Economy Watch: IMF Warns of Structural Problems in US Economy

While the U.S. economy is in good shape at the moment, continued growth will depend on addressing some prevalent issues such as falling labor force participation.

By Dees Stribling, Contributing Editor

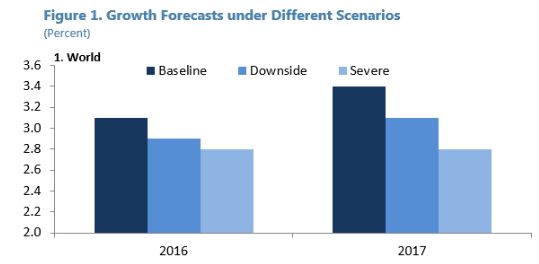

Source: IMF Estimates

Note: The baseline forecasts are constructed by aggregating individual countries’ forecasts produced by area departments. The downside scenarios are simulated using a suite of models, including the IMF’s Global Projection Model and Flexible System of Global Models

Credit: IMF Wold Economic Outlook Update, July 2016

The U.S. economy is doing well at the moment, but continued solid growth over a longer term hinges on addressing chronic issues of falling labor force participation, weak productivity, rising income polarization and high poverty rates, the International Monetary Fund said in its annual review on the state of the U.S. economy, which was released recently.

The economy has been resilient lately, the report noted: for instance, 2.4 million new payroll jobs have been created over the past year; the unemployment rate has fallen to 4.9 percent, about half of its peak during the recession; and inflation remains contained. Even with the added stresses of a strong dollar, an energy-sector contraction and global economic jitters, the IMF nevertheless predicts U.S. GDP growth this year of 2.2 percent, and 2.5 percent in 2017.

Over the longer term, however, the U.S. economy faces a confluence of forces that will weigh on its prospects, the report asserted. Namely, lower labor force participation mainly due to a rising share of the labor force that’s shifting into retirement, scant gains in productivity, income and wealth distribution that are increasingly polarized, and high levels of poverty.

The IMF had some recommendations to avoid longer-term sluggishness. The organization posited that policies need to give incentives for work, raise productivity through investment in infrastructure and innovation, reverse income and wealth polarization trends, which have resulted in a shrinking middle class, and help low-income households to move into higher income brackets.

You must be logged in to post a comment.