$5B JV Demonstrates Energy of Data Center Sector

Blue Owl Capital, Chirisa Technology Parks and PowerHouse have teamed up to build large-scale AI/HPC facilities.

The just-announced $5 billion joint venture development agreement among funds managed by Blue Owl Capital Inc., Chirisa Technology Parks and PowerHouse Data Centers looks like a deal very much of the moment, as data center transactions and development deals get rapidly larger.

Focused on developing large-scale AI/HPC data centers for CoreWeave Inc., the agreement is intended as the first stage of a partnership with the capacity to deploy up to $5 billion of capital for turnkey data center developments also supporting other hyperscale and enterprise data center customers.

The partners described the venture as “an innovative and flexible capital solution allowing for the rapid development and deployment of new AI/HPC capacity across the U.S.” on a build-to-suit basis.

READ ALSO: Data Center Labor Shortages Take Center Stage

An initial 120 MW of capacity will be delivered for CoreWeave in 2025 and 2026 at Chirisa’s 350-acre campus near Richmond, Va. Further deployments in the pipeline reportedly include both brownfield and greenfield campuses in New Jersey, Pennsylvania, Texas, Kentucky and Nevada.

Newmark served as advisor to the joint venture.

CoreWeave is a provider of cloud-based GPU infrastructure to AI developers. In May, TIME named CoreWeave one of the 100 most influential companies.

Chirisa Technology Parks has data centers in Richmond, Va.; Chicago; Piscataway, N.J.; and Seattle. The company currently offers more than 500,000 square feet of purpose-built data center capacity, with a pipeline exceeding 400 MW under development in the U.S.

PowerHouse Data Centers is the data center division of American Real Estate Partners. It has 30 buildings currently in planning or underway, totaling more than 2.3 GW of power in six major U.S. markets.

AI leads the charge

The surge in data center demand, deals and development is mostly a result of the artificial intelligence boom, as Commercial Property Executive recently reported, based on a CommercialEdge report.

An even more recent report from CBRE found that almost all CRE investors surveyed intended to increase their capital deployments to data centers, both in terms of dollar amounts and as a percentage of total CRE investments.

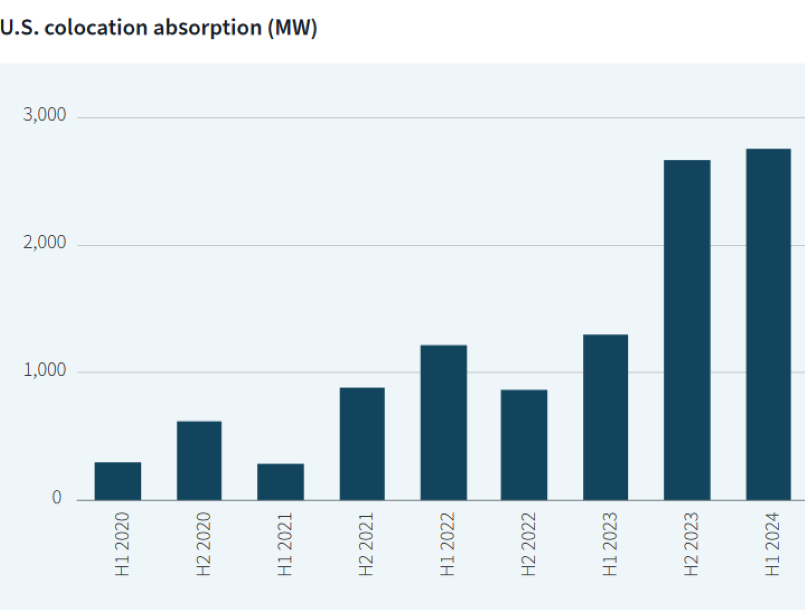

And a mid-year report on the data center sector from JLL states that even though the U.S. colocation data center market has doubled in size in the past four years, vacancy has hit a record low of 3 percent.

JLL further remarked that AI has driven an estimated 20 percent of new data center demand over the last year, though the company also cautions, “AI holds great potential, but it will take years for the technology to evolve and mature.”

You must be logged in to post a comment.