Yardi Matrix: Denver’s Growth Conundrum

Multifamily Spring Report 2016: An influx of Millennials and strong job growth have propelled apartment rent increases in Denver to among the highest in the nation.

An influx of Millennials and strong job growth have propelled apartment rent increases in Denver to among the highest in the nation—but that growth may be hitting a wall as a result of the heavy development pipeline. Employment is fueled by industries such as technology, healthcare, business and hospitality, while the booming medical marijuana sector has helped to attract young adults.

Trade and transportation are also strong economic drivers for the metro. The Denver Regional Transportation District recently completed the state’s first commuter rail line: the University of Colorado A Line connecting the downtown area to Denver International Airport. The 23-mile route is part of the Eagle P3 Commuter Rail project, which entails the development of 122 miles of commuter and light-rail, 18 miles of bus rapid transit service and 21,000 new parking spaces.

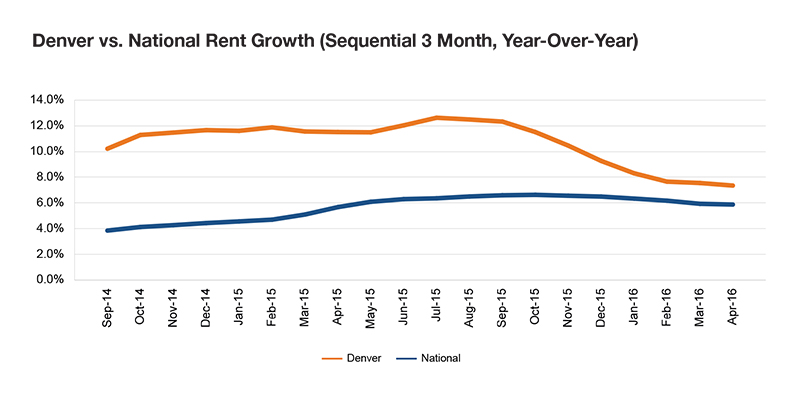

With large employers such as Google, Ibotta and Liberty Global expanding their presence and adding jobs, the demand for multifamily units remains elevated. However, the heavy new supply, mostly concentrated at the higher end of the spectrum, is outstripping demand and dragging the market down far below last year’s 13 percent growth rate. This increase in supply is unlikely to persist for several years, as more than 21,000 units are currently under construction and another 25,000 in the planning stages. The rate of rent increases is consequently expected to drop to a more sustainable level, and we forecast 6.3 percent rent growth for 2016.

You must be logged in to post a comment.