3 Tax Planning Opportunities CRE Execs Don’t Want to Miss

Jim Dubeck and Megan Whitlock of Moss Adams on some key tax concerns that you can get out in front of.

President Joe Biden signed the Inflation Reduction Act of 2022 on Aug. 16, 2022. The enacted version of the Inflation Reduction Act didn’t contain the proposed expanded provisions of the Internal Revenue Code Section 1061 related to carried interest.

While the provisions of carried interest remain unchanged, the originally-proposed modifications are important to note—and consider for addressing—ahead of future legislative packages and shifting industry trends.

In addition to carried interest uncertainty, the following are tax planning areas real estate professionals should consider addressing.

1. Fee Waivers and Property Transfers

Fee waivers have historically been used by fund sponsors and managers subject to IRC Section 1061 rules to provide an income deferral for carried interest treatment on assets with a holding period of less than three years.

Many fund managers and associated personnel hold a partnership interest entitling them to a carry, or additional profit allocation on certain investment disposition gains. Such a partnership interest is referred to as an Applicable Partnership Interest under the IRC Section 1061 rules and can convert gains on investment dispositions held for less than three years to short-term capital gain.

To provide a tax planning mechanism to avoid the conversion of gains on disposition of investment assets held between one and three years from tax at ordinary income tax rates, many fund partnership agreements contain fee waiver provisions.

A fee waiver may allow an API holder the right to elect to forego gain on disposition of assets resulting in the gain being allocated to the other partnership interest holders under the terms of the partnership agreement.

In exchange for foregoing or waiving the carried interest gain allocation in certain years, the API holder typically receives an additional carried interest on the remaining investment assets held in the fund. Fee waivers may also be used in development and management fee structures as well as carry on asset disposition gains.

The IRS proposed IRC Section 1061 regulations in 2019, which attempted to address perceived abuses of fee waivers that would otherwise recharacterize long-term gain as short-term under IRC Section 1061 rules.

The proposed regulations indicate the IRS is also interested in related-party transfers of carried interests that may be received as part of a fee waiver arrangement. Additionally, the preamble to the proposed regulations mentioned the IRS would monitor carry waiver arrangements, but it wasn’t addressed in the final regulations. While the fee waiver regulations aren’t final, they should still be considered when it comes to structuring investments or planning for an exit transaction.

Property owners should frequently review their waivers in agreements, considering the proposed IRC Section 1061 regulations and Proposed Treasury Regulation 1.707-2, to maintain compliance with the new regulations.

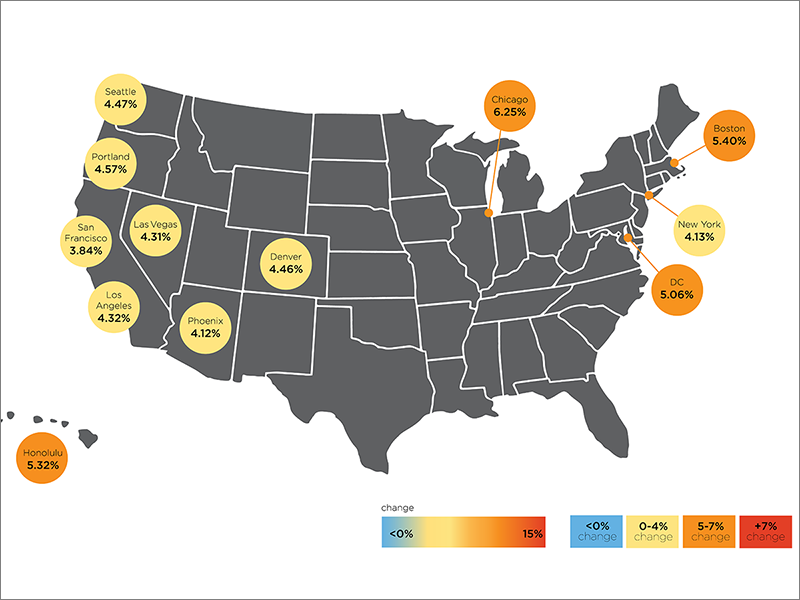

2. Strategic Planning to Counter Rising Interest Rates

Real estate cycles ebb and flow, and the current environment of interest rate increases is giving pause to some property owners, especially those with near or mid-term investment plans.

Taxpayers should consider their strategy and response to the current environment. Critical items to be examined include:

- Holding periods

- Exit strategies for properties

- Debt covenants to ensure proper coverage ratios are met

Property owners may also consider making a real property trade or business election for IRC Section 163(j) interest expense. This election slows depreciation lives, but in return allows a greater deduction for business interest expense in a time when the cost of financing has increased.

This is also a great time to review pledges and guarantees on existing and future debt for purposes of tax basis to partners.

3. Tax Planning at the Deal and Entity Levels

Contact a tax advisor prior to entering a transaction to establish an efficient tax planning strategy, for example, the use of IRC Section 1031, which allows for the deferral of gain on exchanges of like kind property.

Real estate investors and owners should consider timing around:

- Partnership contributions

- Distributions

- Purchases and sales

- The use of debt for cash and liquidity

The above-noted areas can be very complex and trigger taxable gain in certain circumstances, for example, if parties are considered related. As the laws evolve, trusted tax advisors are an invaluable resource for real estate investors and owners in making fully informed tax decisions.

Provisions of the Inflation Reduction Act, the continued application of the carried interest rules, fee waiver arrangements, and broader market trends support the mantra of seasoned investors and their advisors alike: plan ahead and review tax and business strategy—often.

Jim Dubeck, CPA, of Moss Adams has practiced public and private industry tax accounting, focusing primarily on partnerships, since 1990. Megan J. Whitlock, CPA. also with Moss Adams, primarily focuses on the energy, real estate and private equity industries.

You must be logged in to post a comment.