2024 REIT Trading Trends

The Dow Jones Equity All REIT Index’s latest update on performance from S&P Global Market Intelligence. Read the report.

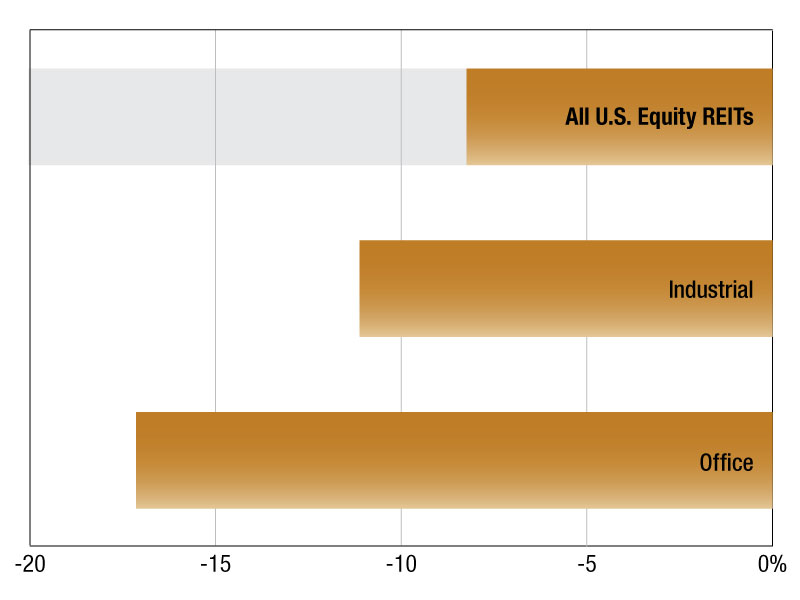

As of Dec. 6, publicly listed U.S. equity REITs traded at an 8.24 percent median discount to consensus net asset value per share.

The industrial sector traded at an 11.12 median discount to NAV estimate, while office REITs traded at a 17.14 percent discount.

At the company level, Industrial Logistics Property Trust traded at the largest discount to NAV estimate at 70.85 percent. This was followed by office REIT Hudson Pacific Properties, Inc. with a 65.10 percent discount to NAV estimate and retail REIT SITE Centers Corp. with a 57.94 percent discount to NAV estimate.

Health-care REIT Welltower Inc. traded at the largest premium to NAV estimate of all U.S. REITs at 89.3 percent followed by CareTrust Inc. at 58.13 percent and National Health Investors at 48.38 percent.

Jerra Joy Agravio is an associate in the Real Estate Client Operations Department of S&P Global Market Intelligence. If you are interested to learn more about the products and services available within S&P Global Real Estate data, please visit us here.

—Posted on Dec. 30, 2024

You must be logged in to post a comment.