Economy Watch: GDP Weak, But Fed Doesn’t Seem Worried

While second-quarter GDP growth was relatively small, the Federal Reserve doesn't seem discouraged from considering an interest rate increase.

By Dees Stribling, Contributing Editor

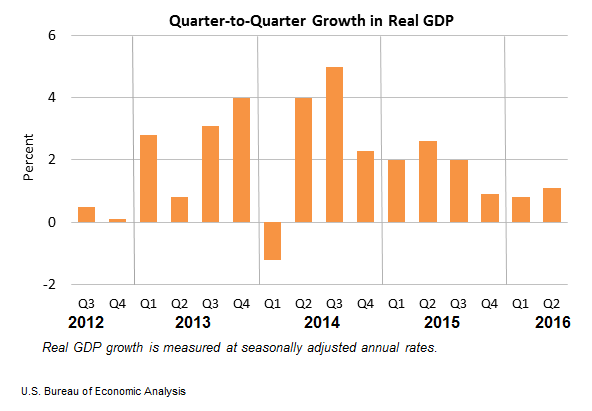

Real U.S. gross domestic product increased at an annualized rate of 1.1 percent in the second quarter of 2016, according to the second estimate released by the Bureau of Economic Analysis on Friday. That was only a modest adjustment from the BEA’s first estimate of 1.2 percent, but still slightly better than the final figure for growth during the first quarter, when real GDP increased only 0.8 percent.

People are spending their money (PCE, or personal consumption expenditures, as the government puts it), which is helping drive what little growth there is, along with nonresidential fixed investment (CRE, in part), an upturn in exports, and a smaller decrease in federal government spending. But a decrease in private inventory investment and downturns in state and local government spending, in residential fixed investment and in imports, are all putting a drag on overall growth.

The recent tepid GDP growth, however, doesn’t seem to be discouraging the Federal Reserve from considering an interest rate increase. Speaking on Friday in Jackson Hole, Fed chair Janet Yellen seemed relatively optimistic about the economy, which is often (but not always) a way for the central bank to prepare markets for an increase. “Based on this economic outlook, the FOMC continues to anticipate that gradual increases in the federal funds rate will be appropriate over time,” she said.

That’s vague, of course, but she also went on to say that, “I believe the case for an increase in the federal funds rate has strengthened in recent months.” Yellen was especially optimistic about the labor market, which drives PCE, perhaps because wage growth is more now than it has in some years. The latest Atlanta Fed Wage Growth Tracker put it at 3.4 percent annualized growth in July; only since last year have wages grown more than 3 percent since before the recession.

You must be logged in to post a comment.