5 Capital Market Trends That Will Impact CRE In 2022

Shlomi Ronen of Dekel Capital on what will determine whether record-breaking deal volume will continue.

Shlomi Ronen

As 2021 comes to a close, the impact of COVID is waning, the economy is accelerating, and real estate fundamentals are improving. As a result, we are seeing real estate transaction volumes increase and general market optimism by most CRE market participants leading into 2022.

According to Real Capital Analytics, Commercial Real Estate deal volume surpassed $450 billion for the first three quarters of 2021— a level that has not been reached to date. The last time deal volume approached this mark was 2007, when the credit markets were unconstrained and entity-level deals in the office and retail sectors increased total activity.

With this momentum leading us into the new year, here are five capital market trends that we expect to impact deal volume in the coming months:

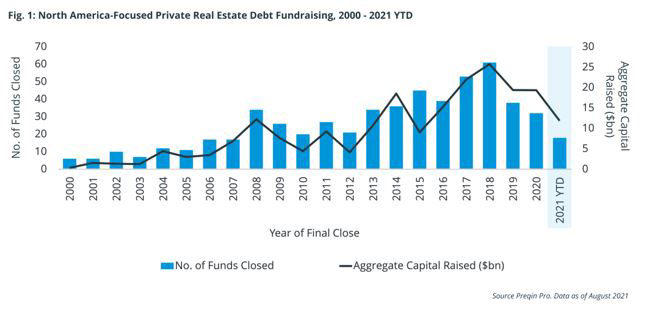

Capital Raised for Debt Funds and Mortgage REITS

Since coming out of the Great Recession, the business of bridge financing has shifted from regulated U.S. Banks to private finance companies and fund managers.

While the annual volume of funds raised has declined in recent years, the cumulative volume of available capital is at record highs and is fueling acquisitions across all product types and geographical regions. According to CBRE, alternative lenders (debt funds and mortgage REITs), led volume and accounted for 39 percent of all non-agency loan closings in 3Q 2021.

Construction Financing

In search of higher yields and less competition, given the crowded bridge lending space, we are seeing the debt funds enter the construction lending business. Their entrance into construction financing is providing developers with higher leverage than has historically been available from the banks and looser underwriting standards as they relate to sponsorship, project business plans, and geographic location. In essence, it has enabled a larger number of development projects to move forward than have in previous years.

Loosening of Underwriting Criteria

As the availability of capital and competition increases for fixed-rate, bridge and construction loans, we are seeing a loosening of underwriting criteria by lenders. For fixed-rate loans, that has resulted in an increase of IO in addition to lower debt yields. On bridge and construction loans, we are seeing lenders willing to increase leverage levels increased to 80 percent of cost from 65 percent to 70 percent that were achievable in 2019.

Bank Consolidation

Facing competition from large national banks and financial technology players, small and regional banks merged and consolidated at record pace in 2021. According to figures released earlier this month, S&P Global Market Intelligence projects $63.3 billion in bank mergers in 2021, up from $27.8 billion in 2020 and $55 billion in 2019. These mergers tend to change and disrupt lending operations as the merged bank evaluate staff and business lines that they look to grow.

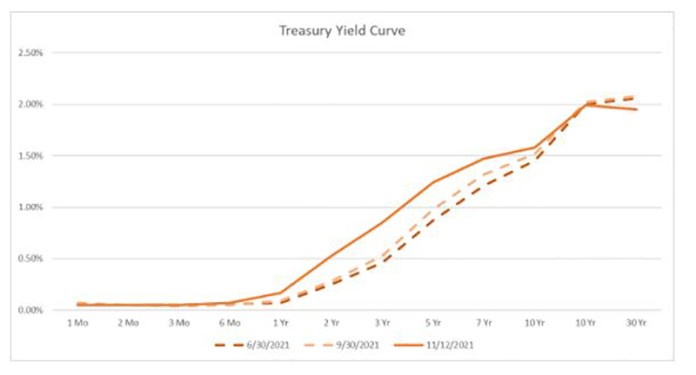

Interest Rate Environment

In recent weeks, we have seen the treasury yield curve steepen as long-term rates increased as a result of positive economic data and increased inflation figures. With economic expansion projected to continue into 2022 we expect both short term and long-term rates to increase.

Source: Federal Reserve

As we close out 2021, lenders are already pushing new loan originations into 2022. If these trends continue, we should see another record setting volume year in 2022.

Shlomi Ronen is managing principal and founder, Dekel Capital.

You must be logged in to post a comment.