2022 REIT Offerings

YTD capital raising from S&P Global Market Intelligence.

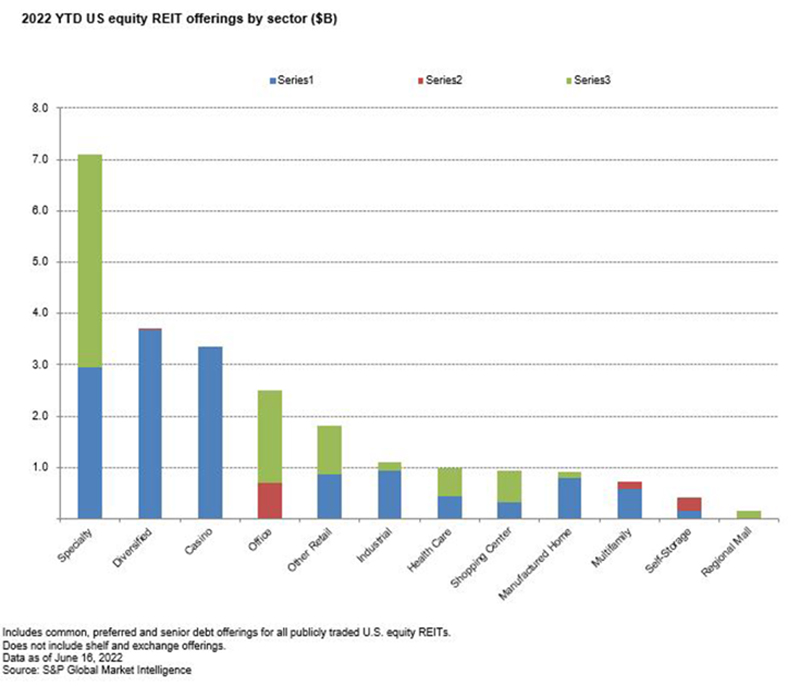

As of June 16, publicly traded U.S. equity REITs raised approximately $23.65 billion through capital offerings. Common equity offerings accounted for 60 percent of total capital raised, amounting to $14.12 billion, followed by senior debt and preferred issuances, which totaled $8.46 billion and $1.07 billion, respectively.

Specialty and diversified REITs topped the charts among property sectors. Among the specialty sector, American Tower Corp., raised $2.35 billion through a common equity offering, while diversified REIT Blackstone Real Estate Income Trust Inc. raised $2.83 billion via common equity offerings.

Winzen Matamorosa is a senior associate in the Real Estate Client Operations Department of S&P Global Market Intelligence.

If you are interested to learn more about the products and services available within S&P Global Real Estate data, please visit us here: https://www.spglobal.com/marketintelligence/en/campaigns/real-estate

You must be logged in to post a comment.