315,900-SF Suburban D.C. Office Building Fetches $90M

Eleven years after snapping up the Class A property for nearly $59.3 million, LaSalle Investment Management Inc. sold the asset to CB Richard Ellis Investors.

May 2, 2011

By Barbra Murray, Contributing Editor

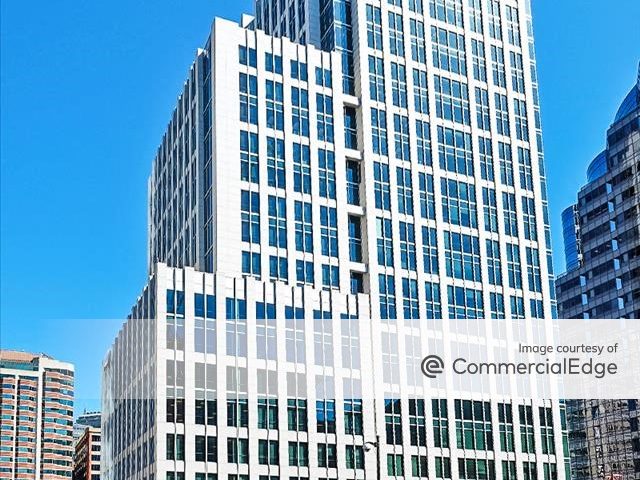

One Washingtonian Center, a 315,900-square-foot office tower located in a premier setting about 20 miles outside of Washington, D.C., has just come under new ownership. Eleven years after snapping up the Class A property for nearly $59.3 million, LaSalle Investment Management Inc. sold the asset to CB Richard Ellis Investors for approximately $90 million.

A 13-story structure carrying the address of 9801 Washingtonian Blvd., One Washingtonian sits just off I-270 at 9801 Washingtonian Blvd. within Washingtonian Center, an 800,000-square-foot lifestyle center surrounded by walking trails and Washington Lake. The 22-year-old building is 88 percent leased to a list of high-quality tenants, including anchor Sodexho Inc., which maintains its North American headquarters in more than half the tower’s space under a lease that does not expire until the beginning of 2019.

The property’s stellar tenant roster is enhanced by its sterling status as a leader in sustainability. Last summer, One Washingtonian earned the U.S. Green Building Council’s LEED for Existing Buildings Platinum rating, making it one of just 38 office buildings in the world to receive the green organization’s highest level of LEED-EB certification.

CB Richard Ellis Investors acquired the asset on behalf of the CBRE Strategic Partners U.S. Value 5 fund, a commingled private equity real estate fund with commitments from institutional investors in the U.S., Europe and the Middle East. LaSalle relied on commercial real estate services firm Cassidy Turley to market the property, and One Washingtonian attracted a great deal of interest among the national investment community. “There is definitely a healthy institutional market for irreplaceable assets like this one, with it being on the lake, having access to the retail amenities and the easy visibility from I-270,” Paul J. Collins, executive managing director and principal with Cassidy Turley, told CPE. “For assets like that, there is always a liquid market.”

Collins anticipates that eager investors who missed out on One Washingtonian will have more opportunities to purchase premier office buildings in the Montgomery County area. “Sales activity is picking up; there should be more properties coming to the market soon.” Prices, he added, are picking up as well.

You must be logged in to post a comment.