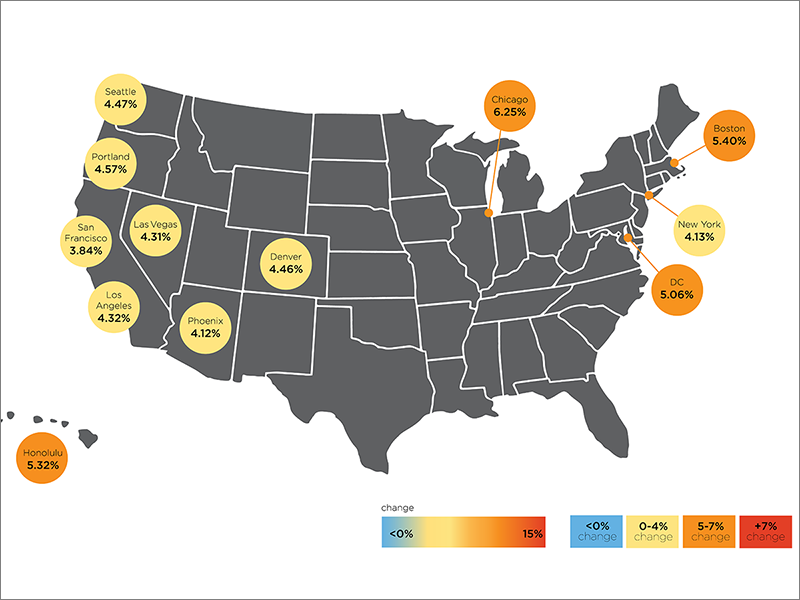

GLP Expands US Holdings in Chicago

The Singapore-based company now owns more than 11 million square feet of industrial space in the Windy City market.

By Gail Kalinoski

Chicago—GLP, a Singapore-based provider of logistics facilities, is boosting its presence in the Chicago area with two industrial acquisitions totaling $33 million.

The buildings were acquired from institutional owners in two separate transactions and comprise multi-tenant assets that are fully leased. GLP did not identify tenants but did say that some were new and others were existing GLP customers. GLP now owns more than 11 million square feet of industrial space in the Chicago market.

The first asset is a 308,000-square-foot distribution building in Bedford Park, a desirable in-fill submarket located near Midway Airport because of the FedEx, UPS and USPC facilities there and the CSX intermodal.

The second property is a 139,000-square-foot distribution building in Western Cook County with proximity to the I-290, I-294 and I-88 highways offering immediate access to Chicago’s urban population. GLP noted the location would also provide an “excellent labor supply” and would also serve as “an ideal choice for ‘last-mile’ delivery to consumers.”

“The quality and location of these two facilities complement our Chicago portfolio well,” GLP’s Eastern Regional Director Amy Curry said in a prepared statement. “GLP remains on the lookout for opportunistic assets that will strengthen our network of state-of-the-art logistics facilities to better serve customers across the U.S.”

The acquisitions were not part of a $1.5 billion fund, GLP US Income Partners III, which closed in December. The fund was seeded with a $1.1 billion portfolio from Hillwood, a Dallas-based development firm, which was announced in September. The first part of that deal, a $700 million portfolio from Hillwood, closed in December. The rest of the fund will be split with $400 million in assets from Hillwood as they are built and leased up, and $400 million that GLP, as the asset manager of the fund, is required to make to satisfy the fund’s investment criteria. The fund has total equity commitments of $620 million from six leading global institutional investors from the U.S., Asia and Middle East, which own 90 percent of the fund. GLP will own the remaining 10 percent of the fund.

The latest Chicago acquisitions will boost GLP’s U.S. footprint to 173 million square feet. GLP entered the U.S. industrial market in December 2014, when it took a 55 percent state in a deal with GIC, Singapore’s sovereign wealth fund, to buy IndCor Properties from Blackstone for $8.1 billion. The firm also purchased a 58 million-square-foot industrial portfolio from Industrial Income Trust, a Denver-based REIT, for $4.6 billion in July 2015.

GLP, which is largest provider of modern logistics facilities in China, Japan and Brazil, owns and manages a global portfolio of 570.5 million square feet and has $39 billion in assets under management.

You must be logged in to post a comment.