2020 CMBS Delinquency Rates

The Trepp CMBS delinquency rate logged its fifth consecutive monthly decline following two large jumps in the reading in May and June of this year.

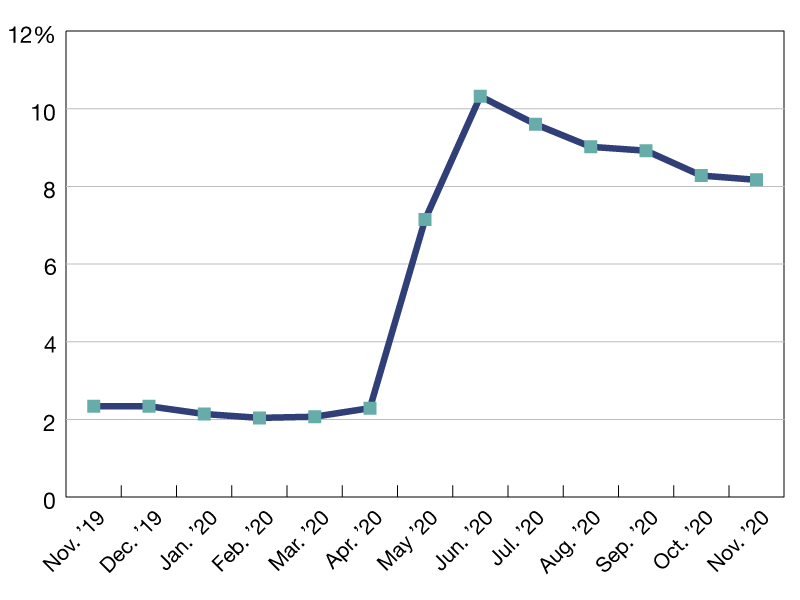

The Trepp CMBS delinquency rate logged its fifth consecutive monthly decline following two large jumps in the reading in May and June of this year. After several months of big dips, the rate fell much more modestly in November.

The CMBS delinquency rate in November is 8.2 percent, a decline of 11 basis points from October. The percentage of loans in the 30 days delinquent bucket is 0.9 percent, which is down six basis points for the month. As the Trepp team has noted before, the declines come with caveats. Some of the loans that have been identified as current came because of the granting of forbearances and the authorization of borrowers to use reserves to bring debt service payments up to date.

Hotel loans were seeing steady declines in recent months due to the high number of forbearances granted in that segment of the market. That reversed course in November with the hotel delinquency rate moving up slightly. In terms of loans in grace period, 2.6 percent of loans by balance missed the November payment but were less than 30 days delinquent. That was down from 3.2 percent in October.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on Dec. 21, 2020

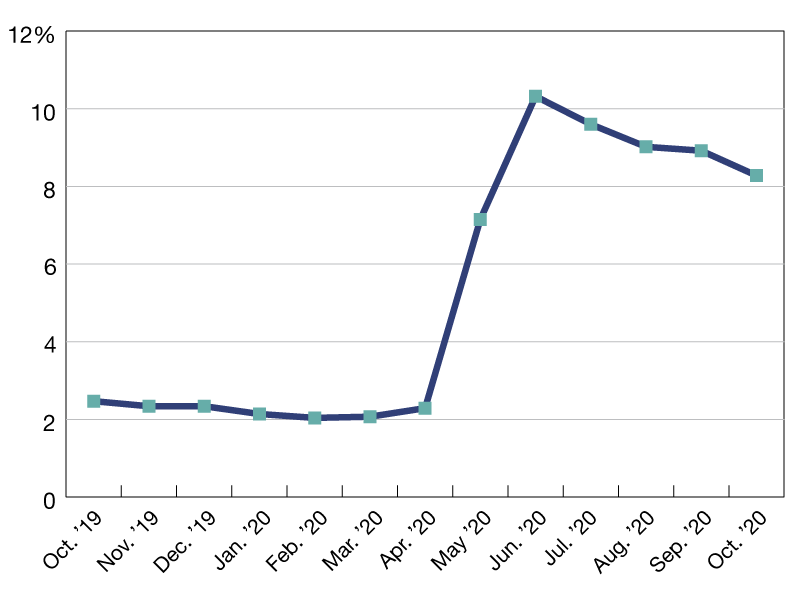

The Trepp CMBS delinquency rate continued to trend notably lower in October. After two huge jumps in May and June, the rate has now declined for four consecutive months. The CMBS Delinquency Rate in October is 8.3 percent, a decline of 64 basis points from the September number. About 1.0 percent of that number represents loans in the 30 days delinquent bucket – down 40 basis points for the month. The declines come with the same caveats we’ve noted before.

Some of the loans being identified as “current” have come as a result of forbearances being granted and borrowers being authorized to use reserves to bring debt service payments up to date. Trepp estimates that more than $30 billion in loans in the private market have been granted thus far. The biggest decline in the delinquency rate came from hotel loans. That is likely due to the high number of forbearances granted to that part of the market. In terms of loans in grace period, 3.2 percent of loans by balance missed the October payment but were less than 30 days delinquent. That was up from 2.9 percent last month.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on Nov. 19, 2020

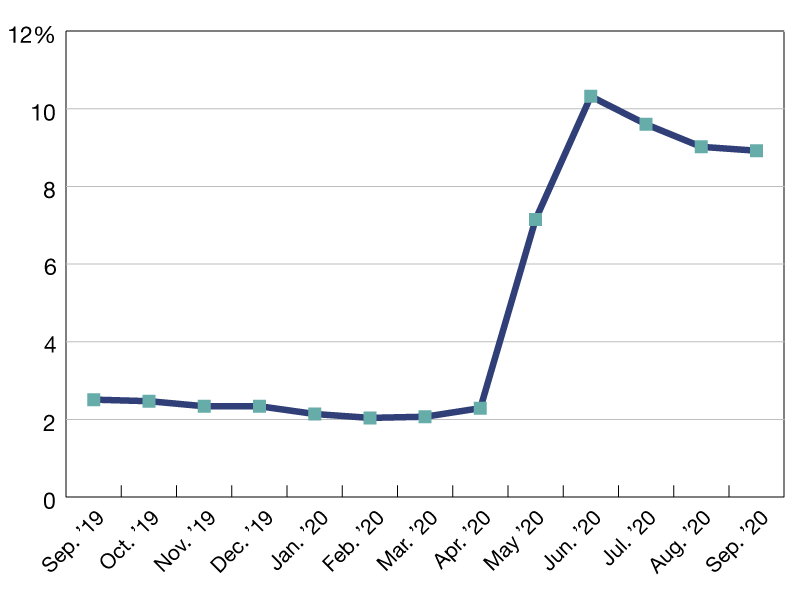

The Trepp CMBS delinquency rate saw another drop in September. After two huge jumps in May and June, the rate has now declined for three consecutive months. The September reading is 8.9 percent, a decline of 10 basis points from the August number. About 1.4 percent of that number represents loans in the 30 days delinquent bucket, which is an increase of 19 basis points. The recent declines come with a caveat as we’ve noted before. Some of the loans which are being identified as current have come as a result of forbearances being granted and borrowers being authorized to use reserves to bring debt service payments up to date. Trepp estimates that more than $20 billion in loans in the private-label CMBS market have been granted forbearances thus far. In terms of loans in grace period, 2.9 percent of loans by balance missed the September payment but were less than 30 days delinquent. That was down from 3.1 percent last month.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on Oct. 26, 2020

The Trepp CMBS delinquency rate continued its downward trend in August after posting the largest decline in four years in July. The overall CMBS delinquency rate in August was 9.0 percent, a decline of 58 basis points from the July number. About $6.5 billion in loans were “cured” in August, helping the rate post another sizable decline. By “cure,” we mean that the loan was delinquent in July but reverted to current (or in or beyond grace period) status in August. Some of these cures came as a result of forbearances being granted and borrowers being authorized to use reserves to make the loan current. In other cases, relief was canceled or withdrawn by the borrowers and the loans were brought current without relief.

About 1.2 percent of the overall number represents loans in the 30 days delinquent bucket while another 1.0 percent is now 60 days delinquent. Both of those numbers were sizable improvements from July. However, the percentage of loans that are 90 or more days delinquent rose to 4.0 percent in August from 2.7 percent in July. In terms of loans in grace period, 3.1 percent of loans by balance missed the August payment but were less than 30 days delinquent. That was up from 2.8 percent in July.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on Sep. 24, 2020

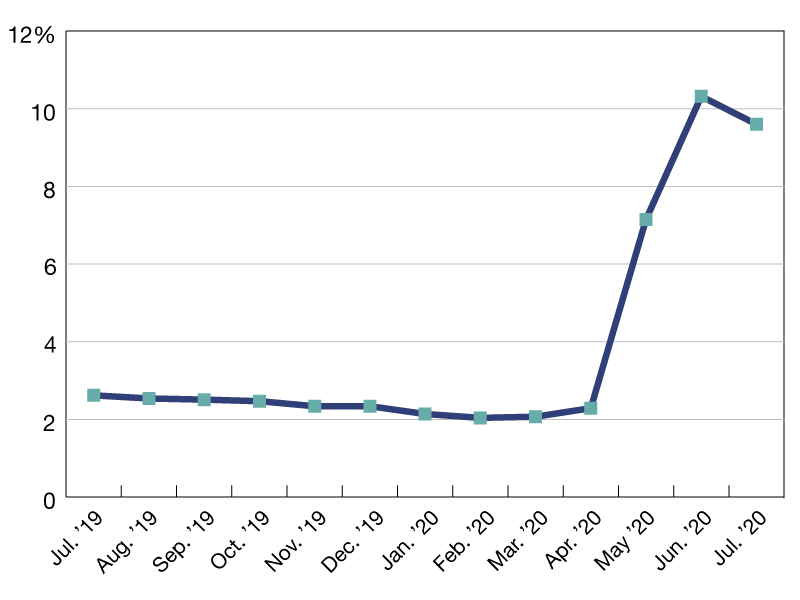

The Trepp CMBS delinquency rate posted its largest drop in more than four years in July. The rate fell by 72 basis points month over month, down to 9.6 percent in July, which is the largest decline in that reading since January 2016. About 1.7 percent of that number is represented by loans in the 30-day delinquency bucket while another 2.6 percent is now 60 days delinquent. Both of those numbers were sizable improvements from June. The percentage of loans that are 90 or more days delinquent, on the other hand, rose from 0.3 percent in June to 2.7 percent in July.

The notable change in the overall delinquency rate was the result of having more than $8 billion in loans “cured” – which means the loan was delinquent in June but reverted to “current” or grace/beyond grace period status in July. As we reported in TreppWire in mid-July, some of the improvements came via loan modifications such as a maturity extension. Additional benefit came via reserve relief, whereby borrowers were permitted to use reserves to keep the loan current. (This was confirmed by special servicer or watchlist comments in July.) There was a large swath of loans that were cured in July for which it was unclear whether the loan became current by way of reserve relief or by the borrower bringing the loan current out of pocket. We will be looking for more evidence of this as August remittances are released.

In terms of loans in grace period, 2.8 percent of loans by balance missed the July payment but were less than 30 days delinquent. The percentage of loans in or beyond grace period (the A/B loans, as we refer to them) fell to 7.6 percent in May from 8.1 percent in April. It moved even lower to 4.1 percent in June before July’s decline.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on Aug. 20, 2020

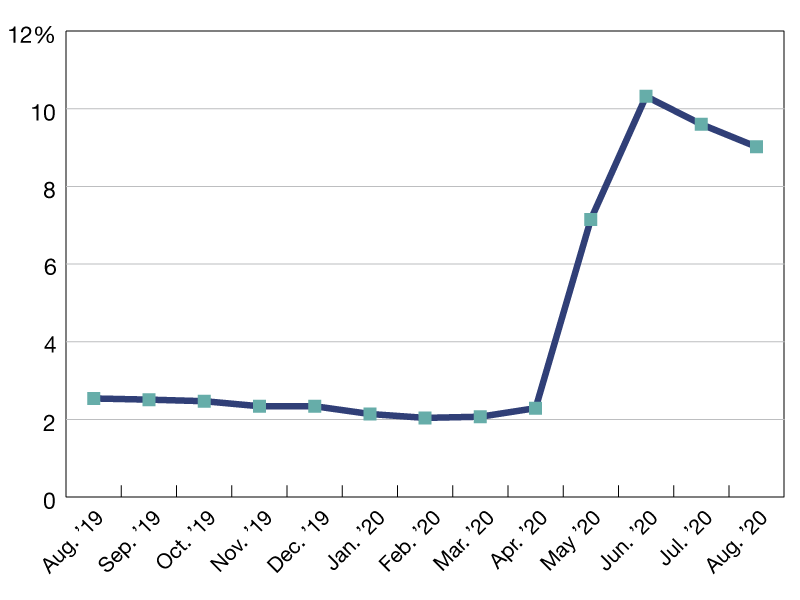

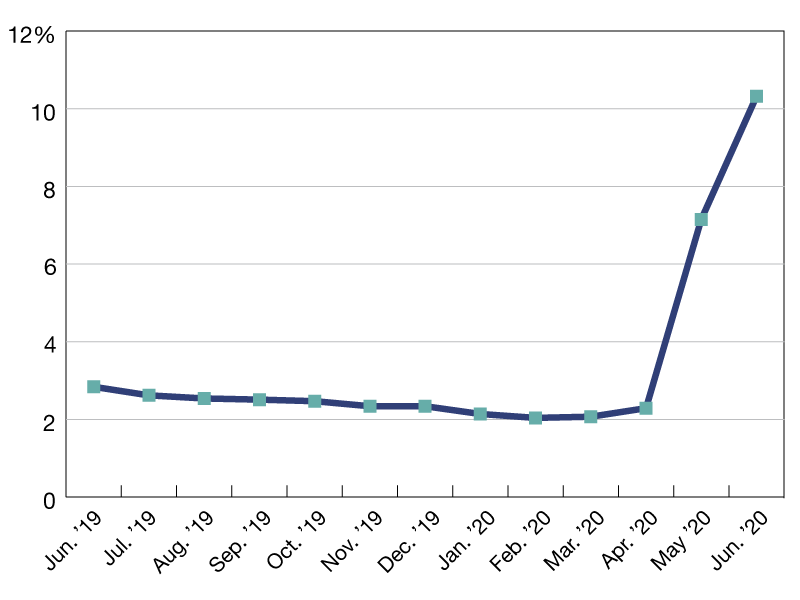

At one point in June, it appeared that a new all-time high for CMBS delinquencies would be reached. However, when the final numbers were posted, the 2012 high remains the peak for the time being. Trepp CMBS Delinquency Rate in June is 10.3 percent, a jump of 317 basis points over the May number. About 5 percent of that number represents loans in the 30 days delinquent bucket while another 3.2 percent are now 60 days delinquent. The numbers could be headed still higher in July. That’s because 4.1 percent of loans by balance missed the June payment but remained less than 30 days delinquent. That percentage of loans in or beyond grace period (the A/B loans as we refer to them) has fallen from 8.1 percent in April and 7.6 percent in May.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on Jul. 22, 2020

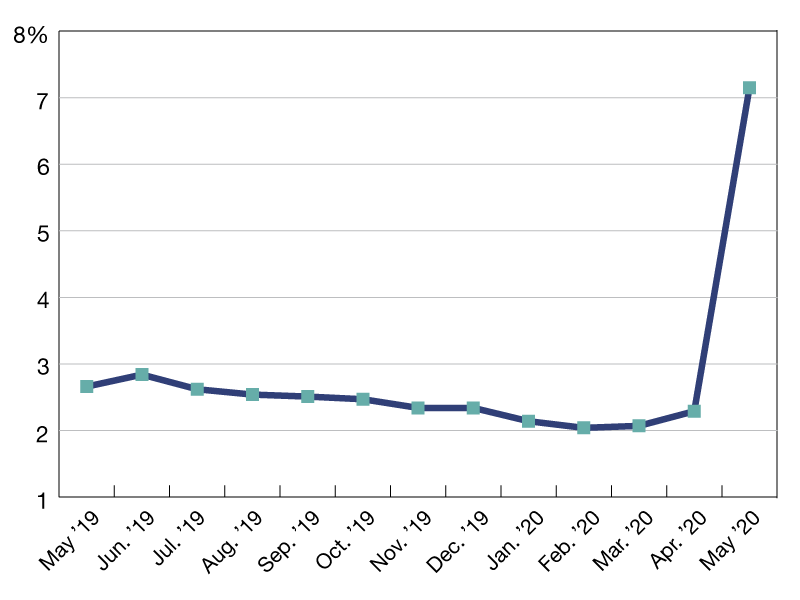

The surge in CMBS delinquencies that most industry watchers were anticipating came through in May–but the size of the jump surprised to the downside. In April 2020, Trepp’s CMBS Delinquency Rate registered at 2.3 percent. About 8 percent of loans by balance missed their April loan payments as we noted in last month’s delinquency report. If all those loans became 30 days delinquent this month, the rate would have topped 10 percent which would have threatened the all-time high recorded in 2012. Many of the loans that were in the “grace” or “beyond grace” period either stayed in that category or reverted to “current,” keeping the jump in the delinquency rate from being worse.

The Trepp CMBS Delinquency Rate in May logged its largest increase since we started tracking this metric in 2009. The May reading is 7.2 percent, a jump of 481 basis points over the April number. Almost 5 percent of that number is represented by loans in the 30-day delinquent bucket. Given that about 8 percent of loans had missed payments for the April remittance cycle, the fact that delinquencies went up less than 5 percent has to be viewed as a small “win.”

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on Jun. 24, 2020

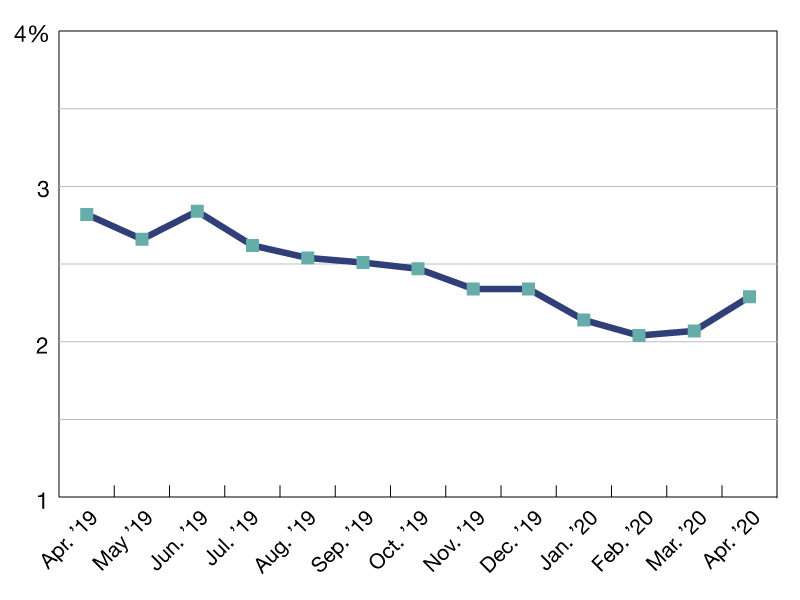

The Trepp CMBS Delinquency Rate saw its biggest jump in almost three years in April 2020. The April reading is 2.3 percent, a jump of 22 basis points over the March number. The last time the delinquency rate saw a bigger jump was in June 2017–when the industry was still talking about the “wave of maturing” 2007 loans. While an increase in the delinquency rate was probably expected by most industry watchers, the magnitude of the move likely surprised many by its modest size.

For now, many are eyeing the loans that have transferred to special servicing as an indicator of what is to come. The percentage of loans with the special servicer grew from 2.8 percent in March to 4.4 percent in April. Prior to the April servicer data, 2.3 percent of all lodging loans were in special servicing. In April, that ballooned to 11.4 percent. The balance of loans in special servicing grew from $14.1 billion to over $22 billion. The new additions to special servicing increased ten-fold between March and April.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on May 22, 2020

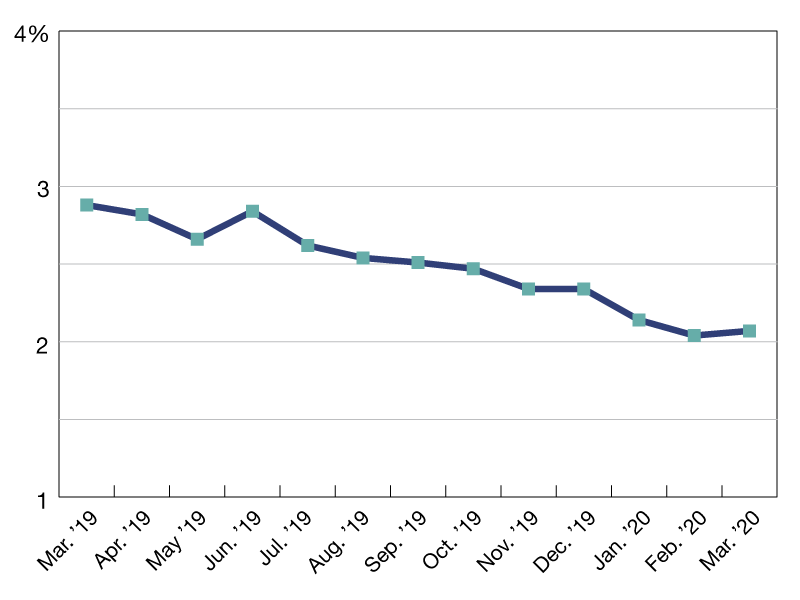

The Trepp CMBS Delinquency Rate inched up in March, a rare break from the downward trend that has extended for almost three years. For those looking for a large COVID-19 induced uptick in March, that was always unlikely. With most loans having payments due on the first of the month, most borrowers for performing loans would likely have made their March payment–this was before the industry gained more clarity on the magnitude of the outbreak’s disruption to businesses.

The March reading was 2.1 percent, an uptick of three basis points from February. At least for now, heavy new issuance from late last year added performing supply to the denominator and some of the defaulted legacy loans continued to get resolved away in February. The downward pressure of both variables on the delinquency rate should be reduced in the coming months with new issuance having stalled, distressed property sales being postponed, and COVID-19 related delinquencies starting to represent a new inflection point. Time will tell if the February level of 2.0 percent represents a post-crisis low for a long time to come.

The delinquency rate started to fall after June 2017 when CMBS delinquencies totaled 5.8 percent. Since then, the rate has fallen in 27 of the last 33 months. The all-time high of 10.3 percent was registered in July 2012.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on Apr. 24, 2020

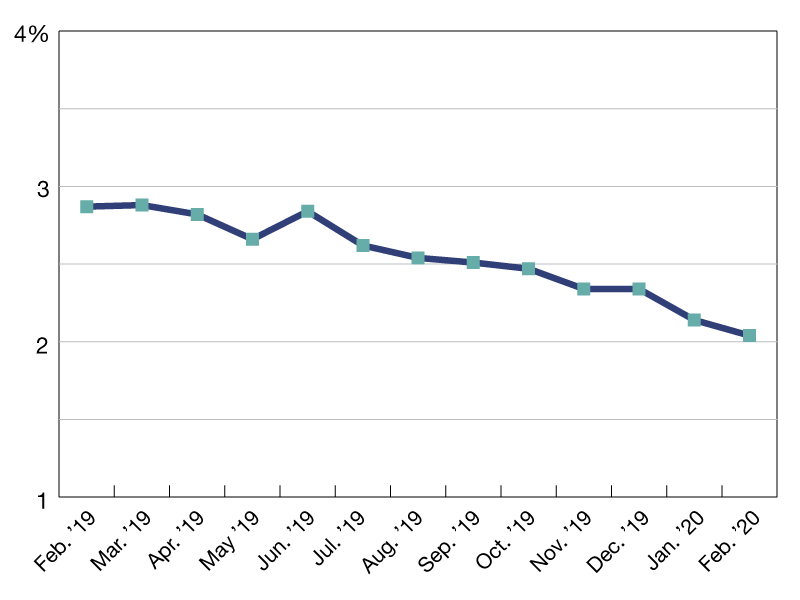

The Trepp CMBS Delinquency Rate dropped once again in February, continuing a trend that has extended to nearly three years by now. Heavy new issuance late last year added performing supply to the denominator while defaulted legacy loans continually get resolved away in early-2020.

The February reading is 2.0 percent, a decline of 10 basis points from the month prior, which is once again another new post-crisis low. The delinquency rate started to fall after June 2017 when CMBS delinquencies totaled 5.8 percent. Since then, the rate has fallen in 27 of the last 32 months. The all-time high of 10.3 percent was registered in July 2012.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on Mar. 26, 2020

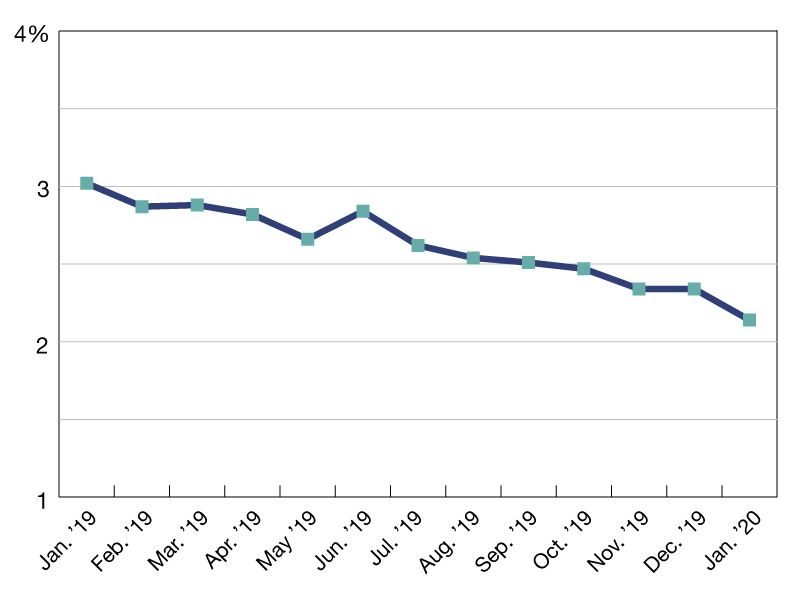

The Trepp CMBS Delinquency Rate dropped sharply in January as heavy new issuance continued to add performing supply to the denominator and defaulted legacy loans were resolved away. The January reading is 2.1 percent, a decline of 20 basis points, and another new post-crisis low. The delinquency rate started to fall after June 2017 when CMBS delinquencies totaled 5.8 percent. Since then, the rate has fallen in 26 of the last 31 months. The all-time high of 10.3 percent was registered in July 2012.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on Feb. 21, 2020

You must be logged in to post a comment.