2023 REIT Trading Trends

Median U.S. equity REIT premium to NAV by sector, according to S&P.

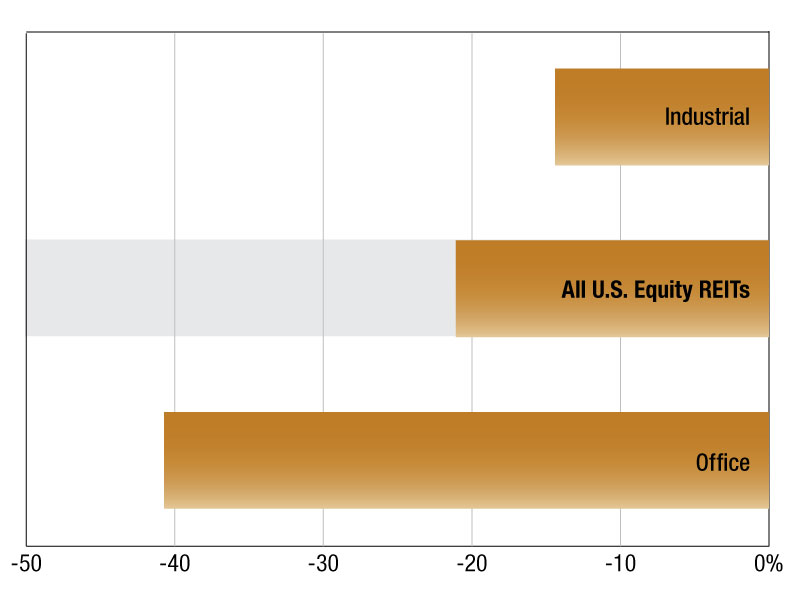

Median U.S. equity REIT premium to NAV by sector

As of Nov. 30, publicly listed U.S. equity REITs traded at a median discount to consensus net asset value per share estimate of 21.08 percent.

The industrial sector traded at the lowest median discount to NAV estimate at 14.40 percent.

At the other end of the spectrum, the office sector traded at the highest median discount to NAV estimate at 40.73 percent.

At the company level, Health Care REIT Welltower Inc. traded at the largest premium to NAV estimate at 50.52 percent. This was followed by CareTrust REIT Inc. and Iron Mountain Inc. trading at premiums/discounts to NAV estimates of 33.89 percent and 23.70 percent, respectively.

Ashford Hospitality Trust, Inc. traded at the largest discount to NAV estimate of all U.S. REITs, at 85.19 percent. At the bottom of the list are Office REITs, Office Properties Income Trust and Creative Media & Community Trust Corp., with large discounts to NAV estimates of 80.09 percent and 74.23 percent, respectively.

Saima Yasmin is an associate in the Real Estate Client Operations Department of S&P Global Market Intelligence.

If you are interested to learn more about the products and services available within S&P Global Real Estate data, please visit us here: https://www.spglobal.com/marketintelligence/en/campaigns/real-estate

—Posted on Dec. 18, 2023

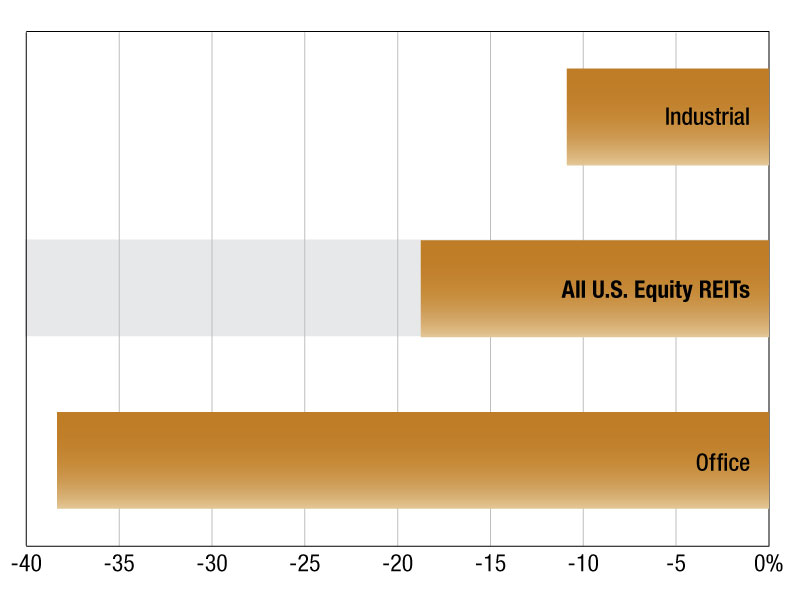

Median U.S. equity REIT premium to NAV by sector

As of August 1, 2023, publicly listed U.S. equity REITs traded at a median discount to consensus net asset value per share estimate of 18.75 percent.

The Industrial sector traded at the lowest median discount to NAV estimate, at 10.88 percent.

At the other end of the scale, the office sector traded at a discount of 38.34 percent, currently the greatest median discount to NAV estimate.

At the company level, Industrial REIT, EastGroup Properties, Inc. traded at the highest premium to NAV estimate, at 4.36 percent. This was followed by Americold Realty Trust, Inc. and Terreno Realty Corporation trading at discounts to NAV estimates of 0.35 percent and 3.51 percent, respectively.

Ashford Hospitality Trust, Inc. traded at the highest discount to NAV estimate of all U.S. REITs, at 75.95 percent. At the top of the list are Office Properties Income Trust and Hudson Pacific Properties, Inc. with large discounts to NAV estimates of 73.78 percent and 71.78 percent, respectively.

-Jerra Joy Agravio is an associate in the Real Estate Client Operations Department of S&P Global Market Intelligence.

If you are interested to learn more about the products and services available within S&P Global Real Estate data, please visit us here: https://www.spglobal.com/marketintelligence/en/campaigns/real-estate

—Posted on Aug. 31, 2023

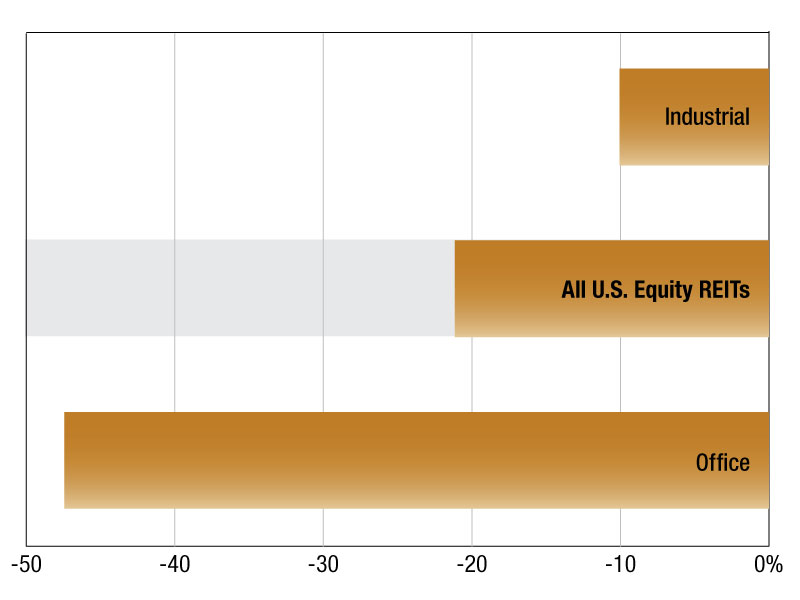

Median U.S. equity REIT premium to NAV by sector

As of June 29, publicly listed U.S. equity REITs traded at a median discount to consensus net asset value per share estimate of 21.14 percent.

The Industrial sector traded at the greatest median discount to NAV estimate, at 10.06 percent.

At the other end of the scale, the office sector traded at a discount of 47.43 percent, currently the greatest median discount to NAV estimate.

At the company level, EastGroup Properties Inc., an industrial REIT, traded at the largest premium to NAV estimate, at 4.38 percent. This was followed by Americold Realty Trust, Inc. and Terreno Realty Corp. trading at premiums/discounts to NAV estimates of 1.95 percent and -0.25 percent, respectively.

Hudson Pacific Properties, Inc. traded at the largest discount to NAV estimate of all U.S. REITs, at 78.54 percent. Also at the bottom of the list are Ashford Hospitality Trust Inc. and Franklin Street Properties Corp., with discounts to NAV estimates of 75.47 percent and 73.51 percent, respectively.

Saima Yasmin is an Associate in the Real Estate Client Operations Department of S&P Global Market Intelligence.

If you are interested to learn more about the products and services available within S&P Global Real Estate data, please visit us here: https://www.spglobal.com/marketintelligence/en/campaigns/real-estate

—Posted on Jul. 25, 2023

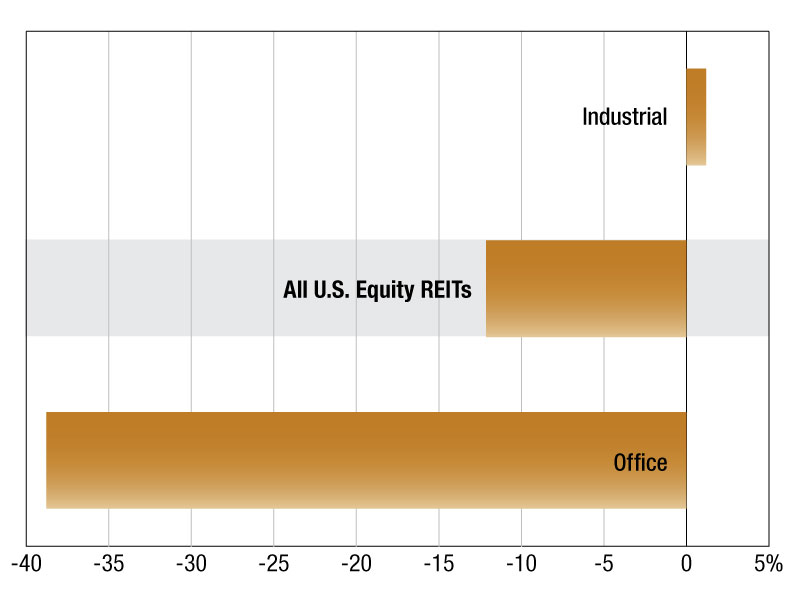

Median U.S. equity REIT premium to NAV by sector

As of February 2, 2023, publicly listed U.S. equity REITs traded at a median discount to consensus net asset value per share estimate of -12.14 percent.

The Industrial sector traded at the greatest median discount to NAV estimate, at 1.19 percent.

At the other end of the scale, the office sector traded at a discount of -38.78 percent, currently the greatest median discount to NAV estimate.

At the company level, Industrial REIT, Terreno Realty Corporation traded at the largest premium to NAV estimate, at 21.68 percent. This was followed by Rexford Industrial Realty, Inc. and Prologis, Inc. trading at premiums to NAV estimates of 21.30 percent and 9.20 percent, respectively.

New York City REIT, Inc. traded at the largest discount to NAV estimate of all U.S. REITs, at -90.82 percent. At the bottom of the list are Healthcare REIT, Diversified Healthcare Trust and Industrial Logistics Properties Trust, with large discounts to NAV estimates of -73.29 percent and 67.12 percent, respectively.

Jerra Joy Agravio is an Associate in the Real Estate Client Operations Department of S&P Global Market Intelligence.

If you are interested to learn more about the products and services available within S&P Global Real Estate data, please visit us here: https://www.spglobal.com/marketintelligence/en/campaigns/real-estate

—Posted on Feb. 28, 2023

You must be logged in to post a comment.