2022 Commercial REIT Results

Publicly traded equity REITs had an average Q3 AFFO payout ratio estimate of 72 percent, according to S&P Global Market Intelligence.

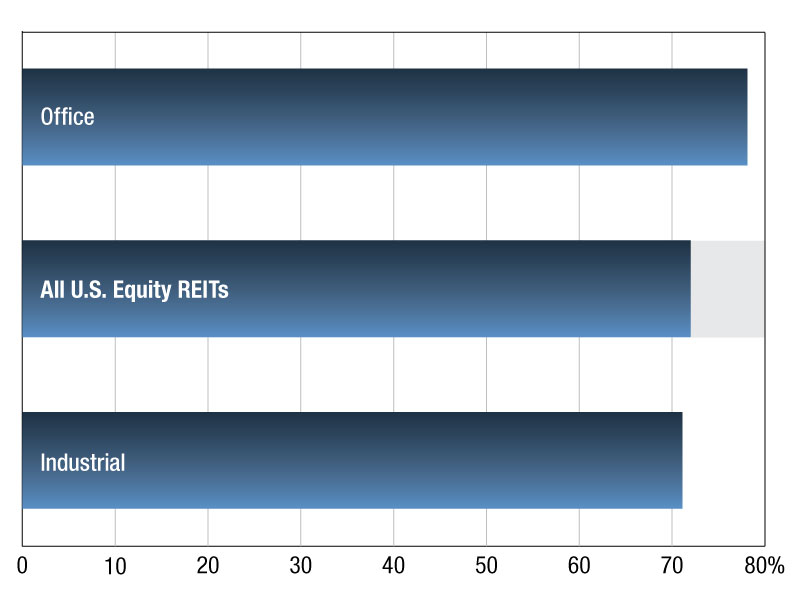

US Equity REIT Average 2022 Q3 AFFO Payout Ratio Estimate

As of October 7, 2022, publicly traded U.S. equity REITs had an average 2022Q3 AFFO payout ratio estimate of 72.0 percent.

Among these sectors, office REITs had the highest average AFFO payout ratio estimate for the third quarter of 2022, at 78.1 percent. The industrial sector followed with an average AFFO payout ratio estimate of 71.1 percent.

— Iman Niazi is an Associate in the Real Estate Client Operations Department of S&P Global Market Intelligence

If you are interested to learn more about the products and services available within S&P Global Real Estate data, please visit us here: https://www.spglobal.com/marketintelligence/en/campaigns/real-estate

—Posted on Oct. 24, 2022

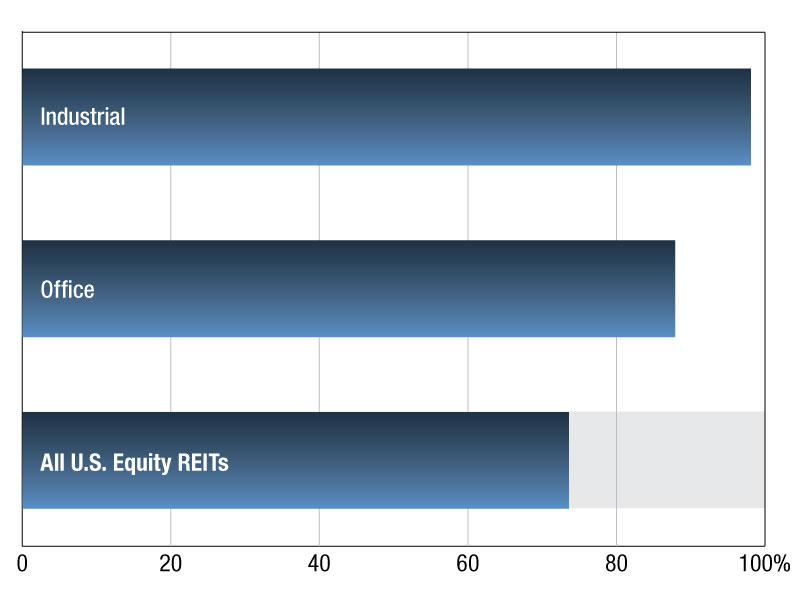

US Equity REIT Average 2021 Q4 AFFO Payout Ratio Estimate

As of May 5, publicly traded U.S. equity REITs had an average 2021Q4 AFFO payout ratio estimate of 73.6 percent.

Among these sectors, industrial REITs had the highest average AFFO payout ratio estimate for the first quarter of 2022, at 98.1 percent. The office sector followed with an average AFFO payout ratio estimate of 87.9 percent.

Anthony Collins is an Associate in the Real Estate Client Operations Department of S&P Global Market Intelligence

If you are interested to learn more about the products and services available within S&P Global Real Estate data, please visit us here: https://www.spglobal.com/marketintelligence/en/campaigns/real-estate

You must be logged in to post a comment.