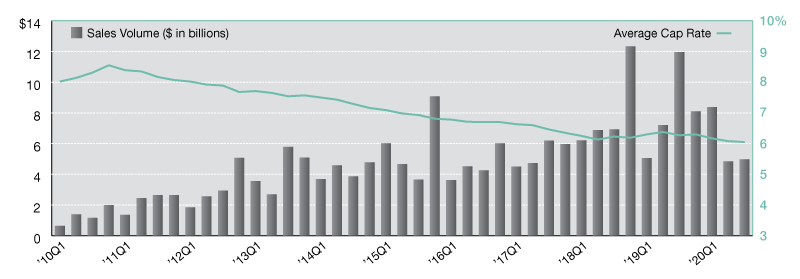

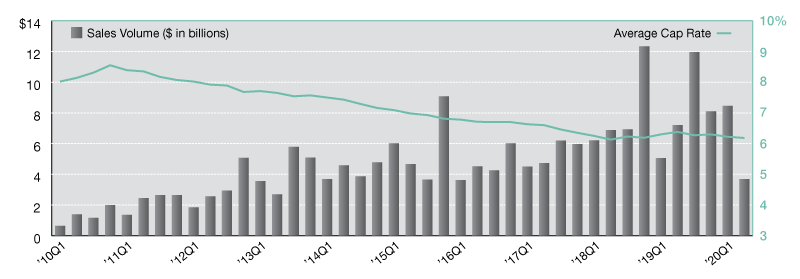

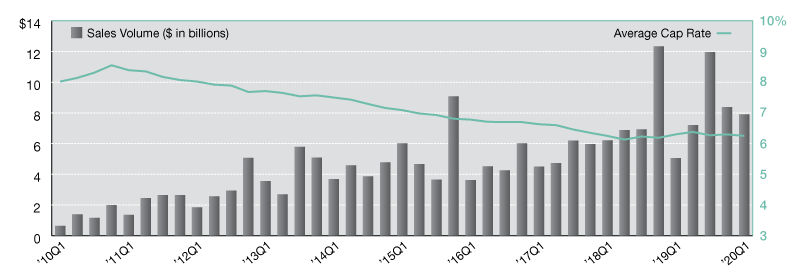

2020 Net Lease Industrial Sales Volume, Cap Rates

Single-tenant industrial sales volume versus average cap rates, updated quarterly.

In third quarter 2020, the single-tenant industrial market saw back-to-back quarters of nearly equal sales volume, with approximately $4.9 billion reported in each of the last two periods. Stronger first quarter activity puts the sector on pace to exceed $24.0 billion annually, but we’ll need to have sustained demand in the final three months of the year for that to happen. Industrial cap rates, rather than demand levels, are the trend to watch in the net lease industrial sector. At an average of 6.1 percent, rates have fallen 20 basis points in the last four quarters and could compress further before bottoming out. Will the market see single-tenant industrial cap rates fall into the high-5’s next year? It’s possible, as quality manufacturing, warehouse, and logistics facilities continue to be in high demand for investors.

Focusing on business development, industry and client-specific research, and the analysis of local and national market trends, Lanie Beck has been the Director of Research for Stan Johnson Co. since 2013.

—Posted on Dec. 21, 2020

The last two years have seen incredibly strong levels of investment sales activity across the single-tenant net lease industrial sector. But COVID-19 has impacted this sector in recent months and despite a strong first quarter 2020, second quarter totals–at approximately $3.7 billion–were the lowest reported in more than four years. While the industrial sector won’t have a third record-setting year of sales activity, it still may outpace totals seen in 2016 and 2017, but we’ll need to see increased activity in the latter half of the year to make that a reality. Average cap rates for net lease industrial are experiencing a W-shaped trendline, as upward movement seen throughout 2019 has reversed course. In the last six months, we’ve seen cap rates across the sector decline nine basis points, ending mid-year 2020 at 6.2 percent–nearly equal to average values reported at mid-year 2018 when rates were projected to have bottomed out.

Focusing on business development, industry and client-specific research, and the analysis of local and national market trends, Lanie Beck has been the Director of Research for Stan Johnson Co. since 2013.

—Posted on Sep. 24, 2020

The net lease industrial sector has been the darling of the industry in recent years, and despite certain sectors coming under fire during the COVID-19 health crisis, manufacturing and logistics have done well to prove their importance. After posting back-to-back years of record investment sales activity, the single-tenant industrial sector reported a very healthy $7.9 billion in sales during Q1 2020. Granted, much of the activity occurred in January and February, with market conditions slowing significantly in March. But strong momentum from the previous year was enough to buoy quarterly totals. Industrial cap rates, while not quite as stagnant as we’ve seen in the retail sector, for example, still have yet to show much overall movement. Average industrial cap rates ended Q1 2020 at 6.25 percent–down 5 basis points from year-end 2019 but still very much on par with quarterly averages reported since 2017.

Focusing on business development, industry and client-specific research, and the analysis of local and national market trends, Lanie Beck has been the Director of Research for Stan Johnson Co. since 2013.

—Posted on Jun. 24, 2020

You must be logged in to post a comment.