2021 REIT Returns

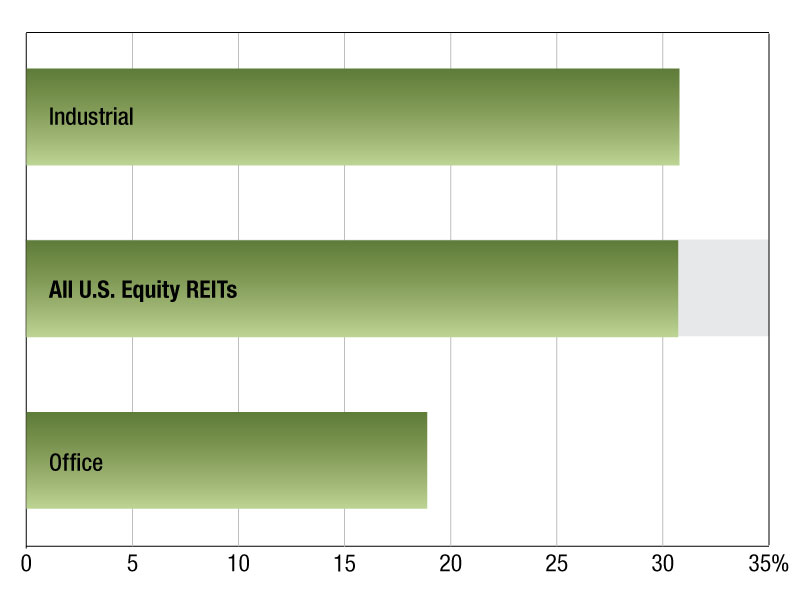

As of Oct. 1, office indexes posted a one-year total return of 30.8 percent, according to S&P Global Market Intelligence.

As of Oct. 1, publicly traded U.S. equity REITs in the Dow Jones equity all REIT index posted a 30.7 percent total return. S&P Dow Jones office and industrial Real Estate indexes posted one-year total returns of 30.8 percent and 18.9 percent, respectively.

Among the office REITs, City Office REIT Inc. recorded the highest one-year total return of 153.8 percent. Whereas New York City REIT Inc. displayed the lowest total return of -30.6 percent.

Innovative Industrial Properties Inc., topped all the industrial-focused REITs as the company posted the highest one-year total return of 92.4 percent. While, Americold Realty Trust logged the lowest total return, at -18.1 percent.

Winzen Matamorosa is an associate in the real estate client operations department of S&P Global Market Intelligence.

If you are interested to learn more about the products and services available within S&P Global Real Estate data, please visit us here.

—Posted on Oct. 25, 2021

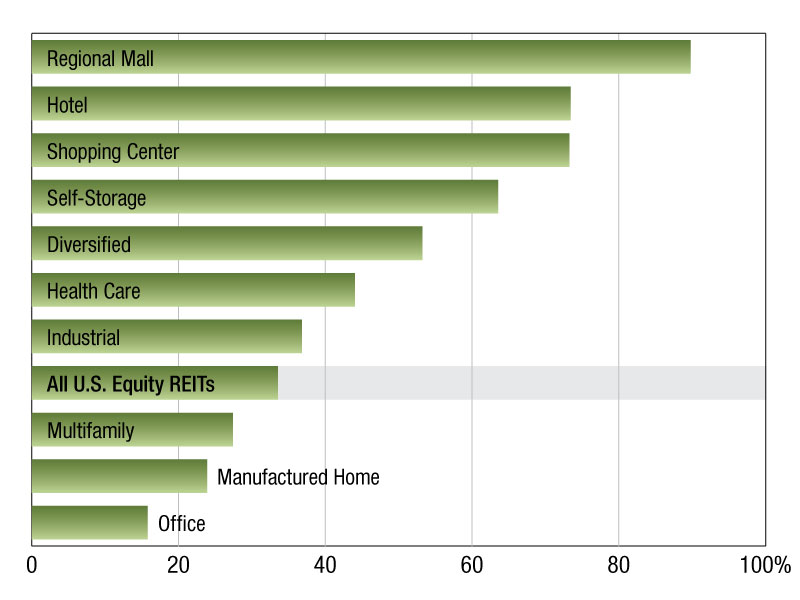

The regional mall REIT sector topped the chart with a 89.8 percent total return, beating the broader U.S. equity REIT index by 56.3 percentage points. The hotel sector followed next and posted a one-year total return of 73.4 percent.

On the other end of the spectrum, the office sector had the lowest one-year total return of 15.8 percent. The manufactured homes sector had the second lowest among the sectors, with a 23.9 percent one-year total return.

The multifamily sector index was ranked eighth out of all property sectors, posting a one-year total return of 27.4 percent. Among the multifamily-focused REITs, BRT Apartments Corp. delivered the highest one-year total return of approximately 103.3 percent. This was followed by Bluerock Residential Growth REIT Inc. and Independence Realty Trust Inc. at 75.4 percent and 73.6 percent one-year total returns, respectively. Investors Real Estate Trust posted a 17.1 percent total return for the one-year timeframe — the lowest among the multifamily REITs.

George Ziglar is an Associate in the Real Estate Client Operations Department of S&P Global Market Intelligence.

—Posted on May 25, 2021

You must be logged in to post a comment.