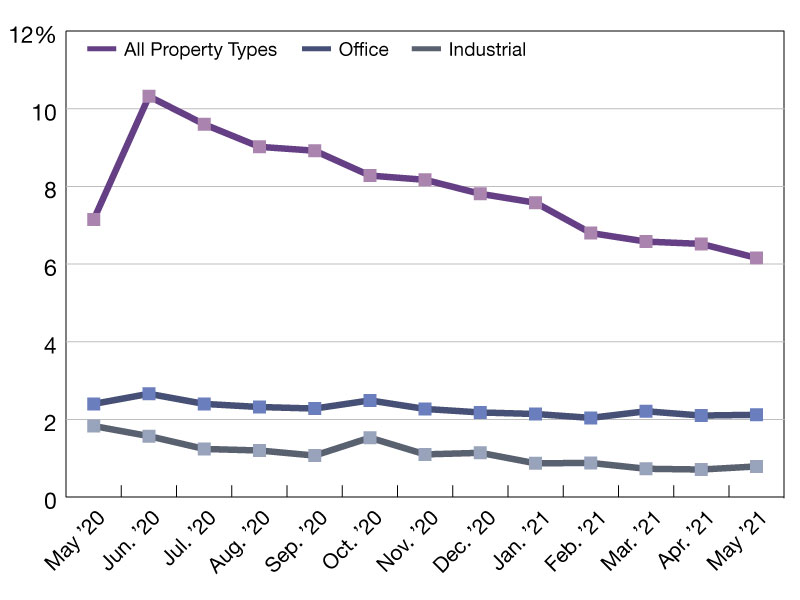

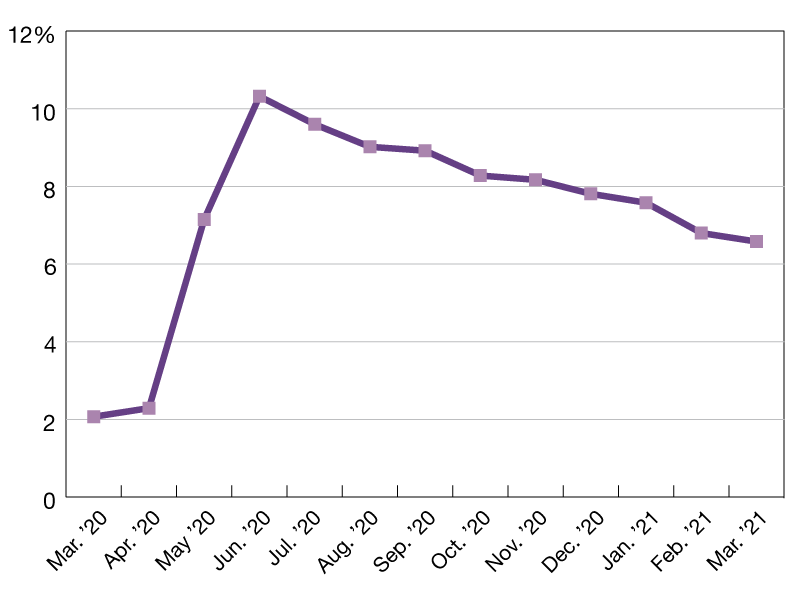

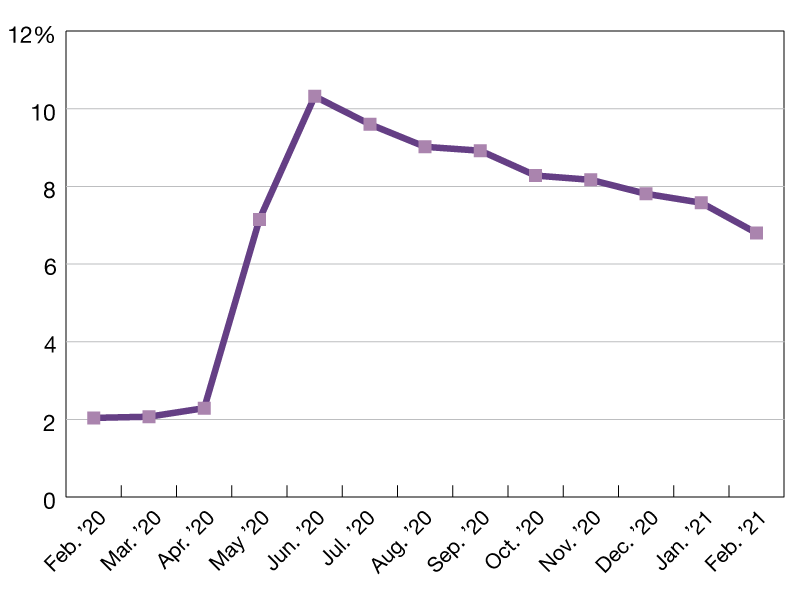

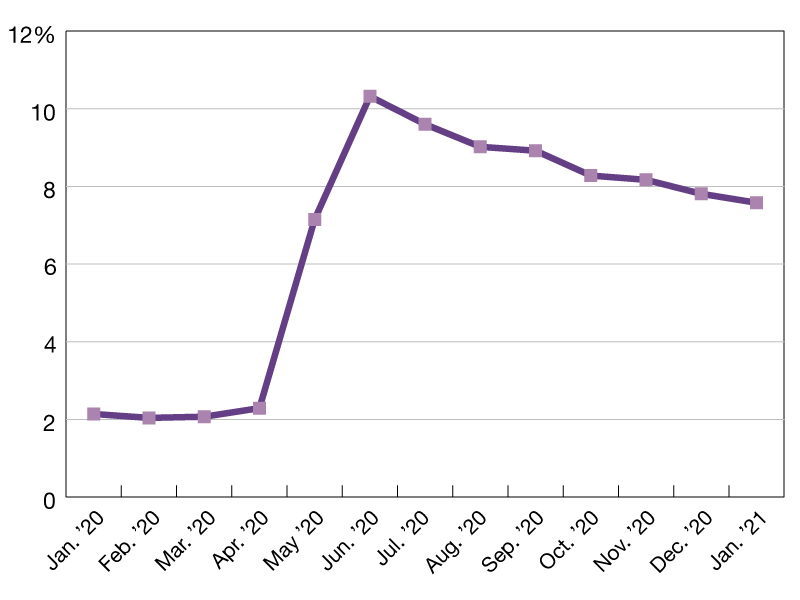

2021 CMBS Delinquency Rate

For the first time since mid-2020, the rate took a new direction in December.

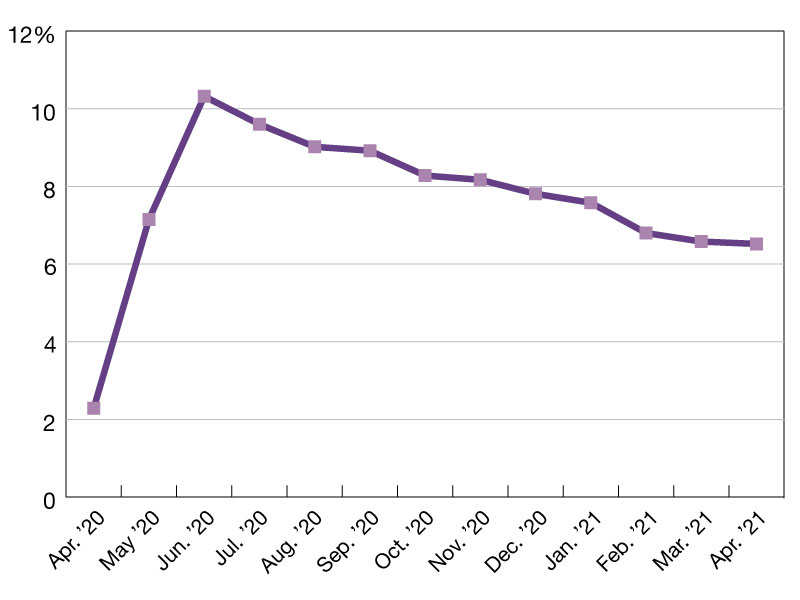

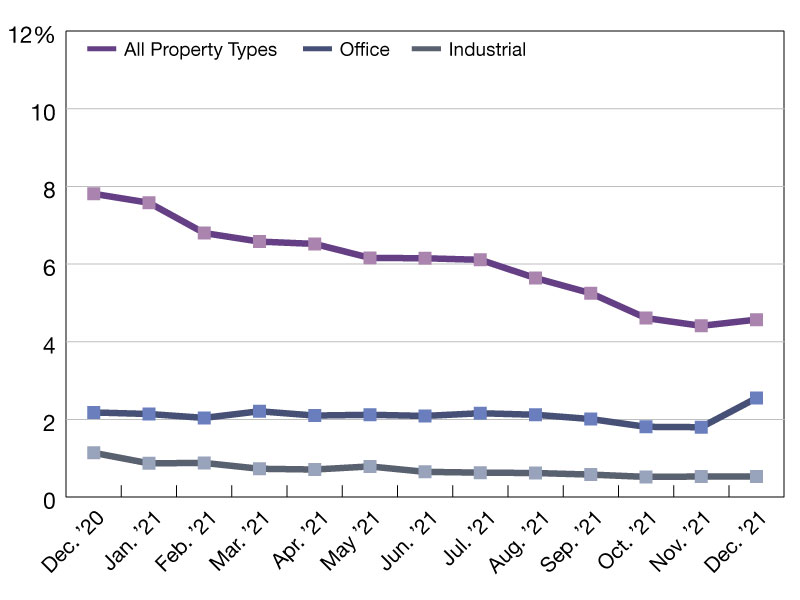

The Trepp CMBS delinquency rate increased for the first time in 18 months in December 2021. After two huge increases in May and June 2020, the rate fell for 17 consecutive months. That stretch ended at the end of the year as several large office delinquencies contributed to the increase.

The CMBS delinquency rate in December was 4.6 percent, an increase of 19 basis points from the November number. The percentage of loans in the 30 days delinquent bucket is 0.5 percent, up 24 basis points for the month. Several big office loans became 30 days delinquent in December, including 245 Park Ave. in Manhattan and 181 W. Madison St. in Chicago. Both loans, which total more than $1.2 billion, became delinquent after PWM Property Management, an arm of Chinese Conglomerate HNA Group, filed for bankruptcy. HNA is the borrower under both loans. Two other loans that we flagged as being 30 days behind on payment in December were the 175 W. Jackson and 135 S. LaSalle loans, also backed by offices in Chicago.

In terms of loans in grace period, 2.1 percent of loans by balance missed the December payment but were less than 30 days delinquent. That was up eight basis points for the month. The percentageof loans withthe special servicer fell to 6.8 percent in December from 6.9 percent in November. The story wasn’t positive for office loans as the percentage of those loans with the special servicer moved up to 3.2 percent in December from 3.0 percent in November. The percentage of loans on servicer watchlist dropped to 26.5 percent in December from 27.5 percent in November.

The industrial delinquency rate fell one basis point to 0.5 percent, while office jumped 72 basis points to 2.5 percent.

—Posted on Jan. 26, 2022

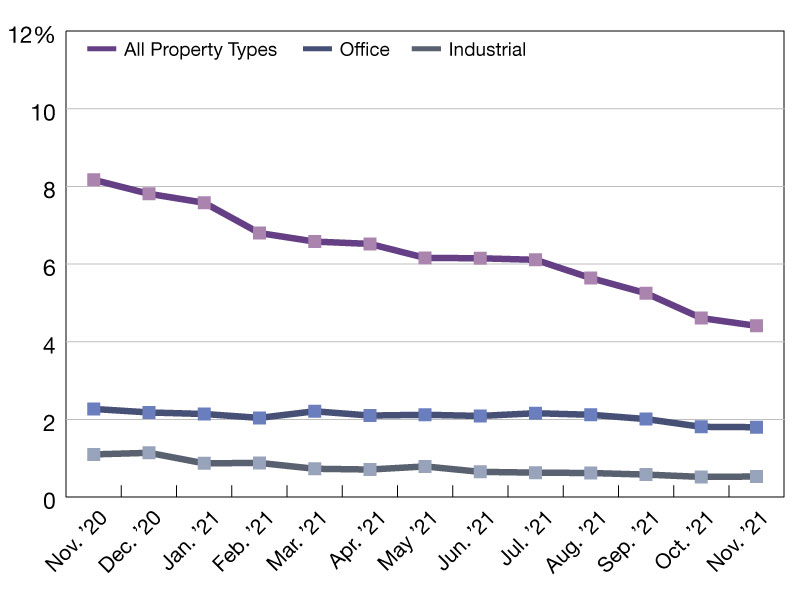

The Trepp CMBS delinquency rate dropped again in November, although the rate of decline slowed. After two huge increases in May and June 2020, the rate has now fallen for 17 consecutive months. The CMBS delinquency rate in November was 4.4 percent, a drop of 23 basis points from the October number. The percentage of loans in the 30 days delinquent bucket is 0.30 percent, up two basis points for the month. In terms of loans in grace period, 2.1 percent of loans by balance missed the November payment but were less than 30 days delinquent. That was up 25 basis points for the month.

The percentage of loans with the special servicer fell to 7.0 percent in November from 7.2 percent in October. The percentage of loans on servicer watchlist dropped to 27.5 percent in November from 28.2 percent in October. Our numbers above reflect percentages that assume defeased loans are still part of the denominator. The all-time high on this basis was 10.3 percent registered in July 2012. The COVID-19 high was 10.3 percent in June 2020. The percentage of A/B was 2.1 percent in November. Year-over-year, the overall US CMBS delinquency rate is down 379 basis points. Year-to-date, the rate is down 343 basis points. The percentage of loans that are seriously delinquent (60+ days delinquent, in foreclosure, REO, or nonperforming balloons) is now 4.1 percent, down 25 basis points for the month. If defeased loans were taken out of the equation, the overall 30-day delinquency rate would be 4.6 percent, down 23 basis points from October. One year ago, the US CMBS delinquency rate was 8.2 percent. Six months ago, the US CMBS delinquency rate was 6.2 percent. For CMBS 1.0 and 2.0+, the industrial delinquency rate was unchanged at 0.5 percent, while the office delinquency rate inched up one basis point to 1.8 percent.

—Posted on Dec. 21, 2021

The Trepp CMBS delinquency rate declined sharply again in October, marking the largest decline since February 2021. The rate was 4.6 percent, a drop of 64 basis points from the September number. The percentage of loans in the 30 days delinquent bucket is 0.2 percent, down one basis point for the month. After two huge increases in May and June 2020, the rate has now fallen for 16 consecutive months.

In terms of loans in grace period, 1.8 percent of loans by balance missed the October payment but were less than 30 days delinquent. That was down 36 basis points for the month. The percentage of loans with the special servicer fell to 7.2 percent in October from 7.5 percent in September. The percentage of loans on servicer watchlist dropped to 28.2 percent from 29.3 percent.

Year to date, the rate is down 320 basis points. The percentage of loans that are seriously delinquent (60+ days delinquent, in foreclosure, REO, or nonperforming balloons) is now 4.4 percent, down 63 basis points for the month. If defeased loans were taken out of the equation, the overall 30-day delinquency rate would be 4.9 percent down 64 basis points from September.

One year ago, the US CMBS delinquency rate was 8.3 percent. Six months ago, the US CMBS delinquency rate was 6.5 percent.The CMBS 2.0+ delinquency rate fell 66 basis points to 4.8 percent in October. The rate is down 331 basis points year-over-year. The percentage of CMBS 2.0+ loans that are seriously delinquent is now 3.9 percent, down 65 basis points for the month. If defeased loans were taken out of the equation, the overall CMBS 2.0+ delinquency rate would be 4.3 percent, down 66 basis points for the month.

For property types CMBS 1.0 and 2.0+, the industrial delinquency rate fell six basis points to 0.5 percent, while the office delinquency rate dipped 22 basis points to 1.8 percent.

For CMBS 2.0+, the industrial rate went down seven basis points month-over-month to 0.2 percent, while office went down 17 basis points to 1.3 percent.

—Posted on Nov. 19, 2021

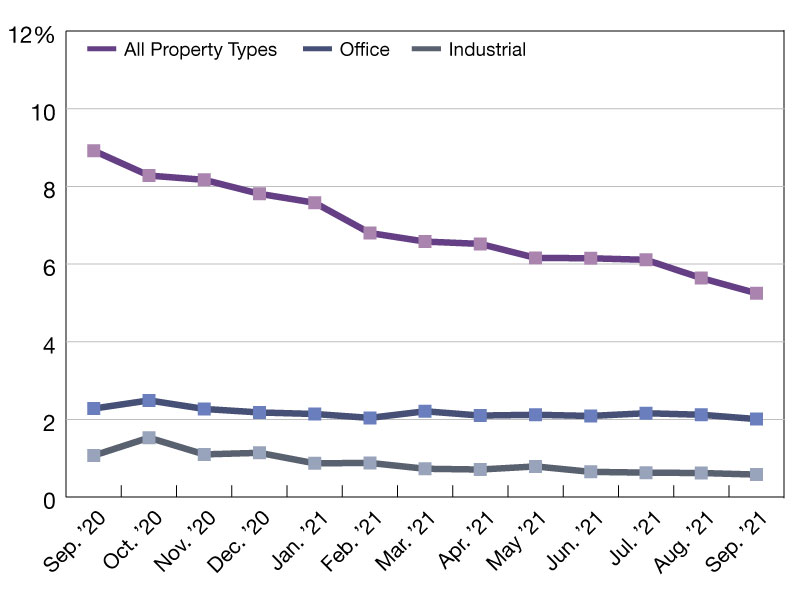

The Trepp CMBS delinquency rate declined sharply in September with the latest number being a little over half the level seen at the peak of the COVID-19 pandemic. After two huge jumps in May and June 2020, the rate has now fallen for 15 consecutive months.

The September number represented another sizable decline, with the rate falling almost 1 percent over the last two months. The delinquency rate in September was 5.3 percent, a drop of 39 basis points from the August number. The percentage of loans in the 30 days delinquent bucket is 0.2 percent, down 17 basis points for the month. In terms of loans in grace period, 2.2 percent of loans by balance missed the September payment but were less than 30 days delinquent. That was down 26 basis points for the month.

The percentage of loans with the special servicer fell to 7.5 percent in September from 7.8 percent in August. The percentage of loans on servicer watchlist climbed to 29.3 percent in September from 29.0 percent the month prior. Our numbers above reflect percentages that assume defeased loans are still part of the denominator.

The percentage of A/B loans (i.e. loans in grace period or beyond grace period) was 2.2 percent in September. Year-over-year, the overall US CMBS delinquency rate is down 367 basis points.

Year to date, the rate is down 256 basis points. The percentage of loans that are seriously delinquent (60+ days delinquent, in foreclosure, REO, or nonperforming balloons) is now 5.0 percent, down 22 basis points for the month. If defeased loans were taken out of the equation, the overall 30-day delinquency rate would be 5.5 percent down 42 basis points from August. One year ago, the US CMBS delinquency rate was 8.9 percent. Six months ago, the US CMBS delinquency rate was 6.6 percent.

The CMBS 2.0+ delinquency rate fell 33 basis points to 4.8 percent in September. The rate is down 330 basis points year-over-year. The percentage of CMBS 2.0+ loans that are seriously delinquent is now 4.5 percent, down 16 basis points for the month. If defeased loans were taken out of the equation, the overall CMBS 2.0+ delinquency rate would be 5.0 percent, down 37 basis points for the month.

For property types CMBS 1.0 and 2.0+, the industrial delinquency rate fell four basis points to 0.6 percent, while the office delinquency rate dipped 10 basis points to 2.0 percent. For CMBS 2.0+, the industrial rate went up three basis points month-over-month to 0.2 percent, while office went up six basis points to 1.4 percent.

—Posted on Oct. 26, 2021

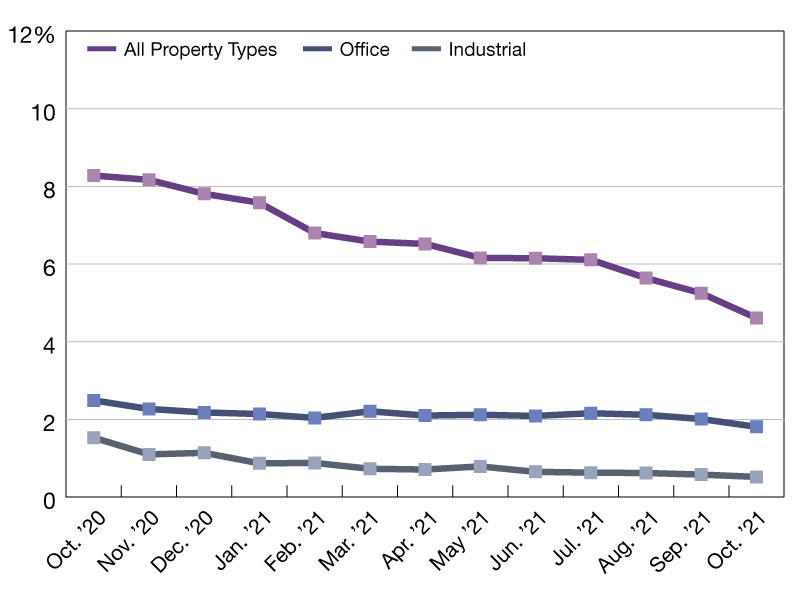

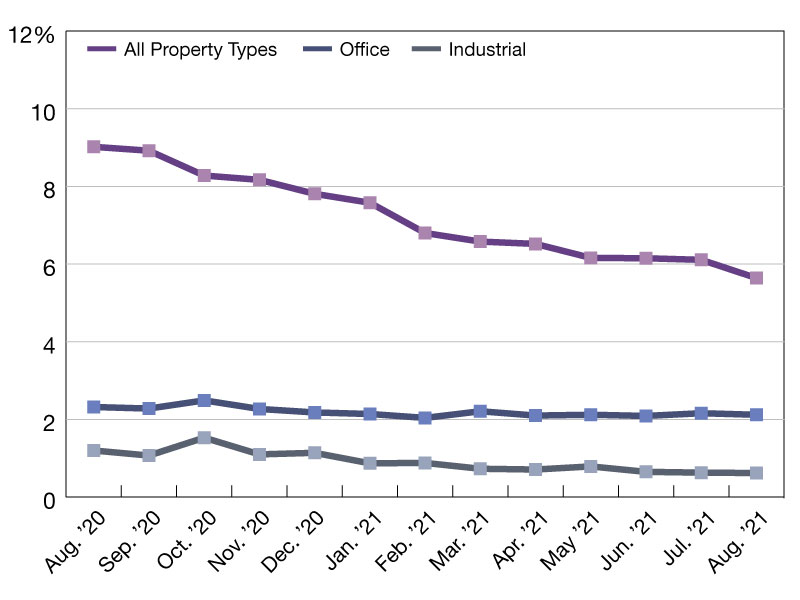

The Trepp CMBS delinquency rate declined sharply in August, posting the largest drop in six months. The August number represented a sizable decline after several months of mostly modest improvements. After two huge jumps in May and June 2020, the rate has now fallen for 14 consecutive months.

The delinquency rate in August was 5.6 percent, a drop of 47 basis points from the July number. The percentage of loans in the 30 days delinquent bucket is 0.4 percent–down 10 basis points for the month. In terms of loans in grace period, 2.4 percent of loans by balance missed their August payment but were less than 30 days delinquent.

That was down 51 basis points for the month. The percentage of loans with the special servicer fell to 7.8 percent in August from 8.1 percent in July. The percentage of loans on servicer watchlist climbed to 29 percent in August from 27.6 percent in July.

The percentage of A/B loans was 2.4 percent in August. Year-over-year, the overall US CMBS delinquency rate is down 338 basis points. Year-to-date, the rate is down 217 basis points. The percentage of loans that are seriously delinquent is now 5.2 percent, down 37 basis points for the month. One year ago, the US CMBS delinquency rate was 9 percent, while six months ago the rate was 6.8 percent.

The CMBS 2.0+ delinquency rate fell 39 basis points to 5.1 percent in August. The rate is down 310 basis points year-over-year. The percentage of CMBS 2.0+ loans that are seriously delinquent is now 4.7 percent, down 28 basis points for the month.

For property types CMBS 1.0 and 2.0+, the industrial delinquency rate was unchanged at 0.6 percent. The office delinquency rate fell four basis points to 2.1 percent. For property tpes CMBS 2.0+, the industrial rate went up 3 basis points month-over-month to 0.2 percent, while office went up 3 basis points to 1.4 percent.

—Posted on Sep. 28, 2021

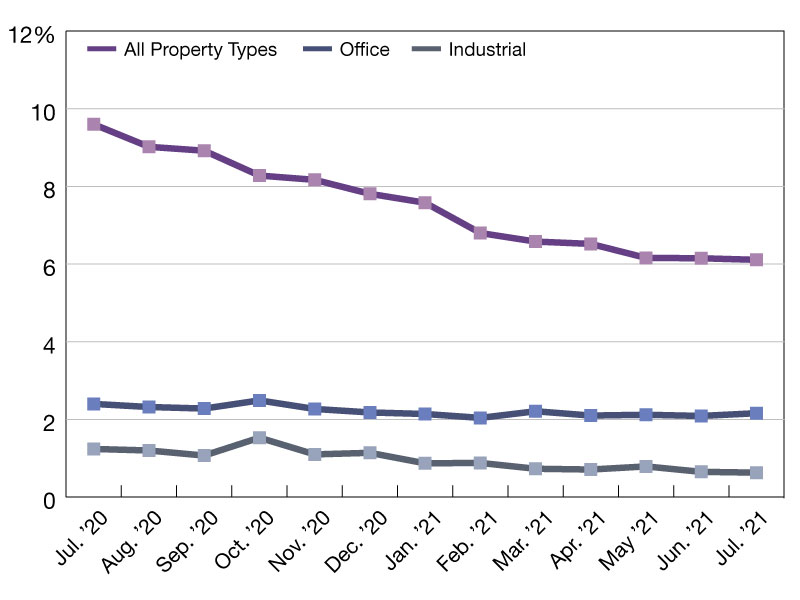

The Trepp CMBS delinquency rate fell again in July, but the rate of decline has leveled off considerably from the improvements the market was seeing six months ago. The CMBS delinquency rate in July was 6.1 percent, a drop of four basis points from the June number. After two huge jumps in May and June 2020, the rate has now fallen for 13 consecutive months.

For those looking for a recap, the surge in CMBS delinquencies that most industry watchers were anticipating at the start of the coronavirus pandemic came through in May 2020 and then again in June 2020. After the surge, the rate hit “terminal delinquency velocity” meaning most of the borrowers that felt the need for debt service relief had already requested it. Since then, the CMBS delinquency rate has been on a downward trend, with the largest drop in the rate seen in February 2021. The percentage of loans in the 30 days delinquent bucket is 0.5 percent, up eight basis points for the month. In terms of loans in grace period, 2.9 percent of loans by balance missed the July payment but were less than 30 days delinquent. That was up 91 basis points for the month.

The percentage of A/B loans was 2.9 percent in July. Year over year, the overall US CMBS delinquency rate is down 349 basis points. Year to date, the rate is down 170 basis points. The percentage of loans that are seriously delinquent (60+ days delinquent, in foreclosure, REO, or non-performing balloons) is now 5.6 percent, down 12 basis points for the month. If defeased loans were taken out of the equation, the overall 30-day delinquency rate would be 6.4 percent, down five basis points from June. One year ago, the U.S. CMBS delinquency rate was 9.6 percent. Six months ago, the U.S. CMBS delinquency rate was 7.6 percent.

The CMBS 2.0+ delinquency rate fell five basis points to 5.5 percent in July. The rate is down 317 basis points yearover-year. The percentage of CMBS 2.0+ loans that are seriously delinquent is now 4.9 percent, down 13 basis points for the month. If defeased loans were taken out of the equation, the overall CMBS 2.0+ delinquency rate would be 5.6 percent, down five basis points for the month.

For property types CMBS 1.0 and 2.0+, the industrial delinquency rate fell two basis points to 0.6 percent, while the office delinquency rate moved up seven basis points to 2.2 percent. For property types CMBS 2.0+, the industrial delinquency rate went down one basis point month-over-month to 0.2 percent, while office increased 10 basis points to 1.4 percent.

—Posted on Aug. 27, 2021

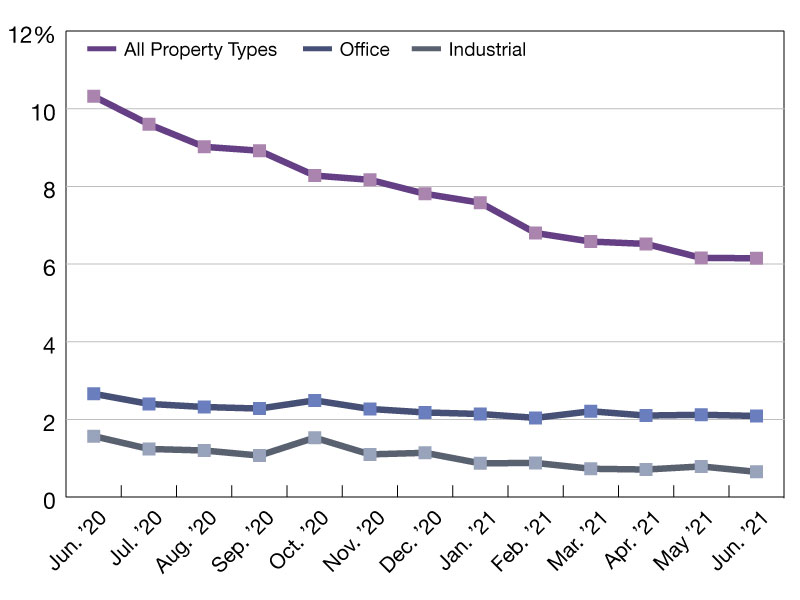

With the improvement in broader US economic indicators slowing down in the second quarter of the year, the same trend was observed in the commercial real estate segment.

The Trepp CMBS delinquency rate continued to decline in June 2021, but this drop came by the narrowest of margins. The CMBS delinquency rate in June is 6.2 percent, a drop of only one basis point from the May number. The rate has now declined for 12 consecutive months.

For those looking for a recap, the surge in CMBS delinquencies that most industry watchers were anticipating at the start of the coronavirus pandemic came through in May 2020 and then again in June 2020. After the surge, the rate hit terminal delinquency velocity meaning most of the borrowers that felt the need for debt service relief had already requested it. (Put another way, if a borrower did not need relief in April, May, or June of 2020, in most cases the borrower did not end up needing it at all.) Since then, the CMBS delinquency rate has been on a downward trend, with the largest drop in the rate seen in February 2021.

The percentage of loans in the 30 days delinquent bucket is 0.4 percent–up five basis points for the month. In terms of loans in grace period, 2.0 percent of loans by balance missed the June payment but were less than 30 days delinquent. That was down 75 basis points for the month.

The percentage of loans with the special servicer fell to 8.2 percent in June from 8.7 percent in May. The percentage of loans on servicer watchlist in climbed to 27.5 percent in June from 26.6 percent the month prior. The industrial delinquency rate fell 14 basis points to 0.6 percent and the office delinquency rate dipped three basis points to 2.1 percent.

—Posted on Jul. 23, 2021

The Trepp CMBS delinquency rate continued to decline in May with the rate posting its biggest drop in three months. After two huge jumps in May and June 2020, the rate has now declined for 11 consecutive months. The CMBS delinquency rate in May was 6.2 percent, a drop of 36 basis points from the April number. The percentage of loans in the 30 days delinquent bucket is 0.38 percent, down 31 basis points for the month.

In terms of loans in grace period, 2.8 percent of loans by balance missed the May payment but were less than 30 days delinquent. That was up 52 basis points for the month. The percentage of loans with the special servicer fell to 8.7 percent in May from 9.0 percent in April. The percentage of loans on servicer watchlist climbed to 26.6% in May from 25.7% in April.

The overall US CMBS delinquency rate dropped 36 basis points in May to 6.2 percent. (The all-time high on this basis was 10.3 percent registered in July 2012). The percentage of A/B loans (i.e. loans in grace period or beyond grace period) was 2.8 percent in May. Year over year, the overall US CMBS delinquency rate is down 99 basis points.

Year-to-date, the rate is down 165 basis points. The percentage of loans that are seriously delinquent (60+ days delinquent, in foreclosure, REO, or non-performing balloons) is now 5.8 percent, down eight basis points for the month. If defeased loans were taken out of the equation, the overall 30-day delinquency rate would be 6.5 percent, down 38 basis points from April. One year ago, the US CMBS delinquency rate was 7.2 percent. Six months ago, the US CMBS delinquency rate was 8.2 percent.

The industrial delinquency rate moved up eight basis points to 0.8 percent, while office increased two basis points to 2.1 percent.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on Jun. 29, 2021

The Trepp CMBS delinquency rate continued its downward trend in April with recent economic data pointing to robust growth across a wide range of sectors, although the rate of improvement has slowed compared to earlier this year.

Back in February, the reading fell an impressive 78 basis points over the January number, its largest decrease since the beginning of the pandemic. After two huge jumps in May and June, the rate has now declined for 10 consecutive months.

The Trepp CMBS Delinquency Rate in April was 6.5 percent, a drop of six basis points from the March number. The percentage of loans in the 30 days delinquent bucket is 0.7 percent, down four basis points for the month.

In terms of loans in grace period, 2.3 percent of loans by balance missed the April payment but were less than 30 days delinquent. That was up 33 basis points for the month.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on May 25, 2021

The Trepp CMBS delinquency rate continued to decline in March following an impressive decline in February. After two huge jumps in May and June 2020, the rate has now declined for nine consecutive months. The Trepp CMBS Delinquency Rate in March was 6.6 percent, a drop of 22 basis points from the February number. (In February, the rate saw the biggest drop since the start of the COVID-19 pandemic.)

As for March, the percentage of loans in the 30 days delinquent bucket is 0.7 percent, up 12 basis points for the month. In terms of loans in grace period, 1.9 percent of loans by balance missed the March payment but were less than 30 days delinquent. That was down 38 basis points for the month and could be a sign that even more delinquency rate improvements are on the way.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on Apr. 26, 2021

In February, the Trepp CMBS Delinquency Rate generated its largest improvement since the beginning of the pandemic. After two huge jumps in the reading in May and June of last year, the rate has now declined for eight consecutive months. The Trepp CMBS Delinquency Rate in February was 6.8 percent, a decline of 78 basis points from the January number, which is the biggest drop over the last eight months.

The percentage of loans in the 30 days delinquent bucket is 0.6 percent – down 16 basis points for the month. In terms of loans in grace period, 2.3 percent of loans by balance missed the February payment but were less than 30 days delinquent. That was down 77 basis points for the month. Some other overall statistics: The percentage of loans with the special servicer dipped to 9.6 percent in February from 9.7 percent in January.

According to February servicer data, 24.2 percent of all lodging loans were in special servicing, down from 24.5 percent in January. In addition, 16.7 percent of retail loans are with the special servicer, down from 17.1 percent last month. The percentage of loans on servicer watchlist climbed to 23.4 percent in January from 22.3 percent last month.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on Mar. 23, 2021

The Trepp CMBS delinquency rate continued to retreat during the first month of the new year, though there are indications that the improvement could be showing signs of a reversal. After two huge jumps in May and June, the rate has now declined for seven consecutive months. The Trepp CMBS Delinquency Rate in January was 7.6 percent, a decline of 23 basis points from the December number. The percentage of loans in the 30-day delinquent bucket is 0.7 percent–down 10 basis points for the month.

In terms of loans in grace period, 3.1 percent of loans by balance missed the January payment but were less than 30 days delinquent. That was up from 2.8 percent in December. Some other overall statistics: The percentage of loans with the special servicer dipped from 9.8 percent in December to 9.7 percent in January. According to January servicer data, 24.5 percent of all lodging loans were in special servicing, up from 24.1 percent in December. In addition, 17.0 percent of retail loans are with the special servicer, down from 17.2 percent last month. The percentage of loans on servicer watchlist climbed to 22.3 percent in January from 21.4 percent last month.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on Feb. 26, 2021

You must be logged in to post a comment.