In a Tentative Year, Office REIT Ratings Remain Sound

By Karen Nickerson, Vice President & Senior Credit Officer, Moody’s Investors Service

Absent another global or domestic shock, office REIT ratings will see a modest improvement during 2012 as long as the firms protect their balance sheets.

By Karen Nickerson,

Vice President & Senior Credit Officer, Moody’s Investors Service

Signs are encouraging for the office sector, but risks remain. The U.S. labor market is improving, corporate profits are strong and balance sheets are stable. Office vacancy in the fourth quarter 2011 declined 50 basis points to 16 percent year-over-year, according to a fourth-quarter report by CBRE Econometric Advisors. However, Europe’s debt situation remains unsettled and U.S. fiscal policy remains uncertain. In light of these unknowns, we expect the office market recovery to remain tentative.

While overall trends in the office market were positive year-over-year, the level of activity shifted in 2011 from robust in the first half to lackluster in the second half. We expect businesses will remain reluctant to spend and hire more aggressively until global and domestic pressures ease. Their hesitancy will translate to only modest improvement in the office market fundamentals for much of 2012.

Net absorption is expected to mirror the activity of 2011 at approximately 21.5 million square feet, according to a third-quarter report by CBRE Econometric Advisors. In contrast to last year, leasing activity is expected to cool in New York City and Washington, D.C., and heat up in markets driven by the energy and technology industries such as northern California, Seattle and select markets in Texas. Low levels of office construction will also aid positive net absorption in 2012.

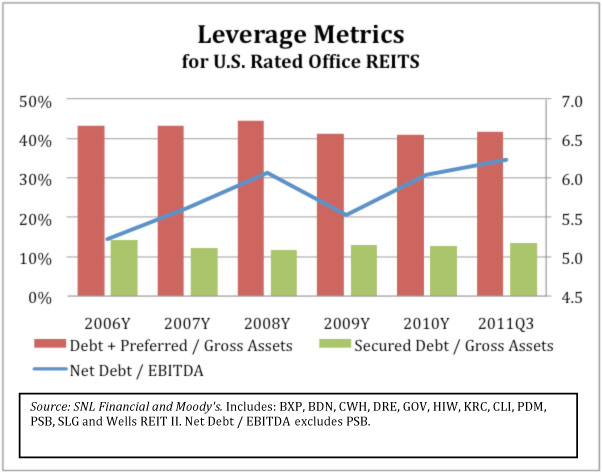

Rated office REITs continue to have a competitive advantage over their private peers. Tenants still flock to well-capitalized landlords, and capital access remains strong for REITs. They have moderate demands on their liquidity with less than 10 percent of total debt maturing over the next year, ample capacity on their bank revolvers, very little in the way of development, and historically low FFO payout ratios. Rated office REITs also have large unencumbered asset pools and measures of balance sheet strength are solid.

Rated office REITs continue to have a competitive advantage over their private peers. Tenants still flock to well-capitalized landlords, and capital access remains strong for REITs. They have moderate demands on their liquidity with less than 10 percent of total debt maturing over the next year, ample capacity on their bank revolvers, very little in the way of development, and historically low FFO payout ratios. Rated office REITs also have large unencumbered asset pools and measures of balance sheet strength are solid.

Many office REITs acquired office properties with lease-up opportunities in 2011. This hurt net debt to EBITDA, as this metric does not benefit from full-year earnings. We view this as a timing issue.

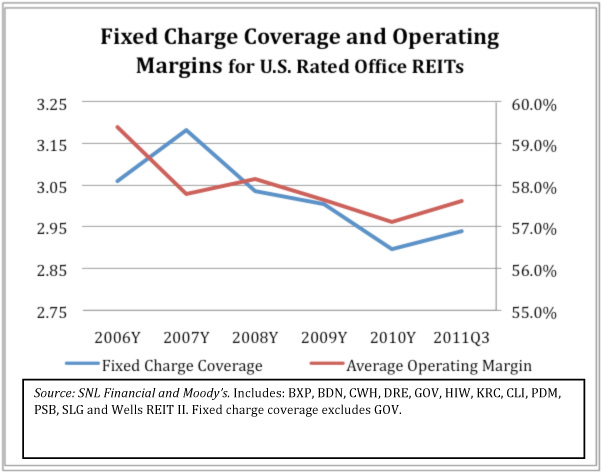

Earnings-based credit metrics turned positive in 2011. Fixed charge coverage ticked up, operating margins grew, and same-store NOI growth was neutral. We expect this momentum to continue in 2012.

Earnings-based credit metrics turned positive in 2011. Fixed charge coverage ticked up, operating margins grew, and same-store NOI growth was neutral. We expect this momentum to continue in 2012.

Our office REIT ratings incorporate modest fundamental improvement in the office sector; however, the stable outlook we have for the office REITs has cushion for a weakening in fundamentals in light of economic and political uncertainties. The outlook assumes that rated office REITS will continue to protect their balance sheets, and manage liquidity and funding conservatively. Because we expect development to remain minimal over the near-term, Moody’s views leveraged acquisitions as the biggest risk to the balance sheet over the near-term, absent another global or domestic shock.

You must be logged in to post a comment.