601W Cos. Pays $420M for Office Trio

This Jersey City portfolio is under new ownership for the first time since 1996.

Veris Residential has sold Harborside 1, 2 and 3, three Class A office buildings in Jersey City, N.J. The assets traded for $420 million, with the company releasing approximately $360 million of net proceeds. Hudson County records show that 601W Cos. acquired the properties. The transaction is part of Veris Residential’s transition to a multifamily-only company.

Cushman & Wakefield alongside CBRE arranged the transaction for the entire 1.9 million-square-foot property, dubbed Harborside Financial Center Plaza.

The acquisition was funded with a $150 million loan provided by Lionheart which included a senior mortgage loan, a mezzanine loan and a preferred equity tranche. In addition, Citigroup and Bank of Montreal jointly put forward a senior loan for the deal secured by a portion of the portfolio. The entire financing added to $375 million.

Managing Director Andy Klein and Vice President Sang Kim with Lionheart led the transaction. Meridian Capital Group brokered the senior debt on behalf of the borrower.

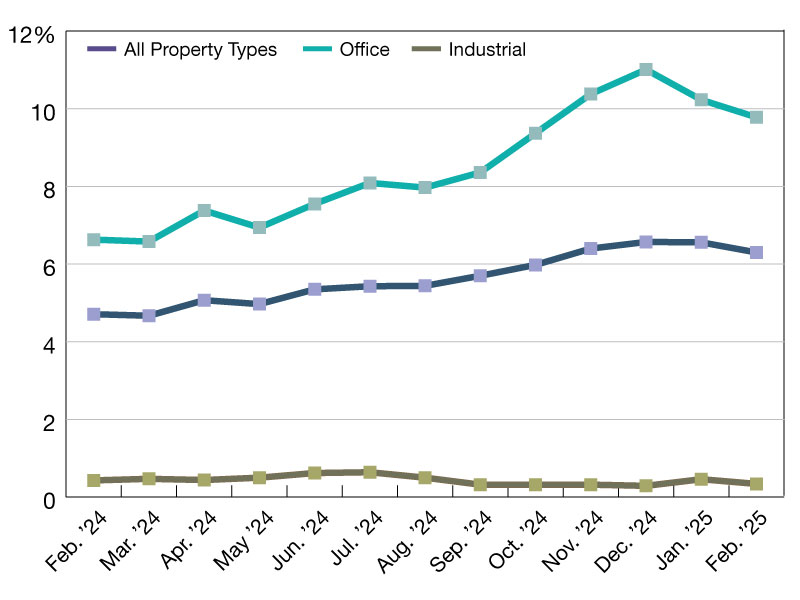

New Jersey registered $423 million in office transactions in the first two months of the year, a recent CommercialEdge report shows, coming in after Boston at $666 million. Despite ranking second, New Jersey’s average price of $142 per square foot is significantly lower than Boston’s, which clocked at $605 per square foot, more than double the national average of $232. With the current transaction, New Jersey’s deal volume will most likely continue to rank among the country’s highest.

Harborside: Adaptive reuse in the heart of Jersey City

Veris Residential acquired the three buildings in a portfolio transaction in 1996 for $293.7 million from AT&T, CommercialEdge data shows. The three buildings, originally constructed as industrial properties in 1929, were converted to office space in 1982. The properties also underwent cosmetic renovations along the years, between 1990 and 2015, and each include 10,000 square feet of retail space.

The eight-story Building 1 encompasses 421,771 square feet, features 63,723-square-foot floorplates, seven passenger elevators and offers 2,000 parking spaces. The 761,200 square feet Building 2 and 725,600 square feet Building 3 have floorplates ranging from 6,344 to 120,923 square feet, 10 passenger elevators and a total of 443 parking spaces. The 12-story buildings each feature controlled access. The retail component includes names such as District Kitchen, Hudson Alley and Whole Foods.

The tenant roster at the three office buildings includes Hudson County Chamber of Commerce, Bank of America, Frenkel & Co., Link9 and Dixon Leasing, among others. Collectors Holding signed a 130,000-square-foot lease at Building 3 last year in February, which was reported as the largest deal of its kind in Jersey City since 2020 at that point.

Harborside Financial Center Plaza is located at 150, 200 and 210 Hudson St., in downtown Jersey City, some 4 miles from downtown Manhattan. The Exchange Place PATH Station is near the three office buildings, offering several commute options.

With this current transaction, Veris Residential completed more than $2 billion of non-strategic asset sales in the past two years and now has 98 percent of the company’s net operating income coming from multifamily properties. Goldman Sachs & Co. and J.P. Morgan Securities are acting as financial advisors for Veris in this business strategy.

You must be logged in to post a comment.