2021 Net Lease Industrial Sales and Cap Rates

Where are these trends heading? The latest update from Stan Johnson Co.

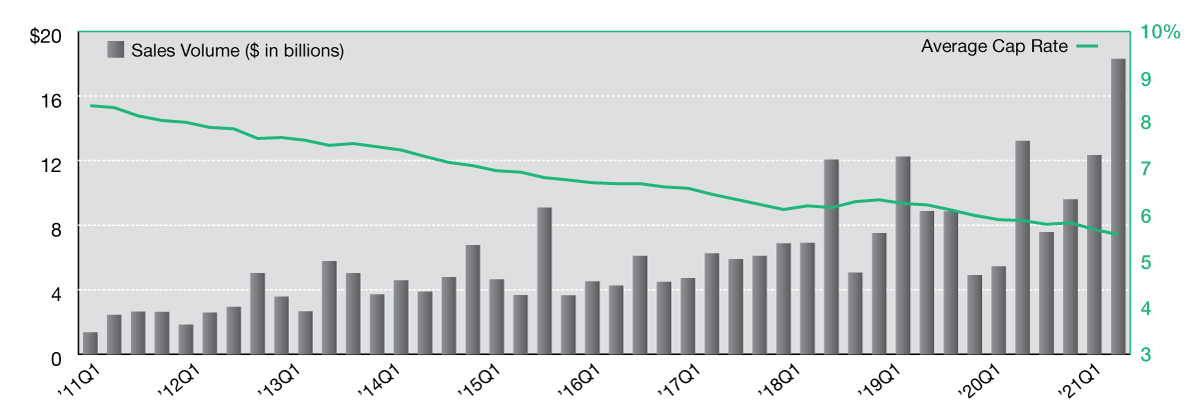

At year-end 2021, the single-tenant industrial sector shattered records for both quarterly and annual investment sales volume. In fourth quarter, activity reached $18.3 billion, representing a 37 percent jump from the previous quarter and a 38 percent increase from fourth quarter 2020.

This newly set quarterly record also pushed annual totals to a new high with more than $47.8 billion reported for the year. While portfolio sales have been leading contributors to overall volume, we continue to see very robust levels of single-asset sales as investors chase well-located, high-quality, newly built facilities across the distribution, cold storage and last-mile sectors, among others.

Single-tenant industrial cap rates have reported significant compression in recent years, falling 65 basis points in the last 24 months to end the year at an average of 5.6 percent. While it’s possible that average rates could fall further, the more likely scenario is that cap rates will fluctuate during 2022 but remain at sub-6.0 percent levels as the industrial sector continue to attract strong interest from all investor groups.

Focusing on business development, industry and client-specific research, and the analysis of local and national market trends, Lanie Beck has been the Director of Research for Stan Johnson Co. since 2013.

—Posted on Jan. 28, 2022

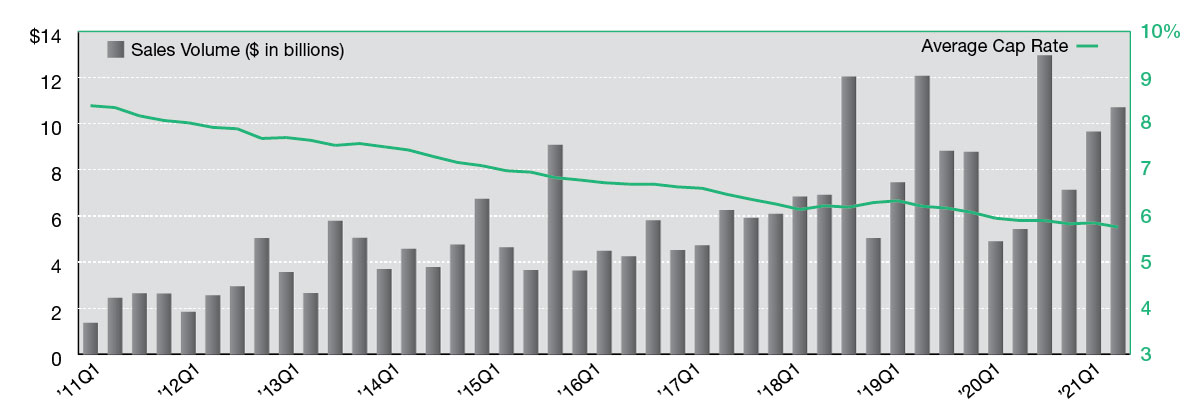

The single-tenant industrial sector is on pace to have its best year ever. With more than $27.5 billion in sales already reported, even a lower than average fourth quarter could make 2021’s annual volume the sector’s new high-water mark. Regionally, the west is the area to watch. The region may also see record-setting activity, as with nearly $8.5 billion reported, year-to-date investment activity has already surpassed 2020 annual totals. Strong activity throughout the sector shouldn’t come as a surprise though.

Over the last few years, investors have been gravitating toward industrial product for several reasons. Growing inventory, strong tenant credits and yield have all been primary drivers. However, many investors who discovered the asset class in the last decade as they chased yield are realizing it’s increasingly difficult to find in today’s market. Average cap rates for single-tenant industrial assets have compressed substantially in recent years, falling more than 100 basis points since the mid-2010s. In just the last year, we’ve seen a 14-basis point decrease, and rates have been below the 6.0 percent mark for six consecutive quarters.

Currently, the average cap rate for net lease industrial sits at 5.8 percent. It’s difficult to think that rates could fall substantially further, however the market could surprise us. More likely, we’ll see industrial cap rates fluctuate in the current range as the highest-quality assets continue to trade through the end of the year and into 2022.

Focusing on business development, industry and client-specific research, and the analysis of local and national market trends, Lanie Beck has been the Director of Research for Stan Johnson Co. since 2013.

—Posted on Oct. 29, 2021

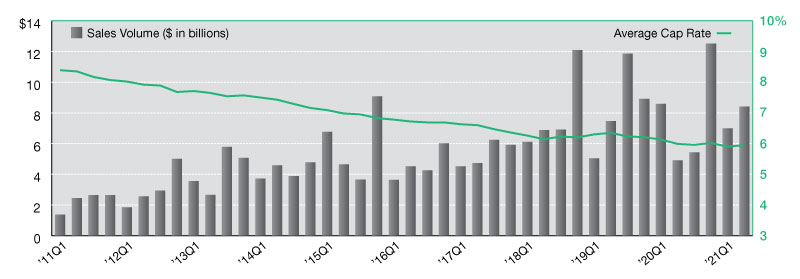

Although single-tenant industrial activity remains far from record-setting levels, the sector continues to outperform within the net lease market and accounted for 47 percent of second quarter 2021’s sales volume. More than $8.4 billion in investment sales were reported over the last three months, jumping 20 percent from the previous quarter and 72 percent from this time last year. Some of the highest profile transactions continue to be Amazon-leased properties, as investors flock to the high-quality, high-credit assets.

But buyer demand is strong across virtually all industrial subtypes. Industrial outdoor storage facilities are gaining interest with investors, and last mile distribution hubs remain a top favorite. Since the beginning of the pandemic, average cap rates have slipped into the high 5.0 percent range and at mid-year 2021, sat at 5.9 percent. Despite a 5-basis point increase in the last quarter, cap rates aren’t expected to move substantially, although it’s possible the sector’s average could rise above the 6.0-percent mark by year-end.

Focusing on business development, industry and client-specific research, and the analysis of local and national market trends, Lanie Beck has been the Director of Research for Stan Johnson Co. since 2013.

—Posted on Aug. 27, 2021

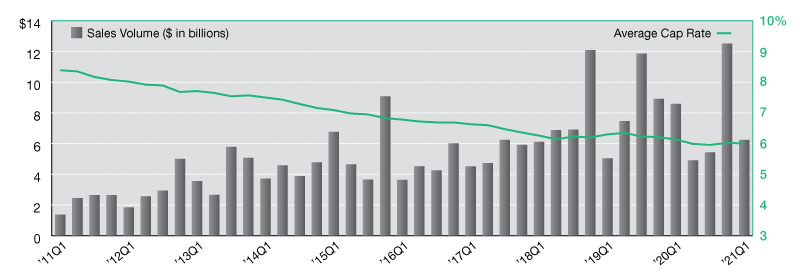

Quarterly sales volume was down across all regions of the single-tenant industrial market in first quarter 2021, however, the data is a bit deceiving. Market activity greatly surpassed expectations in fourth quarter 2020 as investors rushed to close deals before year-end.

This resulted in a record-setting quarter, where more than $12.5 billion in sales were reported. As early 2021 closings were pushed ahead into the previous quarter, first quarter sales activity appears to have lost momentum with a 50 percent drop to $6.2 billion in sales. In actuality, investor demand for industrial product remains quite strong.

Subsets including cold storage, last mile distribution, outdoor industrial storage and others continue to be in high demand, as has been the trend over the past few years. Even as the market emerges from the pandemic, and consumers may depend slightly less on e-commerce in the near term, the outlook still points to a long-term reliance on industrial product, and investors will continue to be drawn to opportunities in this sector.

As expected, the last few quarters have seen compressed cap rates, even falling below the 6.0 percent mark for back-to-back quarters in mid-2020. Average rates have inched back up a few basis points and now sit at 6.0 percent, but they aren’t expected to see much volatility for the remainder of the year.

Focusing on business development, industry and client-specific research, and the analysis of local and national market trends, Lanie Beck has been the Director of Research for Stan Johnson Co. since 2013.

—Posted on Jun. 29, 2021

You must be logged in to post a comment.