Economy Watch: FOMC Details Reasons for Interest Rate Hike Delays

The latest FOMC meeting minutes suggest the Fed is rethinking its schedule of interest rate hikes this year.

By Dees Stribling, Contributing Editor

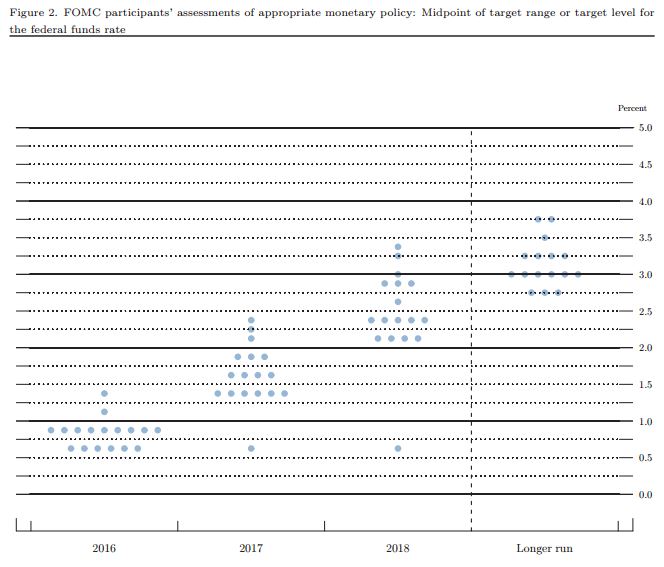

Low interest rates aren’t poised to rise, meaning real estate finance will continue to be low-cost for borrowers that have the best credit. That’s one of the side effects of the Fed re-thinking its informal (and never committed to) schedule of interest rate hikes this year. Those hikes are on hold.

“Almost all participants judged that the surprisingly weak May employment report increased their uncertainty about the outlook for the labor market,” the FOMC noted in the minutes of its latest meeting (June 14-15), which were released on Wednesday. “Even so, many remarked that they were reluctant to change their outlook materially based on one economic data release.”

On the whole, the Fed says it’s optimistic (not using that word) that the labor market will see a resumption of monthly gains in payroll employment “that would be sufficient to promote continued strengthening of the labor market. However, some noted that with labor market conditions at or near… maximum employment, it would be reasonable to anticipate that gains in payroll employment would soon moderate from the pace seen over the past few years.” The next labor report is due on Friday.

Also, the central bankers noted that global financial conditions had improved since earlier in the year, and recent data on net exports suggested that the drag on domestic economic activity from the external sector had “abated somewhat. Still, participants generally agreed that global economic and financial developments should continue to be monitored closely.”

You must be logged in to post a comment.