2020 Special Servicing Rates

The Trepp CMBS Special Servicing rate saw a reduction of 12 basis points in November coming in at 10.2 percent, in comparison to 10.3 percent in October.

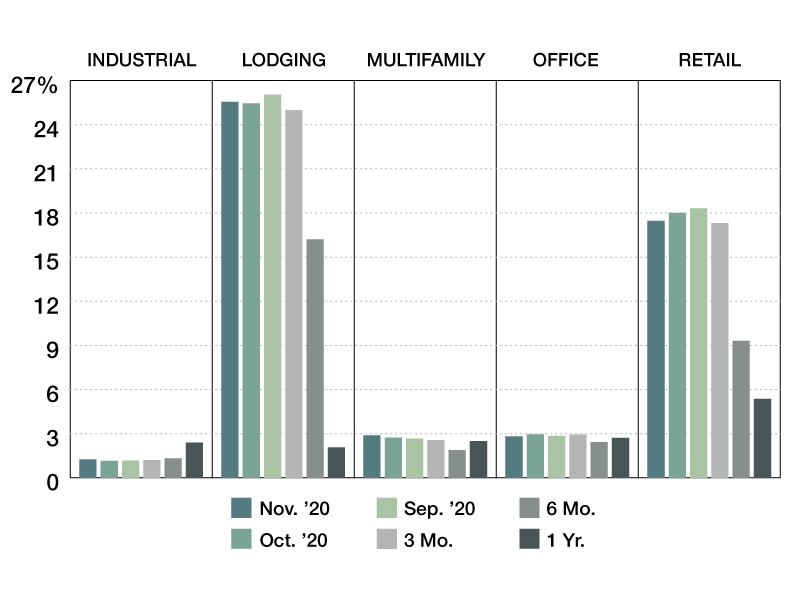

Following 2020 YTD peak in CMBS special servicing rate in September, the month of November was the second month that registered a modest decline. The Trepp CMBS Special Servicing rate saw a reduction of 12 basis points in November coming in at 10.2 percent, in comparison to 10.3 percent in October.

This change can be attributed in part to loans that have been granted forbearances and are now being transferred out of special servicing and returned to the master servicer.

Despite a reduction in overall CMBS special servicing rate, there was a modest uptick in lodging, industrial and multifamily special servicing rates.

Interestingly, after a slight reduction in lodging special servicing rates last month, the increasing trend has resumed with the number up again this month for the most COVID-impacted sector. Retail special servicing rate on the other hand continued its decreasing trend after hitting its YTD peak in September. It came in at 17.5 percent in November, a 53-basis points reduction from the last month.

The special servicing rate for CMBS 2.0+ notes saw a reduction of 11 basis points, clocking in at 9.3 percent in November. In terms of the outstanding balance of these loans that are currently in special servicing, the total reduced by roughly $563 million to $49.03 billion in November.

—Posted on Dec. 21, 2020

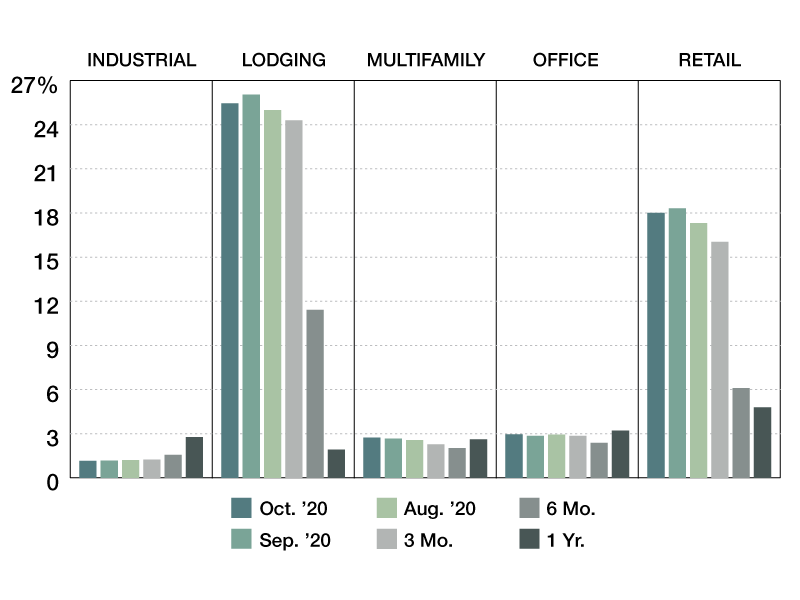

Following 2020 YTD peak in CMBS special servicing rate in September, the number has inched down in October. The Trepp CMBS Special Servicing rate saw a reduction of 20 basis points in October, coming in at 10.3 percent, in comparison to 10.5 percent in September. This change can be attributed in part to loans that have been granted forbearances and are now being transferred out of special servicing and returned to the master servicer.

In terms of the property types, the reduction is on account of a decrease in the lodging and retail special servicing rates. The lodging special servicing rate came in at 25.5 percent, down from 59 basis points from the number in September. The retail special servicing rate clocked in at 18.0 percent, seeing a downtick from 18.3 percent in September.

This is the first month in which CMBS delinquency rates (which saw a reduction of 64 basis points from the September number) and CMBS special servicing rate, both witnessed a decline.

—Posted on Nov. 19, 2020

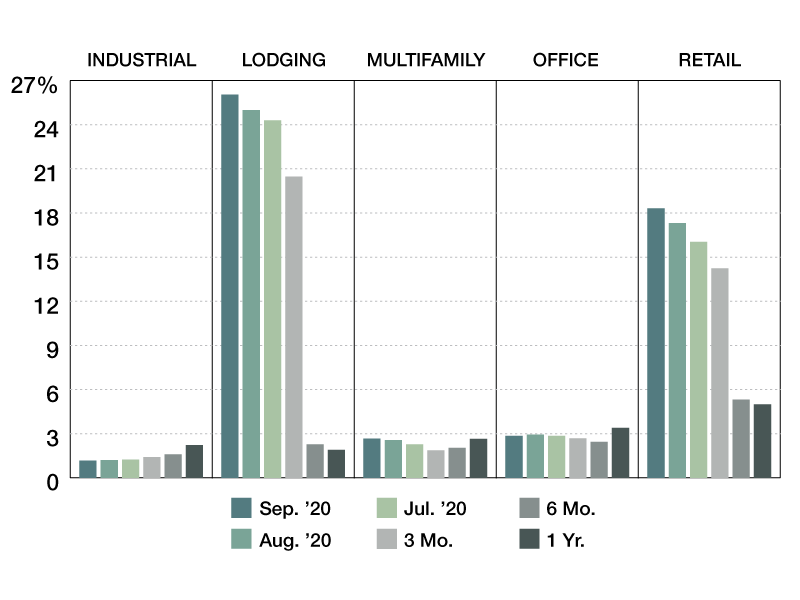

The Trepp Special Servicing rate saw an increase of 44 basis points in September, coming in at 10.5 percent, compared to 10.0 percent in August. Like the last few months, the surge could be attributed mainly to an increase in the retail and lodging special servicing rates. The retail special servicing rate clocked in at 18.3 percent in September, up from 17.3 percent in August.

The lodging special servicing rate came in at 26.0 percent, up from 25 percent in August. Both the lodging and retail CMBS special servicing rates were the highest reported on record. The overall CMBS special servicing rate is the highest rate recorded since May 2013. Going forward, it is likely that the special servicing rate will continue to increase in the coming months.

—Posted on Oct. 26, 2020

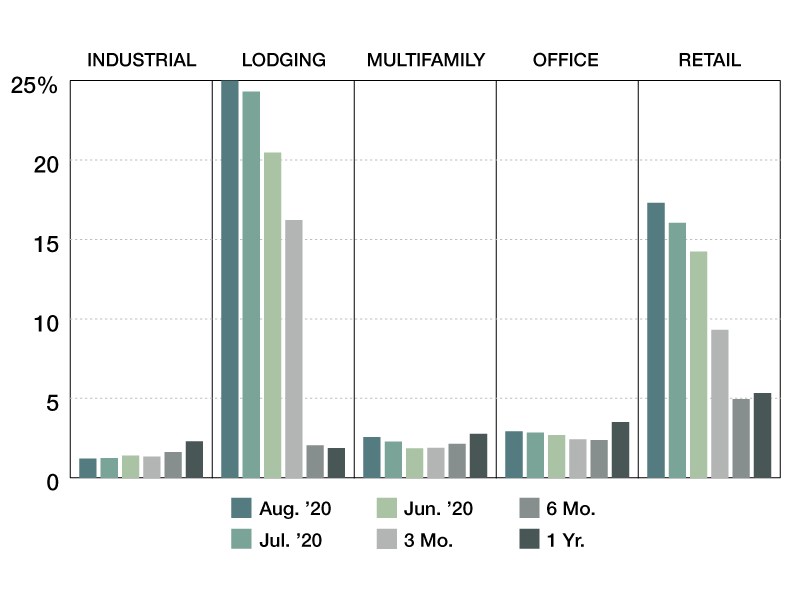

The Trepp Special Servicing rate saw an increase of 55 basis points in the month of August, coming in at 10.0 percent, in comparison to 9.5 percent in the month prior. This surge was mainly on account of increase in retail and lodging special servicing rates. The retail special servicing rate clocked in at 17.3 percent, up from 16.0 percent in July. The lodging special servicing rate, which saw the second highest increase amongst all property types, came in at 25.0 percent, up from 24.3 percent in the month prior.

In the month of August, Trepp data recorded another reduction in delinquency rate which was recorded at 9.0 percent. The delinquency rate saw a high of 10.3 percent in July this year. Since then, a number of loans that were marked delinquent have been cured (reverted to current status). Some of these cures came as a result of forbearances being granted and borrowers being authorized to use reserves to make the loan current. In other cases, relief was canceled or withdrawn by the borrowers and the loans were brought current without relief.

—Posted on Sep. 24, 2020

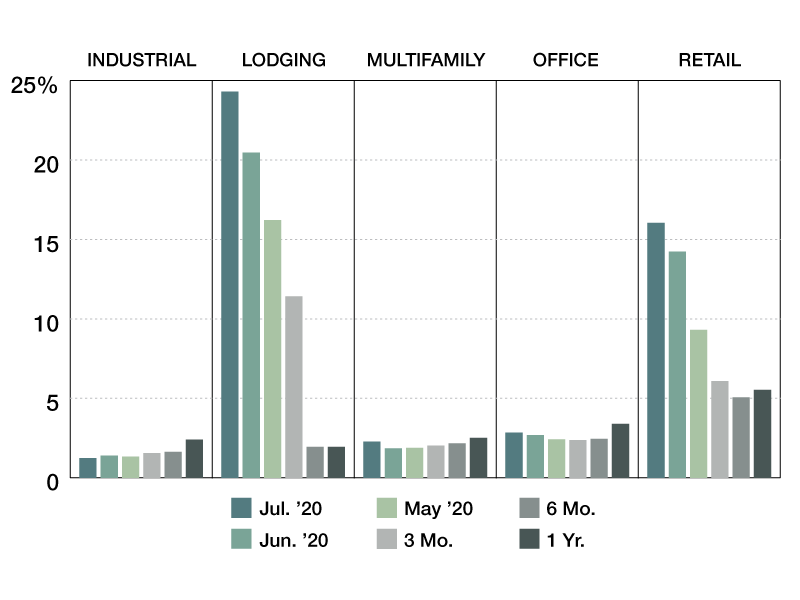

The Trepp Special Servicing rate saw an increase of 121 basis points in the month of July, coming in at 9.5 percent, in comparison to 8.3 percent in the month prior. Once again, this surge is primarily due to an increase in the lodging and retail special servicing rates due to the pandemic. The lodging special servicing rate clocked in at 24.3 percent, up from 20.5 percent in June. The retail special servicing rate came in at 16.0 percent, registering an increase of about five percentage points from 14.2 percent in the month prior.

Trepp data recorded a reduction in delinquency rate in the month of July. However, that did not turn out to be the case for special servicing rate as the metric continued a month-over-month increase. The special servicing rate for CMBS 2.0+ notes saw an increase of 125 basis points, clocking in at 8.5 percent. In terms of the outstanding balance of these loans that are currently in special servicing, the total increased by roughly $7.5 billion to $44.9 billion in July. In the legacy CMBS universe, the overall special servicing rates saw an increase of 70 basis points, coming in at 46.8 percent this month. Additionally, the total outstanding balance of these loans reduced to $6.2 billion last month from $6.3 billion in May.

—Posted on Aug. 20, 2020

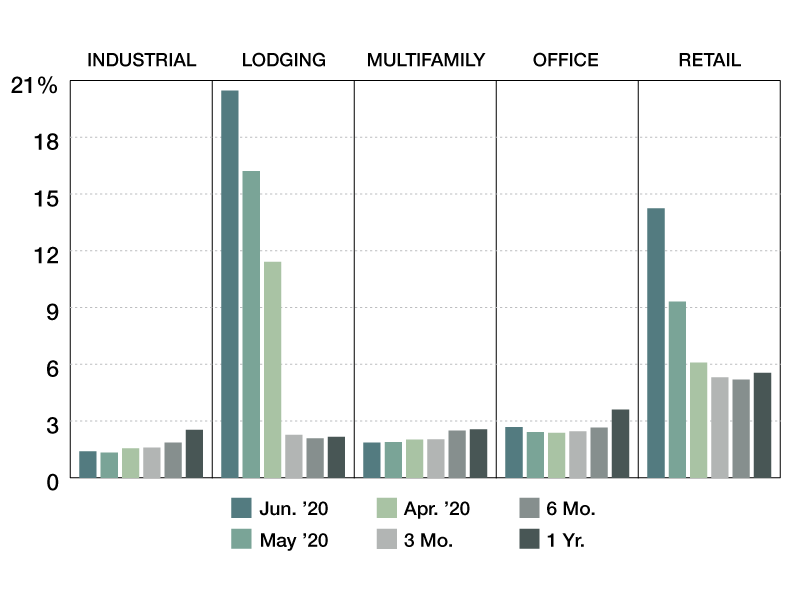

The Trepp Special Servicing rate saw an increase of 220 basis points in the month of June, coming in at 8.3 percent, in comparison to 6.1 percent in the month prior. As expected, this surge is primarily due to an increase in the retail and lodging special servicing rates due to the pandemic.

The lodging special servicing rate clocked in at 20.5 percent, up from 16.2 percent in May. The retail special servicing rate came in at 14.2 percent registering an increase of about five percentage points from 9.3 percent in the month prior.

The special servicing rate for CMBS 2.0+ notes saw an increase of 222 basis points, clocking in at 7.3 percent. In terms of the outstanding balance of these loans that are currently in special servicing, the total increased by roughly $11.4 billion to $37.4 billion in June.

—Posted on Jul. 22, 2020

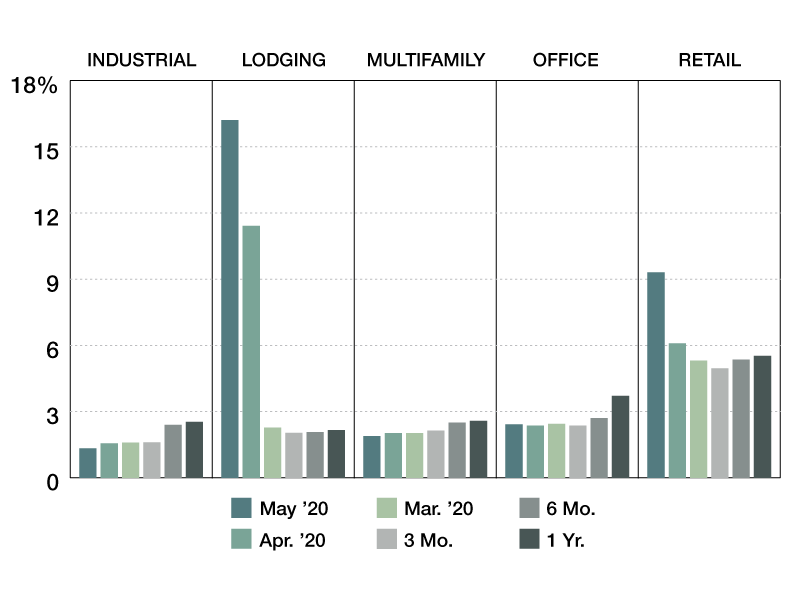

The Trepp Special Servicing rate saw an increase of 168 basis points in the month of May, coming in at 6.1 percent, in comparison to 4.4 percent in April. As expected, this surge is primarily due to an increase in the lodging and retail special servicing rates due to the pandemic. Lodging and retail logged an increase of 479 and 322 basis points, respectively.

The special servicing rate for CMBS 2.0+ notes saw an increase of 181 basis points, clocking in at 5.1 percent. In terms of the outstanding balance of these loans that are currently in special servicing, the total increased by roughly $10.0 billion to $26.0 billion in May. In the legacy CMBS universe, the overall special servicing rates saw a reduction of 43 basis points, coming in at 42.9 percent in May. Additionally, the total outstanding balance of these loans declined to $6.02 billion in May from $6.20 billion in April.

—Posted on Jun. 24, 2020

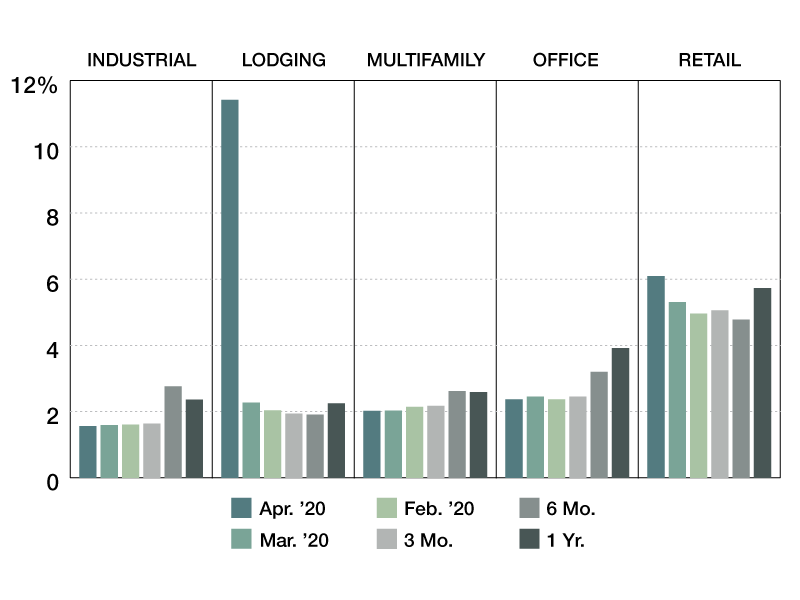

The Trepp Special Servicing rate saw a surge of 156 basis points last month, coming in at 4.4 percent, in comparison to 2.8 percent in March. This increase is mainly on account of a large number of lodging loans sent to special servicing due to the pandemic. The lodging special servicing rate came in at 11.4 percent in April, up from 2.3 percent in March.

The special servicing rate for CMBS 2.0+ notes saw an increase of 164 basis points, clocking in at 3.3 percent. In terms of the outstanding balance of these loans, the total increased by a massive $8.3 million to $16.1 billion in April. In the legacy CMBS universe, the overall special servicing rates saw a modest increase of four basis points, coming in at 43.3 percent this month. Additionally, the total outstanding balance of these loans declined to $6.20 billion last month from $6.27 billion in March.

—Posted on May 22, 2020

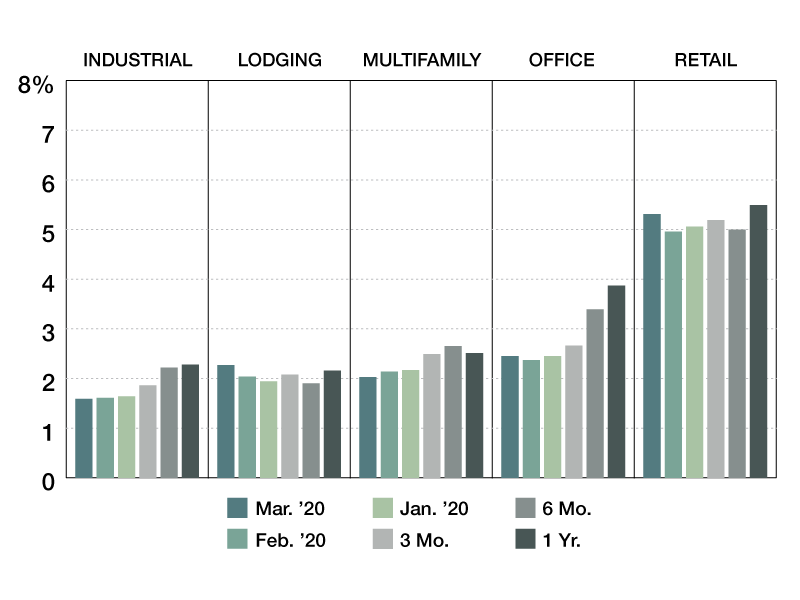

The Trepp Special Servicing rate came in at 2.8 percent in March, an increase of nine basis points from the previous month. The uptick can be mainly attributed to a 35 and 23 basis points spike in the retail and lodging special servicing rates respectively.

It is essential to understand that the increase in this month’s special servicing rate does not reflect the full impact of pandemic-related market disruption and is from when the industry did not have enough clarity on the magnitude of the outbreak.

The special servicing rate for CMBS 2.0+ notes saw an increase of 13 basis points, clocking in at 1.6 percent. In terms of the outstanding balance of these loans, the total increased by $795.70 million to $7.84 billion in March. In the legacy CMBS universe, the overall special servicing rates saw a modest increase of one basis point, coming in at 43.3 percent this month. Additionally, the total outstanding balance of these loans declined to $6.27 billion last month from $6.36 billion in February.

The number of loans newly transferred to special servicing also increased this month, with a total of 29 loans sent to special servicing in comparison to 15 the month before. Together, these loans hold an outstanding balance of $945.75 million. Most of the new specially serviced loans are in the retail sector accounting for over half of the total specially serviced balance this month.

—Posted on Apr. 24, 2020

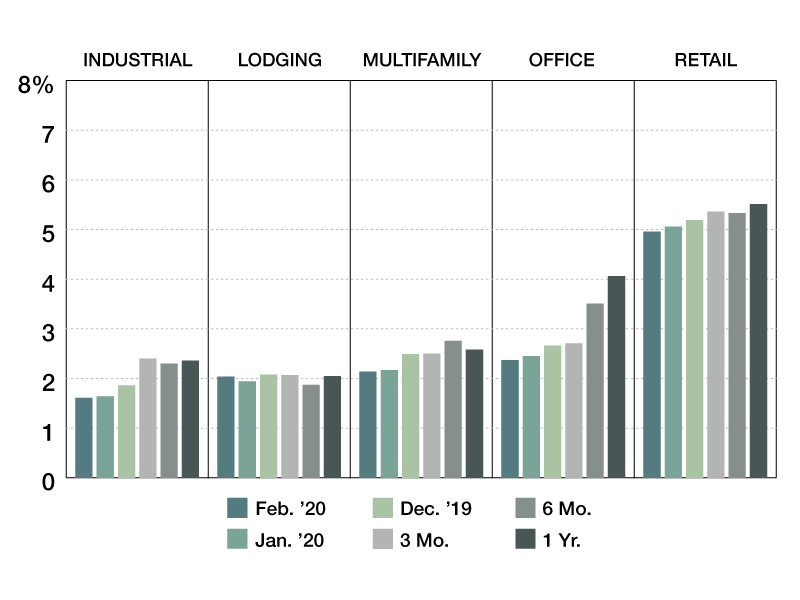

The Trepp Special Servicing rate came in at 2.7 percent in February, a decline of four basis points from the previous month. All property types excluding the lodging sector saw a decline in their special servicing rates. The special servicing rate for CMBS 2.0+ notes saw a modest increase of three basis points. This was mainly on account of a 10 and seven basis points spike in the lodging and retail special servicing rates respectively.

In the legacy CMBS universe, the overall special servicing rates witnessed a drop of 74 basis points, coming in at 43.3 percent this month. The number of loans newly transferred to special servicing saw a decline this month, with a total of 15 loans sent to special servicing in comparison to 25 the month before. Together, these loans hold an outstanding balance of $304.5 million. The majority of the new specially serviced loans are in the retail and lodging sector, accounting for 78.2 percent of the total outstanding balance.

—Posted on Mar. 26, 2020

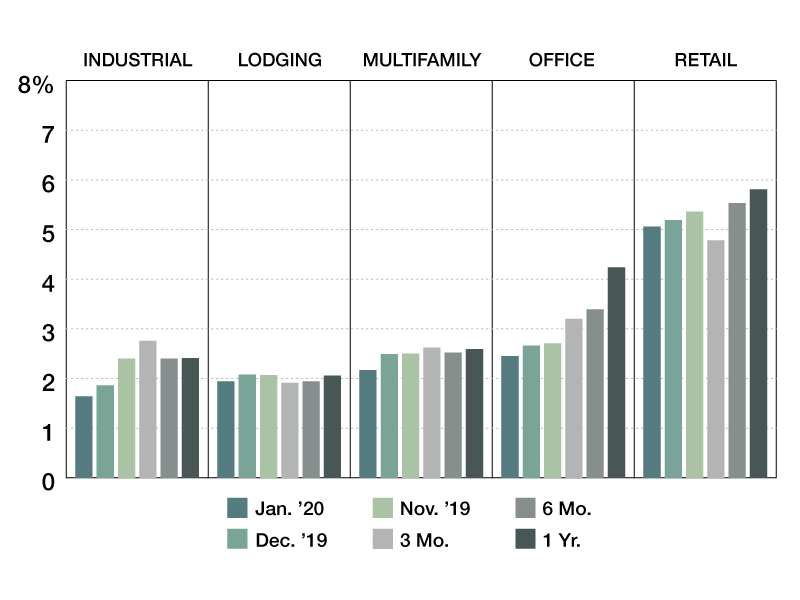

The Trepp Special Servicing rate came in at 2.8 percent in January, a decline of 14 basis points from the previous month. All property types saw a decline in their special servicing rates, with the multifamily sector seeing the largest drop of 32 basis points.

The special servicing rate for CMBS 2.0+ notes saw an increase of five basis points. This was mainly on account of a 31 basis points spike in the retail special servicing rates. In the legacy CMBS universe, the overall special servicing rates witnessed a drastic drop of 349 basis points, coming in at 44.0 percent this month. This was due to significant declines in multifamily, retail and lodging rates.

The number of loans newly transferred to special servicing rose this month, with a total of 25 loans sent to special servicing in comparison to 14 the month before. Together, these loans hold an outstanding balance of $475.1 million. The majority of the new specially serviced loans are in the retail sector, accounting for 65.4 percent of the total outstanding balance respectively.

—Posted on Feb. 21, 2020

You must be logged in to post a comment.