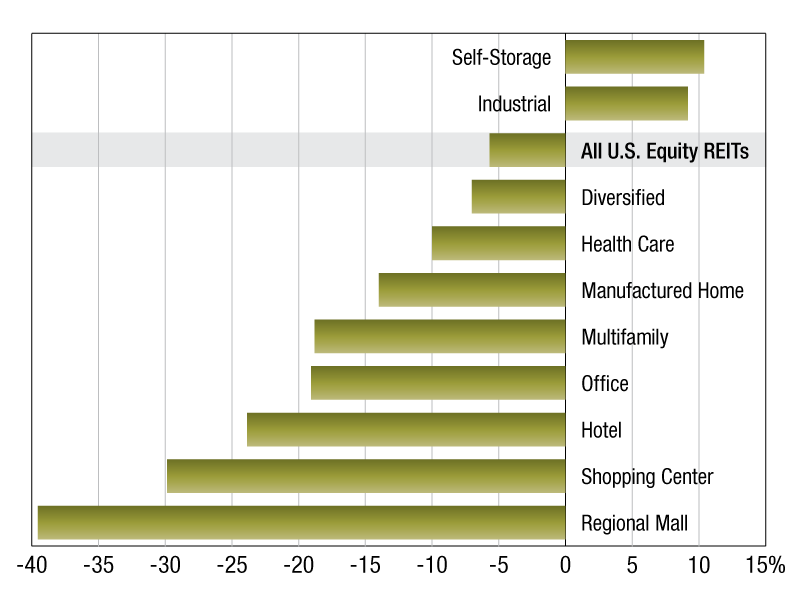

2020 REIT Returns

As of Dec. 1, 2020, publicly traded U.S. equity REITs posted a -5.7 percent one-year total return.

As of Dec. 1, 2020, publicly traded U.S. equity REITs posted a -5.7 percent one-year total return.

The self-storage REIT sector topped the chart with a 10.4 percent total return, beating the broader U.S. equity REIT index by 16.1 percentage points. The industrial sector followed with 9.2 percent one-year total return.

On the other end of the spectrum, the regional mall sector had the lowest one-year total return of -39.6 percent. The shopping center sector had the second lowest among the sectors, with a -29.9 percent one-year total return.

The multifamily sector index was ranked seventh out of all property sectors, posting a one-year total return of -18.8 percent. Among the multifamily-focused REITs, NexPoint Residential Trust Inc. delivered the highest one-year total return of approximately -2.3 percent. This was followed by Investors Real Estate Trust and Mid-America Apartment Communities Inc. at -2.8 percent and -3.6 percent one-year total returns, respectively.

Also, Apartment Investment and Management Co. posted a -33.8 percent return for the one year timeframe, having the lowest among the multifamily index constituents.

Diana Rose Barrun is an associate in the real estate client operations department of S&P Global Market Intelligence.

—Posted on Dec. 21, 2020

As of July 1, 2020, publicly traded U.S. equity REITs posted a -7.2 percent one-year total return. The industrial REIT sector topped the chart with a 13.6 percent total return, beating the broader U.S. equity REIT index by 20.8 percentage points. The manufactured homes sector followed with 8.1 percent one-year total return. On the other end of the spectrum, the regional mall sector had the lowest one-year total return of -54.8 percent. The hotel sector was second lowest among the sectors, with a -49.8 percent one-year total return.

As of July 1, 2020, the multifamily sector index was ranked fourth of all property sectors, posting a one-year total return of -15.9 percent. Among the multifamily-focused REITs, Investors Real Estate Trust delivered the highest one-year total return of approximately 27.0 percent. Independence Realty Trust Inc. and Mid-America Apartment Communities Inc. posted 5.1 percent and 2.4 percent one-year total returns, respectively. Bluerock Residential Growth REIT Inc. posted a -26.1 percent return for 1 year as July 1, 2020, lowest among the total returns of multifamily index constituents.

Diana Rose Barrun is an associate in the real estate client operations department of S&P Global Market Intelligence.

—Posted on Jul. 22, 2020

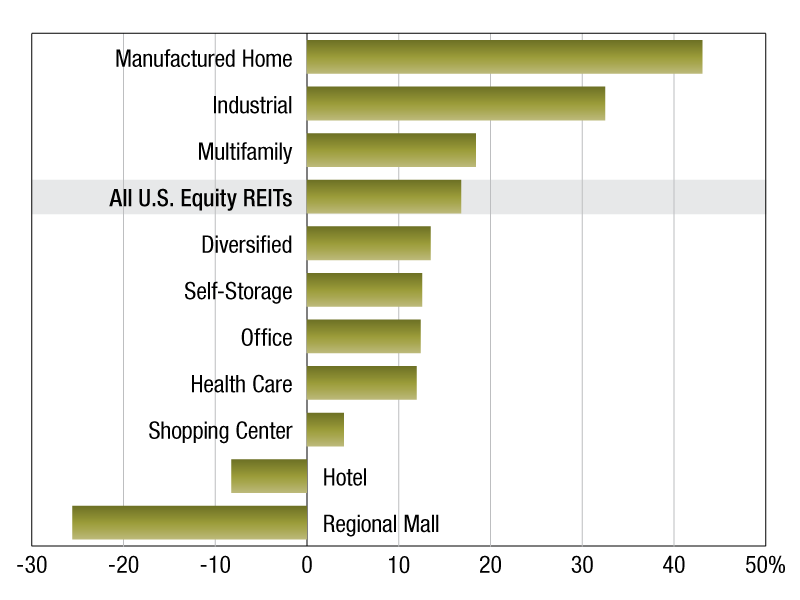

As of Feb. 3, 2020, publicly traded U.S. equity REITs posted a 16.8 percent one-year total return. The manufactured homes REIT sector topped the chart with a 43.1 percent total return, beating the broader U.S. equity REIT index by 26.3 percentage points. The industrial and multifamily REIT sectors followed with 32.5 percent and 18.4 percent one-year total returns, respectively. On the other end of the spectrum, the regional mall sector had the lowest one-year total return of -25.6 percent. The hotel sector was second lowest among the sectors, with a -8.3 percent one-year total return.

As of Feb. 3, 2020, the multifamily sector index was ranked third of all property sectors, posting a one-year total return of 18.4 percent. Among the multifamily-focused REITs, BRT Apartments Corp. delivered the highest one-year total return of approximately 49.7 percent. Following that was Independence Realty Trust Inc. and Mid-America Apartment Communities Inc. with 49.3 percent and 37.9 percent one-year total returns, respectively. Apartment Investment and Management Co. posted a 10.4 percent return for the year, the lowest among the total returns of multifamily index constituents.

Diana Rose Barrun is an associate in the real estate client operations department of S&P Global Market Intelligence.

—Posted on Feb. 21, 2020

You must be logged in to post a comment.