Real Estate on Solid Footing—for Now

By Ken Riggs, President, Situs RERC: While prices are expected to level off this year, there's still reason to believe it's a good time to invest in commercial property.

By Ken Riggs, President, Situs RERC

In our annual forecast report, Expectations & Market Realities in Real Estate 2016—Navigating Through the Crosscurrents, which was released in early February, we stated that commercial real estate was fully priced and that prices could be expected to decelerate and begin to level off in 2016.

With last week’s news that the Moody’s/RCA Commercial Property Price Index (CPPI) national all-property composite index dipped 0.3 percent in January 2016, the first monthly decline in six years, it appears that the leveling-off process in this cycle is getting underway. According to the CPPI, price growth continued in the retail property sector, where prices increased 1.1 percent, and in the apartment sector, where prices grew 0.7 percent. But the CPPI also indicated that price growth in the industrial and office sectors each declined by more than 1 percent in January.

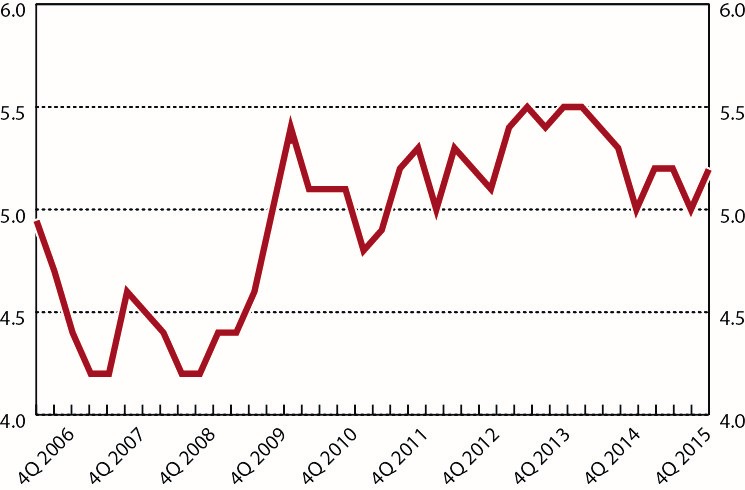

However, according to our forward-looking investor sentiment ratings, as noted in the quarterly Situs RERC Real Estate Report, investors believe that commercial real estate is still more valuable than the price would suggest, given that the “overall” rating increased to 5.2 (on a scale of one to 10, with 10 indicating that value greatly outweighed price) in fourth quarter 2015. Although the overall rating has varied from quarter to quarter (see graph below, left), it has remained at 5.0 (the midpoint of the scale) or above since 2011. This demonstrates that institutional investors believe the value of commercial real estate has been greater than or equal to its price for the past few years, and that prices have not outpaced underlying values.

Situs RERC Value vs. Price Rating for Commercial Real Estate (Overall Rating) Source: Situs RERC, fourth quarter 2015

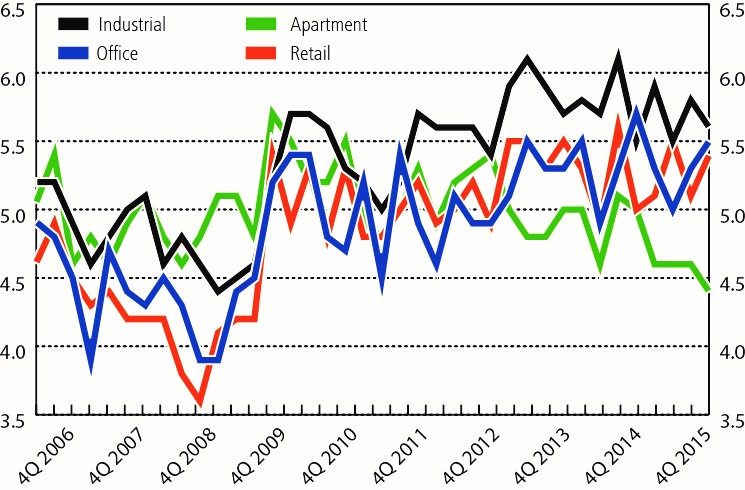

Based on value vs. price ratings for the individual property sectors, the outlook for commercial real estate is even more promising. The ratings for the office and retail sectors increased slightly in fourth quarter 2015 over the previous quarter, while the ratings declined for the industrial and apartment sectors (see graph below, right). Although the ratings demonstrate that institutional investors believe value still outpaces price for most sectors, that is not the case for the apartment sector, in which the value vs. price rating dipped below 5.0, the midpoint of the scale, a year ago and further declined in fourth quarter 2015, indicating that apartment properties were becoming even more overpriced compared to their value. Some institutional investors also noted that the apartment market was becoming oversaturated.

Situs RERC Value vs. Price Ratings for Major Property Types (Institutional Level) Source: Situs RERC, fourth quarter 2015.

One of the sturdiest footings for the commercial real estate market is the strength of property fundamentals. Vacancy rates are expected to continue declining and rents to further increase in 2016 for the office, industrial and retail sectors. The only vacancy rate expected to increase is for the apartment sector, which, according to Axiometrics, is expected to increase from a low of 4.9 percent to 5.4 percent at the end of 2016, as more completions come online. Also according to Axiometrics, apartment sector rent is expected to peak in first quarter 2016 and decline through the rest of the year. Situs RERC institutional investment survey respondents noted that apartment concessions are becoming more likely in markets like Houston.

Despite the leveling off in price as the market correction commences, we can continue to expect reasonable return performance from commercial real estate in 2016, although returns will be based primarily on income (vs. capital appreciation). Returns on a risk-adjusted basis are expected to be higher than those available with bonds or cash, and are certainly more stable than those available with the stock market. With positive job growth, still-low interest rates, and the general stability and reasonable returns of this asset class compared to other, more volatile investment alternatives, we believe commercial real estate will have a relatively soft landing in this correction, even if prices decline a little more quickly than we anticipate.

These solid footings are for now … and in a world of uncertainty, you never know for how long.

Situs RERC’s annual forecast report was published jointly by Situs RERC, The National Association of REALTORS® and Deloitte in February 2016.

You must be logged in to post a comment.