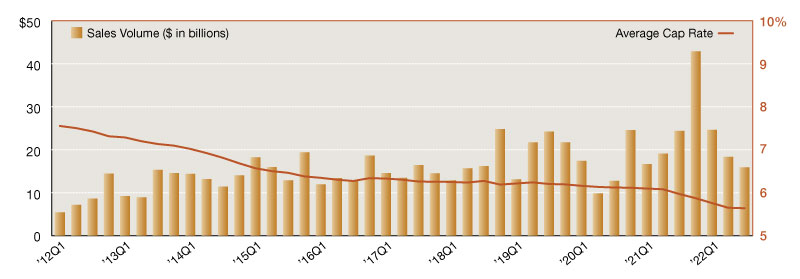

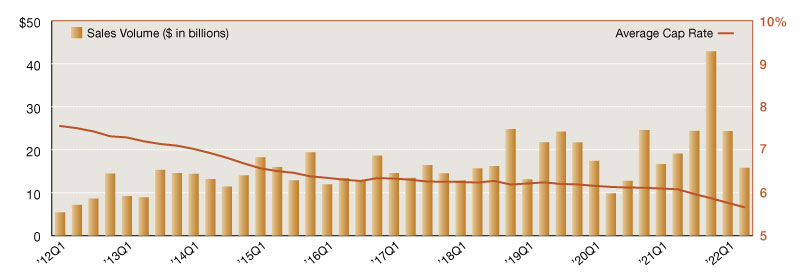

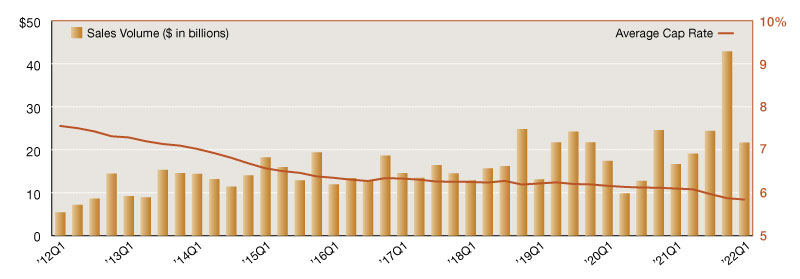

2022 Net Lease Overall Sales Volume and Cap Rates

Below are a few of the top trends impacting the market, according to Northmarq.

With an absence of new, shocking headlines to begin the second half of 2022, the commercial real estate market continues to face the same external influences that will undoubtedly impact how we end the year. The economic picture remains murky, with inflation and rising interest rates at the forefront of consumers’ and investors’ minds. Fears of a recession still loom, and there has been a noticeable decrease in consumer confidence this year. Additionally, the industry continues to question the future of 1031 exchanges, and the mid-term elections could impact economic conditions and investor sentiment as well. These trends, however, have been balanced by strong job growth, low unemployment, robust consumer spending, and insatiable investor demand for quality assets.

In the single-tenant net lease market, we’ve seen investment sales volume decline over the past three quarters and compared to the record-setting end to last year, current activity levels may feel somewhat lackluster. Put in perspective though, the market is on pace to have a very solid year, perhaps topping the $70-billion-mark and solidifying 2022 as a top three year in history. However, fourth quarter will be telling. The final three months of the year will not only dictate how 2022 gets logged in the history books, but it will also set the tone for 2023.

Lanie Beck joined Stan Johnson Co. in 2013. She oversees the firm’s corporate research efforts, publishing the quarterly MarketSnapshot report, the Viewpoint series of whitepapers and a variety of other thought leadership content. Beck is also responsible for leading Stan Johnson Co.’s corporate marketing, communications and public relations strategy, including the coordination of the firm’s social media presence, industry conference and event sponsorships, as well as management of the brand.

—Posted on Dec. 30, 2022

On the s-curve that is the cyclical commercial real estate market, second quarter 2022’s performance suggests that we’ve passed the peak of the market, especially within the single-tenant net lease sector. With rising interest rates and rampant inflation, net lease investors have been watching the market very closely, keeping note of the following measures.

First, cap rates continue to compress, but this could be the last quarter before we start to see a reversal of that trend. Deals being priced today will influence closing cap rates reported for third quarter 2022 and beyond, so investors must keep in mind the lagging nature of this statistic.

Next, sales volume is another important indicator of where we are in the market cycle. It’s almost certain that we’ll look back and identify fourth quarter 2021 as the true peak of this cycle. Sales totals across the net lease market were astonishingly high, surpassing $103 billion. Within the individual property sectors, the end of last year saw activity, especially for industrial and retail, reach levels that seem nearly impossible to achieve again. While every record-setting quarter makes us question its repeatability, sales volume during the first half of 2022 was closer to normal or average levels, and we’re likely to see more of that in the foreseeable future, pending a major market event.

Despite what might feel like a slow-down in market momentum, buyer demand is still incredibly high. Investors are actively seeking high quality and value-add deals, understanding that even though interest rates are rising, debt is still comparatively inexpensive. This will continue to create opportunities for investors, and there is still time for sellers to take advantage.

It’s important to note that even once the market has passed its peak, we are still in positive territory. It remains to be seen how long we’ll stay here, but for now, there’s still a lot to be encouraged about. Yes, the U.S. economy has contracted for two consecutive quarters and consumer confidence has declined sharply in recent months. But on the other hand, unemployment is incredibly low and consumer spending remains high – two very important indicators of economic health. Opportunities abound across the commercial real estate industry, and investors should be able to continue transacting with confidence in the coming months and quarters despite the beginnings of a shifting market.

Lanie Beck joined Stan Johnson Co. in 2013. She oversees the firm’s corporate research efforts, publishing the quarterly MarketSnapshot report, the Viewpoint series of whitepapers and a variety of other thought leadership content. Beck is also responsible for leading Stan Johnson Co.’s corporate marketing, communications and public relations strategy, including the coordination of the firm’s social media presence, industry conference and event sponsorships, as well as management of the brand.

—Posted on Oct. 24, 2022

Following a record-setting 2021 with unprecedented levels of investment sales activity in the final quarter of the year, there was no expectation that the single-tenant net lease market was positioned for back-to-back quarters of such volume. Instead, predictions called for just enough carried momentum to position the market well enough to have a respectable follow-up year. Despite current headwinds–with inflation raging and interest rates rising–the market delivered on those predictions for the most part. It is highly unlikely and perhaps even impossible that we’ll see 2022’s activity reach or surpass the nearly $103 billion reported last year, but we had a healthy start. Overall, the net lease market reported approximately $21.7 billion in sales volume during first quarter 2022. While it’s a decrease of about 50 percent quarter-to-quarter, this was a very strong showing of above average quarterly volume which points to continued buyer demand.

By sector, the industrial net lease market continued to drive the bulk of investment activity, contributing $11.4 billion, or more than half of the quarter’s overall single-tenant net lease total. The office sector, powered by Google’s high-profile purchase of a single-asset Manhattan office building for a reported $1.9 billion, logged nearly $6.9 billion in total. Even without the Google transaction, the single-tenant office sector would have come close to meeting its historic average, indicating investor confidence has rebounded from the height of the pandemic when the future of office use was much more uncertain.

Lanie Beck joined Stan Johnson Co. in 2013. She oversees the firm’s corporate research efforts, publishing the quarterly MarketSnapshot report, the Viewpoint series of whitepapers and a variety of other thought leadership content. Beck is also responsible for leading Stan Johnson Co.’s corporate marketing, communications and public relations strategy, including the coordination of the firm’s social media presence, industry conference and event sponsorships, as well as management of the brand.

—Posted on Jun. 22, 2022

You must be logged in to post a comment.