2024 Special Servicing Rates

The rate has neared 10 percent for the first time in four years.

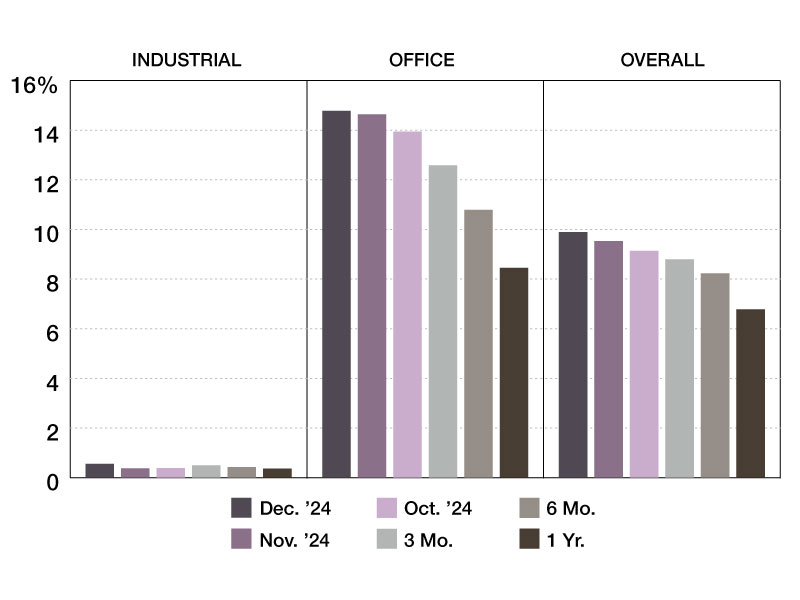

The Trepp CMBS Special Servicing Rate climbed higher in December 2024, increasing 36 basis points to reach 9.89 percent. Throughout 2024, the rate increased about 311 basis points. The overall special servicing rate has not breached 10 percent since November 2020.

The mixed-use sector experienced the highest month-over-month increase in the special servicing rate, soaring 182 basis points to 11.72 percent in December, surpassing 11 percent for the first time since 2013. The multifamily sector also saw a sizable increase in the special servicing rate in December, increasing 136 basis points to 8.72 percent.

The office special servicing rate rose 15 basis points to 14.78 percent from 14.63 percent in November. The last time the office rate was above 14 percent was for three months in 2012, and it has not breached 15 percent since at least the year 2000. The retail rate declined 12 basis points to 11.67 percent, after five consecutive months of increases. Finally, the lodging rate rose by 14 basis points from 8.15 percent to 8.29 percent in December.

—Posted on January 31, 2024

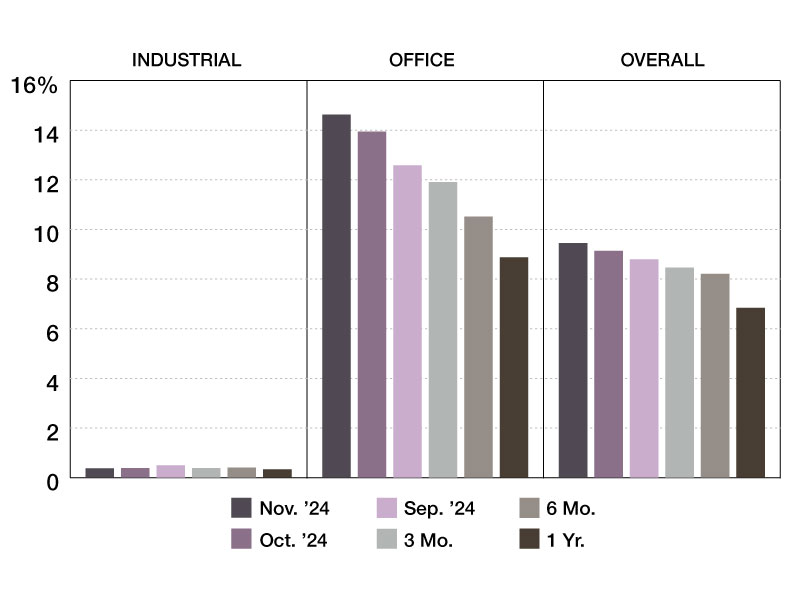

The Trepp CMBS Special Servicing Rate climbed 39 basis points to reach 9.53 percent in November. The rate has increased about 275 basis points so far in 2024, with November seeing the second-largest monthly jump in the overall rate in 2024, following the 80-basis-point increase in April.

About $3.7 billion in outstanding loans transferred to special servicing in November, which is the largest amount that has transferred in a given month in the last six months. The office sector claimed the largest proportion at 35 percent of the newly special serviced loan amount, and the rest of the newly special serviced loan balance was evenly distributed across the multifamily, mixed-use and retail sectors.

The largest loan that transferred to special servicing in November was also the loan that drove the substantial uptick in the mixed-use rate. The $742.8 million 1515 Broadway loan transferred to special servicing due to imminent balloon payment default ahead of its March 2025 maturity date.

—Posted on December 27, 2024

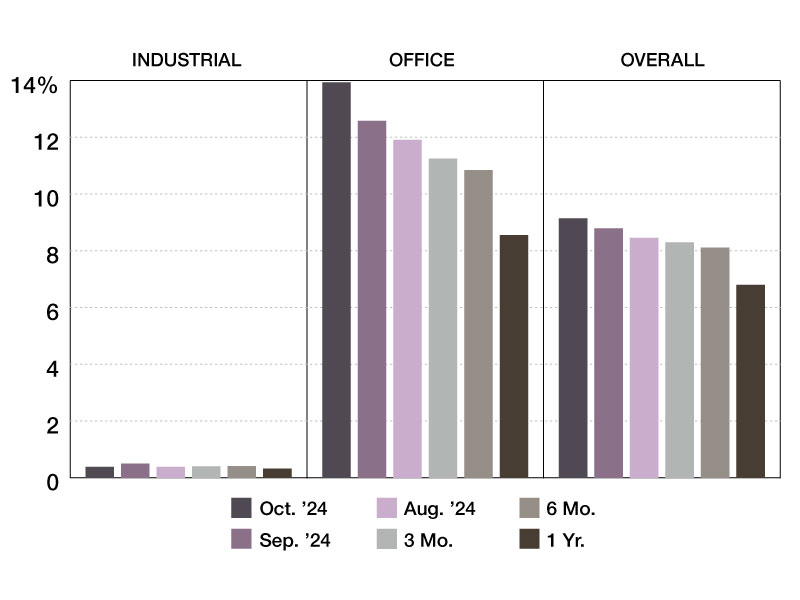

The Trepp CMBS Special Servicing Rate increased another 34 basis points to reach 9.14 percent in October 2024.

In the last six months, the rate has increased just over 100 basis points, with the October figurereflecting the tenth consecutive monthly increase.

Among the major property types, the office sector saw the highest month-over-month increase in the special servicing rate, surging 136 basis points to 13.94 percent. Compared to October 2023, the office rate has climbed 539 basis points. The last time the office special servicing rate breached 13 percent was in November 2011, after which the rate stayed above 13 percent until July 2012.

The lodging rate has continued to climb, reaching 8.32 percent in October; the last time it was above 8 percent was in May 2022 when the rate was coming down from Covid highs. The multifamily and retail property types also experienced upticks in October, rising 14 basis points to 6.21 percent and 14 basis points to 11.37 percent, respectively.

—Posted on November 26, 2024

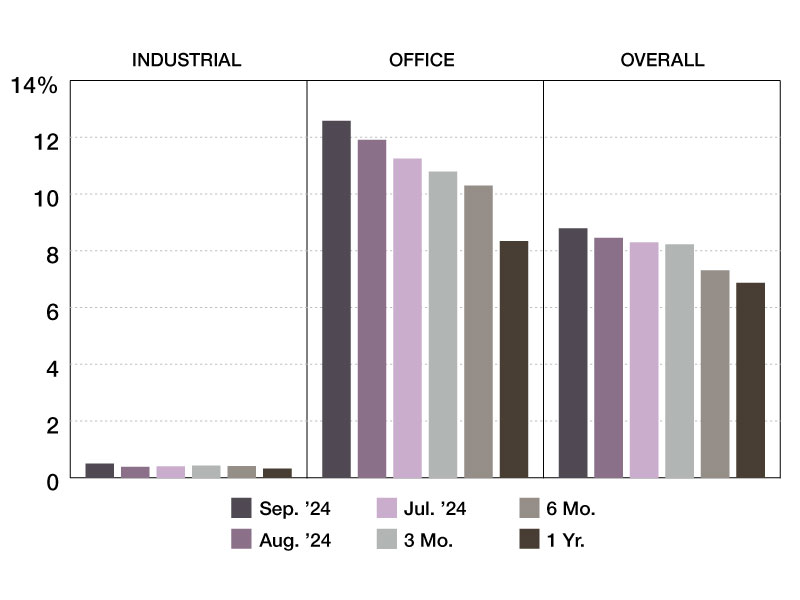

The Trepp CMBS Special Servicing Rate rose substantially in September, jumping up 33 basis points to reach 8.79 percent. This was the ninth consecutive monthly increase, and the second-largest uptick of 2024.

Property type specifics revealed some interesting statistics. Distress was consistent throughout, with the respective special servicing rates of the five major property types all increasing. These increases varied in degree, but four of the five property types increased by at least 30 basis points. Driving the overall increase in September was the office sector, which surged 67 basis points to 12.58 percent. The office rate is now up more than 200 basis points in the past four months alone, with distress continuing to mount. The multifamily rate rose 36 basis points to 6.07 percent, surpassing the 6 percent mark for the first time in nearly nine years. Furthermore, the retail rate reached a near two-year high of 11.22 percent and the lodging rate hit a two-year high of 7.84 percent.

—Posted on October 25, 2024

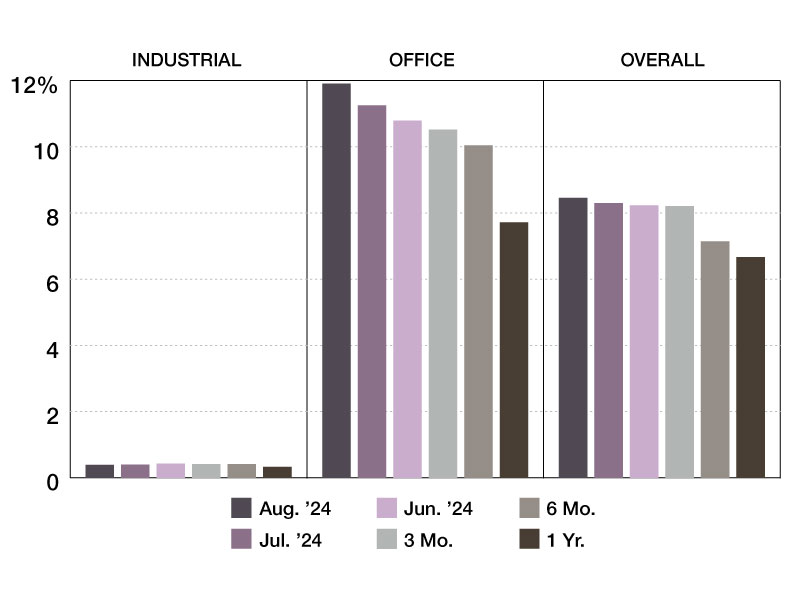

The Trepp CMBS Special Servicing Rate took another jump in August, climbing 16 basis points to 8.46 percent. The rate has still sustained an increase during every month of 2024, and reached another three-year record high in August.

Parsing it out by property type, three experienced substantial upticks last month, each by at least 60 basis points. The multifamily rate rose 60 basis points to 5.71 percent, setting a near nine-year high. The last time the multifamily rate was higher was in December 2015. Furthermore, both the mixed-use rate and office rate increased 66 basis points each in August. The mixed-use rate now sits at 9.59 percent, the highest it has climbed since May 2013. The office rate rose to 11.91 percent, the highest it has reached since April 2013. Both sectors have risen significantly in the past year. Since August 2023, the mixed-use rate has increased more than 265 basis points, and the office rate has pushed higher by more than 415 basis points.

—Posted on September 27, 2024

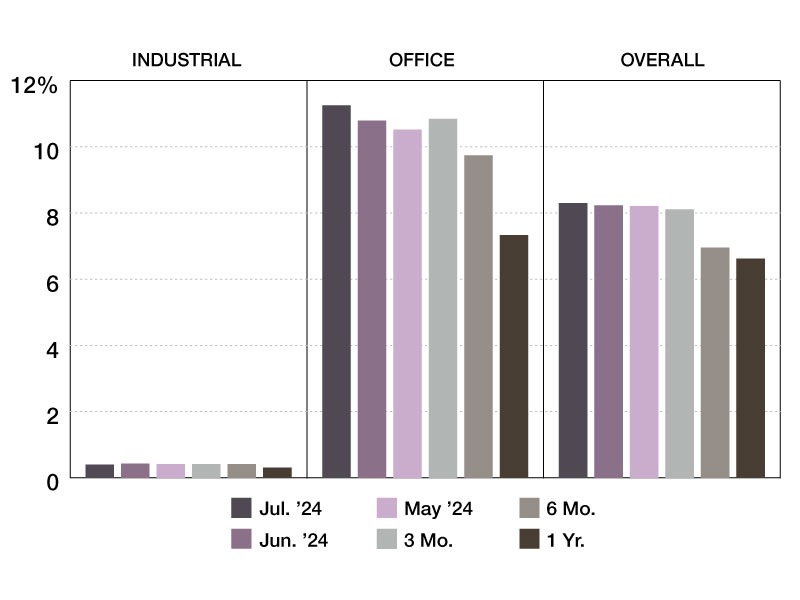

The Trepp CMBS Special Servicing Rate pushed higher in July, increasing 7 basis points to reach 8.30 percent. The rate began 2024 at 6.95 percent and has increased every month since. It currently sits at a 3-year-high, is more than 180 basis points higher than the July 2023 rate of 6.62 percent and clears the July 2022 rate of 4.80 percent by 350 basis points.

Into property type specifics, most experienced minimal change in July, with a few only up or down by around 5 basis points. That said, two property types did change by about 40 basis points each, with one of them driving the uptick in the overall rate. The office special servicing rate rose 46 basis points in July to reach 11.25 percent. The last time this rate eclipsed 11.00 percent was back in August of 2013. Similar to the overall rate, office special servicing has largely been on the rise in 2024, and currently sits 150 basis points higher than its January level of 9.74 percent. After reaching an 11-year high last month, the mixed-use rate pulled back 40 basis points, falling back under 9.00 percent to 8.93 percent.

—Posted on August 30, 2024

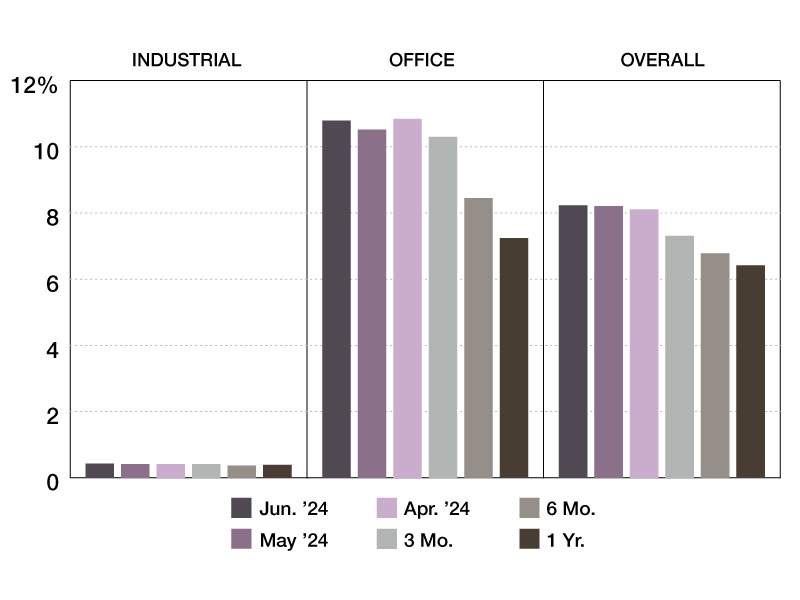

The Trepp CMBS Special Servicing Rate ticked up slightly in June, rising 2 basis points to 8.23 percent. Despite this month’s increase being minimal, the rate itself remains at a very elevated level. Prior to the Covid-19 pandemic, the last time the rate eclipsed this month’s 8.23 percent was back in January 2014. With June’s modest uptick, this now marks the sixth consecutive monthly incline for the special servicing rate.

Parsing it out, there were a few property types that experienced more than modest change. Mixed-use special servicing rose most, up 40 basis points in June to hit 9.34 percent. This is the first time the mixed-use rate has eclipsed 9.00 percent since July 2013. The office rate also rose in June, increasing 27 basis points to 10.79 percent after its first decline of the year one month prior. Two property types that saw material improvement were lodging and multifamily, with drops of 54 basis points and 26 basis points, respectively. Though the multifamily rate experienced some relief, it remains relatively high, still sitting above 5.00 percent.

—Posted on July 31, 2024

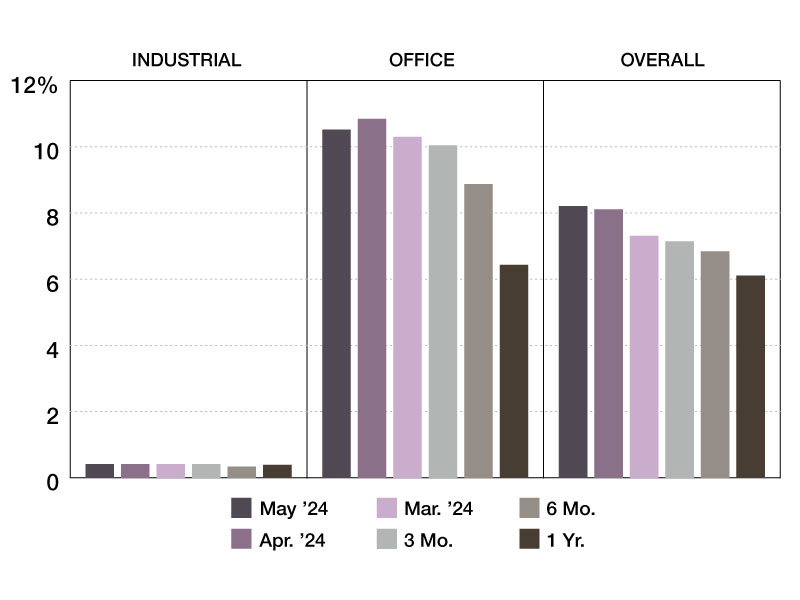

The Trepp CMBS Special Servicing Rate pushed higher in May, up 10 basis points to 8.21 percent. Though this increase was modest compared to the 80 basis point leap a month prior, the overall rate is now at its highest level since June 2021. The rate has increased every month of 2024 and is now 1.43 percent higher than the 6.78 percent mark that it closed out in 2023.

Across individual property types, there were four that experienced changes of at least 30 basis points. Most notable was office, which finally experienced some relief, falling 32 basis points to 10.52 percent. This was office’s first drop of 2024, and a welcome sight considering that the office rate was on pace to eclipse 11 percent for the first time since 2013. Mixed-use saw the largest monthly increase in special servicing rate across the property types, up 69 basis points to 8.94 percent. The mixed-use rate has been consistently rising, up every month this year, and currently sitting at a near 11-year high.

—Posted on June 28, 2024

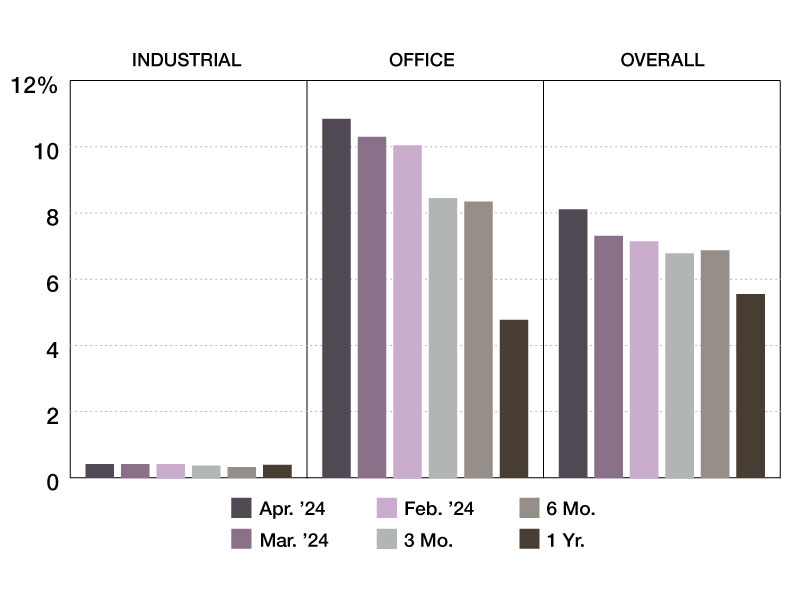

The Trepp CMBS Special Servicing Rate leaped in April, rising 80 basis points to reach 8.11 percent. This marks the largest monthly jump that the rate has experienced in nearly four years, with higher monthly upticks only reached during the COVID-19 pandemic in mid-2020. Furthermore, this is the first time that the rate has eclipsed the 8.00 percent mark since July 2021.

There were some big movers when analyzing by property type, with three up by at least 100 basis points. The office rate continued higher, pushing up to 10.84 percent. Retail was up 106 basis points in April after hardly moving a month prior. The biggest movers were by far ‘Other’ properties and multifamily, which increased a whopping 236 basis points and 269 basis points, respectively. The multifamily rate rose to 5.10 percent, up past the 5.00 percent mark for the first time since June 2017.

—Posted on May 30, 2024

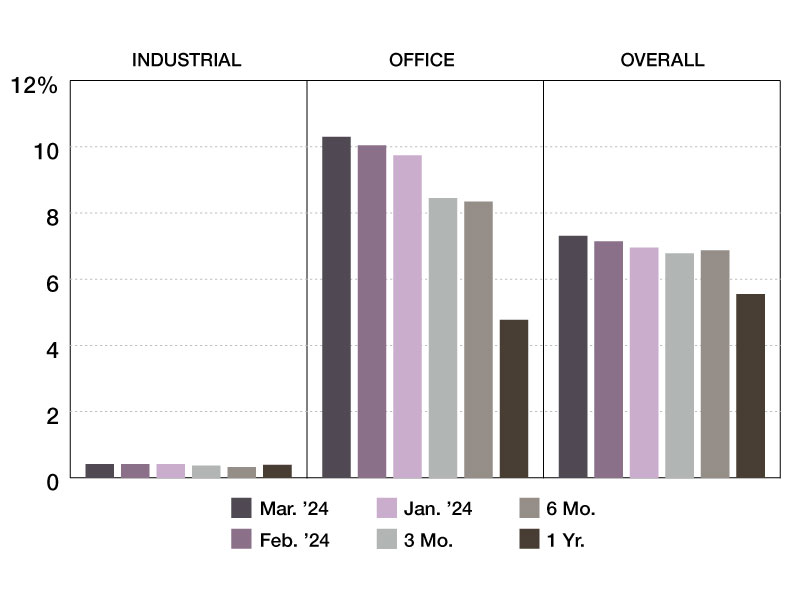

The Trepp CMBS Special Servicing Rate jumped up to 7.31 percent in March, rising 17 basis points from the month before. This now marks the fifth straight month of inclines, over which time the rate has increased over 50 basis points.

Into property type specifics, there were mostly modest increases across the board, aside from lodging properties, which jumped 48 basis points from February. Retail’s two basis point decline was the only monthly decrease, though the industrial rate remained unchanged. Office sustained a 27-basis point increase to reach 10.30 percent, again topping the 10-year high it hit last month.

—Posted on April 26, 2024

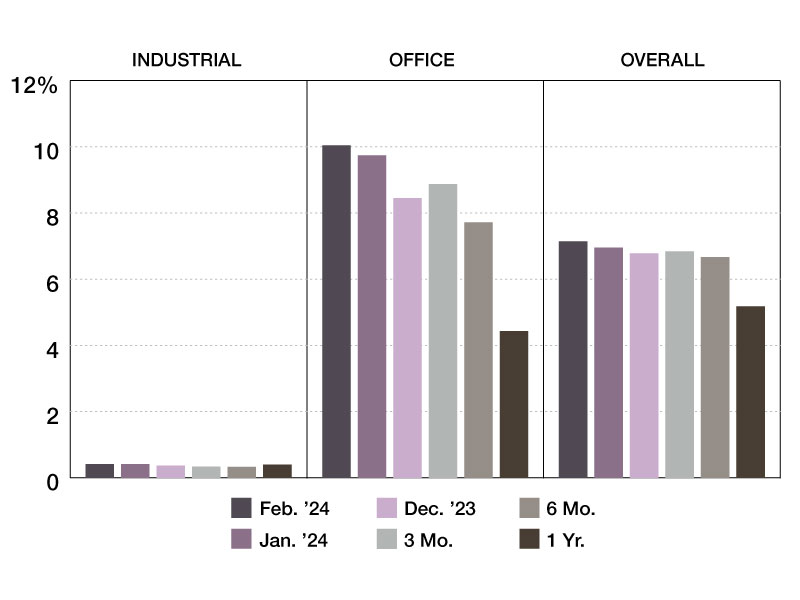

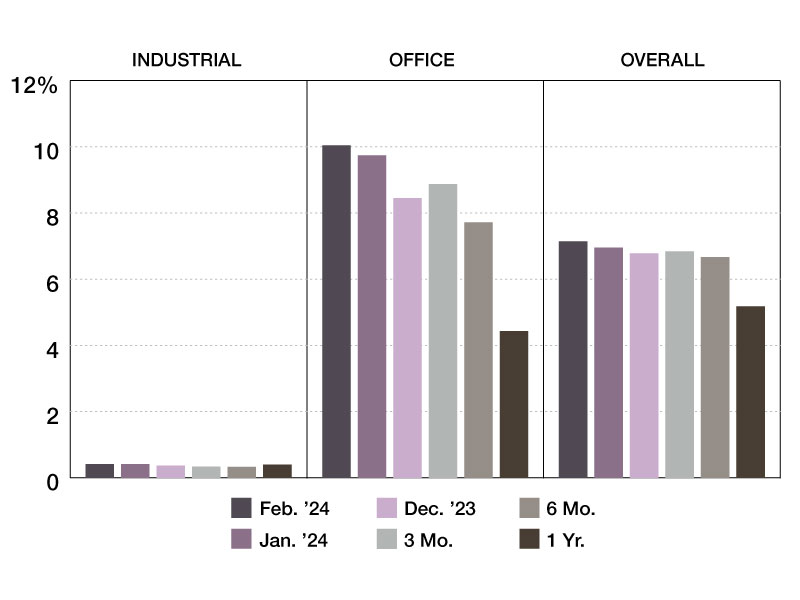

The Trepp CMBS Special Servicing Report continued to rise in February, increasing nineteen basis points to reach 7.14 percent.This is the first time the overall rate has surpassed the 7 percent mark in about 2.5 years.

Breaking it down by property type, three notable sectors sustained material upticks to their rates, causing the overall rate to increase as it did. Office, mixed-use, and retail properties all experienced monthly inclines of at least twenty basis points. Together, these three sectors account for over 70 percent of the special servicing balance across all property types, and with respect to new transfers, they represented over 90 percent of February’s total. This month, the retail special servicing rate climbed by 44 basis points, while office and mixed-use both saw increases of 30 and 22 basis points, respectively. The office rate reached 10.04% in February, the first time since it has entered double-digits since 2013.

—Posted on March 29, 2024

In January, the Trepp CMBS Special Servicing Rate climbed 17 basis points, reaching 6.95 percent. After falling slightly in December, the rise this month has brought the rate to its highest level since October of 2021.

Performance across property types was a mixed bag – with many sustaining substantial increases or decreases to their respective rates. Three property types saw month-over-month changes that exceeded 80 basis points. After fluctuating only slightly for the closing months of 2023, the multifamily rate dropped 83 basis points to 2.34 percent in January 2024. The property type with the largest increase, and the main driver of the overall rate increase, was the office sector. The office special servicing rate rose 129

basis points to 9.74 percent this month, its highest month-over-month increase ever. The last time the office rate exceeded its current level was over a decade ago.

—Posted on February 28, 2024

You must be logged in to post a comment.