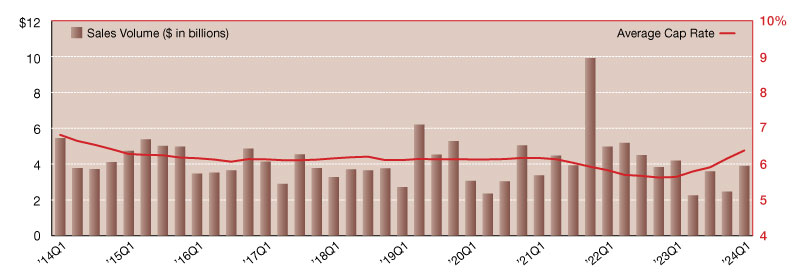

2024 Single-Tenant Retail Quarterly Sales Volume & Cap Rates

Northmarq's update on the sector's investment activity.

Over the last two years, the single-tenant net lease retail sector has experienced its ups and downs as it pertains to investment sales volume. In this time, the market has reported moments of both robust and sluggish activity in alternating quarters. Third quarter 2024, however, witnessed a continuation of second quarter’s slump, with approximately $2.4 billion in transactions recorded. While this represents a 14.6 percent jump over last quarter’s totals, net lease retail sales volume remains depressed, and only $8.6 billion has been logged year-to-date. At this point, the sector is not on track to meet 2023’s annual transaction volume, which would make this year the slowest in over a decade.

READ ALSO: What’s in Store for Retail in 2025?

Climbing sharply in recent quarters, the average net lease retail cap rate now sits at 6.74 percent. The market has seen a 62-basis point jump since the start of the year, and the average has increased 112 basis points from the low mark reached in first quarter 2023. Across the single-tenant market, the retail sector shows the widest range of cap rates across the U.S., with a 147-basis point spread. On the high end, the Midwest has seen average rates creep up to 7.48 percent, while the West region passed the 6.0 percent-mark just this quarter.

Unsurprisingly, private buyers continue to be the dominant investor group for net lease retail assets, representing 50 percent of buyers year-to-date. Their market share has declined from recent years though, as REITs have gradually become more active in the space. After nine months of activity, REITs now comprise 28 percent of retail buyers, compared to 19 percent in 2023 and just 15 percent the previous year. Institutional investors and foreign capital remain largely silent in the retail sector for now.

—Posted on January 30, 2025

With $1.82 billion in transactions reported during second quarter 2024, the single-tenant net lease retail sector posted its slowest quarter since 2011. This is only the third time in 13 years that quarterly activity has failed to exceed the $2.0-billion mark, but with rapidly rising cap rates, it’s been challenging to get buyers and sellers to agree on pricing. High interest rates have exerted pressure on transaction activity as well, and portfolio volume – which has historically contributed significantly to retail sale volume totals – is down more than 49% year-over-year. The market has relied on smaller priced individual asset sales to drive activity levels, which simply don’t add up to impressive totals. With fewer than 300 transactions in second quarter, the net lease retail market is certainly facing its challenges.

Despite the seemingly dismal outlook, expectations call for increased activity in the second half of the year. We regularly see fourth quarter as the strongest and most active for the retail sector, especially as many year-end transactions are motivated by tax savings strategies. Furthermore, if interest rate cuts occur at any time this calendar year, the retail market is positioned to benefit.

International capital remains absent from the net lease retail market, but buyer distribution metrics reflect other noteworthy trends. In the last six months, REIT activity has been noticeably stronger than in recent years. With 38% market share, compared to 19% in 2023 and 15% the prior year, REITs have used current market conditions to their advantage. Conversely, private investors, which comprised 60% to 70% of the retail buyer pool in the last two years, represent less than half the active buyers. Watch for these ratios to adjust as the year progresses, however. With a meaningful uptick in transactions, especially during fourth quarter, it’s likely those tax-motivated private and individual investors will recapture some of today’s market share from the REITs.

—Posted on July 23, 2024

After an up-and-down year in 2023, the single-tenant net lease retail sector started 2024 on a strong note. In the last three months, investment sales volume totaled $3.9 billion, jumping nearly 59 percent quarter-to-quarter. This marks the sector’s strongest reporting period since this time last year and puts the market on track to exceed last year’s annual performance, as long as activity remains consistent.

As the year progresses, however, it’s possible we will see another few quarters of inconsistent transaction volume. Actions by the Fed suggest interest rate cuts are still a ways off, and the bulk of private investor activity is likely to be driven by forced timelines in order to satisfy 1031 exchanges. This opens the door for other investor groups to act opportunistically, and with new net lease retail development still happening across the U.S.—especially for markets with high population growth and stronger economies—activity from public REITs, institutional investors, and international buyers may influence this year’s buyer distribution trends.

Cap rates continued their upward climb, rising 23 basis points from year-end. At an average of 6.38 percent, rates are now 74 basis points higher year-over-year. Interest rates continue to impact investor appetite, especially for private and individual investors who regularly capture the lion’s share of net lease retail acquisitions. In the first quarter 2024, however, we saw public REITs account for over half of all single-tenant retail buyers, reducing private investor activity to only 32 percent of the market.

Investors across all groups should be encouraged by the planned growth and expansion of many retailers that have become net lease favorites. Gas stations, discount retailers, quick service restaurants, and more are among the more aggressively expanding tenants, with some brands committing to open hundreds of new locations in the near-term. Existing stores too are generating opportunities for investors, as companies like Walmart, Starbucks and Dollar General invest billions to renovate and modernize stores, adding value for current owners.

—Posted on May 27, 2024

Lanie Beck is the Senior Director of Content & Marketing Research at Northmarq.

You must be logged in to post a comment.