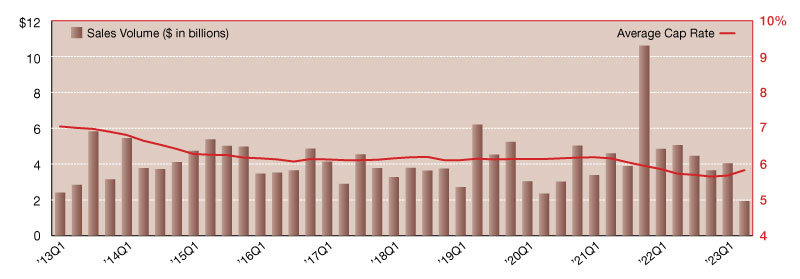

2023 Net Lease Retail Sales Volume & Cap Rates

Investment sales activity within the single-tenant net lease retail sector reported a substantial drop off during second quarter 2023.

Investment sales activity within the single-tenant net lease retail sector reported a substantial drop off during second quarter 2023. In just the last three months, we’ve seen sales volume plummet nearly 52 percent, as just $1.9 billion in sales were logged for the quarter. Without a resurgence in activity, year-to-date totals put the sector only on pace to reach $12 billion for the year, producing an annual performance that would be on par with levels last seen in 2012.

Still, net lease retail assets are in high demand with investors, even if some have elected to temporarily pause while they evaluate today’s shifting market. Freestanding grocery stores, including brands such as Whole Foods, Stop & Shop, and Walmart Neighborhood Market, as well as discount clubs like BJ’s Wholesale Club, were among the highest priced single-store transactions of the last quarter, suggesting investors and consumers alike continue to view these stores as essential retailers. Also of note, today’s post-pandemic environment has seen a resurgence of interest in fitness centers, with LA Fitness, Planet Fitness and a handful of smaller or regional brands trading in recent months. Drugstores remain popular with net lease investors, as do quick service restaurants, dollar stores, and automotive retailers, among others.

The most significant influence on investment activity levels has been rising interest rates, which subsequently has impacted cap rates. Following a 15-basis point increase over the last three months, the mid-year average sits at 5.83 percent. While additional upward movement is expected, future quarterly cap rate increases for net lease retail aren’t likely to be quite as dramatic as seen during second quarter 2023, pending any major market disrupters. Instead, investors should expect a general upward trend with quarterly basis point changes in the single digits.

—Posted on Oct. 31, 2023

Lanie Beck is the Senior Director of Content & Marketing Research at Northmarq. She is responsible for leading the content strategy for the firm and producing research reports in support of the organization’s commercial investment sales division. Beck joined Northmarq in 2022 following the acquisition of Stan Johnson Company, where she had led corporate research, marketing and communications efforts since 2013.

You must be logged in to post a comment.