2020 New Orders

The value of manufacturers’ new orders across multiple industries, updated monthly.

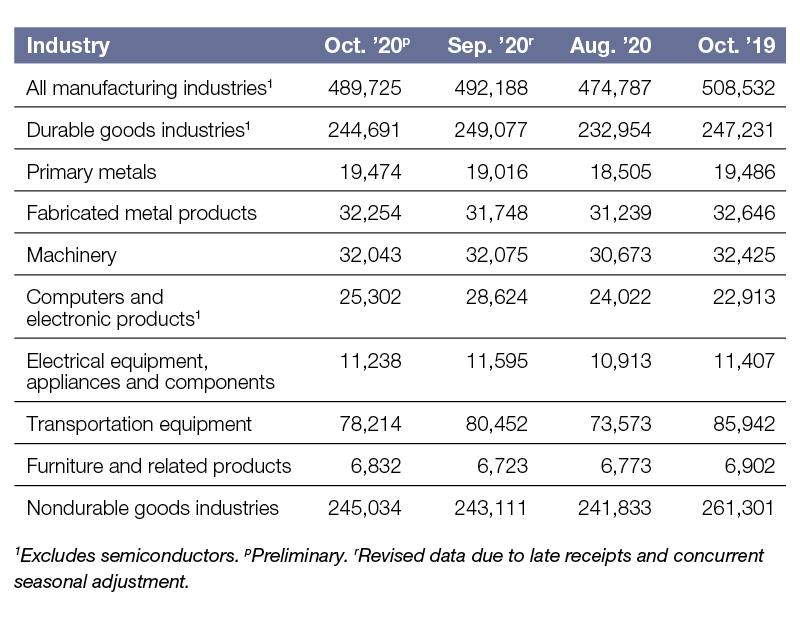

Not seasonally adjusted; $ in millions

Year-over-year, new orders declined for most manufacturing industries, down by an average 3.7 percent, or by $18.8 million, as of October 2020, according to data from the U.S. Census Bureau. Compared to October 2019, Transportation Equipment (-9.0 percent) was the hardest hit sector by the economic dislocation. Just as in previous months, new orders were down for the Nondurable Goods industries (-6.2 percent), while orders for the Electrical Equipment, Appliances and Components sector decreased by 1.5 percent.

As of October, the only industry to register an increase in new orders was Computer and Electronic Products, up by 10.4 percent year-over-year. New orders for Primary Metals saw the smallest decrease (-0.1 percent), while new orders in sectors such as Durable Goods Industries (-1.0 percent) and Transportation Equipment (-1.0 percent) slightly dropped, compared to earlier months of consistent improvement.

On a month-over-month basis, new orders fluctuated for manufacturers, down by an overall 0.5 percent (accounting for $2.5 million) as of October. As opposed to the year-over-year trend, new orders for Computer and Electronic Products saw the most considerable drop (-11.6 percent), followed by Electrical Equipment, Appliances and Components (-3.1 percent) and Transportation Equipment (-2.8 percent). Several manufacturing sectors posted an uptick in new orders—Primary Metals led growth (2.4 percent), followed by Fabricated Metal Products and Furniture and Related Products (both sectors were up 1.6 percent), and Nondurable Goods Industries (0.8 percent).

—Posted on Dec. 15, 2020

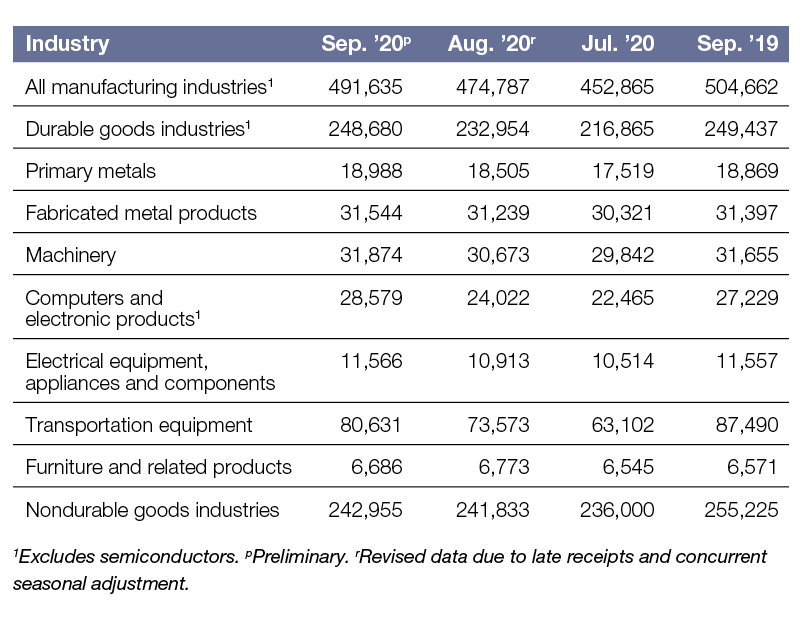

Not seasonally adjusted; $ in millions

Year-over-year, new orders increased for most manufacturing industries, but the rise in orders wasn’t significant enough to move the needle for the overall average, which was down by 2.6 percent (or by $13 million) as of September 2020, according to data from the U.S. Census Bureau. Compared to September 2019, new orders for the Transportation Equipment sector (-7.8 percent) were the most impacted by the economic slowdown. Similar to previous months, new orders slid for the Nondurable Goods industries (-4.8 percent), while orders for the Durable Goods industries were down by 0.3 percent

As of September, the industry with the largest increase in new orders was once again Computer and Electronic Products, which posted a 5.0 percent year-over-year increase as an obvious consequence of many companies switching to the work-from-home business model. Similarly to previous months since the onset of the health crisis, orders for Furniture and Related Products were up—1.8 percent as of September. Electrical equipment, appliances and components, fabricated metal products, primary metals and machinery all recorded improved order numbers, below the 1 percent threshold.

On a month-over-month basis, new orders increased for almost all manufacturing industries, up by an overall 3.5 percent (accounting for $16.8 million) as of September. Computer and Electronic Products led new orders, recording the most considerable improvement—up by 19 percent. Transportation Equipment followed with a 9.6 percent increase, while orders for the Durable Goods industries were up by 6.8 percent. Furniture and Related Products was the only sector where orders declined month-over-month (down 1.3 percent).

—Posted on Nov. 20, 2020

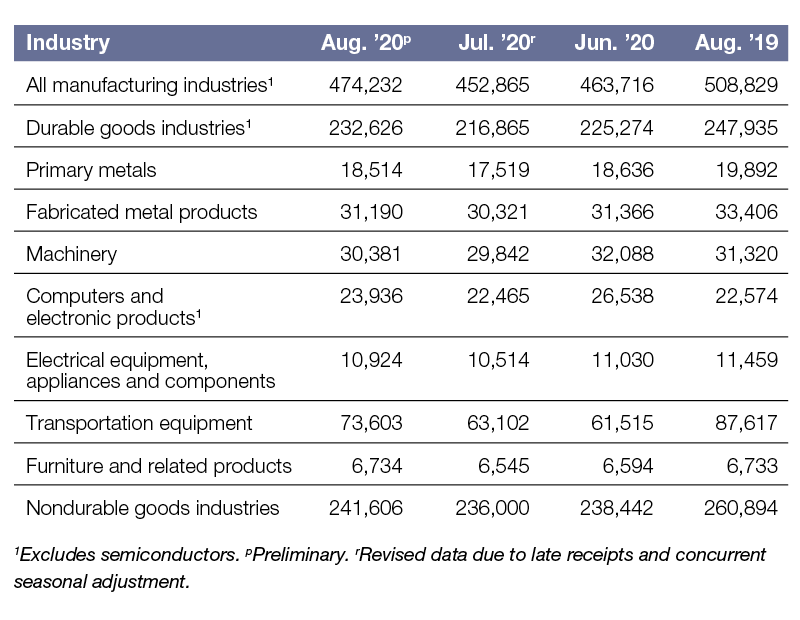

Not seasonally adjusted; $ in millions

Year-over-year, new orders declined for almost every manufacturing industry (down by an overall average of 6.8 percent, or by $34.6 million) as of August 2020, according to data from the U.S. Census Bureau. Compared to August 2019, new orders for the Transportation Equipment sector (-16.0 percent) were the most affected by pandemic-induced restrictions and the ensuing economic fallout. Similar to previous months, new orders fell for Nondurable Goods industries (-7.4 percent), while orders for the Primary Metals fell by 6.9 percent, closely followed by Fabricated Metal Products (-6.6 percent) and Fabricated Metal Products (-6.6 percent).

As of August, the least affected industry—and the only sector where new orders were up—was once again Computer and Electronic Products, which recorded a 6.0 percent year-over-year increase in new orders as a result of many companies switching to the work-from-home business model. And just as in prior months since the onset of the pandemic, orders for Furniture and Related Products registered the smallest change, up by 0.1 percent as of August.

Following gradual reopening efforts, new orders increased on a month-over-month basis. Orders were up for all manufacturing industries by an overall 4.7 percent, or $21.4 million, as of August. As opposed to a year-over-year basis, orders for Transportation Equipment registered the most significant increase, up by 16.6 percent month-over-month. The Durable Goods industries followed with a 7.3 percent rise, while orders for Computer and Electronic Products were up by 6.5 percent. Fabricated Metal Products, Furniture and Related Products and the Nondurable Goods industries all posted gains above the 2 percent threshold. Machinery registered the smallest increase, up by 1.8 percent as of August.

—Posted on Oct. 23, 2020

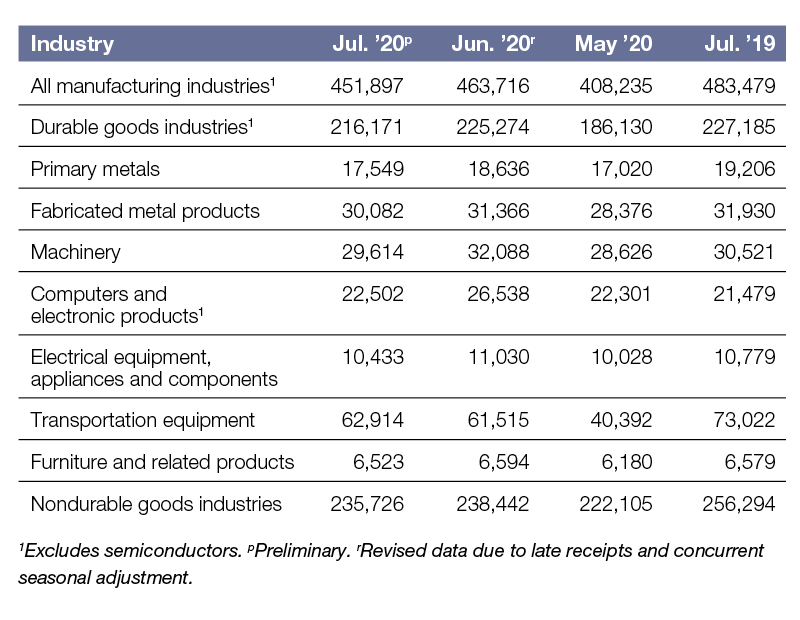

Not seasonally adjusted; $ in millions

Year-over-year, new orders declined for all but one manufacturing industry (down by an overall average of 6.5 percent, or by $31.6 million) as of July 2020, based on U.S. Census Bureau data. Compared to July 2019, new orders for the Transportation Equipment sector (-13.8 percent) were most impacted by pandemic-generated restrictions and the ensuing economic disruption. Just as in previous months, new orders fell for primary metals (-8.6 percent), while orders for the Nondurable Goods industries were down by 8.0 percent, followed by Fabricated Metal Products (-5.8 percent).

As of July, the least affected industry—and the only sector to register an order increase—was once again Computer and Electronic Products, which posted a 4.8 percent year-over-year increase in new orders due to many companies adopting the work-from-home business format. And just as in prior months since the onset of the health crisis, orders for Furniture and Related Products registered the smallest negative change, down by 0.9 percent as of July.

A resurgence in new confirmed cases—following reopenings and easing certain restrictions—have impacted new orders on a month-over-month basis. Orders fell for all manufacturing industries by 2.5 percent, or $11.8 million, as of July. Computer and Electronic Products, the only sector to record an increase in new orders year-over-year, registered the most significant decline month-over-month, down by 15.2 percent. Machinery followed with a 7.7 percent decrease, while orders for Primary Metals fell by 5.8 percent. As of July, the only industry to record a rise in new orders on a month-over-month basis was Transportation Equipment, up by 2.3 percent.

—Posted on Sept. 30, 2020

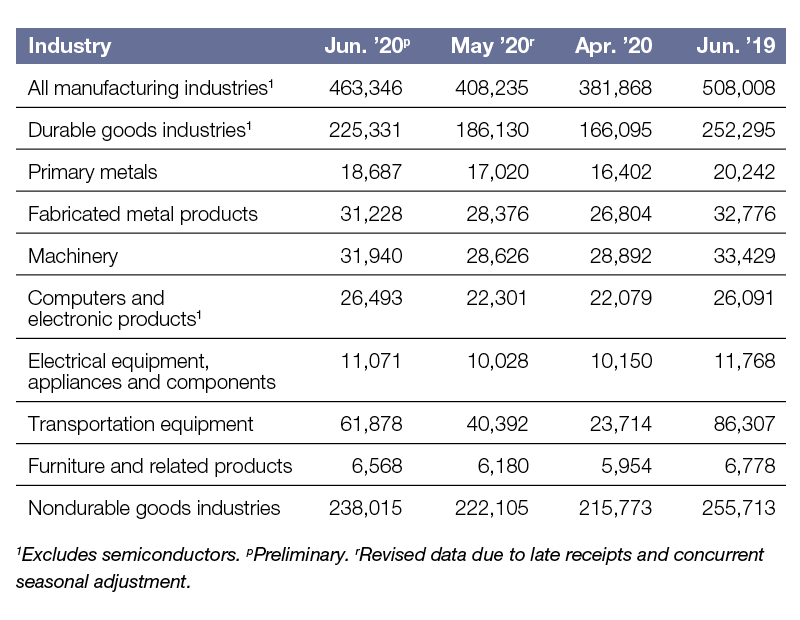

Not seasonally adjusted; $ in millions

Year-over-year, new orders fell for all but one manufacturing industry (down by an overall average of 8.8 percent, or by $44.7 million) as of June 2020, based on U.S. Census Bureau data. Compared to June 2019, new orders for the Transportation Equipment sector (-28.3 percent) were hardest hit by pandemic-induced restrictions and the subsequent economic fallout. Just as in prior months, new orders decreased for the Durable Goods industries (-10.7 percent), while orders for Primary Metals were down by 7.7 percent, followed by the Nondurable Goods industries (-6.9 percent).

As of June, the least impacted industry was once again Computer and Electronic Products, which registered a 1.5 percent year-over-year increase in new orders, following widespread work-from-home measures taken by companies. The smallest negative change came from Furniture and Related Products, where new orders dropped by 3.1 percent as of June.

As was the case in prior months since the onset of the health crisis, new orders rebounded on a month-over-month basis across the board. Orders improved for all manufacturing industries by 13.5 percent, or by $55.1 million, as of June. Transportation Equipment, which was the most impacted sector year-over-year, registered the most considerable increase month-over-month, up by 53.2 percent. The Durable Goods industries followed with a 21.1 percent rise in new orders, while Computers and Electronic Products were up by 18.8 percent. As of June, the smallest change came from Furniture and Related Products, where orders increased by 6.3 percent over May.

—Posted on Aug. 29, 2020

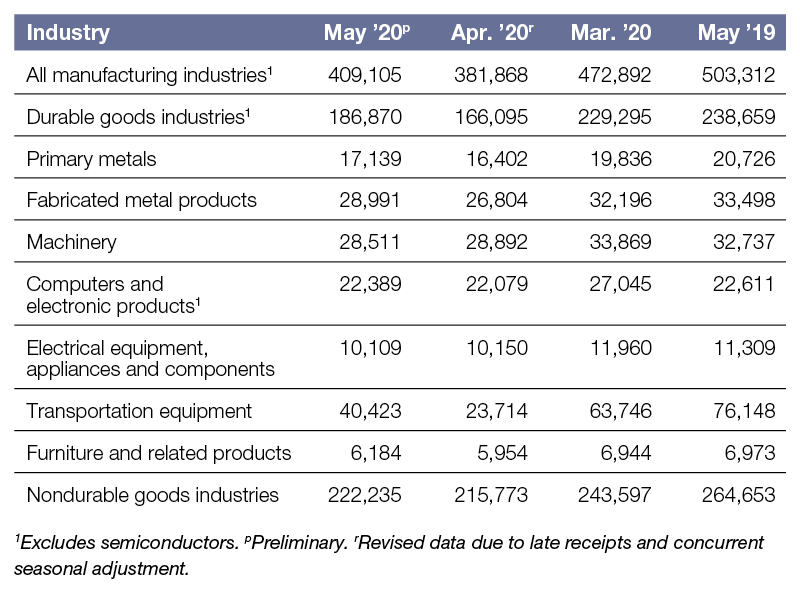

Not seasonally adjusted; $ in millions

Year-over-year, new orders fell for nearly all manufacturing industries (down by an average 18.7 percent, or by $94.2 million) as of May 2020, according to the U.S. Census Bureau. New orders for the Transportation Equipment were hit hardest by the coronavirus pandemic, declining by 46.9 percent compared to May 2019. The Durable Goods Industries followed with a 21.7 percent drop, while orders for Primary Metals decreased by 17.3 percent.

As of May, the industry that was least affected and even recorded modest growth was Computers and Electronic Products, where new orders were up by 1% year-over-year. The smallest decrease came from Electrical Equipment, Appliances and Components, down by 10.6 percent year-over-year, while Furniture and Related Products posted a 11.3 percent drop.

New orders rebounded on a month-over-month basis for almost all manufacturing industries, up by 7.1 percent, or by $27.2 million. The same industries that were most impacted on a year-over-year basis displayed signs of recovery month-over-month. New orders surged by 79.5 percent for Transportation Equipment, followed by Durable Goods with a 12.5 percent increase, while Fabricated Metal Products were up by 8.2 percent as of May. The most modest change came from Computers and Electronic Products, were new orders increased by only 1.4 percent, while Machinery (-1.3 percent) and Electrical Equipment, Appliances and Components (-0.4 percent) were the only sectors to register declines in new orders month-over-month.

—Posted on July 29, 2020

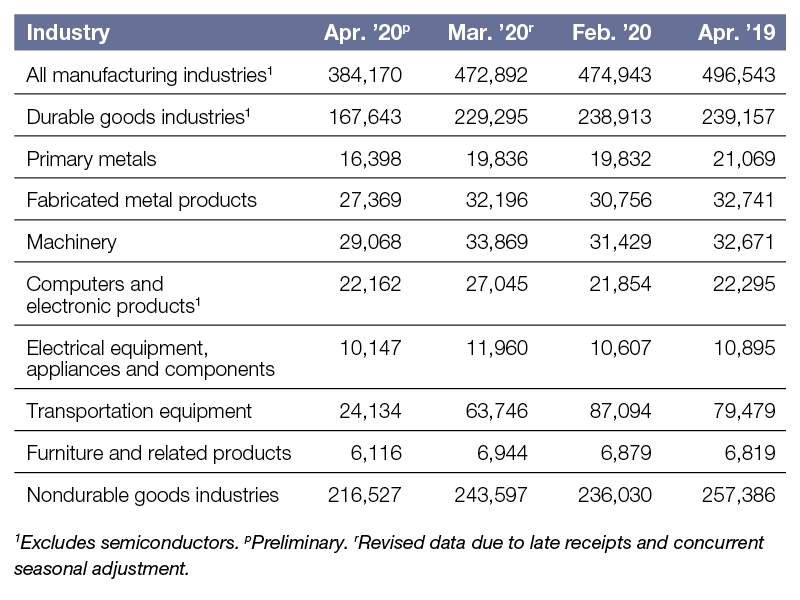

Not seasonally adjusted; $ in millions

Year-over-year, new orders declined for all manufacturing industries (down by an average 22.6 percent, or by 112.4 million) as of April 2020, according to the U.S. Census Bureau. New orders for the Transportation Equipment industry bore the brunt of the coronavirus pandemic, dropping by 69.6 percent compared to April 2019. The Durable Goods Industries followed with a 29.9 percent decrease, while orders for Primary Metals declined by 22.2 percent.

The industries that were least affected due to a lot of people still working from home, but still registered declines, were Computers and Electronic Products and Electrical Equipment, Appliances and Components. The smallest decrease came from Computers and Electronic Products, down by 0.6 percent year-over-year, while Electrical Equipment, Appliances and Components recorded a 6.9 percent drop.

New orders fell on a month-over-month basis as well for all manufacturing industries, down by 18.8 percent, or by $88.7 million. The same industries that were hit hardest on a year-over-year basis were most impacted month-over-month as well. New orders dropped by 62.1 percent for Transportation Equipment, followed by Durable Goods with a 26.9 percent decrease and Primary Metals with a 17.3 percent decline. Furniture and Related Products recorded smaller declines in new orders, down by 11.9 percent, followed by Nondurable Goods Industries, down by 11.1 percent.

—Posted on June 30, 2020

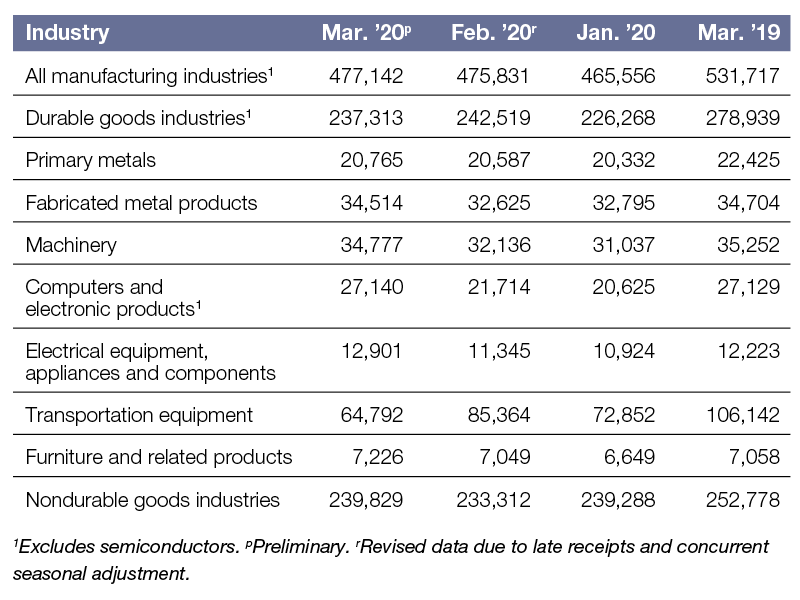

Not seasonally adjusted; $ in millions

Year-over-year, new orders decreased for all manufacturing industries (down by an average 10.3 percent, or by 54.6 million) as of March 2020, according to the U.S. Census Bureau. New orders for the Transportation Equipment industry recorded the steepest decline, down by 39 percent compared to March 2019. The Durable Goods Industries followed with a 14.9 percent drop, while orders for Primary Metals fell by 7.4 percent.

In light of current events and with many people spending more time at home, it comes as no surprise that new orders for Electrical Equipment, Appliances and Components increased on a year-over-year basis by 5.5 percent—the most notable rise as of March. Orders for Furniture and Related Products were also up, increasing by 2.4 percent.

On a month-over-month basis, new orders increased slightly, up by 0.3 percent, or by $1.3 million, for all manufacturing industries. Most likely a direct result of countrywide stay-at-home orders, new orders for Computers and Electronic Products rose by 25 percent, followed by Electrical Equipment, Appliances and Components, up by 13.7 percent.

The most significant decrease on a month-over-month basis came from Transportation Equipment—orders fell by 24.1 percent. New orders declined slightly for Durable Goods Industries, down by 2.1 percent.

—Posted on May 25, 2020

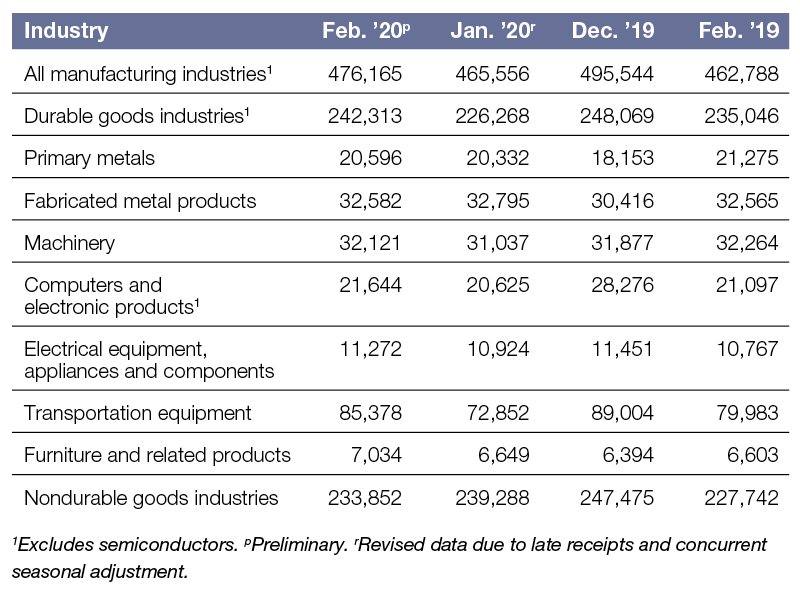

Not seasonally adjusted; $ in millions

Year-over-year, new orders posted modest gains for all manufacturing industries (up by an average 2.9 percent, or by 13.4 million) as of February 2020, according to the U.S. Census Bureau. New orders for the Transportation Equipment industry topped the list, up by 6.7 percent compared to February 2019. Furniture and Related Goods followed closely, with a 6.5 percent increase, while orders for Electrical Equipment, Appliances and Components were up by 4.7 percent.

On the other end of the spectrum, new orders declined for Fabricated Metal Products on a year-over-year basis by 3.2 percent—the largest decrease as of February. Only another industry recorded a drop in new orders as of February—Machinery was down slightly, by 0.4 percent.

On a month-over-month basis, new orders increased by an average 2.3 percent for all manufacturing industries, or by $10.6 million. Transportation Equipment registered the most considerable surge (up by 17.2 percent), followed by Primary Metals (up by 7.1 percent) and Furniture and Related Products (up by 5.8 percent). Only two sectors posted declines month-over-month—orders for the Nondurable Goods Industries were down by 2.3 percent, followed by Fabricated Metal Products (down by just 0.6 percent).

—Posted on April 27, 2020

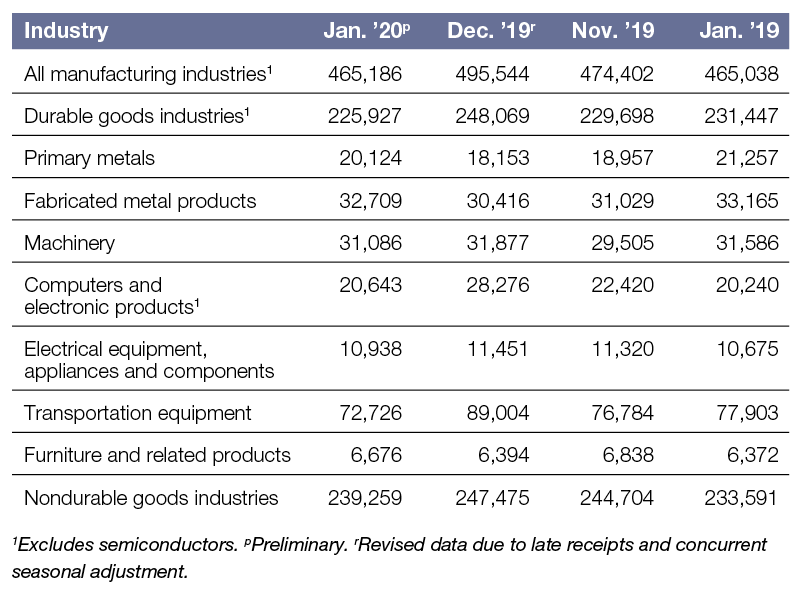

Not seasonally adjusted; $ in millions

Year-over-year, new orders increased insignificantly for all manufacturing industries (just by an average 0.03 percent) as of January 2020, according to the U.S. Census Bureau. Across the board, the most notable improvement came from the Furniture and Related Products sector, up by 4.8 percent compared to January 2019. New orders also increased for Electrical Equipment, Appliances and Components (up by 2.5 percent) and the Nondurable Goods industries (up by 2.4 percent).

New orders declined considerably for Transportation Equipment on a year-over-year basis (down by 6.6 percent, the largest decrease as of January), followed by Primary Metals with a 5.3 percent drop. Orders for Durable Goods decreased by 2.4 percent, followed by Machinery (down by 1.6 percent).

On a month-over-month basis, new orders fell by an average 6.1 percent for all manufacturing industries, or by $30.4 million. Computers and Electronic Products registered the most significant drop (down by 27 percent), followed by Transportation Equipment (down by 18.3 percent) and Durable Goods, with an 8.9 percent decrease. Primary Metals recorded the largest increase month-over month, up by 10.9 percent, followed by Fabricated Metal Products (up by 7.5 percent) and Furniture and Related Products (up by 4.4 percent).

—Posted on March 27, 2020

You must be logged in to post a comment.