2021 REIT Values

The latest Dow Jones Equity All REIT Index from S&P Global Market Intelligence.

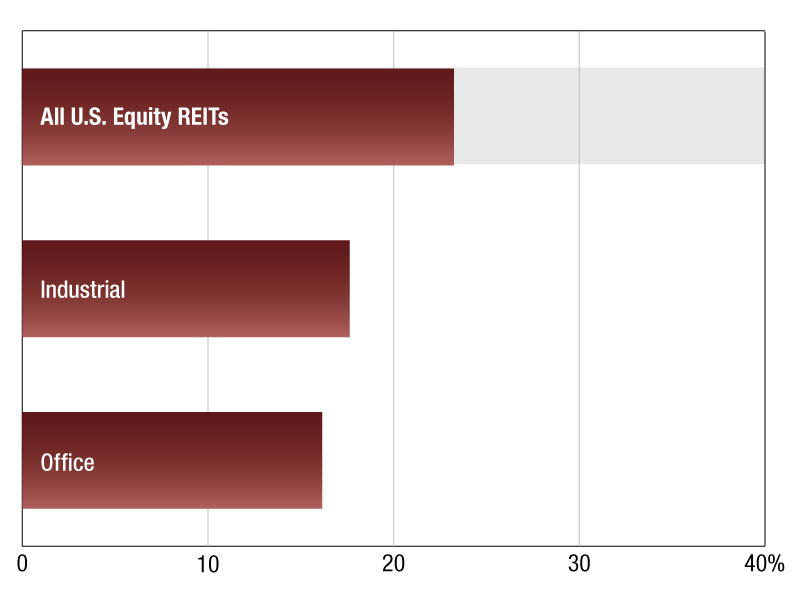

Dow Jones Equity All REIT Index Price/LTM FFO (x)

As of Jan. 6, 2022, the Dow Jones Equity All REIT Index posted the highest multiple based from the last 12 months funds from operations among the three focused indexes.

The broader equity all REIT index posted a 23.25x, followed by the Dow Jones U.S. real estate Industrial index with price to LTM FFO multiple of 17.63x and the Dow Jones U.S. real estate office index with 16.15x.

Winzen Matamorosa is an Associate for the Real Estate Client Operations department of S&P Global Market Intelligence.

If you are interested to learn more about the products and services available within S&P Global Real Estate data, please visit us here.

—Posted on Jan. 26, 2022

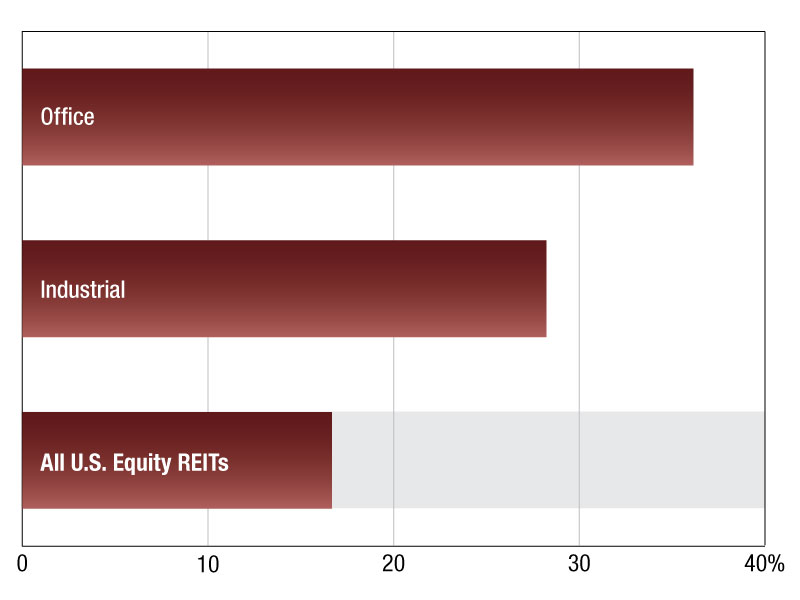

SNL US REIT Index Price/LTM FFO (x)

As of Aug. 2, the Industrial sector led all publicly traded U.S. equity REIT sectors in terms of the last 12 months funds from operations multiple. The sector posted a 36.14x LTM FFO multiple, outperforming the SNL US REIT Equity Index by 7.9 percentage points.

The U.S Office REIT sectors followed next with price to LTM FFO multiples of 16.68.

Among the REITs focused in the Industrial sector, Americold Realty Trust had the highest price to LTM FFO multiple of 61.4x.

Winzen Matamorosa is an Associate for the Real Estate Client Operations department of S&P Global Market Intelligence.

If you are interested to learn more about the products and services available within S&P Global Real Estate data, please visit us here.

—Posted on Aug. 30, 2021

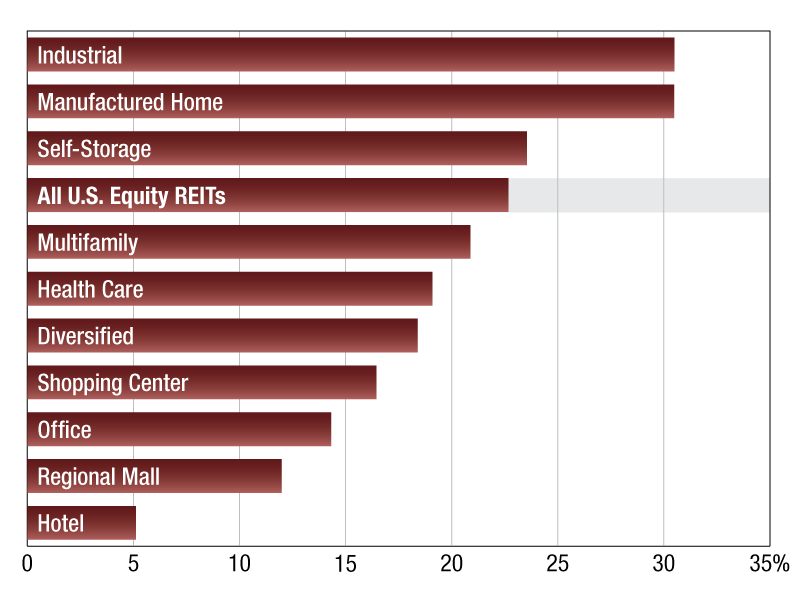

SNL US REIT Index Price/LTM FFO (x)

As of February 26, 2021, the industrial sector led all publicly traded U.S. equity REIT sectors in terms of the last twelve months funds from operations multiple. The sector posted a 30.5x LTM FFO multiple, outperforming the SNL US REIT Equity Index by 7.83 percentage points. The Manufactured Homes and Self-storage REIT sectors followed next with price to LTM FFO multiples of 30.49x and 23.54x, respectively. The Hotel sector ranked last with a 5.12x price to LTM FFO.

Among the REITs focused in the industrial sector, Americold Realty Trust had the highest price to LTM FFO multiple of 46.1x.

George Ziglar is an Associate for the Real Estate Client Operations department of S&P Global Market Intelligence.

—Posted on Mar. 23, 2021

You must be logged in to post a comment.