Q&A with Matt Eggers, Yardi Energy

Eggers explains how companies are using green data to find cost savings and what types of benefits they are realizing.

By Suzann D. Silverman

As cities and states ramp up their energy usage reporting requirements, more building owners are learning to mine their utility bills to improve performance and reduce costs. But the number of companies that have taken such steps remains relatively small. Matt Eggers, vice president with Yardi Energy, shares some advice about the steps he suggests to clients and the types of benefits they are realizing.

As cities and states ramp up their energy usage reporting requirements, more building owners are learning to mine their utility bills to improve performance and reduce costs. But the number of companies that have taken such steps remains relatively small. Matt Eggers, vice president with Yardi Energy, shares some advice about the steps he suggests to clients and the types of benefits they are realizing.

CPE: How has companies’ knowledge of green initiatives improved?

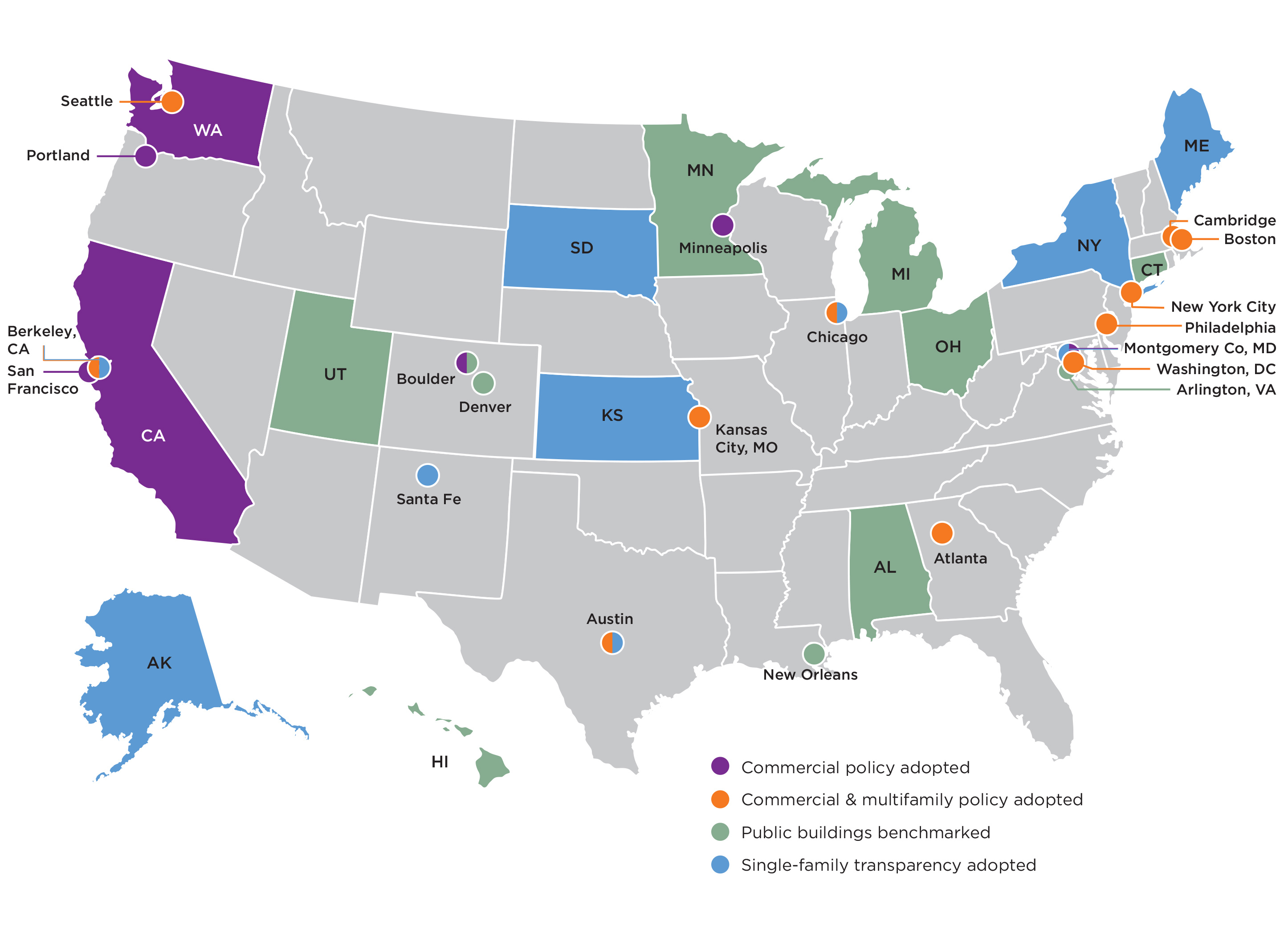

Eggers: I think it’s improved a lot. There’s still a long way to go, but there are a few key drivers that are influencing it. Some of them are regulatory; some of them are market driven. On the regulatory side, there are now 16 or 17 cities and a handful of states that require every medium building and above to have an Energy Star score. … They have to collect a whole lot of data on how much energy their building is using, submit it to the (Environmental Protection Agency) and get the score.

The scores are zero to 100 and scaled, (so) it’s basically a relative number. If you get a 75, that means your building is more efficient than 75 percent of similar buildings. Conversely, if you get a 25, that means 75 percent of buildings are more efficient than your building. They have to do it, and if they see, “Gosh, this (other) building had a 10,” then they’re embarrassed and their competitive juices kick in and they want to improve.

So that’s one driver that’s leading to some green initiatives. Another is GRESB, which stands for the Global Real Estate Sustainability Benchmark. GRESB is sort of like an Energy Star score or a LEED score, but for an entire portfolio, whereas Energy Star and LEED are building by building. … What’s driving GRESB is investors. There are a lot of investors now who are saying, “If we’re going to invest capital in your portfolio, you need to have a GRESB score because we want to know if you’re managing your buildings in a sustainable way.” I haven’t seen the data yet for 2016 filings for GRESB, but in 2015 there were 717 portfolios of real estate around the world that filed and got the score, and it’s been growing at about 15 percent per year for the last two, three, four years. So we’ve had a lot of clients say, “Hey, we’re supposed to file for GRESB, but can you help us because it’s a huge data task.” You need lots of data on energy use, and if they’re not tracking that data carefully, then many real estate companies want help, and we and other companies out there have products and processes to help them. And then once they get a GRESB score, they often say, “It’s not as good as we thought. What can we do to improve?”

And then finally, there’s the operational factors that are being so focused on green initiatives. There’s increased value to buildings that have high sustainability scores and designations, and there’s some data on that. Utilities probably are about 30 percent of the controllable operating costs of a commercial building. So if you want to find one thing to really try to reduce your costs, energy is a very good thing to look at.

CPE: Looking at those three aspects—Energy Star, GRESB and the operational cost factor—how do you see those balancing out? We talk a lot about cost savings—how important is that relative to these scores? Are they all equally important to the building owners right now?

Eggers: Well, the scores still depend on where your building is—if the building is in a city that doesn’t require Energy Star scores or a state, and the real estate owner doesn’t have any investors that are saying, “You need to file for GRESB,” then maybe no one cares about that, but they still care about, “What’s my largest control of costs? Utilities,” and some of the high-value tenants might be looking at a building with a LEED Platinum rating. There’s a lot of education of appraisers and brokers happening around the country through various courses to teach them about the very basics of energy costs, so that tenants will know, “If this building has $3 per square foot of energy costs and this other one has $2, then I can afford an extra dollar of rent in the one that has $2 and break even.”

CPE: Do you see more tenants willing to do that?

Eggers: Yes, there are because they haven’t known about it before. They haven’t had the data, and the brokers and appraisers didn’t talk about these things. But like I said, there are big initiatives underway funded by the Department of Energy and run by groups like the Institute for Market Transformation and the Appraisal Institute and so forth to educate appraisers and brokers on these factors that should make a difference to tenants and to lenders, which is where the appraisers come in.

CPE: So they’re not looking at the rent itself and whether or not that might be higher in a more energy-efficient building. They’re looking at the bigger picture now because they have those numbers of what’s the ultimate cost to them.

Eggers: Yes, what’s the long-term cost of renting that space. They look at build-outs and rent and energy costs. … That’s still not happening in every or even most lease deals, but it’s happening more and more because the data is becoming more available. And data providers are now including information on LEED scores and Energy Star scores for every building, which is helping tenants, brokers, lenders, property buyers—helping everyone see that. And it’s easily available. You can go online and look at a building and you can see, “This one is LEED Gold and has a high Energy Star score and this other one has a bad Energy Star score. Which building would I rather buy? I would rather buy the one that it’s energy costs are significantly lower and it’s more sustainable and more attractive to tenants.”

CPE: You were talking before about energy costs being about 30 percent of the total costs of operating the building. How much of a difference can you make in those energy costs?

Eggers: For a long time, people have ignored those energy costs because they said, “Taxes, interest on debt and energy costs, those are fixed costs. We can’t do anything about them.” What we’re saying and proving in the market, and other folks are too, is that actually, that’s not right. You can significantly influence your energy costs. Some of those ways require investments in capital improvements to the building, but there are a lot of ways that pay off. … My pitch to people on that is, why wouldn’t you do that? You’re just wasting money. There are a lot of ways that folks can reduce energy consumption and reduce demand charges. If they have data, if they have software systems, if they know what to do, they can save energy, they can increase their Energy Star scores and their LEED scores, make more money and make tenants more comfortable and happier.

CPE: How do you keep track of all the different options out there in today’s deregulated energy market? It seems like there are more all the time.

Eggers: The important point to make is, it is really complicated and there are lots of options. And it is constantly changing because the regulators and the states are constantly changing the rules, trying to make them better. So the short story there is you should have a trusted advisor so that you don’t get exposed to big spikes.

And the deregulated markets change sometimes. Some states open up; others close down. A good advisor can help sort through that and knows what a good deal is. Contracts get really complex for this energy, as you can imagine, if you buy $30 million of energy per year for two or three years—their contracts are very complex. So someone who’s familiar with these contracts and can make sure you’re getting the right deal.

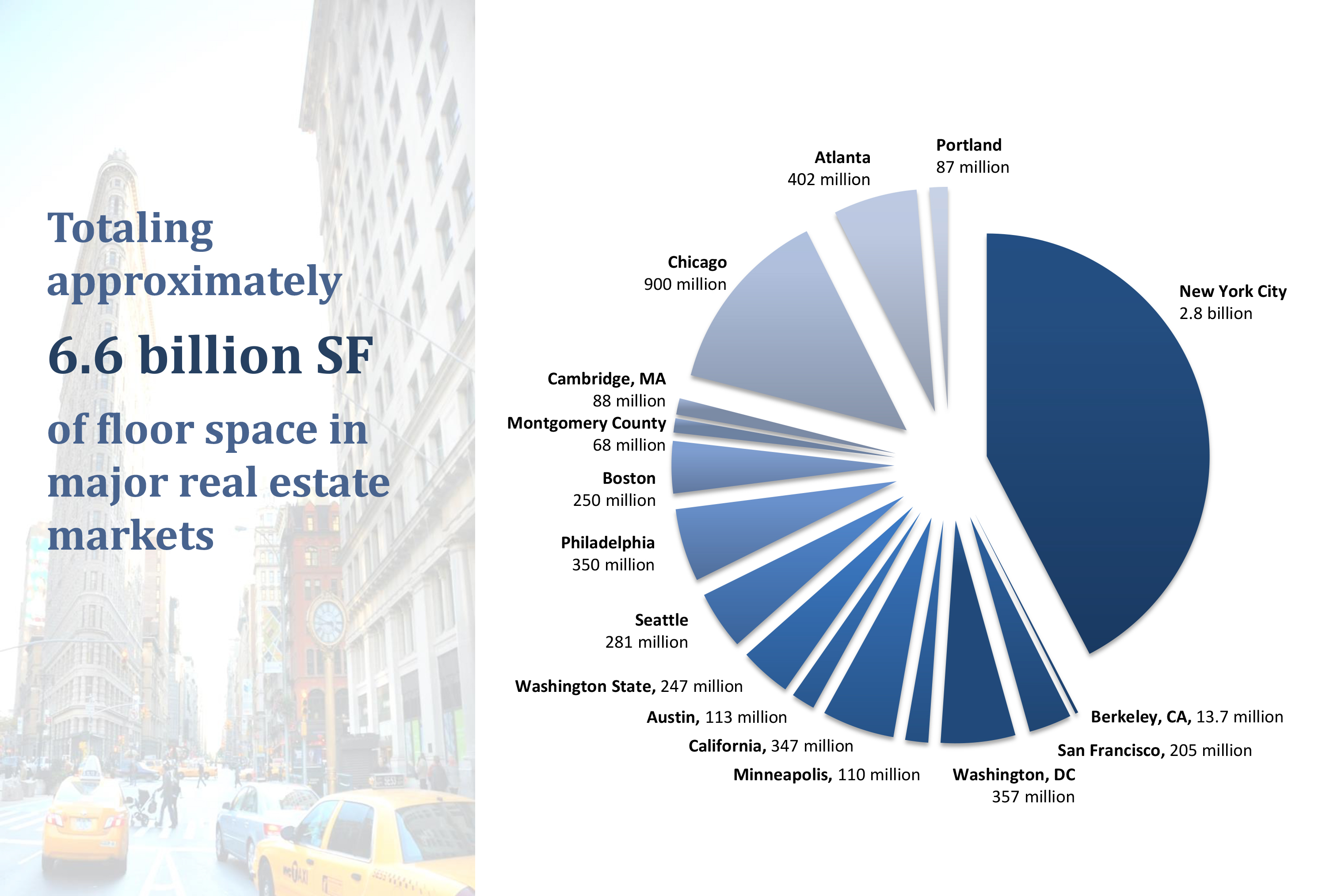

U.S. gross building area covered annually by benchmarking policies, in square feet. Source: Institute for Market Transformation

CPE: And to gauge where building owners are today versus maybe a year ago, how much do you see them jumping on this and taking advantage of either ensuring they’re pursuing the best options or at least being more aware of and open to pursuing the best options out there now?

Eggers: I would say, generally, it’s not that good yet. When we talk to customers and we say, “Hey, we’ve got this software system that has relatively low upfront costs and can save 15 percent of your HVAC energy and it just works, do you know about things like this? Do you want to sign up?” The answer is not as frequently as you might expect, “Oh, yeah, we’re thinking about one of these and we’re going to install it.” … I’d say that there’s a leading edge of maybe 5 percent, 10 percent of early adopters. …

There are a lot of things that have one-, two-, three-year paybacks. … Every time you buy a building, you should be looking at the mechanical systems and the software systems and the data and so forth, because I guarantee you, you can reduce the energy use in that building and make it more profitable within six years.

The final point I’ll make is these regulations requiring Energy Star scores and investors requiring GRESB scores are really new. We had a big client, a big West Coast retail space owner, who signed up for utility expense management service. That’s where we ingest all their utility data, we analyze it, we tell them the bills that don’t look right. We can sometimes see that you might have a water leak in this property; you’d better go fix it. Just from looking at the energy bills. And we said to them when we signed them up just last fall, like in November, “Do you want Energy Star submissions and to get Energy Star scores?” And they said, “What’s Energy Star?” Come along February or March of this year, they called us and said, “We need Energy Star.” That’s because in the interim, they learned about the regulations that require every space in California over 5,000 square feet to have an Energy Star score. So suddenly that became very important to them.

CPE: So for you it’s a constant education process because as the regulations change, you need to go back to existing clients with, “Okay, now you need this, or now you need to be aware of this.”

Eggers: Yes, that’s right.

CPE: What kind of regulatory changes do you anticipate most impacting energy costs for commercial buildings within the next year? New ones or expansions.

Eggers: The big trends that are happening are: I expect more of these requirements around Energy Star. And some cities and states are going so far—California being one, Denver I think is considering this and some other ones—some of them are saying, “Not only do you have to have an Energy Star score but we’re publicly disclosing this so that anybody in the world can look it up and see what your Energy Star score is.” So if it’s terrible, the world knows it. And then they’re also saying, “If your Energy Star score is bad—if you’re in the bottom quartile—you have to take a bunch of actions. You have to get an audit of your building and file it with the city and you may even have to take some actions to improve your building.” … That’s a trend, and I think that will continue to roll out across the city as more and more major thought leader cities adopt things like that. They will become de facto best practice.

I also think that electricity prices have generally been on the rise in the last few years, and that’s partly being driven by regulatory stuff. It’s not regulatory stuff directed at the real estate industry, but it’s things like the federal Clean Power Plan (which commenced review by the U.S. Court of Appeals on Sept. 27), where the federal government’s saying the science is in, climate change is real and we are requiring power plants to be cleaner. That would cause some increase in electricity costs as we either close or upgrade the oldest, dirtiest power plants.

You know, the President of the United States just agreed to join the Paris climate agreement, so while I think there’s a lot of fear mongering out there about how these climate change (proposals) are going to wreck the economy and drive costs up a ton, they’re not going to drive it up all that much but they will increase the costs of power, and new technology is always more expensive at the start. So, like I said, that’s not regulation aimed at building, but it will affect power prices, which, obviously, affects how much people want to try to save.

CPE: So to summarize, what more could companies be doing at this point to improve their energy cost management efforts?

Eggers: Get the data. The invoice data—all the data on the bill that comes from the utilities each month. Get that data into a system and organize it so you can look at it every month. And something more about that, that’s really important, is benchmarking. That’s what getting an Energy Star score is for: benchmarking. If you’re collecting all the data that comes on the utility invoice—the expenses, the total kilowatt-hours used, the demand charge and the demand amount—then you can see: How do our buildings compare? Which ones are good? Which ones are not good? And then it’s really easy when you have that benchmarking data just to direct your resources toward the buildings that need the most help and know that that’s where the easiest wins will be.

CPE: Benchmarking within your own portfolio?

Eggers: Within your own portfolio and between your buildings and other buildings, and Energy Star’s the easiest way to do that.

CPE: Especially as it becomes more widely reported, then you can actually see that data.

Eggers: Yes, and there are already more than a million buildings in Energy Star because people voluntarily do it all the time, because it’s a great way to get a good benchmark. How good is my building? But internal benchmarking is great, too, and so when you’re collecting all that data from your monthly utility invoices, rather than just writing down the number at the bottom of the bill into the accounts payable system and writing the check, you can benchmark your bill. Then you can see which buildings are good and bad, which ones have gotten worse and which ones have gotten better, which ones might have suddenly gotten a leak—this bill this month, it went up; it’s 30 percent higher than it was a year ago this same month. The weather is the same because you’re comparing September to September and something’s wrong.

Getting that data, benchmarking it, looking at it is hugely powerful. Then I would say the next thing (building owners) should do is look into what low capital expense things—or even high capital expense, if they have the capital budget—can I do that might have a one-, two-, three-year payback and save a significant amount of my utility cost, which is 30 percent of my operating costs. How can I reduce that 30 percent? The dollar saved on a cap rate is a huge increase in the value of the building.

Originally appearing in the October 2016 issue of CPE, the Energy Issue.

You must be logged in to post a comment.