2020 REIT Results

Among the sectors, Diversified REITs had the highest average AFFO payout ratio estimate for the quarter.

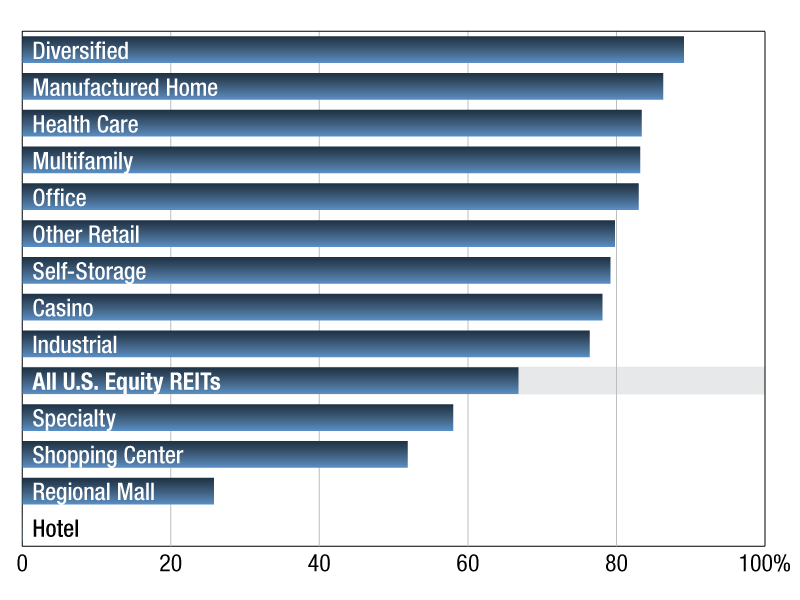

U.S. equity REIT average AFFO payout ratios

As of Dec. 31, 2020, publicly traded U.S. equity REITs had an average 2020Q4 AFFO payout ratio estimate of 66.8 percent.

Among the sectors, Diversified REITs had the highest average AFFO payout ratio estimate for the fourth quarter of 2020, at 89.1 percent. The Manufactured Home and Health Care sectors followed at 86.3 percent and 83.4 percent, respectively. On the other hand, Hotel REITs had 0.0 percent AFFO payout ratio estimate for the fourth quarter of 2020.

The Multifamily REIT sector had an 83.2 percent AFFO payout ratio estimate as of Dec. 31, 2020. Among the multifamily REITs, Bluerock Residential Growth REIT Inc., was on top of the list with 171.1 percent AFFO payout ratio estimate. Following next was Apartment Income REIT Corp., with a 95.6 percent payout ratio estimate. Camden Property Trust was at the bottom of the list with a 12.0 percent payout ratio estimate for 2020Q4.

Diana Rose Barrun is an associate in the real estate client operations department of S&P Global Market Intelligence

—Posted on Feb. 25, 2021

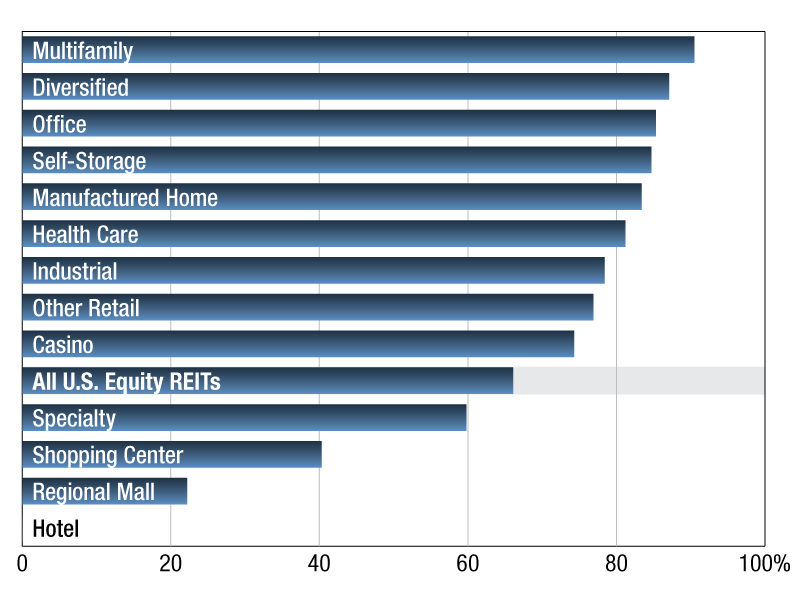

U.S. equity REIT average AFFO payout ratios

As of Sept. 1, publicly traded U.S. equity REITs had an average 2020Q3 AFFO payout ratio estimate of 66.1 percent. Among the sectors, multifamily REITs had the highest average AFFO payout ratio estimate for the third quarter of 2020, at 90.5 percent. The diversified and office sectors followed at 87.1 percent and 85.3 percent, respectively. On the other hand, hotel REITs had 0.0 percent AFFO payout ratio estimate for the third quarter of 2020.

The multifamily REIT sector had a 90.5 percent AFFO payout ratio estimate as of Sept. 1, 2020. Among the multifamily REITs, Bluerock Residential Growth REIT Inc. was on top of the list with 216.7 percent AFFO payout ratio estimate. Following next was Investors Real Estate Trust with a 102.9 percent payout ratio estimate. NextPoint Residential Trust Inc. was at the bottom of the list with a 65.6 percent payout ratio estimate for 2020Q3.

Diana Rose Barrun is an associate in the real estate client operations department of S&P Global Market Intelligence

—Posted on Sep. 24, 2020

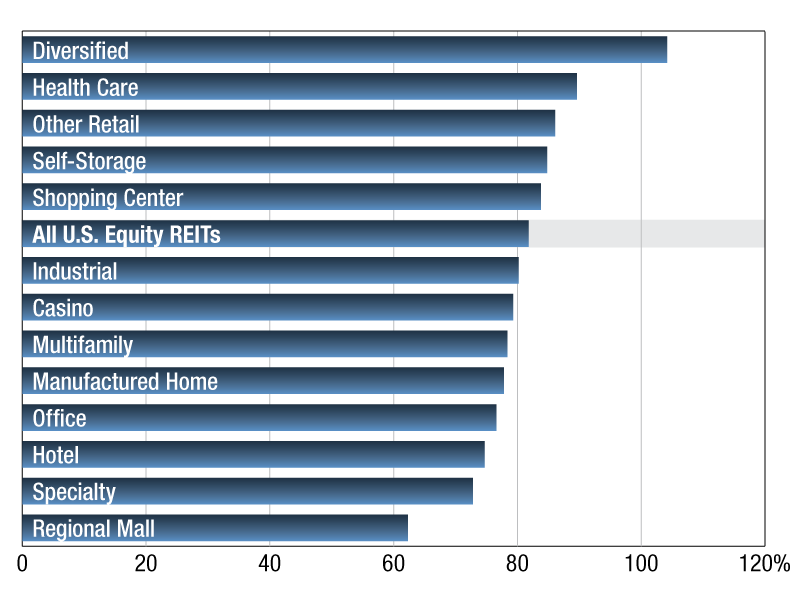

U.S. equity REIT average AFFO payout ratios

As of March 31, publicly traded U.S. equity REITs had an average 2020Q1 AFFO payout ratio estimate of 81.8 percent.

Among the sectors, diversified REITs had the highest average AFFO payout ratio estimate for the first quarter of 2020, at 104.2 percent. The health care and other retail sectors followed at 89.6 percent and 86.1 percent, respectively.

On the other hand, regional mall REITs had the lowest average AFFO payout ratio estimate for the first quarter of 2020 at 62.3 percent.

The multifamily REIT sector had a 78.4 percent AFFO payout ratio estimate as of March 31, 2020.

Among the multifamily REITs, Bluerock Residential Growth REIT Inc. was on top of the list with 104.2 percent AFFO payout ratio estimate. Following next was Independence Realty Trust Inc. with a 103.4 percent payout ratio estimate.

NextPoint Residential Trust Inc. was at the bottom of the list with a 56.5 percent payout ratio estimate for 2020Q1.

Diana Rose Barrun is an associate in the real estate client operations department of S&P Global Market Intelligence

—Posted on Apr. 24, 2020

You must be logged in to post a comment.