2020 REIT Trading Trends

As of Oct. 30, 2020, publicly listed U.S. equity REITs traded at a 19.3 percent median discount to estimated net asset value.

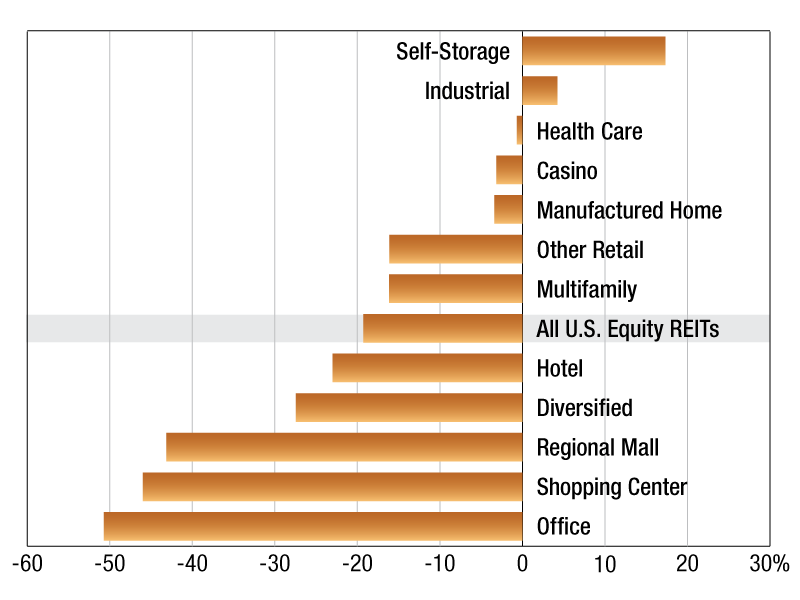

median U.S. equity REIT premium to NAV by sector

As of Oct. 30, 2020, publicly listed U.S. equity REITs traded at a median discount to consensus net asset value per share estimate of 19.3 percent. The self storage sector traded at the greatest median premium to NAV est, at 17.3 percent. The industrial REIT sector was next in line, trading at a median premium to NAV est of 4.3 percent. At the other end of the scale, the office REIT sector traded at a discount of 50.7 percent, currently the greatest median discount to NAV est. The shopping center REIT sector followed with 46.0 percent median discount to NAV est.

At the company level, diversified REIT Safehold Inc. traded at the largest premium to NAV est, at 154.7 percent. Right behind were Summit Hotel Properties Inc., and Ryman Hospitality Properties Inc., trading at premiums to NAV est of 128.6 percent and 101.4 percent, respectively. Washington Prime Group Inc. traded at the largest discount to NAV est of all U.S. REITs, at 168.1 percent. Pennsylvania Real Estate Investment Trust, a regional mall REIT, and hotel REIT Condor Hospitality Trust Inc., were also at the bottom of the list with large discounts to NAV est of 156.7 percent and 75.1 percent, respectively.

The U.S. multifamily REIT sector traded at a median discount to consensus net asset value of 16.2 percent as of Oct. 30, 2020.

Within the sector, NextPoint Residential Trust Inc. traded at a premium to NAV est of 10.2 percent. Trading at the greatest discount to NAV among multifamily REITs was BRT Apartments Corp. at 34.6 percent. Apartment Investment and Management Co. and Equity Residential followed, trading at 31.2 percent and 28.2 percent discounts to NAV est, respectively.

Diana Rose Barrun is an associate in the real estate client operations department of S&P Global Market Intelligence.

—Posted on Nov. 19, 2020

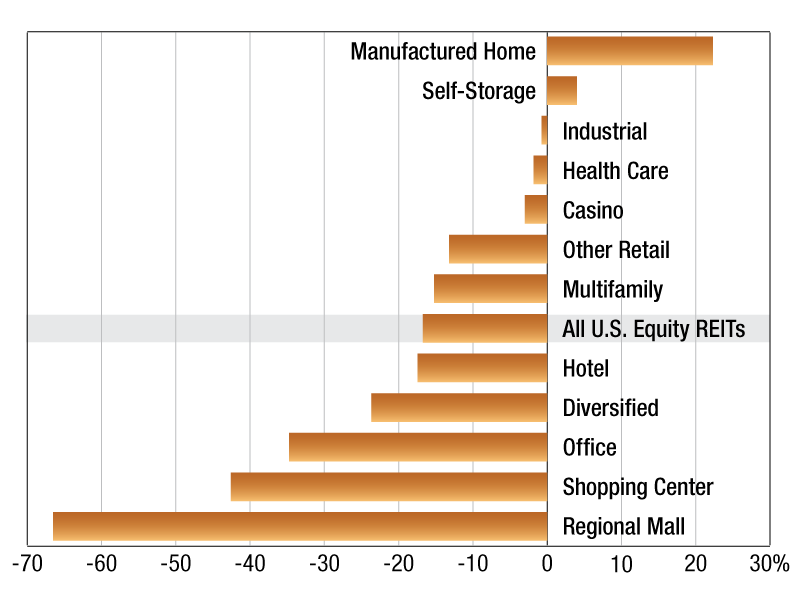

median U.S. equity REIT premium to NAV by sector

As of June 1, 2020, publicly listed U.S. equity REITs traded at a median discount to consensus net asset value of 16.7 percent. The manufactured home sector traded at the greatest median premium to NAV, at 22.3 percent. The self storage REIT sector was next in line, trading at a median premium to NAV of 4.0 percent. At the other end of the scale, the regional mall REIT sector traded at a discount of 66.5 percent, currently the greatest median discount to NAV. The shopping center REIT sector followed with 42.6 percent median discount to NAV.

At the company level, diversified REIT, Safehold Inc. traded at the largest premium to NAV, at 111 percent. Right behind were Community Healthcare Trust Inc. and Equinix Inc., trading at premiums of 61.3 percent and 43.4 percent, respectively. Pennsylvania Real Estate Investment Trust traded at the largest discount of all U.S. REITs, at 145.3 percent. Washington Prime Group Inc., a regional mall REIT, and hotel Ashford Hospitality Trust Inc., were also at the bottom of the list with large discounts of 121.1 percent and 86.0 percent, respectively.

The U.S. multifamily REIT sector traded at a median discount to consensus net asset value of 15.2 percent as of June 1, 2020. Within the sector, Investors Real Estate Trust traded at a premium to NAV of 1.3 percent. Trading at the greatest discount among multifamily REITs was Bluerock Residential Growth REIT Inc. at 36.2 percent. Independence Realty Trust Inc. and Apartment Investment and Management Company followed, trading at 21.0 percent and 20.6 percent discounts to NAV as of June 1, 2020.

Diana Rose Barrun is an associate in the real estate client operations department of S&P Global Market Intelligence.

—Posted on Jun. 24, 2020

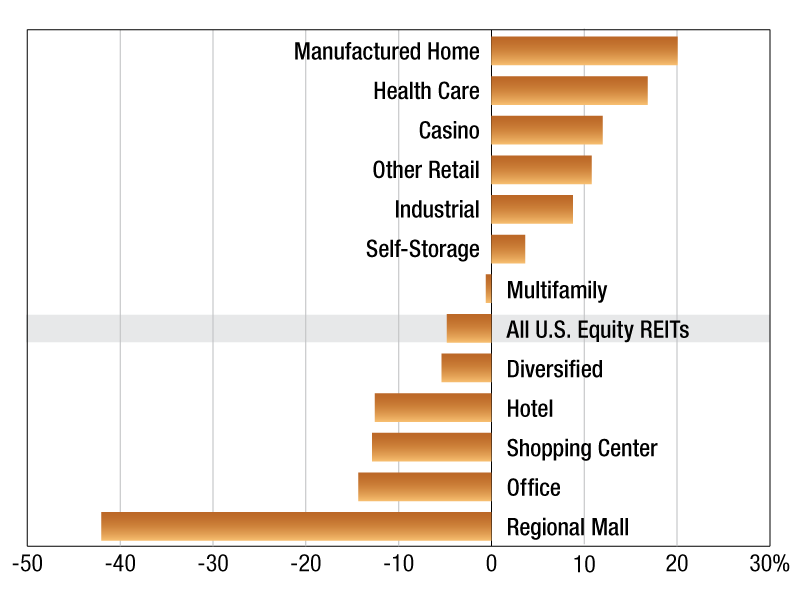

median U.S. equity REIT premium to NAV by sector

As of Jan. 2, 2020, publicly listed U.S. equity REITs traded at a median discount to consensus net asset value of 4.8 percent. The manufactured home sector traded at the greatest median premium to NAV, at 20.1 percent. The healthcare and casino REIT sectors were next in line trading at median premiums to NAV of 16.8 percent and 12.0 percent, respectively. At the other end of the scale, the regional mall REIT sector traded at a discount of 42.0 percent, currently the greatest median discount to NAV. The hotel REIT sector followed with 14.7 percent median discount to NAV. At the company level, Community Healthcare Trust Inc. traded at the largest premium to NAV, at 83.0 percent. Right behind were Omega Healthcare Investors Inc. and National Storage Affiliates Trust, trading at premiums of 51.0 percent and 37.7 percent, respectively. Xenia Hotels & Resorts Inc. and CBL & Associates Properties Inc. traded at the largest discount of all U.S. REITs, at 54.9 percent. Taubman Centers Inc. was also at the bottom of the list with large discount of 52.7 percent, respectively.

The U.S. multifamily REIT sector traded at a median premium to consensus net asset value of 4.0 percent. Within the sector, Mid-America Apartment Communities Inc. traded at a premium to NAV of 9.7 percent. NexPoint Residential Trust Inc. and UDR Inc. were next in line at 5.6 percent and 4.0 percent premiums, respectively. Trading at the greatest discount among multifamily REITs was Bluerock Residential Growth REIT Inc. at 18.9 percent. Preferred Apartment Communities Inc. and Investors Real Estate Trust followed, trading at 12.6 percent and 9.1 percent discounts to NAV.

Aftab Alam is a senior associate in the real estate client operations department of S&P Global Market Intelligence.

—Posted on Jan. 16, 2020

You must be logged in to post a comment.