Measured Recovery

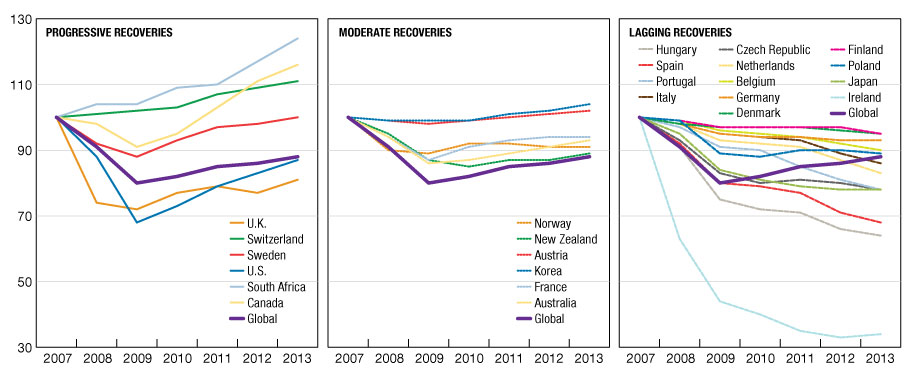

(capital value performance in this cycle; all property 2007 capital growth indexed to 100) By Peter Hobbs The cyclical position of markets is a critical consideration for investors and managers of existing portfolios and those seeking to deploy new capital. The comparison of value change since 2007 across the IPD global markets shows three different…

(capital value performance in this cycle; all property 2007 capital growth indexed to 100)

By Peter Hobbs

The cyclical position of markets is a critical consideration for investors and managers of existing portfolios and those seeking to deploy new capital. The comparison of value change since 2007 across the IPD global markets shows three different courses through the current cycle. Six markets progressed very well in recent years, with some bouncing back strongly from a severe downturn (the U.S., the U.K. and Sweden) and some continuing to perform well through a relatively mild downturn (Canada, Switzerland and South Africa).

Another six markets (including Australia, Korea and Norway) experienced more modest recoveries. The remaining 13 regained less of their peak values, with many continuing to experience value decline. For this latter group, however, there are some signs of a turnaround, as illustrated by the strong performance of Ireland over the past year. This recovery is likely to be supported by the surge of capital headed to most of these markets. Conversely, increasing questions are being raised as to the ability of the strongest-performing markets to maintain their recent trajectories.

—Peter Hobbs is managing director & head of research at IPD.

You must be logged in to post a comment.