2023 CMBS Delinquency Rates

Trepp's monthly update.

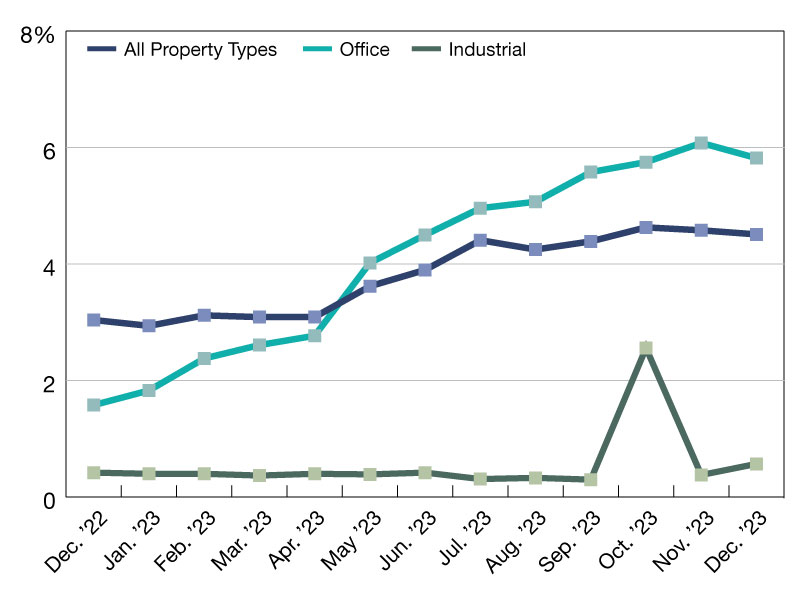

The Trepp CMBS Delinquency rate fell modestly again in December 2023. Overall, the delinquency rate fell seven basis points to 4.51 percent.

In the heavily watched office segment, delinquencies fell for the first time in several months. The office delinquency rate dropped 26 basis points to 5.82 percent.

If we included loans that are beyond their maturity date but current on interest, the delinquency rate would be 5.49 percent, down nine basis points from November.

The percentage of loans in the 30 days delinquent bucket is 0.23 percent, down nine basis points for the month.

Our numbers assume defeased loans are still part of the denominator unless otherwise specified.

—Posted on Jan. 31, 2024

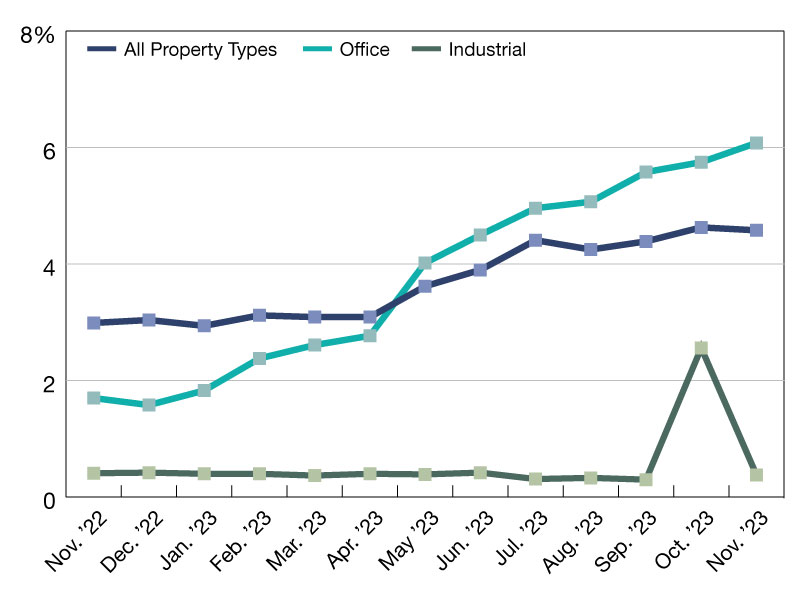

The Trepp CMBS Delinquency rate fell modestly in November 2023, but as with the October report, there were a lot of moving pieces.

Overall, the delinquency rate fell five basis points in November to 4.58 percent.

As we noted last month, one large industrial loan that went delinquent influenced the numbers considerably and blew up what was previously an incredibly low delinquency rate for that segment. That specific loan flipped back to current in November which means, in short, that while the industrial rate tumbled, the average rate on the remaining property types moved higher.

In the heavily-watched office segment, delinquencies rose another 33 basis points and the rate for that segment is now 6.08 percent.

Since the advent of the calculation, Trepp has not included delinquent loans that are past their maturity date but are current on interest payments in its headline number. That is because a significant number of these loans involve borrowers who are currently in the process of finalizing extension options that are included in the loan agreement. However, there is a growing trend among borrowers choosing to forego these extension options.

If we included loans that are beyond their maturity date but current on interest, the delinquency rate would be 5.58 percent, up 10 basis points from October.

The percentage of loans in the 30 days delinquent bucket is 0.32 percent, up seven basis points for the month.

Our numbers assume defeased loans are still part of the denominator unless otherwise specified.

—Posted on Dec. 18, 2023

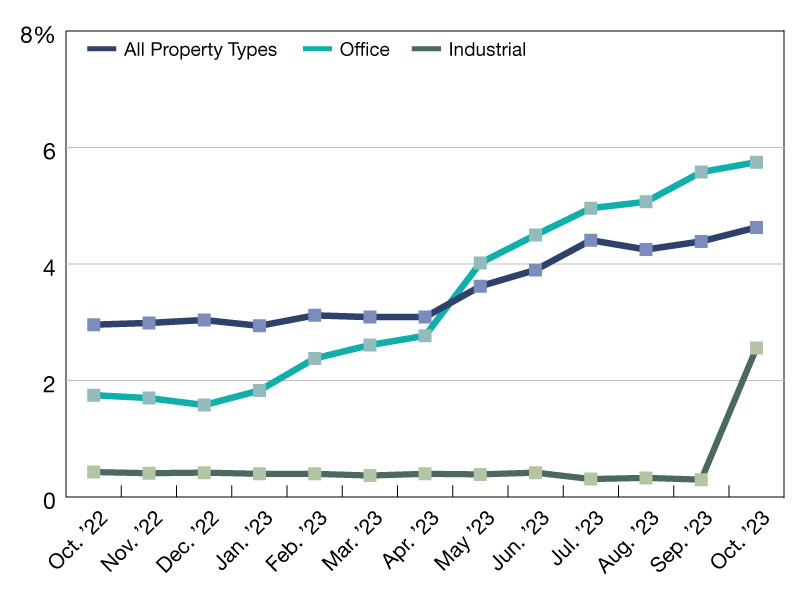

The Trepp CMBS Delinquency rate moved higher again in October 2023, but there were a lot of moving pieces in the latest report.

Overall, the delinquency rate rose 24 basis points in October to 4.63 percent. That is the highest reading since the end of the COVID-19 pandemic.

However, one large industrial delinquency influenced the numbers considerably and blew up what was previously an incredibly low delinquency rate for that segment. Trepp has more to share on that below.

In the heavily watched office segment, delinquencies rose another 17 basis points and the rate for that segment is now 5.75 percent.

Since the advent of the calculation, Trepp has not included delinquent loans that are past their maturity date but are current in interest payments in its headline number. That is because a significant number of these loans involve borrowers who are currently in the process of finalizing extension options that are included in the loan agreement.

However, there is a growing trend among borrowers choosing to forego these extension options.

If Trepp included loans that are beyond their maturity date but current on interest, the delinquency rate would be 5.48 percent, up from 5.17 percent in September.

The percentage of loans in the 30 days delinquent bucket is 0.25percent, down five basis points for the month.

—Posted on Nov. 30, 2023

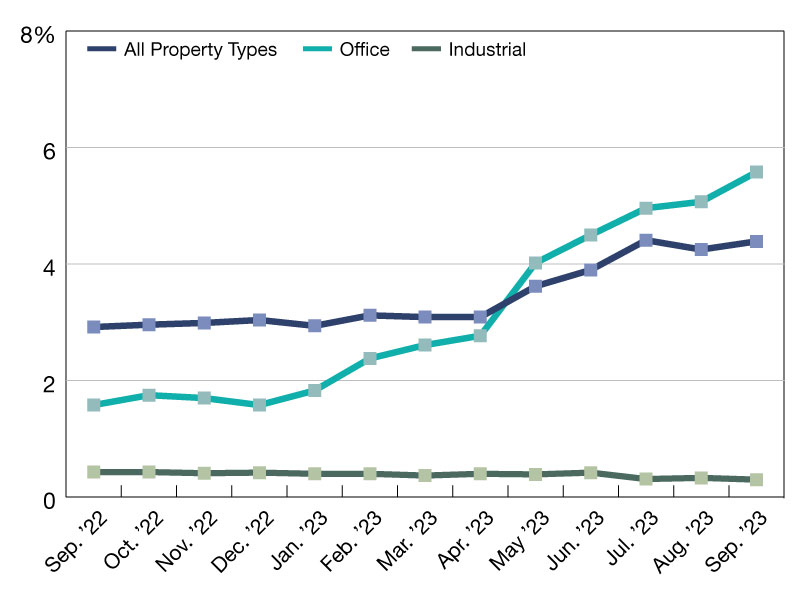

After a modest improvement in the delinquency rate in August 2023, the Trepp CMBS Delinquency rate moved higher again in September.

The uptick in September was due to another sharp increase in the delinquency rate for loans backed by office properties. All other major commercial property types saw only modest moves.

Overall, the delinquency rate rose 14 basis points to 4.39 percent. That is the second-highest reading since the end of the COVID-19 pandemic.

In the heavily watched office segment, delinquencies rose another 51 basis points and the rate for that segment is now 5.58 percent.

Since the advent of the calculation, Trepp has not included delinquent loans that are past their maturity date but are current in interest payments in its headline number. That is because a significant number of these loans involve borrowers who are currently in the process of finalizing extension options that are included in the loan agreement. However, there is a growing trend among borrowers choosing to forego these extension options.

If Trepp included loans that are beyond their maturity date but current on interest, the delinquency rate would be 5.17 percent, up from 5.01 percent from August.

The percentage of loans in the 30 days delinquent bucket is 0.30 percent – up six basis points for the month.

Our numbers assume defeased loans are still part of the denominator unless otherwise specified.

—Posted on Oct. 31, 2023

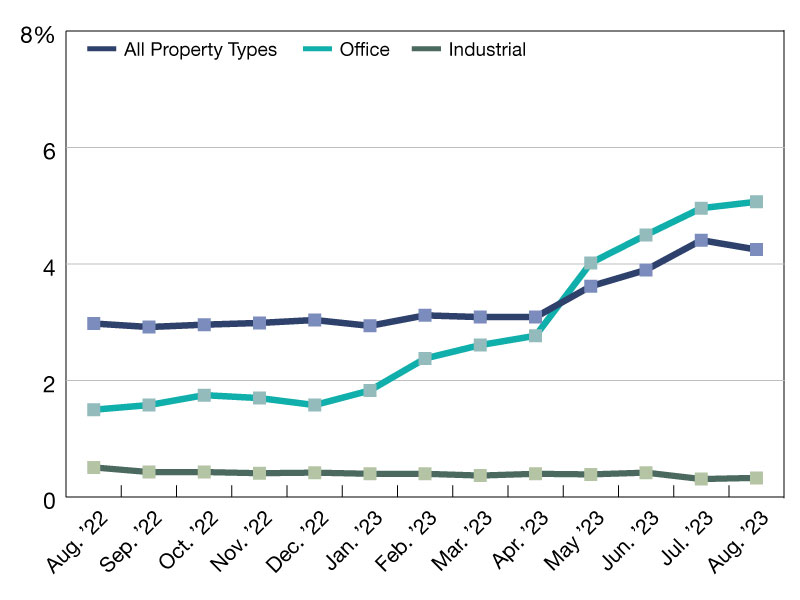

The commercial mortgage-backed securities (CMBS) market saw a modest reprieve from surging delinquencies in August as an improvement in the hotel market helped pull the headline number lower. However, it may be too early to start popping corks.

For four of the five major commercial real estate (CRE) property types, the rate inched up in August. In addition, the improvement in the hotel delinquency rate was driven by one large hotel loan seeing its status change modestly. This month’s data has a lot of nuances, so we encourage readers to parse and analyze it carefully.

Overall, the Trepp CMBS delinquency rate fell 16 basis points to 4.25 percent in August 2023. That represents the second decline in the last six months. In the heavily-watching office segment, delinquencies rose another 11 basis points and the rate for that segment is now 5.07 percent.

—Posted on Sep. 29, 2023

While the rest of the US economy has seen relief in terms of higher equity prices, better-than-expected corporate earnings, and falling inflation numbers, the commercial real estate (CRE) market continues to be left behind.

The Trepp commercial mortgage-backed securities (CMBS) delinquency rate jumped again in July 2023 with four of the five major property segments posting sizable increases. Overall, the delinquency rate rose 51 basis points to 4.41 percent. That is the highest level since December 2021.

Office delinquencies rose another 46 basis points and the rate for that segment is now 4.96 percent. The office delinquency rate is now up more than 350 basis points since the end of 2022. Since the advent of the calculation, Trepp has not included delinquent loans that are past their maturity date but are current in interest payments. That is because many of those loans are ones for which borrowers are in the process of finalizing extension options that are embedded in the loan. Now, however, borrowers are more often foregoing those extension options.

If Trepp included loans that are beyond their maturity date but current on interest, the delinquency rate would be 4.77percent (compared to 4.41percent). The percentage of loans in the 30 days delinquent bucket is 0.49 percent, up 31 basis points for the month.

Our numbers assume defeased loans are still part of the denominator unless otherwise specified.

—Posted on Aug. 31, 2023

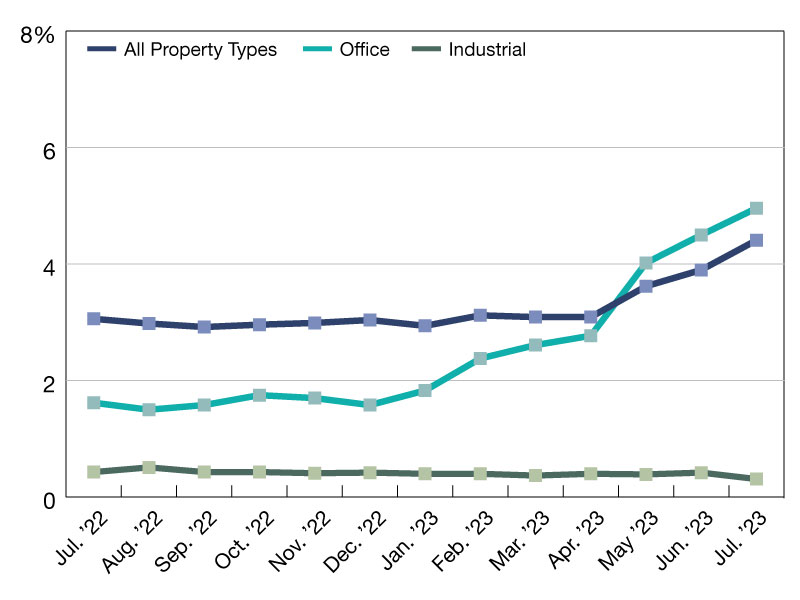

In May 2023, the commercial mortgage-backed securities (CMBS) market saw a noticeable uptick in delinquencies. The headline number hit its highest rate in 14 months. That trend continued in June 2023, although the rate of increase slowed somewhat for the overall number and the highly scrutinized office sector.

In June 2023, the overall CMBS delinquency rate rose 28 basis points to 3.90 percent.

The increase was driven by a large jump in hotel delinquencies. That was primarily a result of one big single asset, single-borrower (SASB) hotel loan that missed its balloon date.

Office delinquencies rose another 48 basis points, pushing the delinquency rate for that segment to 4.50 percent.

As noted, the Trepp CMBS Delinquency Rate jumped 28 basis points in June to 3.90 percent.

Since the advent of the calculation, Trepp has not included delinquent loans that are past their maturity date but current on interest payments. That is because many of those loans are ones for which borrowers are in the process of finalizing extension options embedded in the loan. However, now borrowers are more and more frequently foregoing those extension options.

—Posted on Jul. 24, 2023

CMBS investors and market participants have been waiting for months for delinquencies to spike. Since last summer, higher rates and lagging office demand have led to expectations of substantially higher delinquency levels.

It appears that the tipping point came in May 2023, when the overall CMBS delinquency rate shot up 53 basis points to 3.62 percent. The rate is at the highest level since March 2022.

The 53 basis point increase is the largest since June 2020, when delinquencies surged more than 3 percent.

The increase in May 2023 was driven by a huge spike in office delinquencies. The office rate jumped 125 basis points to 4.02 percent. The last time the office rate was above 4 percent was 2018. At that time, many loans originated in 2006 and 2007 were still outstanding, accounting for the high level. That is not the case currently.

Office has been the most heavily watched part of the market as firms look to aggressively reduce space. Sublease space is at or near record highs in many markets as demand from big tech firms has eroded sharply. In addition, many companies are letting leases expire or are renewing with smaller footprints.

At the end of May, Google announced it was offering up 1.4 million square feet in Northern California for sublease.

Since the advent of the calculation, Trepp has not included delinquent loans that are past their maturity date but are current in interest payments. That is because many of those loans are ones for which borrowers are in the process of finalizing extension options that are embedded in the loan. However, now borrowers are more and more foregoing those extension options.

If Trepp included loans that are beyond their maturity date but current on interest, the delinquency rate would be 4.99 percent. For CMBS 2.0+ loans, the rate would be 4.80 percent.

The percentage of loans in the 30 days delinquent bucket is 0.24 percent—up four basis points for the month.

Our numbers above reflect percentages that assume defeased loans are still part of the denominator.

—Posted on Jun. 26, 2023

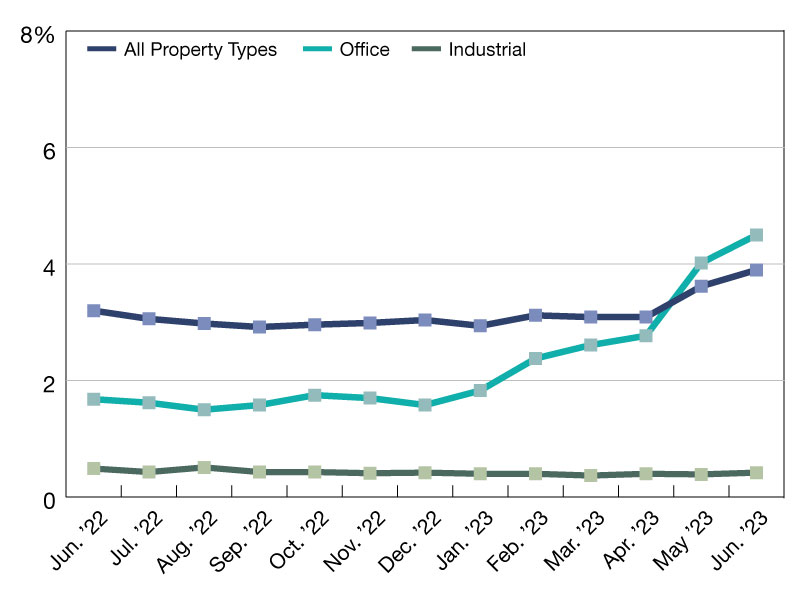

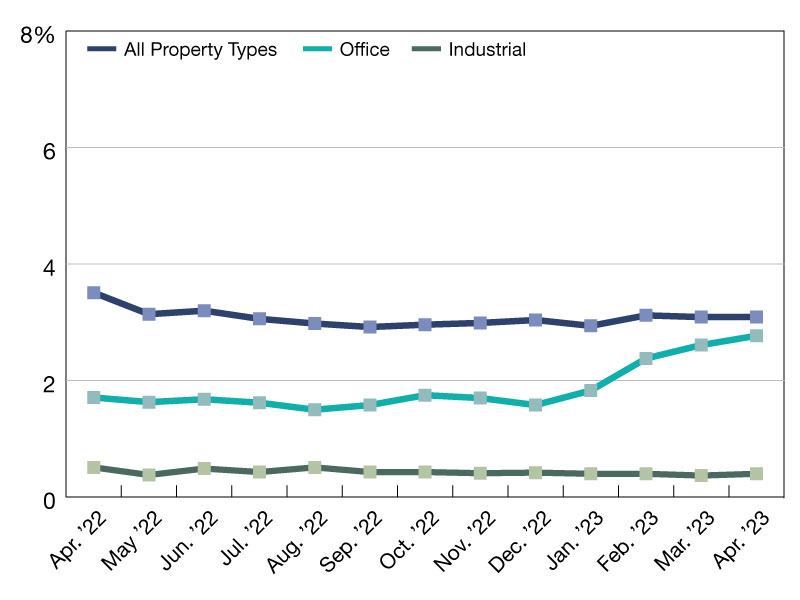

The Trepp CMBS Delinquency Rate held steady, but the segment that everyone continues to watch closely saw its rate move higher again in April 2023.

The Trepp CMBS Delinquency Rate was unchanged in April at 3.09 percent. Declines in the retail rate, lodging, and multifamily offset a small increase in industrial loans and a bigger increase for offices.

Office remains the most heavily watched part of the market as firms look aggressively to reduce space. Sublease space is at or near record highs in many markets as demand from big tech firms has eroded sharply. In addition, many companies are letting leases expire or are renewing for smaller footprints.

Last month, the Trepp CMBS Office Delinquency Rate rose another 16 basis points and is now up almost 1 percent over the last three months.

The percentage of loans in the 30 days delinquent bucket is 0.20 percent – down four basis points for the month.

Our numbers above reflect percentages that assume defeased loans are still part of the denominator.

—Posted on May 31, 2023

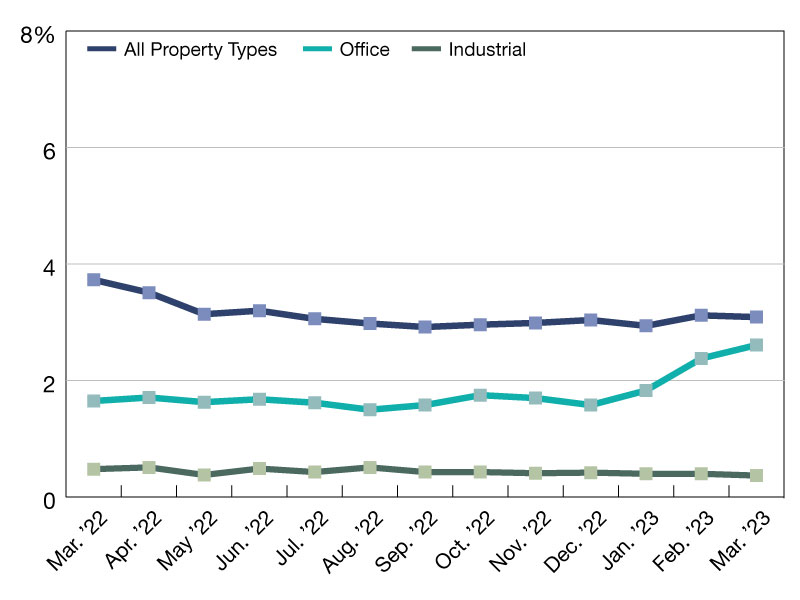

The Trepp CMBS Delinquency Rate fell slightly, but the segment that everyone continues to watch closely saw its rate move higher again in March.

The Trepp CMBS Delinquency Rate fell three basis points in March to 3.09 percent. A big decline in the retail rate, along with small improvements in industrial and hotel, helped the overall number. However, the office market – for which sentiment has turned sharply negative over the last few months – saw a sizable uptick last month. Concerns over the office segment were already high before 2023 over higher interest rates, looming maturity, falling values, and uncertainty about demand post-COVID.

The tone has gotten decidedly worse over the last three months as some big office loans (held by big property owners) have defaulted and/or been sent to special servicing.

In addition, a tightening of credit conditions in CMBS and with bank lending has made capital even more scarce. As noted, the Trepp CMBS Delinquency Rate fell three basis points in March to 3.09 percent.

The percentage of loans in the 30 days delinquent bucket is 0.24 percent – unchanged for the month. Our numbers above reflect percentages that assume defeased loans are still part of the denominator.

—Posted on Apr. 28, 2023

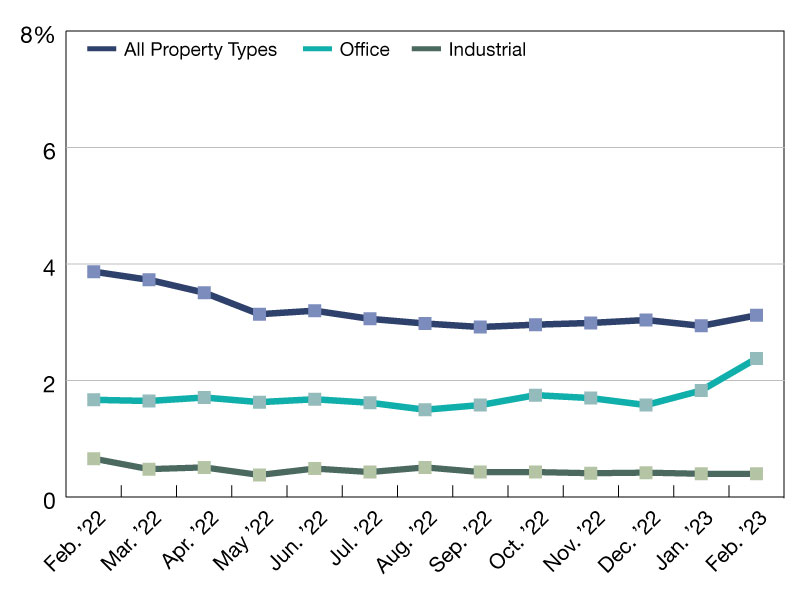

Even though expectations since June had been that commercial mortgage-backed securities (CMBS) delinquencies were poised to move higher, the reality was that until January, CMBS delinquencies only increased modestly from what was seen over the previous seven months.

That changed in February 2023, as the CMBS delinquency rate moved sharply higher. The Trepp CMBS Delinquency Rate moved up 18 basis points in February to 3.12 percent. That follows the January reading which was the second lowest since the onset of the COVID-19 pandemic.

The February jump of 18 basis points was the second largest increase since June 2020 when COVID-19 sent delinquency rates skyrocketing. Only December 2021 (up 19 basis points) saw a larger increase over the last 30 months.

The percentage of loans in the 30 days delinquent bucket is 0.24 percent, up 12 basis points for the month. Our numbers above reflect percentages that assume defeased loans are still part of the denominator.

—Posted on Mar. 29, 2023

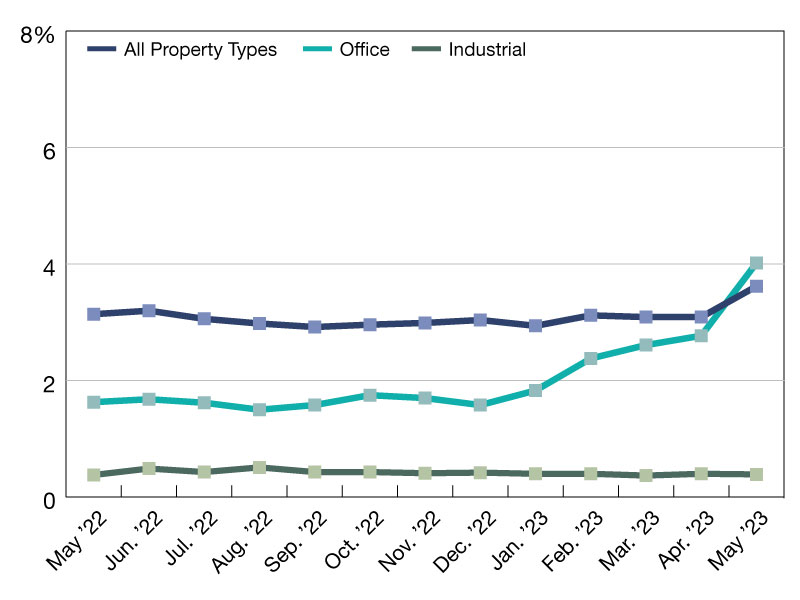

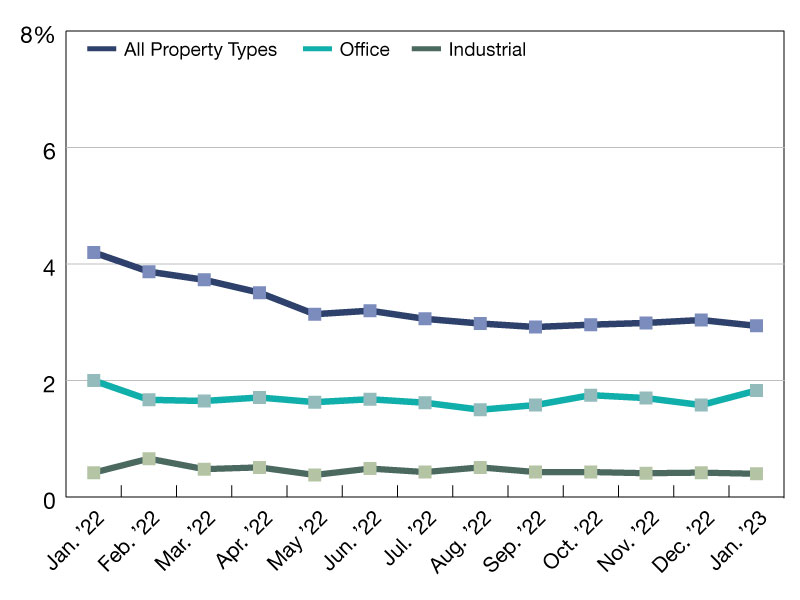

The narrative in the commercial mortgage-backed securities market since last summer has been that CMBS loans will not be easy to refinance in the current higher-interest-rate environment and that delinquencies will have nowhere to go but up. However, for the last several months, the delinquency rate has seen only de minimis increases, and now January 2023 data shows the rate decreased. For now, the data stands in contrast to the concerns put forth by many in the CMBS market over the last six months.

The Trepp CMBS Delinquency Rate fell 10 basis points in January to 2.94 percent. That is the second-lowest reading since the onset of the COVID-19 pandemic. Only the September 2022 reading of 2.92 percent was lower.

The percentage of loans in the 30 days delinquent bucket is 0.12 percent, down four basis points for the month.

Our numbers above reflect percentages that assume defeased loans are still part of the denominator.

—Posted on Feb. 28, 2023

You must be logged in to post a comment.