2022 CMBS Delinquency Rates

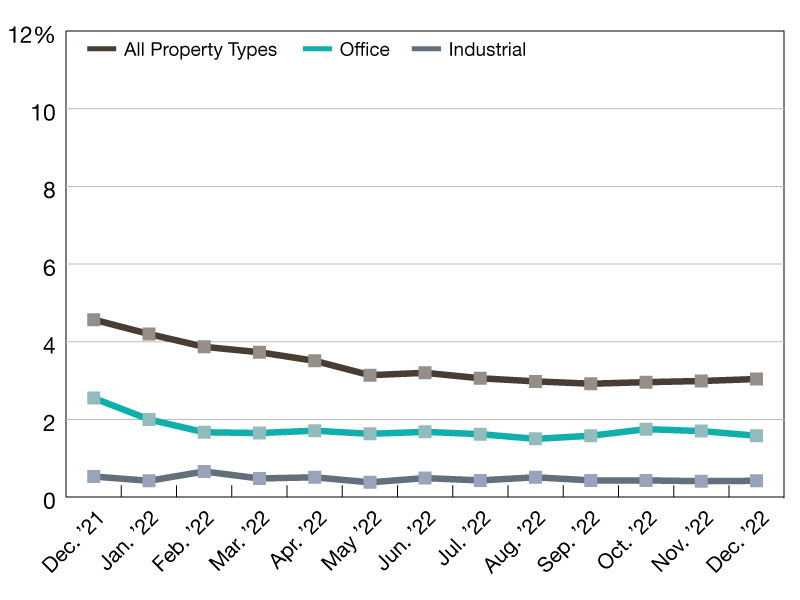

The Trepp CMBS Delinquency Rate in December was 3.04 percent, an increase of five basis points from November.

The Trepp CMBS Delinquency Rate moved up slightly again in December, rising above 3 percent for the first time since July 2022.

After reaching a post-COVID-19 trough of 2.92 percent in September 2022, the rate has inched up for three consecutive months.

A consensus has formed in the CMBS market with many analysts and investors anticipating higher delinquency rates in 2023. The biggest impact could come from loans slated to mature in 2023. With interest rates considerably higher than a year ago and with uncertainty for the US economy in 2023, many maturing loans could face challenges getting refinanced. That is particularly true in the office segment where the future of office demand remains unclear.

The Trepp CMBS Delinquency Rate in December was 3.04 percent, an increase of five basis points from November. The percentage of loans in the 30 days delinquent bucket is 0.16 percent – up three basis points for the month.

Our numbers above reflect percentages that assume defeased loans are still part of the denominator.

—Posted on Jan. 30, 2023

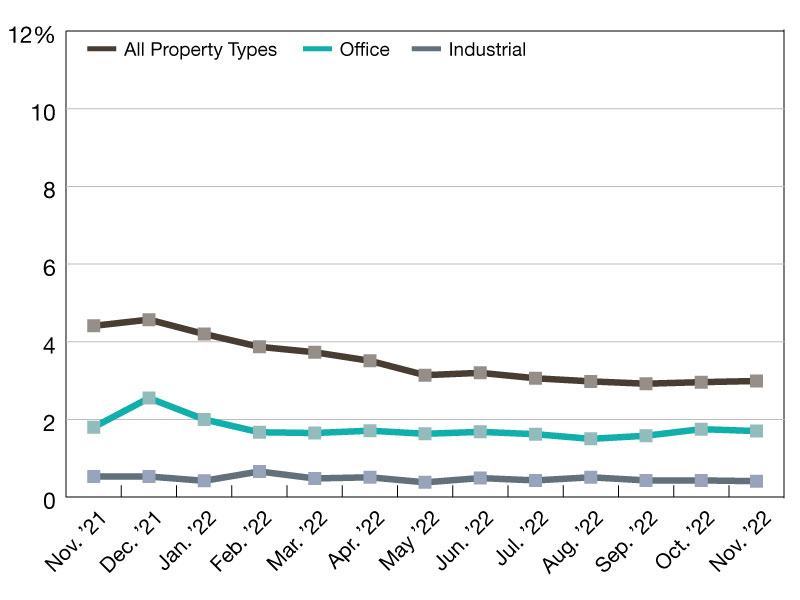

In November, the Trepp CMBS Delinquency Rate moved up slightly but remained just a tick below 3 percent.

Expectations for the CRE market have been for higher delinquency rates over the next few months as a result of higher interest rates, challenges refinancing maturing loans, and a slowing US economy. Yet, the latest overall delinquency reading would have been lower had it not been for a few large multifamily loans going delinquent in November.

The Trepp CMBS Delinquency Rate in November was 2.99 percent, an increase of three basis points from October. The increase in the delinquency rate was only the fourth in the last 29 months.

A loan backed by apartments in Queens, NY led to a big spike in the multifamily rate, as did a delinquency for a large 2019 single-asset, single-borrower (SASB) apartment loan. That may not be the last of such stories. Trepp noted recently that a large apartment loan backed by San Francisco properties could also become delinquent in the near future. (The Queens and San Francisco stories were covered in Trepp’sclient, only newsletter, TreppWire.)

All other major property types showed declines in the delinquency rate in November, defying some analyst expectations.

Without the multifamily blip, the overall delinquency rate would have been lower in November.

The percentage of loans in the 30 days delinquent bucket is 0.13 percent – up four basis points for the month.

Our numbers above reflect percentages that assume defeased loans are still part of the denominator.

—Posted on Dec. 30, 2022

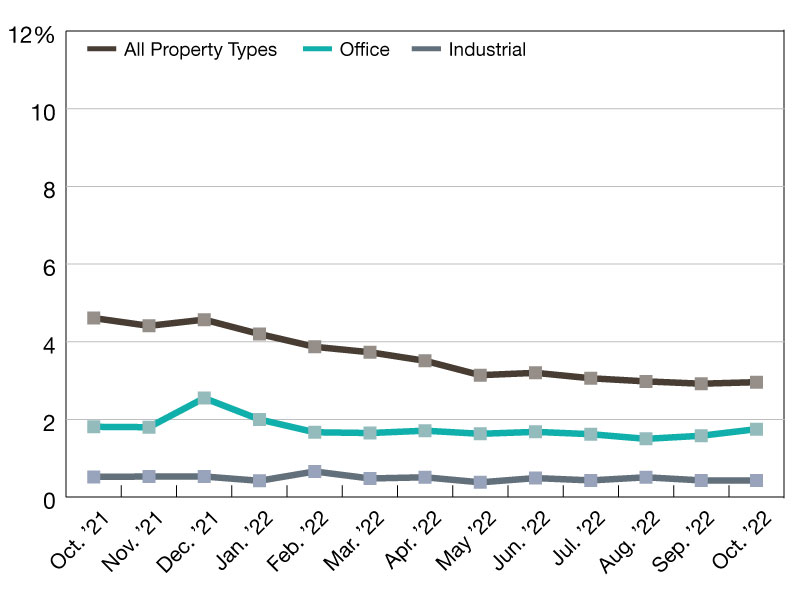

In October 2022, the Trepp CMBS Delinquency Rate moved up modestly. Whether this is the beginning of

a turning point as a result of higher interest rates and a slowing US economy or just a momentary bump remains to be seen.

CMBS investors have been watching carefully for signs of distress. It is expected that the higher refinancing costs could make it difficult for some marginally performing assets to be refinanced.

The Trepp CMBS Delinquency Rate in October was 2.96 percent, an increase of four basis points from the September reading. The increase in the delinquency rate was only the third in the last 28 months.

The percentage of loans in the 30 days delinquent bucket is 0.09 percent, down five basis points for the month.

Our numbers above reflect percentages that assume defeased loans are still part of the denominator.

—Posted on Nov. 30, 2022

Source: Trepp

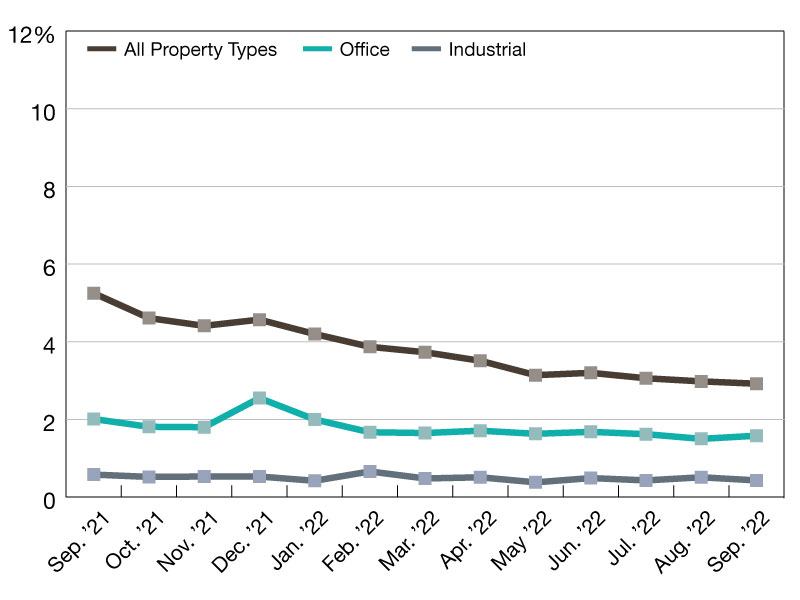

In September 2022, the Trepp CMBS Delinquency Rate fell once again. For now, commercial mortgage-backed securities (CMBS) loan performance remains the model of steadiness even as volatility in the equity and foreign exchange markets have spiked and interest rates and lending spreads have moved considerably higher and wider.

There may be more challenges ahead for the CMBS market, particularly for loans with near-term

maturities and office properties with expiring leases. For now, however, the performance in the

CMBS universe continues to defy the growing market turbulence.

The Trepp CMBS Delinquency Rate in September was 2.92 percent, a decrease of six basis points from August. The delinquency rate has now fallen for 25 of the last 27 months.

The percentage of loans in the 30 days delinquent bucket is 0.14 percent – up five basis points for the

month.

Our numbers above reflect percentages that assume defeased loans are still part of the denominator.

—Posted on Oct. 24, 2022

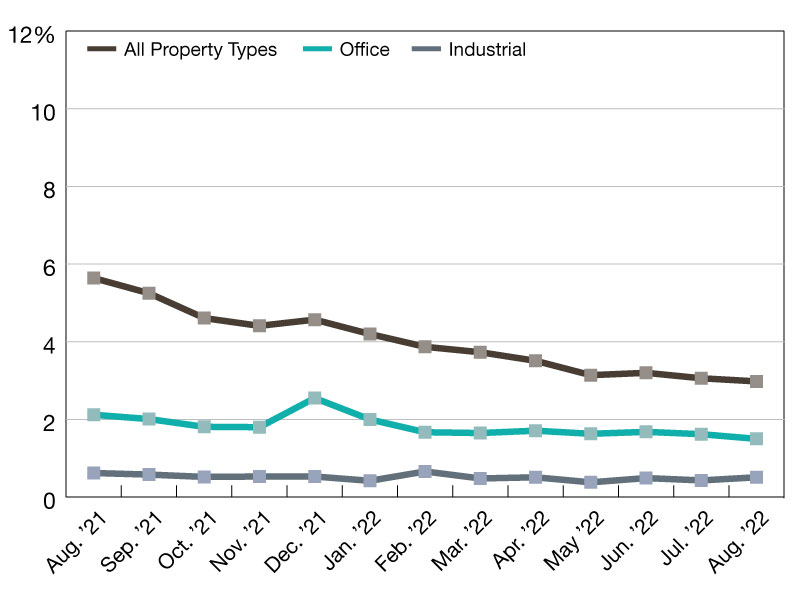

In August 2022, the Trepp CMBS Delinquency Rate fell below 3 percent for the first time since before the COVID-19 pandemic. It was a year ago that the benchmark dropped below 6 percent and six months since the rate fell below 4 percent.

The declines should not be terribly shocking to players in the CM BS market. Those property segments that were crushed by the COVID-19 pandemic—hotel and retail—continue to see steady improvement each month as loans in those categories cure and/or pay off.

Meanwhile, distress in the office segment—the property type most likely to be impacted by increased work from home trends—will take years to play out as a result of most firms being locked into five- and 10-year leases.

The Trepp CMBS Delinquency Rate in August 2022 was 2.98 percent, a decrease of eight basis points from July. The delinquency rate has now fallen for 24 of the last 26 months.

The percentage of loans in the 30 days delinquent bucket is 0.09 percent—unchanged for the month.

Our numbers above reflect percentages that assume defeased loans are still part of the denominator.

—Posted on Sep. 28, 2022

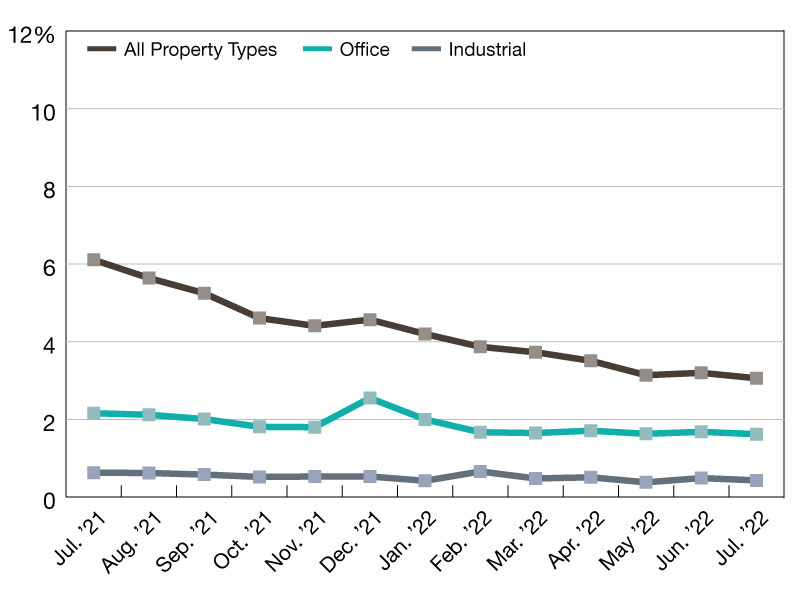

After a rare uptick in June 2022, the Trepp CMBS Delinquency Rate resumed its two-year long decline.

In June, the rate inched up for only the second time since June 2020. In July, the rate declied anew and has now fallen for 23 of the last 25 months. The July number also represented another post-COVID-19 low.

The Trepp CMBS rate in July was 3.1 percent, a decrease of 14 basis points from June. The percentage of loans in the 30 days delinquent bucket is 0.1 percent, down nine basis points for the month.

Year-over-year, the overall US CMBS delinquency rate is down 305 basis points. Year-to-date, the rate is down 151 basis points. The percentage of loans that are seriously delinquent is now 3.0 percent, down five basis points for the month.

If defeased loans were taken out of the equation, the overall 30-day delinquency rate would be 3.2 percent, down 15 basis points from June. One year ago, the rate was 6.1 percent, while six months ago it was 4.2 percent.

For overall property types CMBS 1.0 and 2.0+, the industrial rate fell six basis points to 0.4 percent, office dropped six points to 1.6 percent and retail fell 12 basis points to 6.6 percent. For CMBS 2.0+, industrial went down four basis points to 0.2 percent, office up two basis points to 1.3 percent and retail down four basis points to 5.7 percent.

—Posted on Aug. 25, 2022

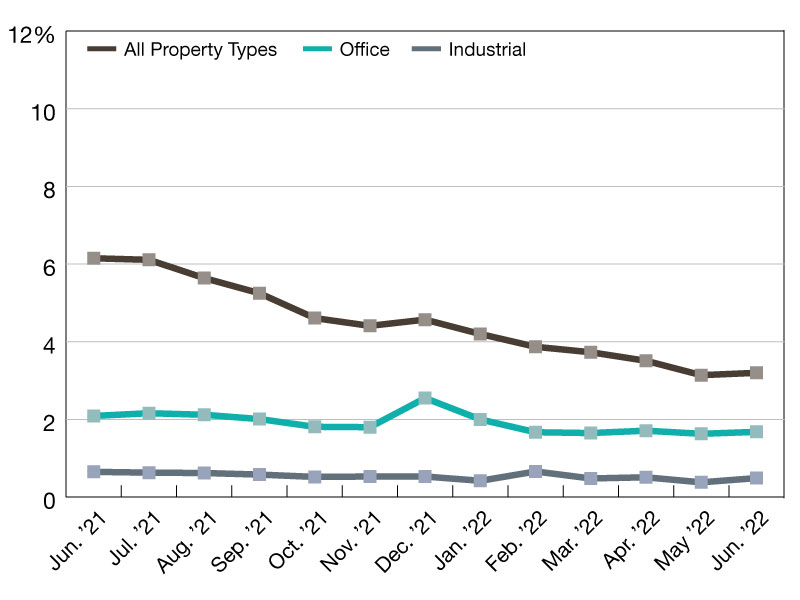

The Trepp CMBS delinquency rate posted a rare uptick in June 2022. The rate moved up just six basis points, and only time will tell if this is just a blip, or an inflection point triggered by higher borrowing costs for commercial real estate and weakening fundamentals for the U.S. economy.

The uptick is only the second increase in the rate over the last 24 months. The last increase in the rate came in late 2021.

The Trepp CMBS delinquency rate in June was 3.2 percent. All major property types say small increases in their respective delinquency rates in June. The all tiem high on this basis was 10.3 percent registered in July 2012. One year ago, the rate was 6.2 percent, while six months ago it was 4.6 percent.

The percentage of loans in the 30 days delinquent bucket is now 0.18 percent, up five basis points for the month.

Year-over-year, the overall rate is down 295 basis points. Year-to-date, the rate is down 137 basis points. The percentage of loans that are seriously delinquent is now 3.0 percent, up one basis point for the month. If defeased loans were taken out of the equation, the overall 30-day deliquency rate would be 3.4 percent, up five basis points from May.

The CMBS 1.0 and 2.0+ rates for industrial increased 11 basis points to 0.49 percent, while office increased five basis points to 1.7 percent.

—Posted on Jul. 27, 2022

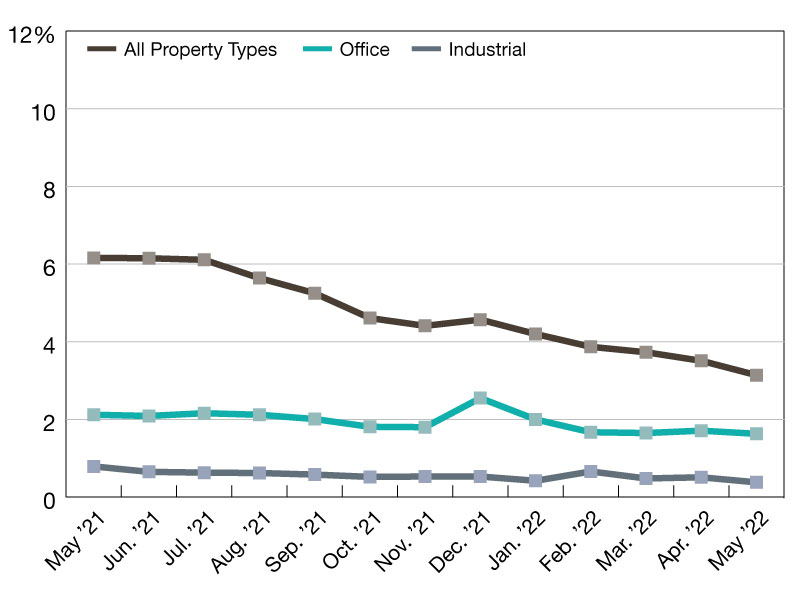

The Trepp CMBS delinquency rate posted another large decline in May 2022. At the current improvement rate, the overall delinquency rate could fall below 3 percent in the coming months, a prospect that seemed unthinkable during the COVID-19 pandemic. As a refresher, the delinquency rate hit 10.3 percent in June 2020 amid the market volatility caused by the pandemic. This was near the all-time high of 10.3 percent seen in July 2012.

The May 2022 delinquency rate was 3.1 percent, a decline of 37 basis points from April. That is the biggest decline since January 2022. The rate has now fallen in 22 of the last 23 months with only a brief uptick in late 2021. All major property types saw improvements in May 2022.

The percentage of loans in the 30 days delinquent bucket is 0.1 percent–down four basis points for the month. Year-over-year, the overall US CMBS delinquency rate is down 302 basis points. Year-to-date, the rate is down 143 basis points.

For overall property type analysis 1.0 and 2.0+, the industrial rate fell 13 basis points to 0.4 percent, while office dipped eight basis points to 1.6 percent.

—Posted on Jun. 22, 2022

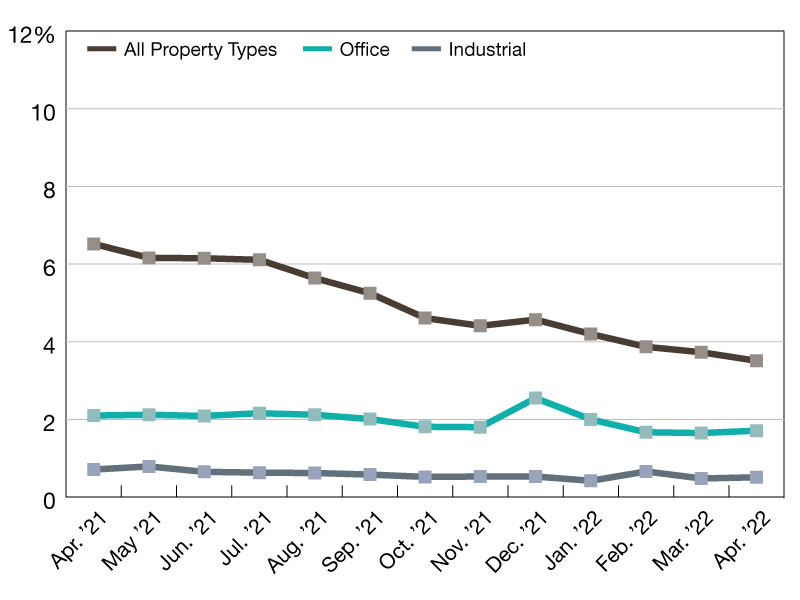

The Trepp CMBS delinquency rate posted another sizable decline in April 2022, continuing a trend that started only a few months after the onset of COVID-19.

The rate has now fallen in 21 of the last 22 months with only a brief uptick in late 2021. The Trepp CMBS delinquency rate in April was 3.5 percent, a decline of 22 basis points from March. The percentage of loans in the 30 days delinquent bucket is 0.2 percent—down two basis points for the month.

The all-time high on this basis was 10.3 percent registered in July 2012. The COVID-19 high was 10.3 percent in June 2020. Year over year, the overall US CMBS delinquency rate is down 301 basis points. Year to date, the rate is down 106 basis points. The percentage of loans that are seriously delinquent is now 3.3 percent, down 20 basis points for the month.

One year ago, the rate was 6.5 percent. Six months ago, it was 4.6 percent. The industrial rate increased three basis points to 0.5 percent, while office went up six basis points to 1.7 percent for CMBS 1.0 and 2.0+. For just CMBS 2.0+, industrial went up nine basis points to 0.3 percent and office inched up nine basis points as well, to 1.3 percent.

—Posted on May 23, 2022

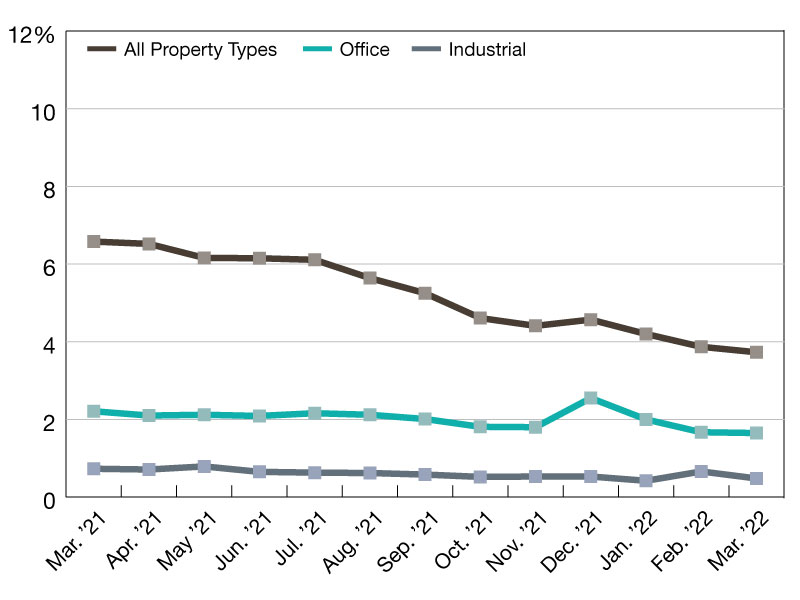

The recent increase in interest rates, commodity prices, and general volatility hasn’t had any noticeable performance in the CMBS market aside from some spread widening up and down the credit stack. The Trepp CMBS delinquency rate posted another decline in March, continuing a trend that started almost two years ago. The rate has now fallen in 20 of the last 21 months with only a brief uptick in late 2021. The overall delinquency rate in March 2022 was 3.7 percent, a decline of 14 basis points from February.

The percentage of loans in the 30 days delinquent bucket is 0.2 percent, up one basis point for the month. In terms of loans in grace period, 1.9 percent of loans by outstanding balance missed the March payment but were less than 30 days delinquent. That’s up five basis points from February. Year-over-year, the overall rate is down 285 basis points. Year-to-date, the rate is down 84 basis points.

The percentage of loans that are seriously delinquent is now 3.5 percent, down 15 basis points for the month. If defeased loans were taken out of the equation, the overall 30-day delinquency rate would be 3.9 percent, down 16 points from February. One year ago, the rate was 6.6 percent, while six months ago it was 5.3 percent. For overall property types, CMBS 1.0 and 2.0+.

—Posted on Apr. 27, 2022

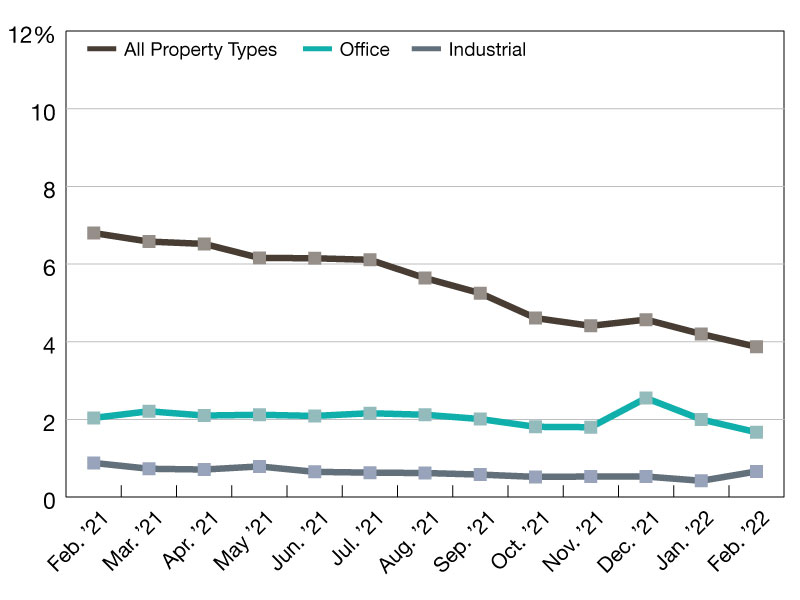

The Trepp CMBS delinquency rate continued its impressive decline in February 2022. The rate has now fallen in 19 of the last 20 months with only a brief uptick in late 2021. The delinquency rate in February was 3.9 percent, a decline of 31 basis points from January. That’s the first time the rate has been below 4 percent since April 2020.

The percentage of loans in the 30 days delinquent bucket is now 0.2 percent, up two basis points for the month. In terms of loans in grace period, 1.9 percent of loans by balance missed the February payment but were less than 30 days delinquent. That’s a drop of 30 basis points and could be a sign that more improvements in the delinquency rate are forthcoming.

The overall US CMBS delinquency rate dropped 31 basis points in February to 3.9 percent. (The all-time high on this basis was 10.3 percent registered in July 2012. The COVID-19 high was 10.3 percent in June 2020.) The percentage of A/B loans (i.e. loans in grace period or beyond grace period) was 1.9 percent in February. Year over year, the overall US CMBS delinquency rate is down 293 basis points. Year to date, the rate is down 70 basis points. The percentage of loans that are seriously delinquent (60+ days delinquent, in foreclosure, REO, or nonperforming balloons) is now 3.7 percent, down 33 basis points for the month. If defeased loans were taken out of the equation, the overall 30-day delinquency rate would be 4.1 percent, down 33 basis points from January. One year ago, the US CMBS delinquency rate was 6.8 percent. Six months ago, the US CMBS delinquency rate was 5.6 percent. Loans that are past their maturity date but still current on interest are considered current.

The CMBS 2.0+ delinquency rate fell 29 basis points to 3.5 percent in February. That, too, is a post-April 2020 low. The rate is down 261 basis points year-over-year. The percentage of CMBS 2.0+ loans that are seriously delinquent is now 3.3 percent, down 32 basis points for the month. If defeased loans were taken out of the equation, the overall CMBS 2.0+ delinquency rate would be 3.7 percent, down 31 basis points for the month. For CMBS 1.0 and 2.0+, the industrial delinquency rate moved up 24 basis points to 0.7 percent. The office delinquency rate declined 33 basis points to 1.7 percent. For CMBS 2.0+, the industrial rate went up 20 basis points to 0.31 percent. The office rate went down 32 basis points to 1.2 percent.

—Posted on Mar. 25, 2022

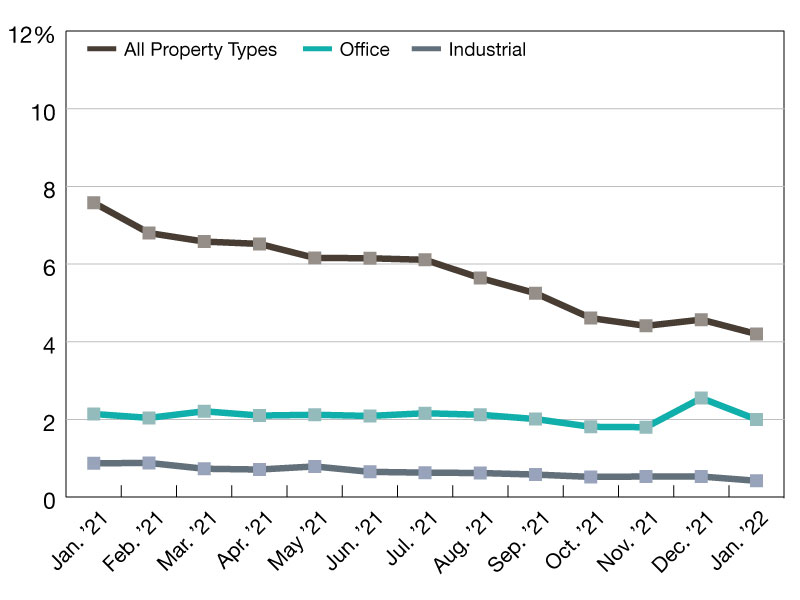

The Trepp CMBS delinquency rate resumed its decline in January 2022 after a one-month pause in December 2021. In December, the rate increased for the first time since June 2020. Prior to the rise, the rate had fallen for 17 consecutive months. In January, the overall delinquency number saw a sizable decline as the Trepp CMBS delinquency rate posted its lowest reading since April 2020. The January 2022 CMBS delinquency rate was 4.2, a decrease of 39 basis points from the December number.

The decline in the rate was helped by the curing (reverting from delinquent to current status) of two big HNA Group loans which total more than $1.2 billion. The 245 Park Ave. (NY) loan and the 181 W. Madison St. (Chicago) loan both went from being 30 days delinquent in December to being reported as current in January. (An affiliate of the HNA Group filed for bankruptcy which led the two loans to go to special servicing. The fact that the loans became current in January does not yet mean that lenders are out of the woods on these assets.) The percentage of loans in the 30 days delinquent bucket is now 0.2 percent, down 33 basis points for the month. In terms of loans in grace period, 2.2 percent of loans by balance missed the January payment but were less than 30 days delinquent. That was up 4 basis points for the month. Our numbers above reflect percentages that assume defeased loans are still part of the denominator.

The percentage of A/B loans (i.e. loans in grace period or beyond grace period) was 2.17% in January. Year over year, the overall US CMBS delinquency rate is down 340 basis points. The percentage of loans that are seriously delinquent (60+ days delinquent, in foreclosure, REO, or nonperforming balloons) is now 4.0 percent, down 6 basis points for the month. If defeased loans were taken out of the equation, the overall 30-day delinquency rate would be 4.4 percent, down 39 basis points from December. One year ago, the US CMBS delinquency rate was 7.6 percent. Six months ago, the US CMBS delinquency rate was 6.1 percent.

The CMBS 2.0+ delinquency rate fell 40 basis points to 3.8 percent in January. That, too, is a post-April 2020 low. The rate is down 308 basis points year-over-year. The percentage of CMBS 2.0+ loans that are seriously delinquent is now 3.6 percent, down 6 basis points for the month. If defeased loans were taken out of the equation, the overall CMBS 2.0+ delinquency rate would be 4.0 percent, down 39 basis points for the month.

For CMBS 1.0 and 2.0+, the industrial delinquency rate fell 10 basis points to 0.4 percent, while office declined 53 basis points to 2.0 percent. For 2.0+, industrial went down 10 basis points to 0.1 percent, while office went down 56 basis points to 1.5 percent.

—Posted on Feb. 28, 2022

You must be logged in to post a comment.