Yardi Matrix: Appealing Austin

Austin's economic and multifamily sector growth continues unabated, although the heavy supply pipeline triggers fears of overdevelopment, Yardi Matrix data and analysis shows.

Austin‘s steady economic and multifamily sector growth continues unabated, although the heavy supply pipeline is leading to fears about overdevelopment. The metro is at the top of many “best of” lists that rank potential growth and livability. A technology hub, it draws highly educated and high-income young adults, which has helped to boost apartment demand and rents.

Employment was up 3.7% in the year through January 2016, with job creation driven by the tech and education sectors. For example, Apple is expanding its local footprint with a Northwest Austin campus totaling 1.1 million square feet that will employ around 7,000 workers. The facility is slated for completion in 2017. Oracle also presented plans to construct a next-generation technology campus that will trigger an expansion of its Austin team by more than 50% over the next few years. The firm is planning to purchase housing to ensure employees have somewhere to live that is convenient and affordable.

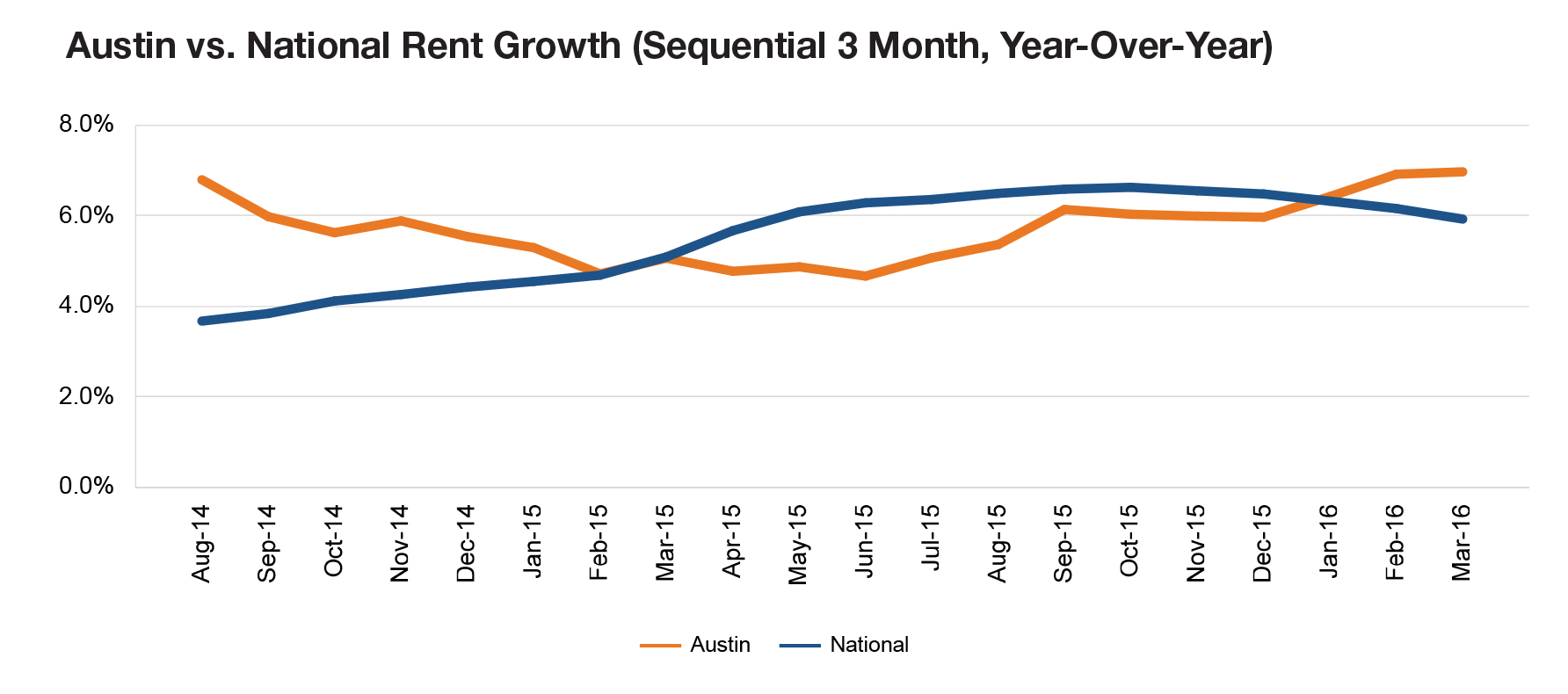

Good news for apartment owners is that roughly one-third of the metro’s 2 million residents are in the 20- to 30-year-old prime renter cohort. Rent growth was up to 7% year-over-year in the first quarter, and we project strong increases of 5.8% in 2016. However, growth will be moderated by the construction pipeline. More than 15,000 units are under construction, and nearly 11,000 are in the planning stages.

You must be logged in to post a comment.