UK Hospitality Sector Badly Hit by Brexit

STR and Oxford Economics predict a negative impact of Brexit on the country’s hotel industry, though the exact extent of the effects has not been established.

By Alexandra Pacurar

London—The referendum on Great Britain’s exit from the European Union has caused international turmoil and the first effects of the vote were reflected in the economy. While the value of the British pound quickly dropped, experts fear that there are long-term consequences that will also impact the hospitality sector in London and Regional U.K.

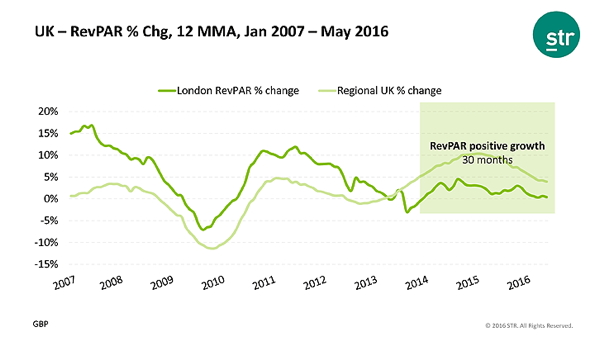

So far, numbers indicate a positive outlook. According to STR, the U.K.’s hotel industry is in the midst of 30 consecutive months of moving average revenue-per-available-room (RevPAR) growth. According to a market report in May 2016, London’s monthly performance has been positive, but its year-to-date May RevPAR was down 3 percent to £99.88, driven by a 2.7 percent decline in occupancy levels. When it comes to Regional U.K., RevPAR increased by over 2 percent to £46.87, as the 2.9 percent increase in average daily rate offset the 0.6 percent decline in occupancy.

Short-term effects

Though there is no specific factor that might directly affect the hospitality sector, the general economic indicators will negatively influence the numbers, according to STR and Oxford Economics. If Britain leaves the EU, the country might face a weaker domestic hotel demand, in line with a weaker GDP and consumer spending, and higher unemployment. Also, a larger drop in capital investment, including hotel investment, will affect business travel—a large component of the London hotel market—because of the ensuing uncertain business environment of Brexit.

On a more positive note, experts predict that a sharp drop in currency exchange might make London more affordable and this could cancel any effects of a weaker domestic demand. Another relevant aspect for the U.K.’s economy is investor’s attention. If Britain’s relations with other countries in the EU will remain on the positive side, any negative effects might be balanced out.

Long-term predictions

Oxford Economics predicts that the long-term impact on overall domestic economic activity will be negative, but outlines a possible positive outcome due to increased affordability of the U.K. and London as a destination (because of a weaker exchange rate). However, lower investment might affect business-travel decisions on the long-run.

Large foreign companies in Britain, especially U.S. banks, have been big supporters of the Remain campaign. London, considered Europe’s financial capital, might lose about 40,000 workers in this sector because of Britain’s exit from the EU, according to Fortune. So far, no company has made a firm announcement and considering past situations (where banks threatened to move workers out of London because of special bonus taxes and caps without actually doing so), dark times seem less likely.

In the end, there is little certainty when it comes to the consequences of Brexit, but there are many variables. Things might change one way or another, but one thing is for sure. Any major player in Companies operating in Britain’s hospitality or financial industries will have to adapt to the country’s new legal structure and this alone may cause mayhem.

You must be logged in to post a comment.