2022 REIT Trading Trends

The latest updates on the industrial and office sectors from S&P Global Market Intelligence.

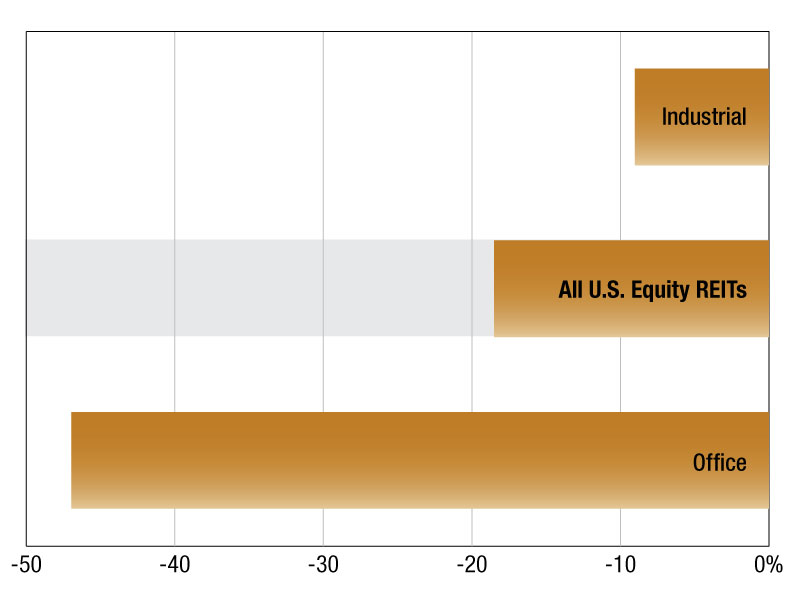

Median U.S. equity REIT premium to NAV by sector

As of December 1, 2022, publicly listed U.S. equity REITs traded at a median discount to consensus net asset value per share estimate of -18.51 percent.

The office sector traded at the greatest median discount to NAV estimates, at 46.96 percent. Meanwhile, Industrial property sector traded at 9.02 percent median discount to NAV estimates.

At the company level, industrial REIT, Terreno Realty Corporation traded at the largest premium to NAV estimate, at 6.94 percent. Right behind were Americold Realty Trust, Inc., and Prologis, Inc., trading at premiums to NAV estimates of 2.82 percent and 1.97 percent, respectively.

New York City REIT, Inc. traded at the largest discount to NAV estimate of all U.S. REITs, at 85.91 percent. Industrial Logistics Properties Trust an industrial REIT, and healthcare REIT, Diversified Healthcare Trust , were also at the bottom of the list with large discounts to NAV estimates of 83.78 percent and 65.65 percent, respectively.

Iman Niazi is an Associate in the Real Estate Client Operations Department of S&P Global Market Intelligence.

If you are interested to learn more about the products and services available within S&P Global Real Estate data, please visit us here: https://www.spglobal.com/marketintelligence/en/campaigns/real-estate

—Posted on Dec. 30, 2022

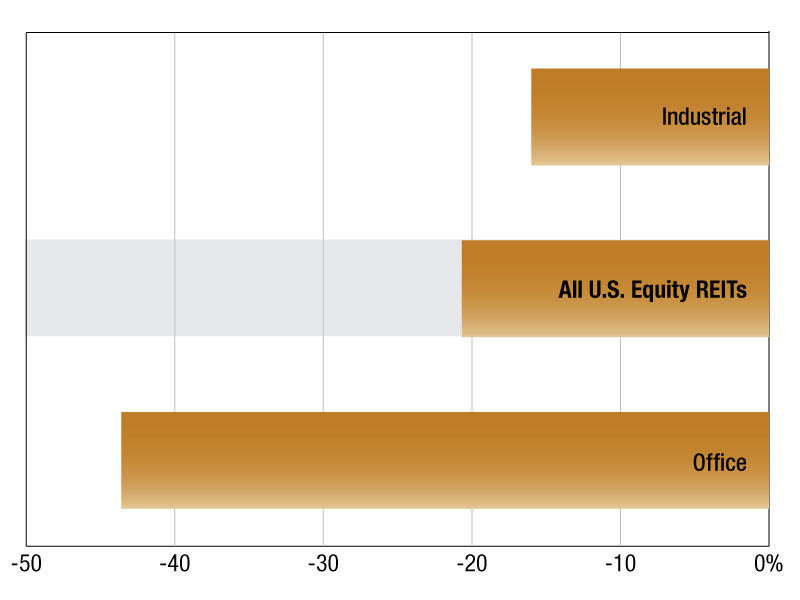

Median U.S. equity REIT premium to NAV by sector

As of July 1, publicly listed U.S. equity REITs traded at a median discount to consensus net asset value per share estimate of -20.7 percent.

The industrial sector traded at the greatest median discount to NAV estimate, at -16.0 percent. At the other end of the scale, the office sector traded at a discount of -43.6 percent, currently the greatest median discount to NAV estimate.

At the company level, industrial REIT Bluerock Residential Growth REIT Inc. traded at the largest premium to NAV estimate, at 31.4 percent. Right behind were Welltower Inc. and LTC Properties Inc., trading at premiums to NAV estimates of 28.8 percent and 23.5 percent, respectively.

New York City REIT Inc. traded at the largest discount to NAV estimate of all U.S. REITs, at -76.5 percent. Hudson Pacific Properties Inc. an office REIT, and regional mall, The Macerich Co., were also at the bottom of the list with large discounts to NAV estimates of -63.6 percent and -63.4 percent, respectively.

Iman Niazi is an Associate in the Real Estate Client Operations Department of S&P Global Market Intelligence.

If you are interested to learn more about the products and services available within S&P Global Real Estate data, please visit us here: https://www.spglobal.com/marketintelligence/en/campaigns/real-estate

—Posted on Jul. 27, 2022

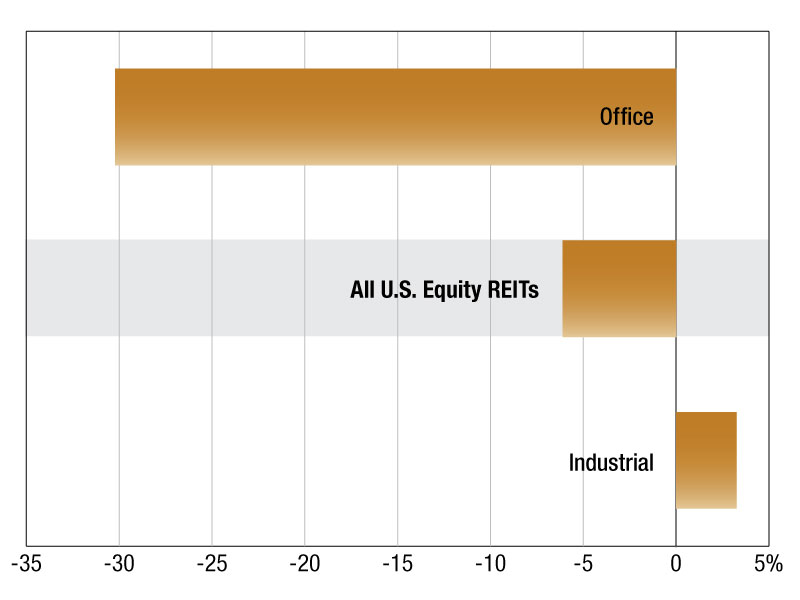

Median U.S. equity REIT premium to NAV by sector

As of Feb. 4, publicly listed U.S. equity REITs traded at a median discount to consensus net asset value per share estimate of 6.1 percent.

The industrial sector traded at the greatest median premium to NAV estimate, at 3.3 percent. At the other end of the scale, the office sector traded at a discount of 30.2 percent, currently the greatest median discount to NAV estimate.

At the company level, industrial REIT Innovative Industrial Properties Inc. traded at the largest premium to NAV estimate, at 63.6 percent. Right behind were EastGroup Properties Inc. and Rexford Industrial Realty Inc., trading at premiums to NAV estimates of 17.0 percent and 15.4 percent, respectively.

CIM Commercial Trust Corp. traded at the largest discount to NAV estimate of all U.S. REITs, at 62.8 percent. Medalist Diversified REIT Inc., a diversified REIT, and office REIT Office Properties Income Trust Inc., were also at the bottom of the list with large discounts to NAV estimates of 50 percent and 49.4 percent, respectively.

Winzen Matamorosa is an Associate in the Real Estate Client Operations Department of S&P Global Market Intelligence.

If you are interested in learning more about the products and services available within S&P Global Real Estate data, please visit us here.

—Posted on Feb. 28, 2022

You must be logged in to post a comment.