2023 Commercial REIT Dividend Yields

S&P Global’s latest snapshot compares the dividend yields of major asset categories.

Values shown are average by property type. As of Dec. 12, 2023.

Source: S&P Global Market Intelligence

As of Dec. 12, 2023, publicly traded U.S. equity REITs posted a one-year average dividend yield of 4.09 percent.

The health-care REIT sector recorded the highest one-year average dividend yield among this group, at 5.07 percent, outperforming the broader Dow Jones Equity All REIT Index by 0.98 percentage points. The self-storage sector followed with 4.21 percent.

The 10-Year T-Note outperformed the apartment REIT sector by 25.11 basis points. The apartment REIT sector logged a dividend yield of 3.70 percent.

On the other end of the spectrum, the manufactured homes REIT sector logged the lowest average dividend yield at 2.83 percent.

Jerra Joy Agravio is an associate in the Real Estate Client Operations Department of S&P Global Market Intelligence.

If you are interested to learn more about the products and services available within S&P Global Real Estate data, please visit us here:

—Posted on Dec. 18, 2023

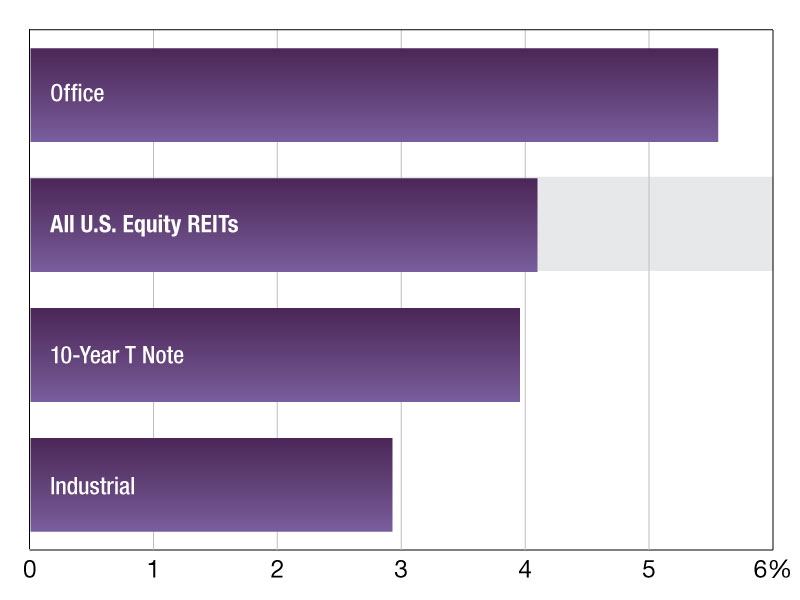

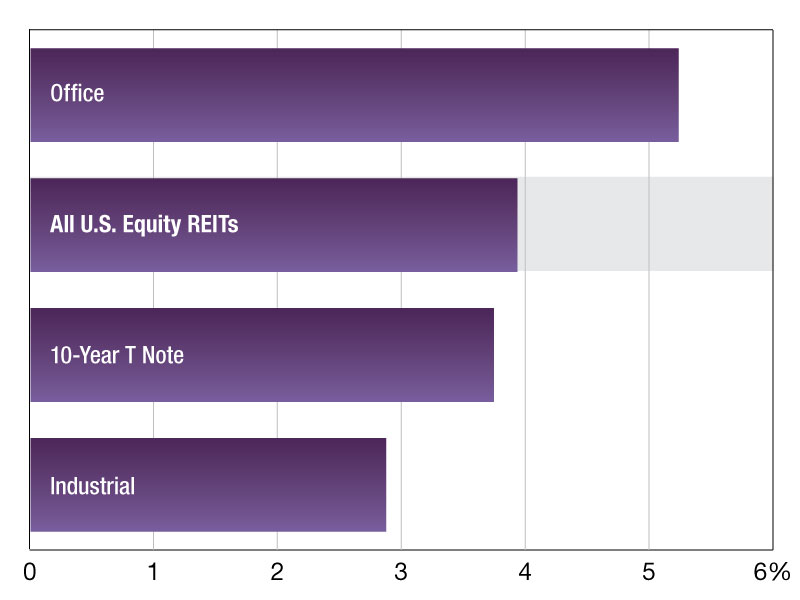

Values shown are average by property type. As of Sep. 4, 2023.

Source: S&P Global Market Intelligence

As of September 4, 2023 publicly traded U.S. equity REITs posted a one-year average dividend yield of 3.93 percent.

The office REIT sector recorded the highest one-year average dividend yield among this group, at 5.23 percent, outperforming the broader Dow Jones Equity All REIT Index by 1.30 percentage points.

The 10-Year T-Note outperformed the industrial REIT sector by 87 basis points. The industrial REIT sector also logged the lowest dividend yield with 2.87 percent.

— Iman Niazi is a Senior Associate in the Real Estate Client Operations Department of S&P Global Market Intelligence.

If you are interested to learn more about the products and services available within S&P Global Real Estate data, please visit us here: https://www.spglobal.com/marketintelligence/en/campaigns/real-estate

—Posted on Sep. 29, 2023

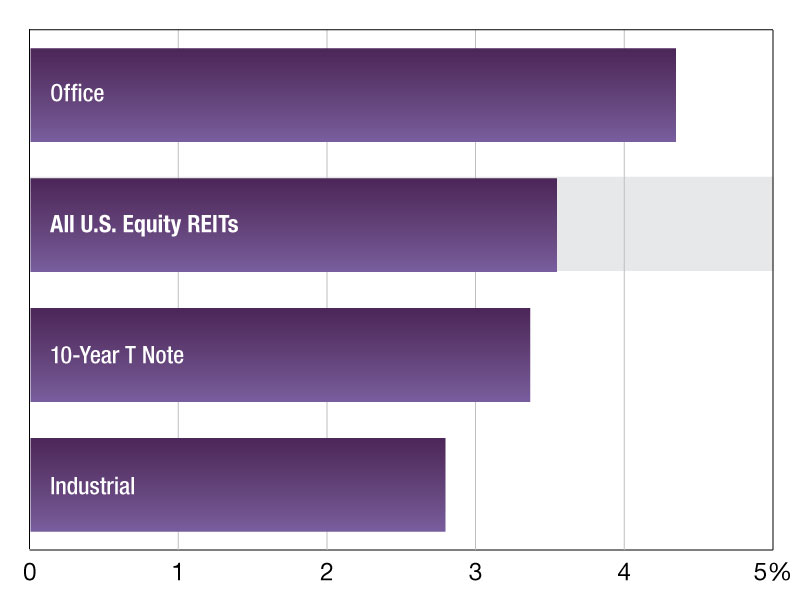

Values shown are average by property type. As of Mar. 30, 2023.

Source: S&P Global Market Intelligence

As of March 30, 2023 publicly traded U.S. equity REITs posted a one-year average dividend yield of 3.54 percent.

The Dow Jones U.S. Real Estate Office recorded the highest one-year average dividend yield among this group, at 4.34 percent, outperforming the broader Dow Jones Equity All REIT Index by 0.80 percentage points.

The 10-Year T-Note outperformed the industrial REIT sector by 58 basis points. The industrial REIT sector also logged the lowest dividend yield with 2.79 percent.

Jerra Joy Agravio is an Associate in the Real Estate Client Operations Department of S&P Global Market Intelligence.

If you are interested to learn more about the products and services available within S&P Global Real Estate data, please visit us here: https://www.spglobal.com/marketintelligence/en/campaigns/real-estate

—Posted on Apr. 28, 2023

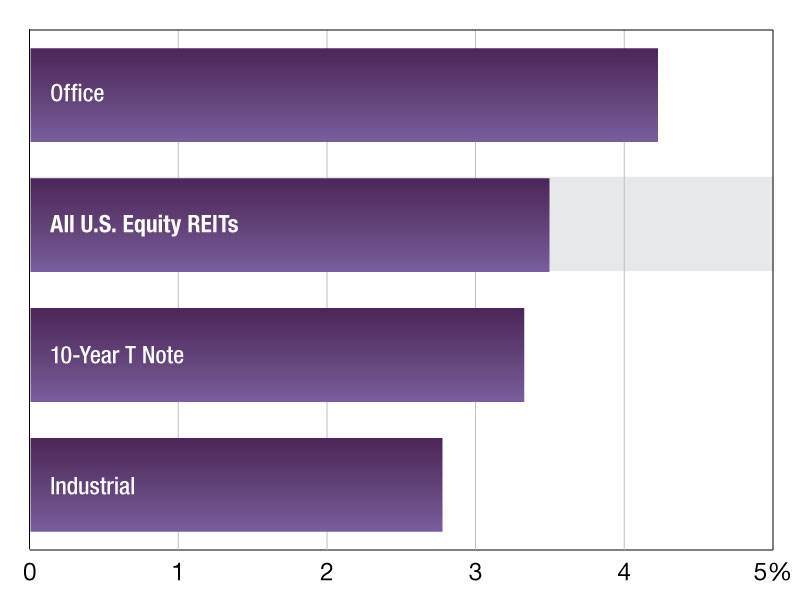

Values shown are average by property type. As of Mar. 15, 2023.

Source: S&P Global Market Intelligence

As of March 15, 2023 publicly traded U.S. equity REITs posted a one-year average dividend yield of 3.49 percent.

The office REIT sector recorded the highest one-year average dividend yield among this group, at 4.22 percent, outperforming the broader Dow Jones Equity All REIT Index by 0.73 percentage points.

The 10-Year T-Note outperformed the industrial REIT sector by 55 basis points. The industrial REIT sector also logged the lowest dividend yield with 2.77 percent.

Iman Niazi is an Associate in the Real Estate Client Operations Department of S&P Global Market Intelligence.

If you are interested to learn more about the products and services available within S&P Global Real Estate data, please visit us here: https://www.spglobal.com/marketintelligence/en/campaigns/real-estate

—Posted on Mar. 29, 2023

You must be logged in to post a comment.