2020 Development

Year-over-year change in U.S. commercial real estate properties under construction in the industrial, office and retail sectors, updated monthly.

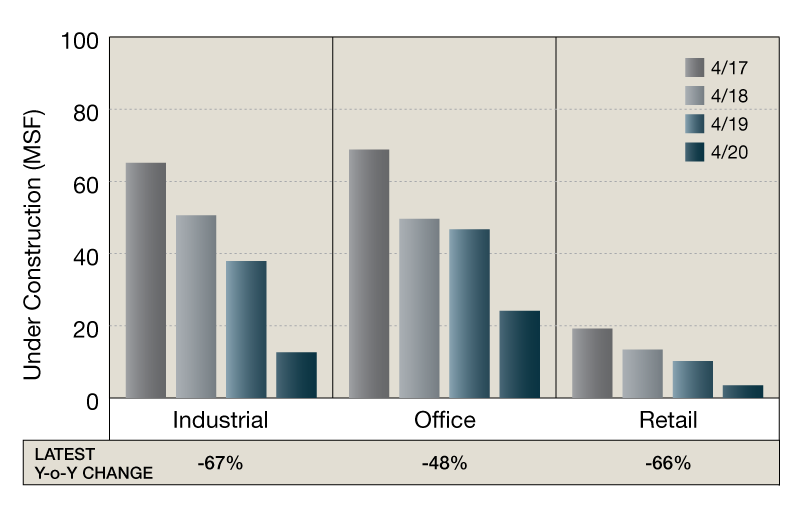

Year-over-year, new development decreased on a square-foot basis for all property types. As of April, the industrial sector recorded the most notable decline, down by 67 percent, closely followed by retail development activity, down by 66 percent. The office sector registered a 48 percent decline in construction activity, according to CoStar information. On a month-over-month basis, development activity dipped in every sector—down by 20 percent for industrial, followed by a 13 percent drop for retail and a 6 percent decrease for office.

As of April, some 24.1 million square feet of office space was underway nationwide. Year-over-year, construction activity in the office sector dropped by 48 percent, from 46.7 million square feet. Over the past three years, development in the sector peaked in April 2017 at 68.8 million square feet. Compared to this cycle high, construction in April 2020 declined by a 65 percent, while compared to April 2018, development activity fell by 51 percent.

—Posted on May 29, 2020

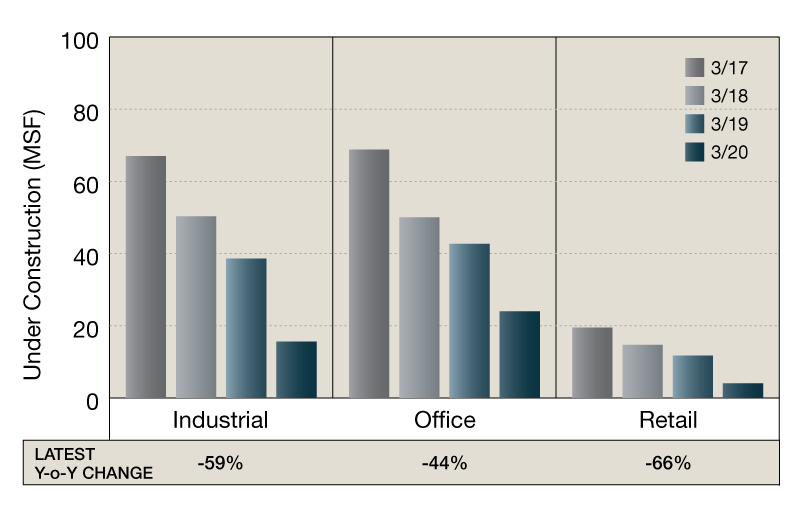

Year-over-year, new development declined on a square-foot basis for all property types. As of March, the retail sector registered the most notable decrease, down by 66 percent, while industrial construction dropped by 59 percent, according to CoStar information. Development activity in the office sector declined by 44 percent year-over-year. On a month-over-month basis, construction activity fell in every sector—down by 7 percent in the retail sector, followed by a 6 percent drop for office and a 6 percent dip for industrial.

As of March, some 15.6 million square feet of industrial space was under construction nationwide. Year-over-year, development activity in the industrial sector dropped by 59 percent, from 38.6 million square feet. Over the past three years, construction in the sector peaked in March 2017 at 67 million square feet. Compared to this cycle peak, construction in March 2020 dropped by a 77 percent, while compared to March 2018, development declined by 69 percent.

—Posted on April 27, 2020

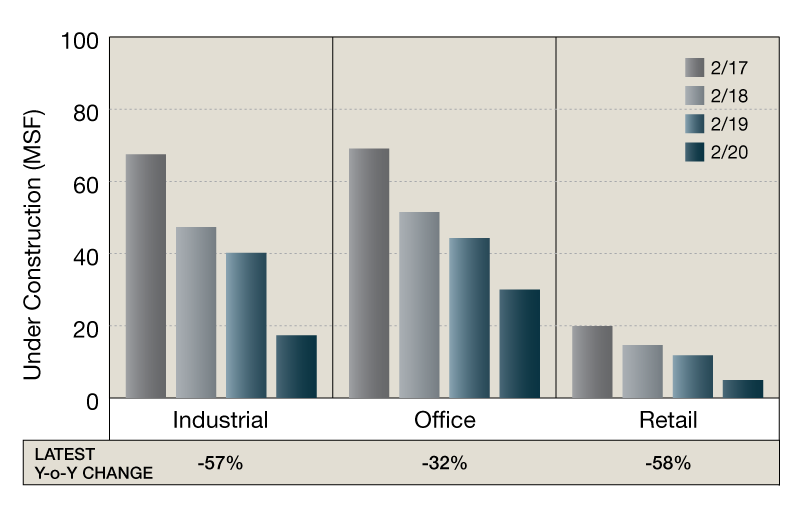

Year-over-year, new development fell on a square-foot basis for all property types. As of February, the retail sector registered the most notable decrease, down by 58 percent, while industrial construction dropped by 57 percent, according to CoStar information. Development activity in the office sector declined by 32 percent year-over-year. On a month-over-month basis, construction activity decreased in every sector—down by 22 percent in the industrial sector, followed by a 14 percent dip for office and a 13 percent drop for retail.

As of February, some 4.9 million square feet of retail space was under construction nationwide. Year-over-year, development activity in the retail sector dropped from 11.8 million square feet. Over the past three years, construction in the sector peaked in February 2017 at 19.9 million square feet. Compared to this cycle high, construction in February 2020 dropped by a 75 percent, while compared to February 2018, development declined by 66 percent.

—Posted on March 27, 2020

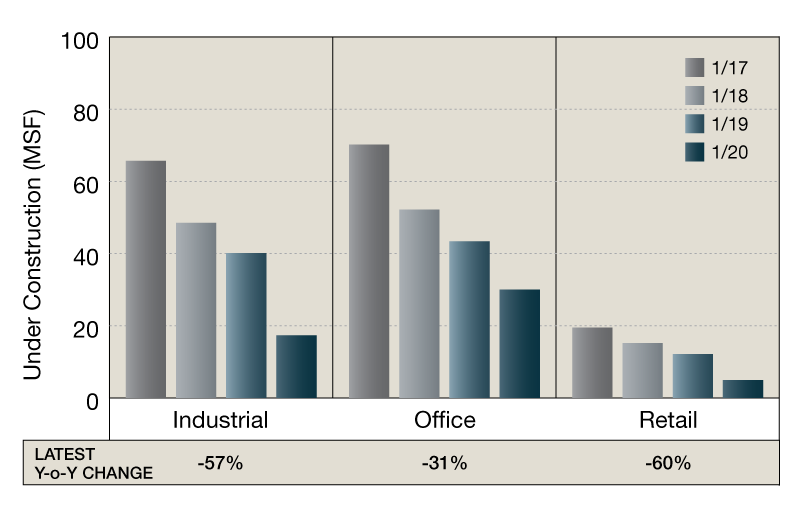

Year-over-year, new development declined on a square-foot basis for all property types. As of January, the retail sector registered the most significant drop, down by 60 percent, while industrial development fell by 57 percent, according to CoStar information. Construction activity in the office sector decreased by 31 percent year-over-year. On a month-over-month basis, construction activity decreased in every sector—down by 22 percent in the industrial sector, followed by a 14 percent decrease for office and a 13 percent dip for retail.

As of January, some 30 million square feet of office space was under construction nationwide, a 31 percent decrease year-over-year, from 43.4 million square feet. Over the past three years, construction in the office sector peaked in January 2017 at 70.2 million square feet. Compared to this cycle high, development in January 2020 dropped by a whopping 134 percent, while compared to January 2018, construction decreased by 42 percent.

—Posted on Feb. 28, 2020

You must be logged in to post a comment.