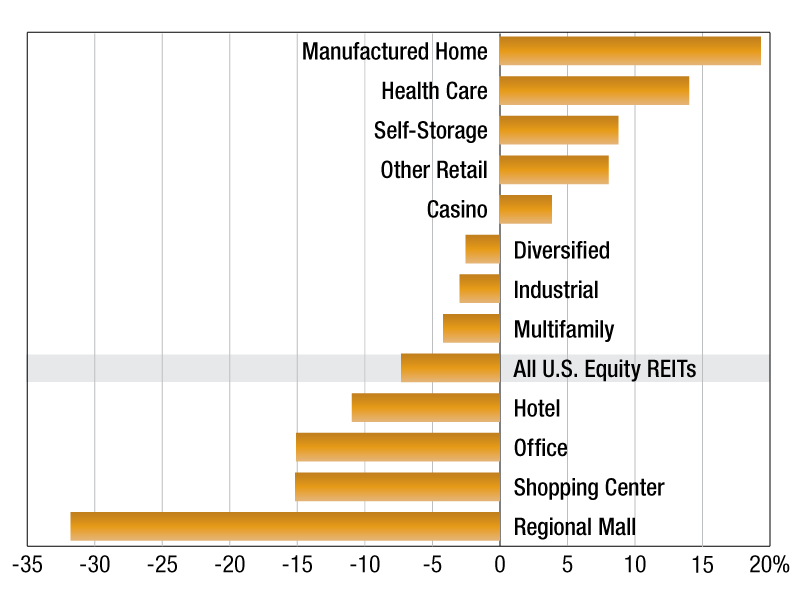

median U.S. equity REIT premium to NAV by sector

As of February 28, publicly listed U.S. Equity REITs traded at a median discount to consensus net asset value of 7.3 percent.

The manufactured home sector traded at the greatest median premium to NAV, at 19.3 percent. The health-care and self storage REIT sectors were next in line, trading at median premiums to NAV of 14 percent and 8.8 percent, respectively.

At the other end of the scale, the regional mall REIT sector traded at a discount of 31.8 percent, currently the greatest median discount to NAV. The shopping center REIT sector followed with 15.2 percent median discount to NAV as of the last trading day of February.

At the company level, Industrial REIT Innovative Industrial Properties Inc. traded at the largest premium to NAV, at 172.1 percent. Right behind were Community Healthcare Trust Inc. and CareTrust REIT Inc., trading at premiums of 66.8 percent and 48.6 percent, respectively.

CBL & Associates Properties Inc. traded at the largest discount of all U.S. REITs, at 68.4 percent. Farmland Partners Inc., a Specialty REIT and regional mall REIT Pennsylvania Real Estate Investment Trust, were also at the bottom of the list with large discounts of 55.6 percent and 54.4 percent, respectively.

The U.S. multifamily REIT sector traded at a median discount to consensus net asset value of 4.2 percent as of February 28. Within the sector, UDR Inc. traded at a premium to NAV of 4.7 percent. Essex Property Trust Inc. and NexPoint Residential Trust Inc. were next in line at 4 percent and 0.2 percent premiums, respectively.

Trading at the greatest discount among multifamily REITs was Bluerock Residential Growth REIT, at 20.7 percent. Investors Real Estate Trust and BRT Apartments Corp. followed, trading at 15.9 percent and 15.5 percent discounts to NAV as of the end of February.

Carter Phillips is an analyst in the real estate client operations department of S&P Global Market Intelligence.

—Posted on Mar. 26, 2019

You must be logged in to post a comment.