2025 CMBS Delinquency Rates

Trepp's monthly update. Read the report here.

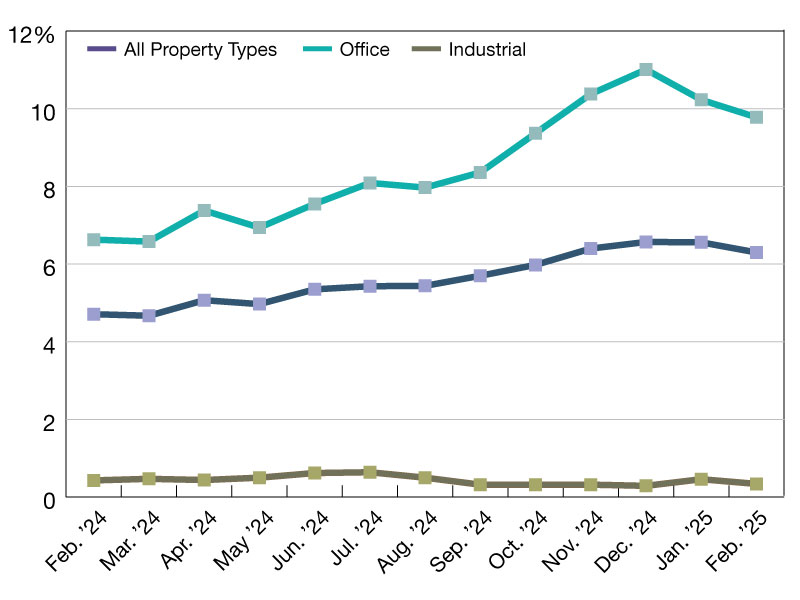

The Trepp CMBS Delinquency Rate decreased again in February 2025, with the overall rate falling 26 basis points to 6.30 percent.

This is the second consecutive month in which the overall delinquency rate decreased, following a stretch of six straight months of increases. The fall in the overall rate was driven again by the office sector, with its rate falling 45 basis points to 9.78 percent. This continues to be welcome relief for the sector, which reached an all-time high of 11.01 percent at the end of last year.

READ ALSO: Potential Federal Building Sale Adds Uncertainty to Office Sector

Outside of the office sector, three of the remaining four major property types also experienced decreases to their respective delinquency rates, with the exception of lodging. Rate movements were relatively muted in February, with lodging’s 20-basis-point increase standing as the second-largest change. On the loan level, the largest loan to become newly delinquent was a mixed-use single-asset, single-borrower loan with a current balance of $395 million.

If we included loans that are beyond their maturity date but current on interest, the delinquency rate would be 8.18 percent, down 11 basis points from January. The percentage of loans in the 30 days delinquent bucket is 0.39 percent, unchanged from the month prior.

Our numbers assume defeased loans are still part of the denominator unlessotherwise specified.

—Posted on March 27, 2025

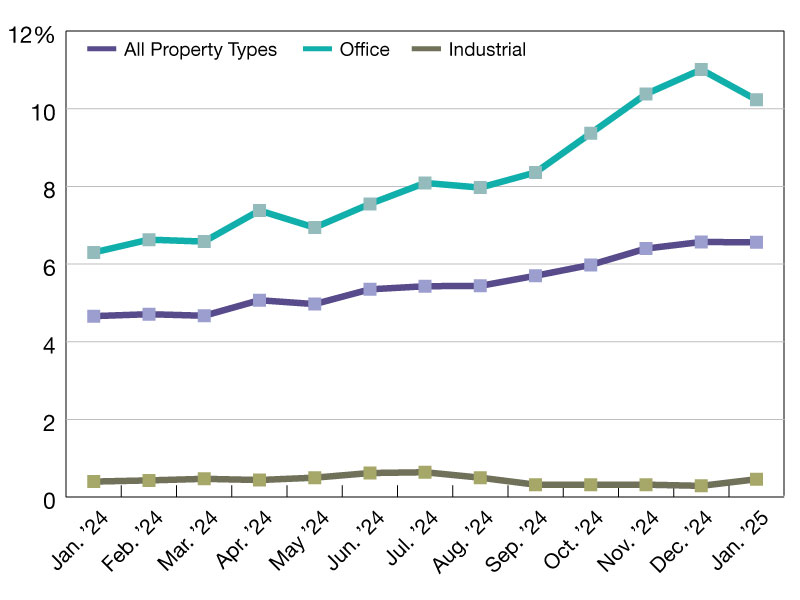

The Trepp CMBS Delinquency retreated slightly in January 2025, with the overall delinquency rate decreasing 1 basis point to 6.56 percent.

This pullback follows six straight months of increases to the overall delinquency rate, during which the rate rose almost 120 basis points. The decrease in the overall rate was driven by the office sector, with the office rate falling 78 basis points to 10.23 percent. This was some welcome relief for the sector, which had reached an all time high to end last year.

READ ALSO: Best Capital Stack Strategies for 2025

Outside of the office sector, the remaining four of five major property types all experienced increases to their respective delinquency rates. These increases were relatively tame however, with only the industrial rate increasing more than 10 basis points. On the loan level, the largest loan to become newly delinquent was a single-asset single-borrow office loan worth $525 million.

If we included loans that are beyond their maturity date but current on interest, the delinquency rate would be 8.29 percent, down 29 basis points from December. The percentage of loans in the 30 days delinquent bucket is 0.39 percent, up 13 basis points for the month.

Our numbers assume defeased loans are still part of the denominator unless otherwise specified.

—Posted on February 27, 2025

You must be logged in to post a comment.