2023 Net Lease Office Sales Volume and Cap Rates

While it’s no secret that the office sector has had its fair share of setbacks in recent years, the reality is likely less dramatic than some may suggest.

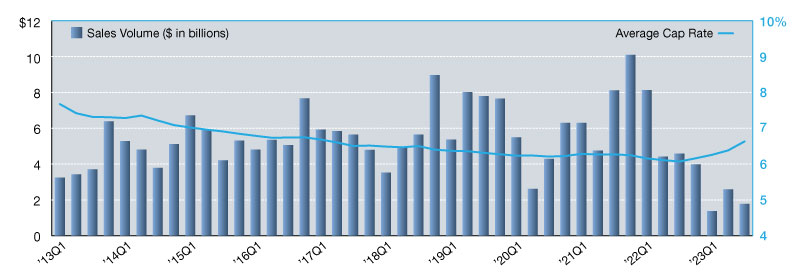

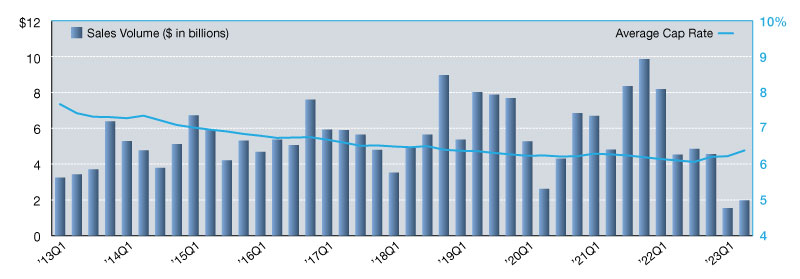

The single-tenant office market reported $1.78 billion in investment sales volume during third quarter 2023. This represents a 31 percent decline from second quarter, and activity levels are down 63 percent year-over-year. Furthermore, net lease office sales have dropped 82 percent from fourth quarter 2021’s all-time high. There are several reasons for the drastic decline in sales volume seen this year, with rising interest rates being a key factor. But will a stabilization or reduction in debt costs in 2024 and beyond be enough to lure investors back?

Healthcare continues to be an important subset of single-tenant office – helping to buoy recent activity – but investor demand for urgent cares, dialysis facilities, medical office buildings, and other specialty healthcare properties isn’t likely to translate to traditional office product. There should be continued crossover into research/development or lab space – critical office facilities that ultimately support the medical office sector – but with the bulk of office inventory being housed in more traditional urban high-rises, suburban office parks, and campus-style headquarters, general office owners have a more challenging road ahead.

While it’s no secret that the office sector has had its fair share of setbacks in recent years, the reality is likely less dramatic than some may suggest. Yes, values are falling, tenants are actively looking to give back unused space, owners are considering converting underutilized properties to multifamily or other commercial uses, and the entire sector is essentially looking at a reset. But to suggest that office is beyond repair or irredeemable is simply reckless. This is not the first time commercial real estate investment activity has declined substantially, nor is it the first time owners have been faced with the threat of distressed loans or high vacancies. The future of the office sector may be unknown or unclear right now, but that’s normal during any transition period. Office owners and investors will need to weather the storm and find ways to keep and attract tenants in the near term, while evaluating creative solutions for generating long-term value for their assets. There will continue to be users and buyers of office space – just don’t expect future-state to exactly resemble the past.

Lanie Beck is the Senior Director of Content & Marketing Research at Northmarq. She is responsible for leading the content strategy for the firm and producing research reports in support of the organization’s commercial investment sales division. Beck joined Northmarq in 2022 following the acquisition of Stan Johnson Company, where she had led corporate research, marketing and communications efforts since 2013.

—Posted on Jan. 30, 2024

For the first time in 11 years, the single-tenant office sector has reported two consecutive quarters of investment sales activity below the $2.0-billion mark. Combined with a general sense of market uncertainty, office investors are now questioning the future of the asset class. Many employers are continuing to struggle with the decision of whether to require workers to return to the office full-time, which is leading to reductions in occupied square footage, higher sublease availability, and declining rental rates. Some landlords are fielding requests from tenants to buy out remaining lease term, while others are evaluating multifamily conversion opportunities.

Despite current-day challenges that are causing investors to take pause, there remain bright spots across the sector. First, general office space is unlikely to become obsolete. Instead, we’ll likely witness a shift over the coming years as companies evolve to attract and meet the needs of the next generation of their workforces, which will result in physical office spaces evolving too. Additionally, medical office, as a subset of the larger office sector, continues to offer net lease investors tremendous opportunities. Our aging, and growing, population is driving the need for every type of healthcare facility – from ambulatory surgery and urgent care centers to dialysis facilities and freestanding emergency rooms. Traditional doctor’s offices, including dentists, family physicians, veterinarians, and more, also continue to offer investment opportunities in today’s high demand environment. Lastly, less traditional office space is a niche sector to watch as well. Lab facilities, call centers, and other specialty office assets present opportunities as they support fast growing sectors like pharmaceutical and technology, among others.

Single-tenant office cap rates are currently the highest across the net lease sectors, with a mid-year average of 6.38 percent. This reflects a 16-basis point increase from the previous quarter, and rates are now 35 basis points higher than the sector’s record low set in third quarter 2022. With interest rates expected to remain elevated, investors are likely to see additional cap rate expansion in the second half of 2023.

Lanie Beck is the Senior Director of Content & Marketing Research at Northmarq. She is responsible for leading the content strategy for the firm and producing research reports in support of the organization’s commercial investment sales division. Beck joined Northmarq in 2022 following the acquisition of Stan Johnson Company, where she had led corporate research, marketing and communications efforts since 2013.

—Posted on Sep. 29, 2023

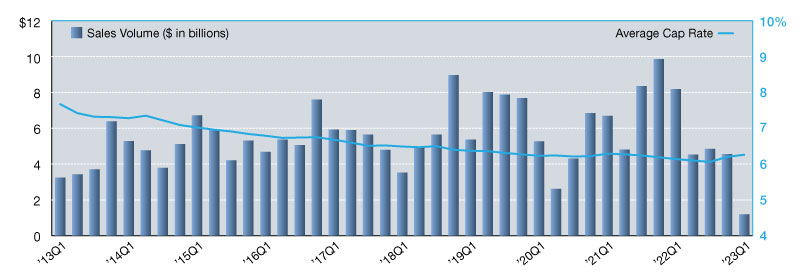

Single-tenant office assets have fallen further and further out of favor with investors in recent months due to uncertainty in today’s market. Rising interest rates and remote work continue to cloud the sector’s long-term outlook and, as a result, we’ve seen investment sales volume plummet 74 percent quarter-over-quarter and more than 85 percent year-over-year. In first quarter 2023, transaction volume totaled just shy of $1.2 billion, marking the lowest level of quarterly activity reported since late 2009.

Current sales volume has been impacted greatly by a reduction in larger office sales. First quarter 2023 saw very few suburban corporate headquarters, single-occupier campuses, or downtown high-rises trade hands. Instead, early 2023 activity was dominated by healthcare, medical office and smaller traditional office sales in the $2 to $10 million range. Not surprisingly, this shift in asset class popularity has impacted buyer distribution. Institutional investors, which typically comprise one-quarter to one-third of the single-tenant office buyer pool, only represented five percent during first quarter. This investor profile often gravitates toward larger single-tenant assets and portfolios, and in the absence of those trading, the market has seen a significant pullback from institutions. Private buyers, on the other hand, now represent half of today’s net lease office buyer pool, capturing higher market share compared to previous years with so many smaller assets transacting. Today’s environment is creating opportunities for all-cash buyers and those seeking sale leasebacks, as well as investors interested in purchasing smaller assets.

Average cap rates across the single-tenant office market have reported two consecutive quarters of increases. At 6.26 percent, average rates now sit 20 basis points above the record low set in third quarter of last year. With cap rates so closely tied to interest rates, all signs point to continued upward movement in future quarters, although some minor fluctuation could be seen.

Lanie Beck is the Senior Director of Content & Marketing Research at Northmarq. She is responsible for leading the content strategy for the firm and producing research reports in support of the organization’s commercial investment sales division. Beck joined Northmarq in 2022 following the acquisition of Stan Johnson Company, where she had led corporate research, marketing and communications efforts since 2013.

—Posted on Jul. 24, 2023

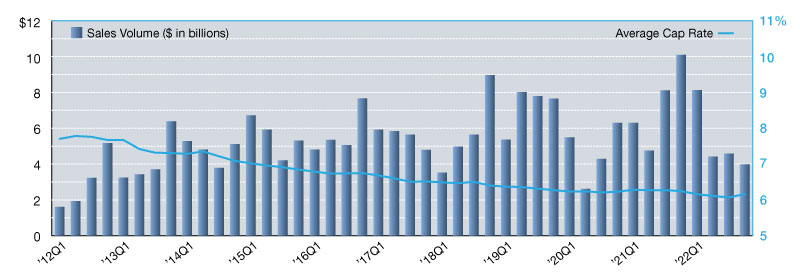

Investment sales activity across the single-tenant office sector has cooled in recent quarters. While strong momentum carried over from 2021 into the first quarter of this year, the last nine months have not kept pace. Approximately $4.0 billion in office sales volume was reported during fourth quarter 2022, representing a 13 percent decline quarter-to-quarter and 59 percent year-over-year. Despite the slowdown that has impacted the entire market in recent months, the single-tenant office sector still witnessed a handful of high-profile transactions across traditional office assets, medical office buildings, life science facilities, government-leased properties, and more. Additionally, suburban markets as well as urban, CBD districts both continued to see investor interest, and office portfolio transactions – while down substantially this year – still contributed more than 25 percent of investment activity in 2022.

One trend to watch in 2023 and beyond will be cross-border investment activity. Over the past decade, international investors have been infrequent sellers of net lease office product, typically comprising less than 5 percent of market share, and more active on the buy-side, with 10 to 25 percent market share in any given year. In the last 12 months, we’ve seen a reversal of that trend with 17.4 percent of single-tenant office transactions involving a non-U.S.-based seller, while only 5.4 percent of transactions included a cross-border buyer. If this pattern continues, investors may see an uptick in supply if additional international investors look to divest of quality assets or portfolios.

Lanie Beck is the Senior Director of Content & Marketing Research at Northmarq. She is responsible for leading the content strategy for the firm and producing research reports in support of the organization’s commercial investment sales division. Beck joined Northmarq in 2022 following the acquisition of Stan Johnson Company, where she had led corporate research, marketing and communications efforts since 2013.

—Posted on Apr. 28, 2023

You must be logged in to post a comment.