2021 REIT Trading Trends

The latest updates on the industrial and office sectors from S&P Global Market Intelligence

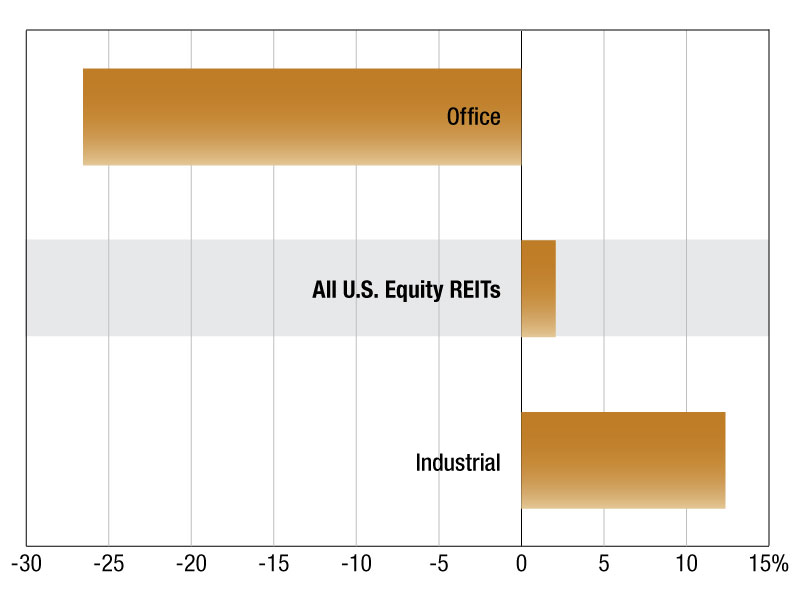

median U.S. equity REIT premium to NAV by sector

As of Sept. 1, publicly listed U.S. equity REITs traded at a median premium to consensus net asset value per share estimate of 2.1 percent.

The industrial sector traded at the greatest median premium to NAV estimate, at 12.4 percent. At the other end of the scale, the office sector traded at a discount of 26.6 percent, currently the greatest median discount to NAV estimate.

At the company level, industrial REIT Innovative Industrial Properties Inc. traded at the largest premium to NAV estimate, at 168.4 percent. Right behind were Prologis Inc. and EastGroup Properties Inc. trading at premiums to NAV estimates of 26.9 percent and 24.0 percent, respectively.

New York City REIT Inc. traded at the largest discount to NAV estimate of all U.S. REITs, at 55.9 percent. Office REIT Paramount Group Inc. and diversified REIT iStar Inc. were also at the bottom of the list with large discounts to NAV estimates of 47.5 percent and 46.1 percent, respectively.

Winzen Matamorosa is an Associate in the Real Estate Client Operations Department of S&P Global Market Intelligence.

If you are interested to learn more about the products and services available within S&P Global Real Estate data, please visit us here.

—Posted on Sep. 28, 2021

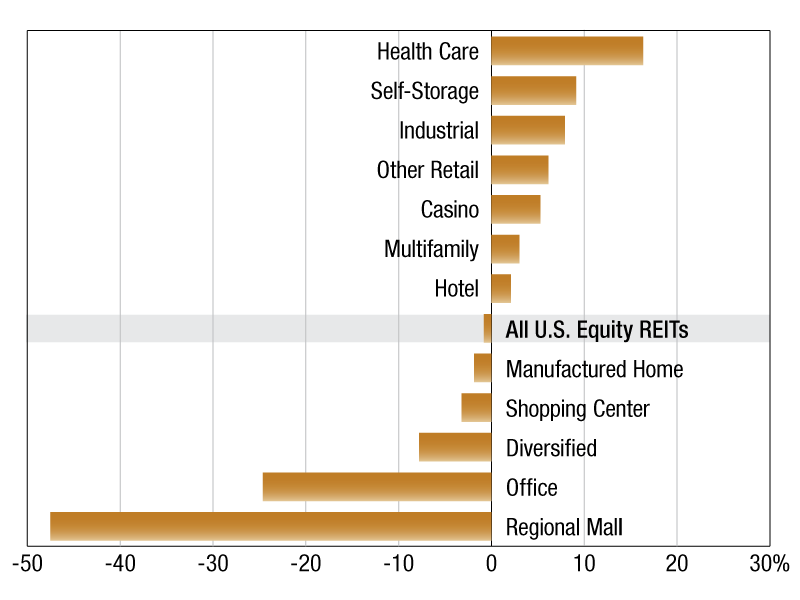

median U.S. equity REIT premium to NAV by sector

As of March 31, 2021, publicly listed U.S. equity REITs traded at a median discount to consensus net asset value per share estimate of 0.8 percent. The health care sector traded at the greatest median premium to NAV est, at 16.3 percent. The self storage sector was next in line, trading at a median premium to NAV est of 9.1 percent.

At the other end of the scale, the regional mall sector traded at a discount of 47.5 percent, currently the greatest median discount to NAV est. The office REIT sector followed with 24.6 percent median discount to NAV est.

At the company level, Innovative Industrial Properties Inc. traded at the largest premium to NAV estimate, at 111.7 percent. Right behind were Community Healthcare Trust Inc. and CareTrust REIT Inc., trading at premiums to NAV estimates of 66.6 percent and 37.9 percent, respectively.

Apartment Investment and Management Co. traded at the largest discount to NAV est of all U.S. REITs, at 89.1 percent. Washington Prime Group Inc., a regional mall REIT, and office REIT New York City REIT Inc., were also at the bottom of the list with large discounts to NAV est of 86.1 percent and 52.8 percent, respectively.

The U.S. multifamily REIT sector traded at a median premium to consensus net asset value of 3.0 percent as of March 31, 2021. Within the sector Mid-America Apartment Communities Inc. traded at a premium to NAV estimate of 11.7 percent. Trading at the greatest discount to NAV among multifamily REITs was Apartment Investment and Management Co. at 89.1 percent. BRT Apartments Corp. and Bluerock Residential Growth REIT Inc. followed, trading at 21.4 percent and 18.4 percent discounts to consensus NAV, respectively.

George Ziglar is an Associate in the Real Estate Client Operations Department of S&P Global Market Intelligence.

—Posted on Apr. 27, 2021

You must be logged in to post a comment.