2024 Net Lease Sales Volume and Cap Rates

Top trends impacting the market according to Northmarq.

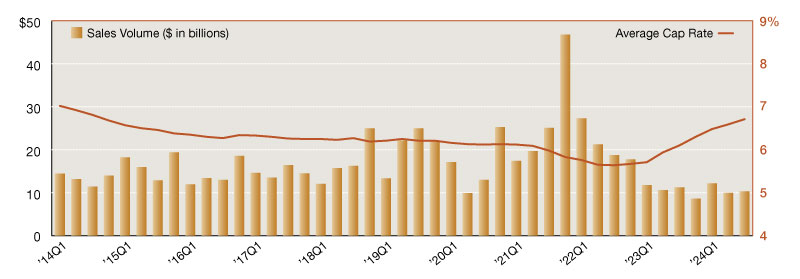

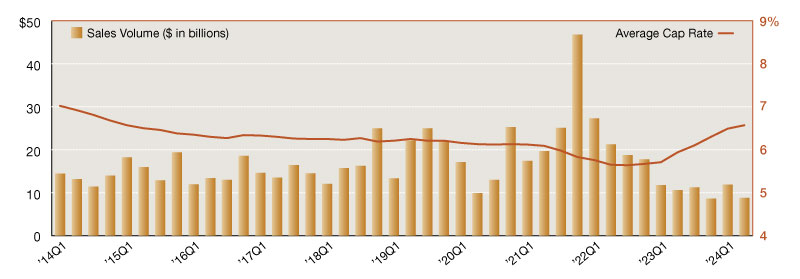

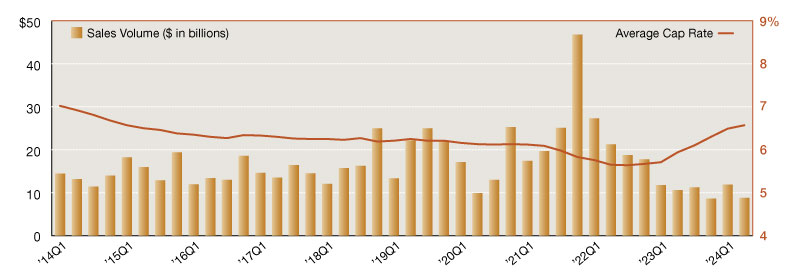

As 2024 drew to a close, the single-tenant net lease market showed a welcomed burst of activity, wrapping up the year with impressive growth in the final quarter. While many investors had been cautious earlier in the year, the year-end push offers hope for a more active 2025. The fourth-quarter total of $13.8 billion in investment sales—a 57.6 percent increase from the same period last year—signals not just an uptick in transactions but a resurgence of confidence in the market. Investors who had been holding off earlier in 2024 are now jumping back in, showing that despite the uncertainty, the sector still has strong appeal.

Cap rates have climbed steadily for nine consecutive quarters and now average 6.78 percent. While the increase of just nine basis points in fourth quarter may seem minor, it’s a signal of broader market shifts. Investors are still adjusting to higher borrowing costs, and 1031 exchange buyers have pulled back significantly. The rise in cap rates signals a shift in the pricing of risk in today’s cautious environment.

A difficult investor environment

Navigating the market in 2024 hasn’t been easy for net lease investors. With inflationary pressures, interest rate hikes, and murky forecasts for Federal Reserve policy, investors have had to be far more strategic. For many, balancing short-term market volatility with long-term investment goals has been a challenge. The uncertainty driven by the election season only added another layer of complexity, as buyers weighed the political landscape along with financial pressures.

Despite these pressures, the resilience of the net lease market is no accident. The sector’s stability—driven by long-term leases with creditworthy tenants and low tenant turnover—has kept investor interest strong. Even in the face of rising interest rates, these fundamentals continue to provide a buffer against broader economic fluctuations.

Looking ahead to 2025, new challenges will undoubtedly arise, from regulatory changes to evolving capital markets. But with strategic planning and a focus on core fundamentals, net lease investors can weather these uncertainties. For those who’ve been waiting for the right moment, it may finally be time to act – especially with the market showing promising signs of stabilization after a volatile year.

—Posted on February 27, 2025

The single-tenant net lease market posted a slight uptick in transaction volume during third quarter 2024, with $10.3 billion in sales volume reported. While this represents a 3.6 percent rise from last quarter, year-over-year activity remains down. However, just this small increase now puts the net lease sector on track to outpace 2023’s annual total, as nearly $32.5 billion has been logged in 2024 year-to-date.

The industrial sector remained the dominant contributor to investment sales activity, representing 61.5 percent of this quarter’s volume. While net lease industrial witnessed a healthy increase in transaction volume, the retail sector reported a much more modest quarter-to-quarter increase, as the office sector reported a second straight quarter of declining sales volume.

Cap rates continued to rise across all net lease sectors, with the overall single-tenant average reaching 6.71 percent in third quarter. Up 12 basis points in the last three months, average cap rates have now increased steadily for eight consecutive quarters.

Several disrupters are set to influence investor sentiment in the final months of the year. With the U.S. Presidential election right around the corner and continued uncertainty regarding the timing and severity of interest rate cuts, it remains to be seen whether potential buyers will make a push to close deals before year-end, or if appetites will cool in hopes of a more favorable environment in 2025.

—Posted on November 27, 2024

At mid-year 2024, the overall single-tenant net lease market continued to struggle with reduced investment sales activity. Office volume was down approximately 43 percent from last quarter, and retail property transactions fell 56 percent in the last three months. The 17 percent boost in quarterly industrial activity was only enough to push the combined volume to $8.8 billion, making it the second slowest quarter of sales activity in over ten years. At this time, and without an uptick in volume during the second half of 2024, it’s likely the market will fall short of matching last year’s stunted totals.

Even with one or two interest rate cuts this year, which are still far from guaranteed, the market will need time to react and adjust. Activity is not expected to balloon overnight, although transaction volume will almost certainly increase somewhat in response to more affordable debt. Rather, investment sales between now and year-end will primarily be driven by upcoming loan maturities, opportunistic acquisitions of distressed assets, 1031 exchange activity and other tax-motivated investment decisions. Elevated interest rates, coupled with the upcoming U.S. presidential election, have created a muddy, uncertain environment that many investors are simply waiting out if they have that luxury.

With today’s shifting market conditions, property values have dropped. Average cap rates for the overall net lease market have been on an upward trajectory since bottoming out in third quarter 2022. In the last seven quarters, cap rates have increased 93 basis points to the current average of 6.57 percent. While the last three months saw a decline in average cap rates for the single-tenant office and industrial sectors, further reductions are not expected. Instead, cap rates across all net lease sectors may experience some fluctuation quarter to quarter, especially if transaction volume remains slow.

—Posted on August 28, 2024

During the first quarter of 2024, the single-tenant net lease market reported rebounding investment sales activity as levels increased to $11.2 billion—up more than 26 percent from the previous quarter. While this represents a slight 4.5 percent decline compared to this time last year, the market has performed consistently in four out of the last five quarters, with the first three months of 2024 putting the market on a promising trajectory to surpass 2023’s total.

Average cap rates for the combined net lease sector increased 20 basis points during first quarter to 6.50 percent—the highest average seen since mid-2015. Unsurprisingly, single-tenant office cap rates are the highest at 6.81 percent, while retail remains the lowest at 6.38 percent. Year-over-year, however, the net lease industrial sector has seen the most significant increases. At 6.55 percent, industrial cap rates now sit 102 basis points higher than this time last year. As buyers and sellers continue to adjust their pricing expectations in today’s market, further increases across all sectors should be expected as we move through 2024.

Buyer distribution

One notable trend across the single-tenant net lease market is a shift in buyer distribution. The most dominant investor group in the last decade has been private buyers, regularly capturing between one-third and one-half of all net lease activity. In the first three months of 2024, that dynamic shifted as public REITs became more active.

With 36 percent of the overall single-tenant market, public REITs also dominated market share in the office and retail sectors. They were less involved in industrial acquisitions though, outpaced by a noticeable uptick in foreign capital investment.

These observations don’t mean private investors are out of the market, however. Ratios are likely to even out as the year progresses, but with interest rates still elevated, some individual investors who aren’t being driven to act by a 1031 exchange, for example, might decide to rest on the sidelines for a little while longer.

Lanie Beck is the Senior Director of Content & Marketing Research at Northmarq. She is responsible for leading the content strategy for the firm and producing research reports in support of the organization’s commercial investment sales division.

—Posted on April 28, 2024

You must be logged in to post a comment.